QuickBooks Simple Start is one of the ideal QuickBooks Online plans for every single business owner, who wants to track their business on the right path. It is the quickest medium to manage income, and expenses, connect bank and credit card accounts, track sales tax, and run basic financial statements.

This article will give you a complete overview of the QuickBooks Online Simple Start, who can use it, how much it cost, what are the features available in the plan, etc. Meanwhile, you can contact our QuickBooks certified experts through the toll-free number +1-855-525-4247 for further solutions.

Table of Contents

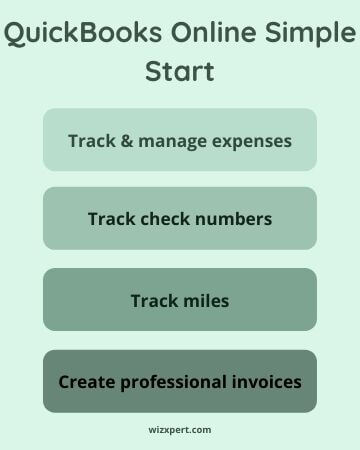

Available Features in QuickBooks Simple Start

In QuickBooks Simple Start, a user can see its business position by tracking the income, expenses, miles, managing the basic reports like invoicing, 1099, and etc. Here we have given some of the important features or tools of Simple Start. Check them to know, what types of features are available in the QuickBooks Simple Start.

- Bookkeeping Automation: Bookkeeping Automation is added new in the Quickbooks Online Simple Start that reduces the manual work. It helps in categorizing the transactions which reduces the time to categorize manually. Automation also helps in sorting the expenses according to their categories which makes tax time easier. Set up rules to reduce tedious effort by automatically categorizing recurring transactions.

- Track Income, and Expenses: With Simple Start, you can securely import transactions from your attached bank, credit cards, and other payment processes.

- It sorts your transactions into the right tax category automatically.

- It automatically matches the existing expenses, if you take photos of the receipts.

- Now you can get the report of where you are spending money, by creating custom tags and organizing them into 40 tag groups.

- Capture and Organize Receipts: Capture the receipts by using your phone, and it will sort and match them to rate.

- Just snap a photo of the receipt, and upload the receipt to QuickBooks in a few seconds.

- QuickBooks will match the receipt with the existing expenses automatically. And can also create a new expense.

- All of the receipts are automatically sorted into tax categories.

- Maximize Tax Deductions: Maximizing tax deductions with the Simple Start means you can sort commercial tariffs automatically into the best tax listing to keep more of what you earn.

- Arrange the income, and expenses into tax categories in an easy way.

- Sort list all the business expenses into the right tax categories to track, what you earn.

- You can easily share your books with the accountant.

- Invoice and Accept Payments: Obtain paid fast with a credit card and bank transfer best in the bill with Simple Start.

- It accepts all credit cards, and bank transfers, in the right invoice.

- You can easily track the invoice status and can send payment reminders automatically.

- With this, you can get the facility of matching payments to invoices automatically.

- Create a professional custom invoice with QuickBooks Simple Start, with a logo, and send the invoice from any device.

- Track Miles: Make it simpler to categorize commercial trips use your phone’s GPS to accurately track the miles you drive.

- You can categorize the personal, and business trips, and can add trips manually.

- And get the shareable reports that break down the miles driven.

- Run Basic Reports: To run and export outline reports it also includes profit and loss, and ease of use panel.

- QuickBooks Simple Start gives you the advantage of running and exporting reports like profit and loss reports, balance sheets, and expenses.

- You can create custom tags, and run reports to know, where you are spending the money.

- Track the cash flow, and get the report on the dashboard.

- Send Estimates: Generate custom and pro-rate that will create trust and simpler to convert them to a statement.

- You can convert your estimates into invoices easily.

- Simple Start accepts mobile signatures.

- You can also see the estimated status.

- Estimates can be customized according to the brand, and business needs.

- Track Sales and Sales Tax: Obtain credit cards and payments everywhere and it will calculate the sales tax automatically.

- Sync the popular app, and accept credit cards anywhere by using the mobile card reader.

- Easily connect with any e-commerce tool.

- Calculate the taxes automatically for invoices.

- Manage 1099 Contractors: Construct, and record 1099s in QuickBooks Simple Start.

- You can assign the vendor payment to the 1099 category.

- And here, you can find, who you have paid, and when you did it.

- Create a 1099s form from QuickBooks.

- Manage Expenses:

- You can easily manage your expenses by importing the photo of receipts.

- Snap receipts are categorized automatically in the expenses.

- Connect your bank Easily:

- With QuickBooks online simple start you’ll get information about your all money that is transacted through your company.

- You can also able to see where your business stands by tracking your financial data.

- Track Check Numbers:

- If you want to track the paper check numbers then it can be done simply in QuickBooks Online simple start.

- You can record and print checks from the bank account menu of QuickBooks.

Pricing of QuickBooks Online Simple Start

The QuickBooks Simple Start is available at the price of $30.00 per month. If you are purchasing the Simple Start for the first time then, you will get the offer of a 50% discount for three months which is $15.00 per month, and a free trial for a month.

Review of QBO Simple Start

Here we are giving you a review of QuickBooks Simple Start by discussing its advantages, and disadvantages.

Advantages of QBO Simple Start

For users who need to sort and track bank and credit card transactions for their commercial enterprise and who do not want to use this software to input bills and plan payments, for this purpose, QuickBooks Online Essentials is the right choice. It contains support teams that are free of cost and it rates (4 out 5) for ease of use because it is easy to use and navigate.

Customer Services:

It provides support teams to solve user problems, in case they need to convey any information to rectify the query for the purpose on their official website they provide the form we need to fill out and it is a must to provide your contact number to contact you and submit the form. It generally takes time to reply to your response until you wait for the reply.

Ease of Use:

It rates (4 out of 5) because it is easy to use and navigate. It provides complete guidance tools for setup. It is not necessary to install any software, by having a stable internet connection we can access your account from any device. It is possible to import your economic and accounting data by using these versions. By using this we can able to import client information and other contact data from Excel, Outlook, and Emails.

We can able to access our day-to-day activities because it will not contain more features for sorting and maintaining your books. It allows importing your financial institutions and credit card transactions into QuickBooks. It mainly ”Save time” is a major advantage. No copy will be available and it will backup the bookkeeping data daily.

Mobile Apps:

It will be available for iPhone, Android, and Blackberry. We are able to direct your payable, receivable, bank balances, and client contact information. It also consists of free product upgrades.

Reports:

It provides 20 economical sales and liability reports and also includes accounts receivable aging, profit and loss, balance sheets, and cash flows. It contains a reports menu. It contains a lot of report templates, It is possible to make custom reports by adding them or editing the report templates.

Disadvantages of QBO Simple Start (QuickBooks Easy Start)

This plan has also some disadvantages. Here we have listed some of the points for not going with the plan.

- Only one single business owner can use the plan.

- It can only do some limited work to manage business finance.

- It is not suitable for commercial purposes.

It’s all about the review of QuickBooks Online Simple Starts, and the information about the price, features, advantages, and disadvantages. We hope this article will definitely be informative for you. Consider the overall information, and go for this plan, if you want to track your business accurately. If you need any expert help or want to get QuickBooks Online support to know more about this plan then you can drop a call to us through the toll-free number [QuickBooks].

FAQs

What is QuickBooks Online Simple Start?

Quickbooks Simple Start is a very useful application designed for single users, freelancers, or solo entrepreneurs that manages accounting (income and expense) easily. You can also connect bank and credit card accounts, tac sales tax, invoice customers and manage basic financial statements.

What is the difference between QuickBooks Online Plus, Simple Start, and Essentials?

QuickBooks Online plus Simple Start and Essentials are the different versions of QuickBooks that are designed for managing accounting but there is a nominal difference between them. The main two difference is the number of users who use it and the features.

In Simple Start there is only one user can access it at a time which is best for solo entrepreneurs. In QuickBooks Essentials, up to 3 users can use it at a time. But, QuickBooks Online Plus includes 5 users at a time. Secondly, some features are additionally added in QuickBooks Online Essentials like managing bills and tracking time. QuickBooks Online gives you all the features that are included in Simple Start and Essentials with an addition to track inventory and track profitability by project.

Can I upgrade between plans?

Yes, you have the option to upgrade any version of QuickBooks to the upgraded version anytime.

What’s included in QuickBooks Live Full-Service Bookkeeping?

There are two stages to Full-Service Bookkeeping: ongoing bookkeeping and cleanup.

During the cleanup and setup phase, your bookkeeper assists you in configuring your bank connections, and setting up your chart of accounts, and teaches you the basics of QuickBooks. During the first month of service, your bookkeeper will assist in cleaning up if you have information in QuickBooks already.

Your bookkeeper categorizes your transactions into categories and does a monthly account reconciliation as part of routine bookkeeping.

Your bookkeeper is capable of creating a trial balance and closing your books. Important financial reports, such as balance sheets and profit and loss statements, can also be sent in PDF format.