If you want to use QuickBooks in an easy way, Here we are providing you some easy tutorials which you can go through it. Read some features and advantages of using QuickBooks Online to understand it in a better way. In this article, we have designed a tutorial guide for beginners to understand the usage of QBO. Read the article, you will get your solutions on your screen and for much-explained tutorials refer to our videos for beginners to learn QuickBooks online. Still, having a problem with usage contact our QuickBooks ProAdvisor toll-free:+1-844-405-0904

The new generation QuickBooks Online accounting software is here to fit all your business needs and make your accounting easy. It is the easiest way to handle your business to save both time and effort. Wherever you go, it’s easy to keep track of your sales and expenses, accept payments, pay your employees and even more.

Everything that you do in QuickBooks Online is synced between your desktop, laptop, smartphone, and tablet. Hence, this makes you stay up-to-date in your professional life.

Table of Contents

Who are suitable to use Quickbooks Online

It is a great platform, if:

- You run a small business where your team members will need faraway access to the books.

- If you want to pay monthly fee comfortably.

- Comfortable with the safety risk of cloud computing.

- Comfortable with the fact that you can access your books only if you have internet access.

- You run a service-based business where you don’t have to track a large volume of sales.

Currently, 80% of new QuickBooks user is choosing for the online version and Intuit pushing the consumers to subscribe to the cloud, so the number of QuickBooks online is growing day-by-day with a minimum number of QuickBooks Desktop.

Reasons why you should use QuickBooks online

There are several reasons to use this software. Here is a list of 10 reasons why there is a need to use QuickBooks online.

- QuickBooks is extremely adaptable to most small businesses. All documents and reports can be customized to the business needs.

- You save time on bookkeeping and paperwork. Because many of simple bookkeeping tasks are handled automatically. Making it easier to run your business.

- And also you can easily generate the reports with the information you need. So you always know where your business stands. Because you instantly know whether you’re making money and whether your business is healthy.

- And you save money because QuickBooks is so affordable. You can use it to run a $5 million or a $25 million business for a few hundred bucks. PC accounting software is truly one of the great bargains in business.

- Your business can grow with QuickBooks. It will help you improve a business plan to use when trying to secure your small business loans. Or a line of credit or to plan for the future for more profit. QuickBooks will create a projected balance sheet also. For your business, profit and loss statement for your monthly and statement of cash graph. In the format recommended by the U.S. Small Business Administration.

- Because the installed user base of QuickBooks is so extensive. Because the product has been widely tested. By it experts. And it is very stable and reliable for the accounting related solutions. When you compare all the features and functionality of this software in relation to its cost. There is simply no other product that exists in the market at this level which offers a better value for the small business enterprise.

- You can customize QuickBooks to work, the way you want. To broaden its appeal, It has recently added customized accounting packages for the different fields like Contractors, Retailers, Health Care Professionals, and Non-Profit organizations.

- You can save typing time and errors by sharing data between QuickBooks and over 100 business applications.

- With its online payments, Now you will get paid faster. E-mail and get invoice or statement and also with its Online Billing. Your customer can easily pay you with via credit card or bank account transfer by any mode.

- You can rest assured knowing that it is a stable, reliable and proven product. Hundreds of thousands of small businesses throughout. The world has chosen QuickBooks accounting format as their accounting software. You can not go wrong with a software program with such an extensive installed user base software.

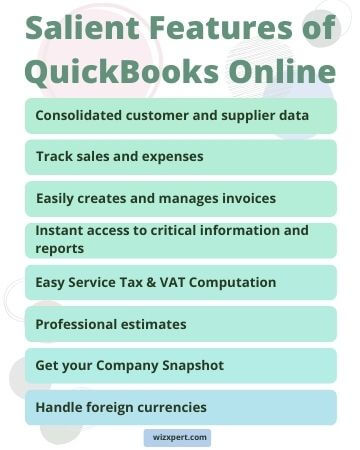

Features of QuickBooks Online

There are different features in the online version that is totally different from QB desktop which are as follows:

- Location tracking.

- Customize customer labels.

- Unlimited tracking of time and generation of report.

- Journal entries have more than one AP or AR lines.

- Per fiscal year, manage and Establish multiple budgets.

- Integrate with third party apps easily.

- To attach images, documents and other work-related file, you can access mobile or tablet.

- Using the Audit log, track changes and actions review time-to-time.

- Bank transactions can be set and can automatically download every night.

Systems required for QuickBooks Online

Here is the list of the systems which you can use for QuickBooks online

- Apple Mac: OS X 10.5 Intel-based Mac or later

- Windows PC: Windows XP with 1 GHz computer with 256 MB RAM or later

- Latest version of Google Chrome, firefox, Internet Explorer or Safari for Mac

- High speed Internet

How to use QuickBooks Online

1. Sign up into QuickBooks Online Accountant

You can Sign Up into QuickBooks Online Accountant for accessing your ProAdvisor benefits. With this, you can manage your QB online clients and join up with other firm members. You can call our QuickBooks support number +1-844-405-0904 to save your time and effort and ask for any technical support.

An accountant can sign up via client’s email invitation

- If any of your clients invite you to become an accountant in their QuickBooks online company, then you will get an email invitation link with an option to sign up for QuickBooks Accountant account. You can make your client follow the steps in ‘Inviting an accountant to your QuickBooks’. When you will be done with accepting the invitation, then you can sign up with the opportunity given to you for QuickBooks Online Accountant.

- For more information regarding how to send or accept an invitation for QB Online Accountant, refer to ‘Add New Clients to QuickBooks Online Accountant’.

- If any error comes while accepting the invitation, then refer to Error received while clicking on Accept Invitation or logging into QuickBooks Online Accountant.

2. Different Sign up Websites for Accountants

- User from the United States can sign up via QuickBooks Online Accountant.

- User from the United Kingdom can sign up via QuickBooks Online Accountant.

- And for the Canada User, signup via QuickBooks Online Accountant.

- User from Australia can sign up via QuickBooks Online Accountant.

- User from France can sign up via QuickBooks Online Accountant.

3. If you have an Intuit Login? Or you are ProAdvisor

You can create your QuickBooks Online Accountant firm under the same login which you are already using:

- At the signup page, opt for the ‘Sign In’ option. You’ll see the fields on the sign-up form changing into a login form on the screen.

- Enter your username and password according to the login you want to create for your QB Online Accountant account. And if you’re a ProAdvisor then you can use your ProAdvisor Login here.

- Then Opt for ‘Continue’.

4. However, if you still don’t have an Intuit Login?

You can make your Own login at the time you Sign up for the QuickBooks Accountant account.

- Enter your information as per asked in the Sign-Up form such as email address, first and last name, phone, and password for your QuickBooks account.

- Your Email Id will become the new User ID that you can use it for signing in into your QuickBooks Online account.

- Select ‘Continue’ to proceed further and build your QuickBooks Online Accountant business.

How to set up QuickBooks Online

Here we have broken down QuickBooks into 15 lessons. Some of the simplified QuickBooks setup processes include:

- Set up of Chart of Accounts: This ensures that you have accurate financial statements.

- Setting up vendors and customers: This ensures that you have precise expense and sales report.

- Connecting with your bank and credit card accounts: To ensure all expenses and sales are accounted for.

- Customizing QBO with your company information: To create sales forms.

The 15 lessons to setup QuickBooks Online are:

This lesson is all about the setup of the company’s basic information. This includes the Company name, logo, website, email, address, and legal entity.

This lesson is about customizing sales forms and provide detailed information of payment terms, the field for deposits, discount field and other information for customers.

In this, you will decide what data and information will appear on your sales forms like shipping fields, service date, and whether your customer is comfortable receiving invoices via email or snail mail.

This lesson is about the details that you have to include on sales forms. This includes quantity, cost and detailed description.

In this lesson, you will learn how you can send personalized message to your customers along with their sales receipts, invoices and estimates.

In this lesson, we deal with the QuickBooks setup options you have when sending statements to your customers.

In this lesson, we deal with how to customize your QuickBooks setup to track expenses which includes billing customers for expenses incurred on their behalf, setting up accounts payable and creating purchase orders.

This deals with how to turn on settings for your financial reports,like your profit and loss statement, balance sheet, and cash flow statement.

- Lesson 9: How to import banking transactions into QuickBooks Online

In this lesson, we deals with how to connect your bank account to QuickBooks so that your banking transactions download into QuickBooks automatically. We will also deal with how to import your banking transactions using a Microsoft Excel file or comma-separated value (CSV).

This lesson deals with how to connect your credit card to QuickBooks, so that your credit card transactions automatically download into QuickBooks. We also deals with how to import your credit card transactions using an Excel file or a CSV.

This lesson deals with how to set up QuickBooks Online to give your accountant and other users like a tax professional or bookkeeper access to your QuickBooks data.

This lesson deals with how to add, edit and delete accounts from your chart of accounts list in QuickBooks. When you create your QuickBooks file, you will have a chart of accounts list based on the industry that your business falls into.

In this lesson, we will discuss how to set up QuickBooks Online to track the products and services that you sell and cover different options for tracking inventory.

- Lesson 14: How to setup customers in QuickBooks Online

In this lesson, we will discuss how to set up QuickBooks Online to track key fields of information for your customers like phone number,email, primary contact, and social media channels. This information will be used to communicate with customers and generate customer and sales reports.

- Lesson 15: How to setup vendors in QuickBooks Online

In this lesson, we will discuss how to set up QuickBooks Online to track key fields of information for your vendors like email, phone number, primary contact, and credit limit. This information will be used to communicate with vendor suppliers, generate vendor reports, and vendor bills.

QuickBooks Tutorials

Refer these videos for better understanding.

Accounting

- What are QuickBooks app?

- Reconcile your accounts

- Add a user

- Export Your Company File to QuickBooks Online

- Mobile Overview

- Online Banking Overview

- Manage expenses

Invoicing

- Receive Payments in QuickBooks

- Time Tracking Invoices in QuickBooks

- How to Set Up and Use QuickBooks Payments

- Create estimates

- How To Create An Invoice

Sales

- Create Sales Receipts in QuickBooks

- Receive Payments in QuickBooks

- How to Set Up and Use QuickBooks Payments

- Create a Refund Receipt

- Add customers to QuickBooks

- Add Product Information

- How To Create An Invoice

Taxes

Expenses

Inventory

Pay Employees

Bills

Insights

Conclusion

I hope till now you are convinced that there is no need to be a certified public accountant or have an accounting background to learn how to use QB.

You should also know that QB is a much better solution as compared to a Microsoft Excel spreadsheet. Just to keep track of your income and expenses.

So, what are you waiting for guys! Hurry up sign up today and receive a 50 percent discount on a paid QB subscription. There are no contracts which means that you can cancel your subscription if you change your mind.

For more details, you can dial our toll-free QuickBooks Online support number, and get free assistance from our ProAdvisors.