Read this article to know in-depth details of what is a QuickBooks General Ledger, how to prepare, find & print a general ledger on QuickBooks Desktop. What we should maintain in it? How to print trial balance? Go through the article and get all your related queries resolved. For more info contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

In QuickBooks General Ledger, we can handle any general ledger transactions like prepare financial expenses, totaling the expenses, calculating the income, keep the data up to date anytime, anywhere. QB syncs it all immediately on your phone, personal computer, and tablet so that you can run your business from anywhere.

Table of Contents

What Is A General Ledger In QuickBooks Desktop

A QuickBooks General Ledger is a specific report of all transactions posted to each account and for every transaction, there is a Credit and Debit account so it lists them all up. You may pull up the Trial Balance to see the summary balances for all Accounts’ Debits and Credits.

The QuickBooks accounting software supervises the financial data of your company and other tasks that were earlier required to be completed by a full-time accountant. QuickBooks software auto-runs the calculations organizes information by an accountant and alerts you when you attempt to input an inaccurate debit or credit.

Basics Of A QuickBooks General Ledger

When we do our record-keeping by hand, we have separate journals for each task. These are the three main journals:

- Accounts receivable: The daily record of the company’s sales and receipts, and the invoices that clients had not yet paid.

- Accounts payable: The daily record of the company’s purchases and invoices the company still had to pay.

- Payroll: The record of each employee’s compensation, the checks written to pay the employees and the related payroll taxes.

Enter the summary of the monthly activities into the general ledger “the Books”. A master record for the company’s activities. We made journal entries using a double-entry system. If you enter everything correctly, the company’s books would balance. In other words, when you added up the balances in each account, the total would be zero.

Why We Need QuickBooks General Ledger?

- Ensure books are accurate- General Ledger is a beneficial tool and a very easy method of looking at your spending for orderly tracking of your business. QB General Ledger allows you to find the mistakes made on data entry or see why the numbers are not coming right. You can review the General Ledger report to make sure everything is correct.

- Track the Financial Expenditures– It is very essential to track all the financial expenditure on time. Therefore, a general ledger can keep you above on your expense and assure that the correct entries are made. For example, you can see that the correct entries are made for the correct accounts such as vehicle payments that are not allocated to the Auto Expense account but are put in their particular accounts.

Track Company’s transactions- General ledger helps you to track various company transactions, like paying personal deposits to your business bank account, to pay business expenses with personal funds, the general ledger in a great way. It is often difficult to separate business and personal expenses; However, the general leader helps here.

How Does The General Ledger Report QuickBooks Works

QuickBooks general ledger follows a specific process to turn on its functions for the users. It follows the double-entry accounting method to generate the financial statements. It needs both debits, credit cards, and dollar amounts to work out.

It has some criteria to functions with the cards, and amounts like;

- The dollar amount of credits and debits must be the same.

- The used number of debits, and credits account, should not be equal.

- At least one debit and credit entry are allowed for each journal entry.

The double-entry method keeps the accounting balance. And it follow the balance sheet formula to keep it in balance. The adding of liabilities, and owner’s equity shows the business assets.

Always remember that, you are following the below procedure for the balance sheet;

Liabilities + Owner’s equity = Assets

QuickBooks General Ledger Reports

The General Ledger report provides a summary of entire transactions for the current month. The starting summary report shows the totals for each account and also you can view any transaction report or any exceptions. This report is sufficient to check every transaction that occurred during a certain period of time.

How can you find the General Ledger Report?

If you don’t know where to find the General Ledger Report, then

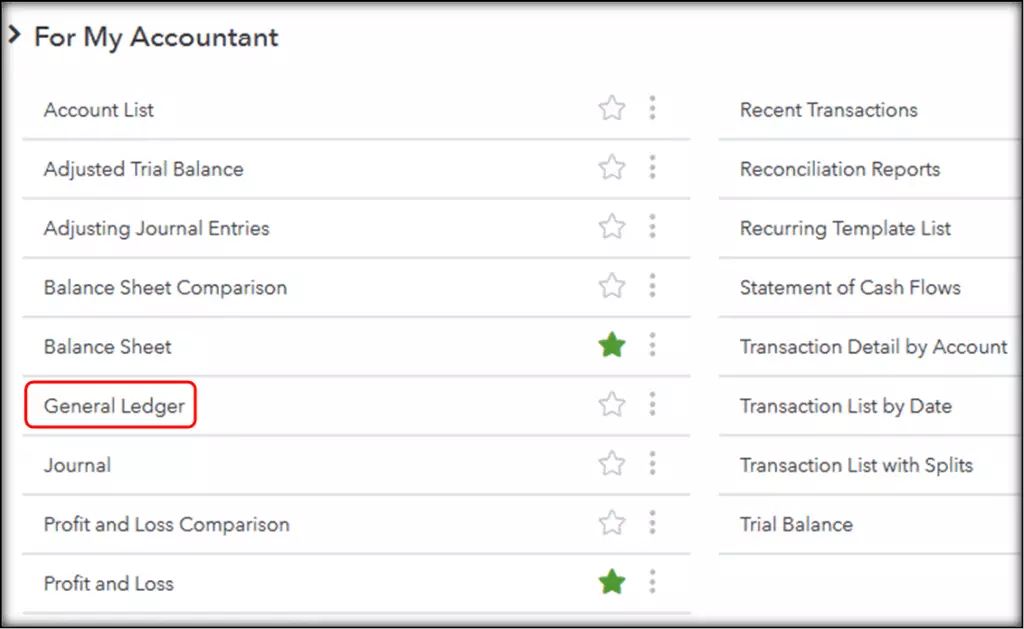

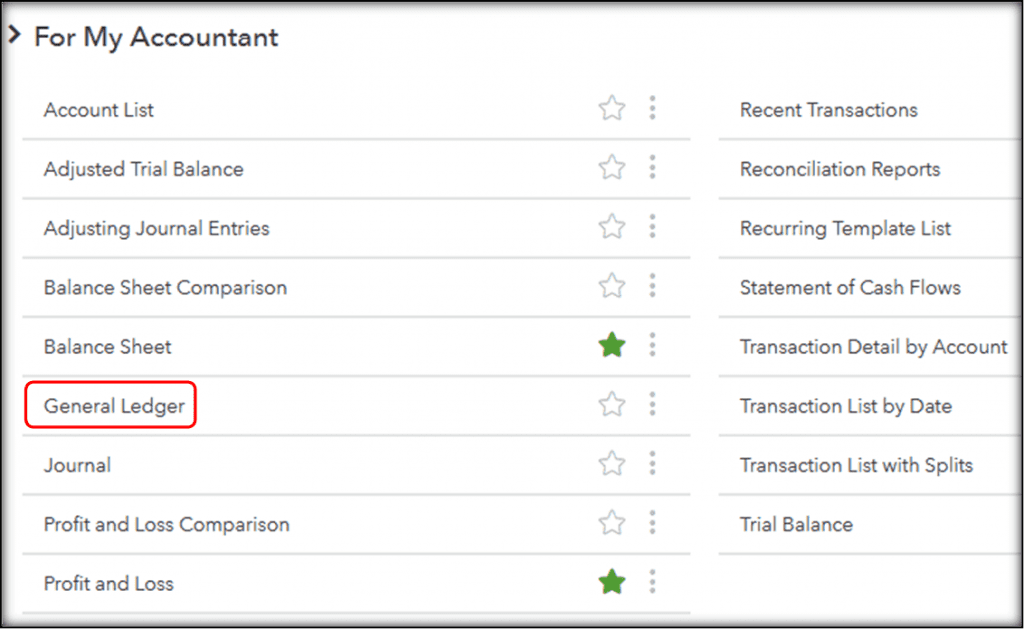

- Select Reports from the left navigation panel and then choose All.

- Go to the bottom of your screen and then select For My Accountant. Click on General Ledger.

- Select the date range and then choose between Cash or Accrual basis.

- Select Run Report to generate the report.

How To Prepare QuickBooks Journal Entry?

You can make general QuickBooks journal entry by following these steps:

- Choose Make General Journal Entries from the QuickBooks Company menu.

- After that, In the Make General Journal Entries window, change the Date field.

- Then enter any number of journal entries in the Entry No. field.

- After that enter the General Journal Entry details.

- Select the very first account in your transaction. If you use accounts receivable or accounts payable account, ensure that the first account in the General Journal transaction entries should be either Account Receivable or Accounts Payable account.

- Enter the debit or credit amount for the account you have selected in the Debit or Credit columns.

- Type a memo which can describe the transaction. That will be displayed on reports including this journal entry.

- Select the Customer, Vendor/Supplier, Employee, or Other name associated with the transaction.

- If you select an Expense account along with a customer, you will have to take the amount billable to the customer.

- Then assign a class to the amount.

- Repeat steps a through e to enter distribution lines until the transaction reaches to zero balance. Make sure that the Debit side column should be equal to the total in the Credit column.

- Click on the Save & Close button to save the journal entry and close the window, or click Save & New to save the journal entry and open a new window.

- If you want to view and adjust the journal entry in QuickBooks, after preparing the journal entry then you can go for that. But make sure that, if everything is already adjusted perfectly then you need not to do any changes in it.

How To Print General Ledger In QuickBooks

- First, go to Print Reports, Transaction Reports, and choose General Ledger.

- Next, enter a month and year.

- Leave the account range fields blank to print the complete General Ledger.

- If you want to print for an account range, enter the beginning and ending account numbers.

- Please note that entering the account limit will almost always result in a balance error, as debits often do not match credit transactions for a specified limit.

- Keep in mind, this report is not date-sensitive.

- This means that any transaction entered into within a particular month (even if the transaction date is for another month) will be included in the report.

- This is very useful for accountants who want to enter quarterly balances, for the situation.

- Now, click on Print, Start Printing.

- You can also preview the screen or Print to Printer.

How To Find General Ledger In QuickBooks Desktop

Follow the below steps to find general ledger in Quickbooks Desktop.

- Go to the left navigation panel and click on Reports and later click on choose All.

- Now, scroll down and look for the For My Accountant and click on it.

- Clain on General Ledger.

- Now choose the date range and later select between Cash or Accrual basis.

- Click on Run Report to create the report.

If you face any problem or have any kind of Query/Question regarding QB General Ledger. You can contact our QuickBooks Experts [] to get immediate help and support with best service.