Making mistakes while managing payroll with QuickBooks Online Payroll is not acceptable. It can be a huge problem to manage 1099s at the end of the year. So it is better to find the best QuickBooks Online Payroll support. This is the right platform, where QuickBooks payroll help you to find all of your solutions and fix related to QuickBooks Online Payroll issues and connect with QB Payroll Support. Join and continue with us till the end to collect more ideas about this topic. Find out what the phone number is for QuickBooks Online payroll support. How do I talk to a live person?

Our Intuit Certified QuickBooks ProAdvisors will help you to solve all your problems related to QBO Payroll. Dial the toll-free number +1-844-405-0904, and connect with the experts to find your answers. They are well-trained and have the experience to provide any kind of services related to QuickBooks.

Table of Contents

In What Ways Can You Contact QuickBooks Payroll Support For Help

Here you’ll learn how to contact and get help from the officials of QuickBooks payroll support.

- You can contact QuickBooks payroll support anytime on any day.

- First of all, log in to your QuickBooks Online Payroll Support.

- The next step is to go to the “Help Menu” and click on it.

- Now you are on the next page, where you have to go to the search tab and then select Contact Us.

- Now you have to enter your question and then click on continue.

- You also have another option to connect with QuickBooks Online payroll support

- You can chat online in real-time through the chatbot, where you’ll get a response instantly.

- You can get a callback through the officials if they are busy at the time you are contacting them.

- There is also a community where you can put your Question and get a response.

- If all the above-mentioned procedures don’t work, then you can feel free to call our experts, who are certified QuickBooks advisors by dialing +1-844-405-0904.

QuickBooks Online Payroll Service for Businesses

QuickBooks Online payroll support has add-on plans for payroll management. It processes and manages the employees’ financial records for a clear business report. It covers all the details of employees’ salaries, bonuses, net pay, deductions, incentives, etc. QuickBooks Online Payroll Support has advanced payroll management features to run a payroll report.

Each company has its own needs and systems. By considering the different needs and business types, QuickBooks Online Payroll has different plans. Let’s check what they are.

Plans & Pricing

In QBO Payroll Support is available in three different plans: QuickBooks Payroll Core, QuickBooks Payroll Premium, and QuickBooks Payroll Elite. And all of the plans are made according to the demand of different needs. Read the following to get an overview of the payroll plans in QuickBooks.

- Payroll Core

QuickBooks Payroll Core is the basic Online payroll plan of QuickBooks. It can easily pay your team and will do the taxes for you. This offers you to run payroll automatically, features easy management of the business, and gives you the simplest solution to your payroll problem.

- Payroll Premium

QuickBooks Payroll Premium works like a powerful tool to manage your employees. In advance, you can track time, review, and approve payroll with this payroll subscription. The Premium plan has the feature of same-day direct deposit so that your employees can pay faster. The HR tool helps to customize the onboarding checklists and gives you a lot of facilities to manage your business payroll.

- Payroll Elite

QuickBooks Payroll Elite is the advanced payroll plan of QuickBooks Online. It includes all of the features of Core and Premium. And in advance, it has 24/7 expert support and tax penalty protection.

You can add payroll in QuickBooks easily. There are three steps to add the payroll. And they are;

- Decide and select the payroll plan

- Add accounting to the payroll plan (optional)

- Check out

QuickBooks Online payroll plans are available on a monthly basis for subscriptions. You can get the Core, Premium, and Elite plans at the price of $ 45/mo, $ 75/mo, and $ 125/mo, respectively, with a 3-day free trial. If you purchase during this period, you will get your plans at a 50% discount. But it will not offer your free trial version for 30 days.

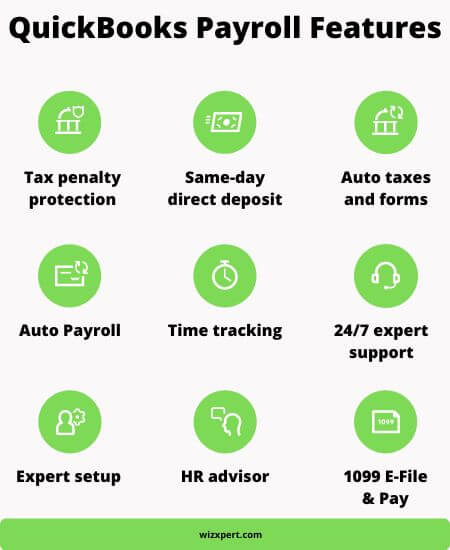

Explore Payroll Features of QuickBooks Online

QuickBooks Online Payroll has all the features to manage payroll. The features may vary according to the plan type. Here we have mentioned some of the advanced payroll features, have a look.

- Tax Penalty Protection:

During the tax preparation, if you find any mistake made by QuickBooks, then you can receive a tax penalty. QuickBooks pays you up to $25,000 to recover all the mistakes.

- Time Tracking:

Tracking time is easy and saves an average of 4% on payroll costs. With this feature, you can get the right time of your employees, approve the timesheets, and can pay your team accordingly. You can download the time clock app for your Android and iOS, and can do the same thing on your handset.

- Same-day Direct Deposit:

Make a schedule, and pay your employees on the same day. It can be processed in three steps: select employees, set the schedule, and run payroll. It is the most flexible feature of QuickBooks Payroll. You can run payroll with the same-day direct deposit and also make last-minute adjustments.

- Auto Payroll:

In QuickBooks Online payroll, you can run payroll automatically. Just make a schedule for the auto payroll, and run it. This will run your payroll according to the scheduled date and time.

- Automated Taxes and Forms:

In QuickBooks Online, most of its features are automatic. QuickBooks will calculate your file and pay your federal and state payroll taxes for you. You do not need to do it manually.

The Other Common Payroll Plan of QuickBooks

Read the following to know the common features included in the QuickBooks Payroll plans.

- Calculate paychecks and taxes automatically: QuickBooks will calculate paychecks automatically on every paycheck. And it monitors all of the taxes for you.

- Automated tax and forms: All of the payroll taxes and federal taxes will be added by QuickBooks automatically.

- Fast unlimited payroll runs: As the owner, you can approve the employee’s hours in less than 5 minutes before running the payroll. It can manage everything at the last minute and run the payroll.

- Payroll Reports: You can download all of the important payroll reports in QuickBooks. Like, payroll history, bank transactions categorization, paid time off, tax payments, etc.

- Workforce Portal: It is easy to access the W-2s and pay stubs in QuickBooks. Not only that, but you can also view the PTO balances and allowances online. All these plans are available in 50 states.

Benefits of Using Online Payroll in QuickBooks

The Online payroll service of QuickBooks provides a lot of benefits for employees. You may need QuickBooks Online payroll help to know the details of the benefits. You can see the following to get a little overview of the benefits;

- Workers’ Compensation:

Get coverage for job inquiries with a policy, and save money with the QuickBooks Online payroll. With the help of the workers’ compensation feature, the employees can protect themselves in case of job injuries, which includes wage replacement and medical coverage.

- HR Support:

QuickBooks Online payroll gives you access to talk to an HR advisor. You can fit your business with HR services in one place. With this, you can access tools and templates and customize the job descriptions, checklists, and onboarding. This will help boost and measure your business performance.

- Health Benefits:

QuickBooks Online payroll gives you the insurance package of Healthcare. SimplyInsured is patterned with QuickBooks (only for payroll plans), which offers vision health insurance nationwide, and free administration benefits. As a businessman, you can apply the form for your employee in only 4 steps. Just choose a plan, complete the application, add your employees, and upload the documents.

- 401(k) plans:

This is the new guideline in QuickBooks Payroll. It is a retirement plan for all employees. QuickBooks offers 3 types of retirement plans for every budget, and they are: Core, Flex, and Max. This works in three simple steps: sign up for QuickBooks Payroll, choose a 401 (k) plan, and start saving.

You have read how QuickBooks made all its features advanced and easy to use. But due to some reasons, users can’t run the features properly all the time. They need support for that. So here we have mentioned some of the tutorial links in the section below, so that it will be a little easier to run payroll in QuickBooks Online.

Tutorials to Get QuickBooks Online Payroll Support

Here we have given some of the tutorials for QuickBooks Online Payroll Support. See below, here you can find out solutions for your query related to QB Payroll Support. If in case, your query is not listed below, then you can directly call the QuickBooks Online payroll help number +1-844-405-0904 for an instant solution to your query.

Starter Tutorials

- Intuit QuickBooks Payroll login

- QuickBooks payroll setup checklist

- Run QuickBooks payroll summary report

How-to Tutorials

- Enter prior payroll in QuickBooks Online

- Create a one-time payroll check in QuickBooks Online

- Print paychecks with QuickBooks Online Payroll

- How to do payroll in QuickBooks

- Change paycheck date in QuickBooks Online Payroll

- Manually enter payroll paychecks in QuickBooks

- Set up, and manage payroll schedules in QuickBooks

- Pay and file payroll taxes in QuickBooks Online

- Cancel direct deposit in QuickBooks Payroll

- Enter QuickBooks Payroll service key

Tutorials for QuickBooks Payroll Errors

- Fix, an employee not showing up in QuickBooks payroll error

- QuickBooks error 2002

- Common QuickBooks Payroll Error

- QuickBooks Error 15270

Frequently Asked Questions (FAQs)

Can we run payroll through QuickBooks?

Obviously yes, you can run payroll through QuickBooks. QuickBooks has the payroll function in both versions, Desktop & Online. And each version has its own plans according to requirements, and features.

What types of businesses use QuickBooks Payroll?

Mainly, QuickBooks Online Payroll works for small, and mid-sized businesses. And it works from accountants to non-profits, restaurants, and construction companies. It is not compulsory for all businesses, but if you want some add one feature to do payroll on time then you can add it to the QuickBooks Payroll plan.

What does the payroll report cover?

Payroll management is one of the important aspects of businesses. So payroll reports play a major role to manage employees’ details perfectly. It covers all of the following details; multiple worksites, payroll tax liability, payroll deductions, and contributions, payroll tax and wage summary, vacation, and sick leave, workers’ comp, time activities, etc. It allows to run and print the payroll report, and the facility of exporting payroll reports and sharing valuable insights with accountants.

How many employees can add to QuickBook’s payroll plan?

It depends on the QuickBooks plan you have chosen. So before going with a QuickBooks Payroll Plan, check the available plans type, and observe the features, you need to use for payroll management.