Have you found yourself in a situation where your customer refuses to pay your debt? Haven’t been able to get your money back despite repeated reminders? Wanted to delete that invoice, but don’t want to lose the data associated with that customer? As a result, you can write off an invoice in QuickBooks rather than delete it. By doing so you can also make adjustments to your sales tax payable account. Go through the procedure given below to write off an invoice, and for any query contact our QuickBooks expert at +1-844-405-0904.

The reasons behind the due payment could be the bad financial condition of the customer or an underpayment due to some error from the customer’s end. Maybe he doesn’t want to pay the amount for other reasons. Sometimes in the case of unpaid invoices, you also want to write it off. No matter what the reasons are if you don’t write off unpaid invoices properly then you may have to pay sales tax that you never actually collected. Here we will see how you can write off an invoice in QuickBooks Desktop and QuickBooks Online.

Table of Contents

How to Write Off an Invoice in QuickBooks Desktop

The methods to write off an invoice in QuickBooks Desktop and QuickBooks Online are nearly the same, with a slight difference in some steps. This is how to do it in QB Desktop:

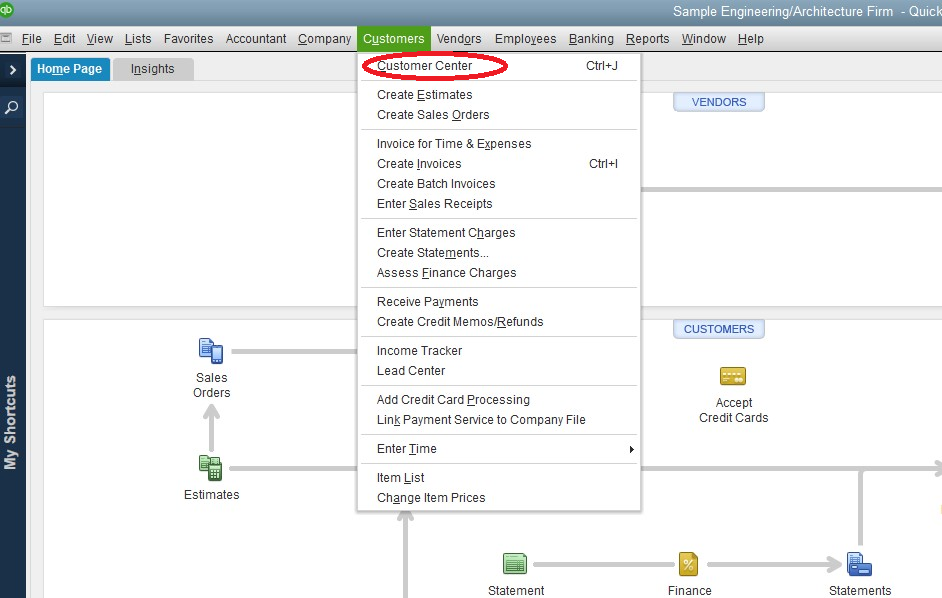

- From the Customer Menu at the top, select ‘Customer Centre‘.

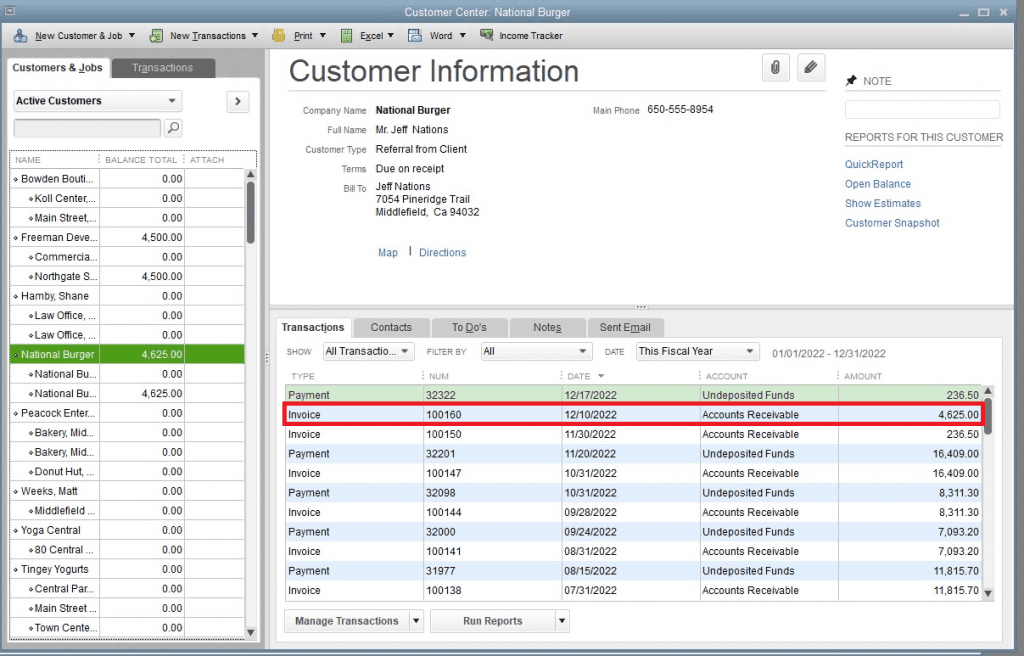

- Then in the next window, enter the customer name on the left side and select the invoice from the list.

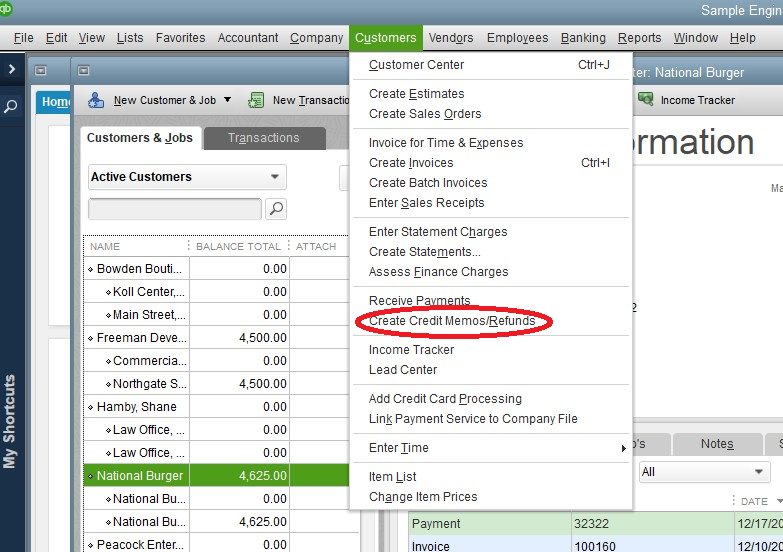

- Again in the Customer tab, select ‘Create Credit Memo/Refunds’.

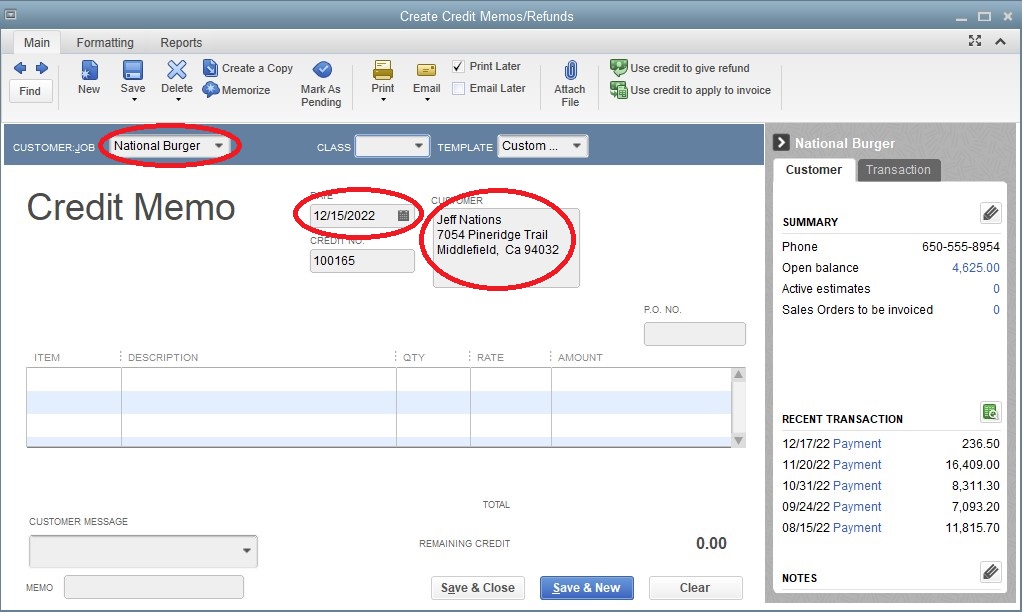

- In the Credit Memo window, enter the customer’s name and the date of writing off an unpaid invoice. The credit memo number will automatically be filled by QuickBooks.

- The next step is to create a Bad Debt field. For this click on ‘Item’ then ‘Add new’ and select ‘Other charges’ as a type. Then in the item name enter bad debt.

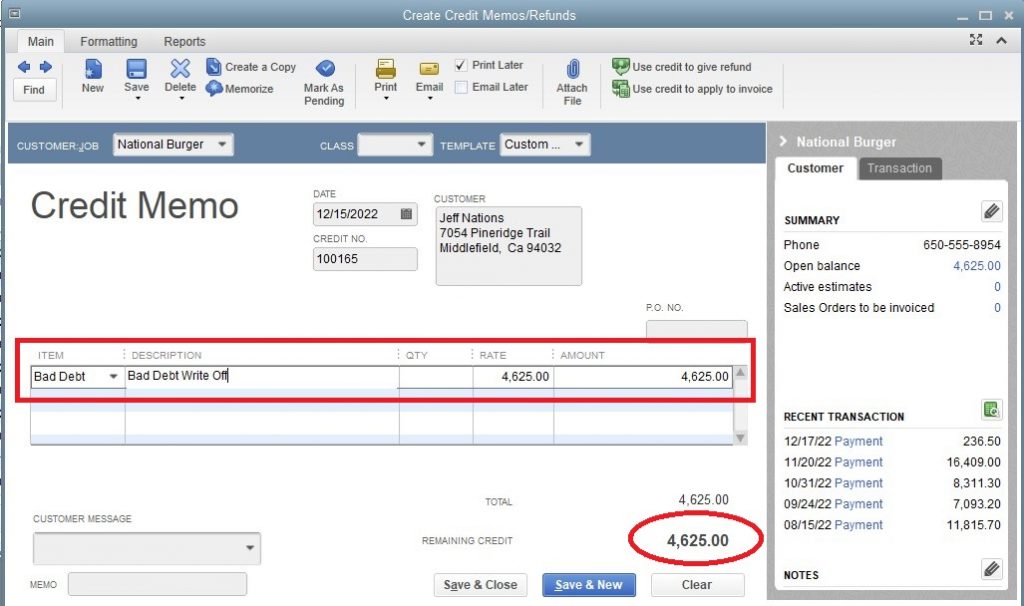

- Add a new product but instead of using original products/services use the ‘Bad debt’ that you created in the previous step. Unmark the box saying ‘Is Taxable’ and then save and close.

- Then, enter the pre-text amount of the bad debt/unpaid invoice.

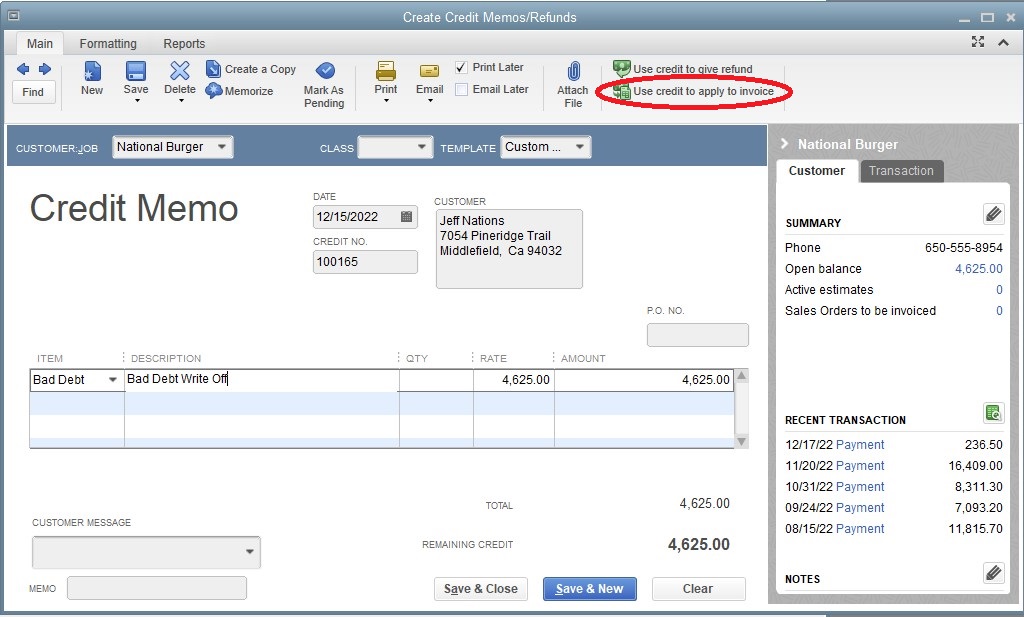

- Select the invoice you want to write off then click on the ‘Use credit to apply to invoice’.

- Lastly, select ‘Save and close’.

How to Write Off an Invoice in QuickBooks Online

Here, we are showing you how to write off an invoice in QuickBooks Online using the credit memo feature. In this way, your sales tax liability account will be restored to the original condition as same as before the bad debt issue.

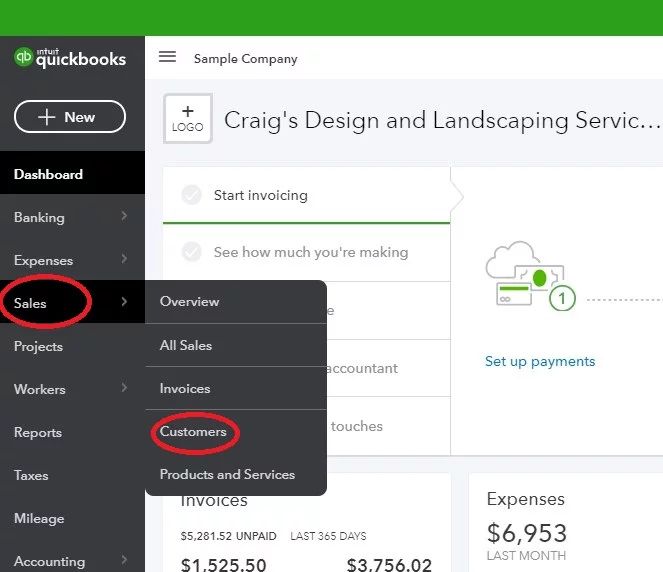

- First, open the invoice you want to write off, and for this click on the +New icon then Sales<Customers.

- Next, enter the customer’s name and choose the invoice from the list.

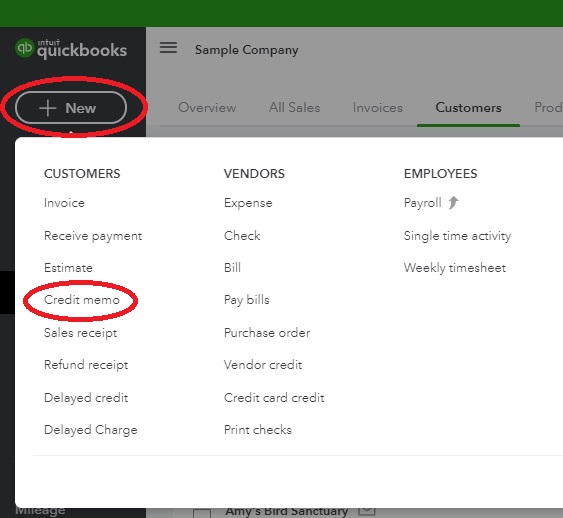

- To create a new credit memo, open a new tab in the browser and then click on the +New icon. After the select ‘Credit Memo’ from the Customers column.

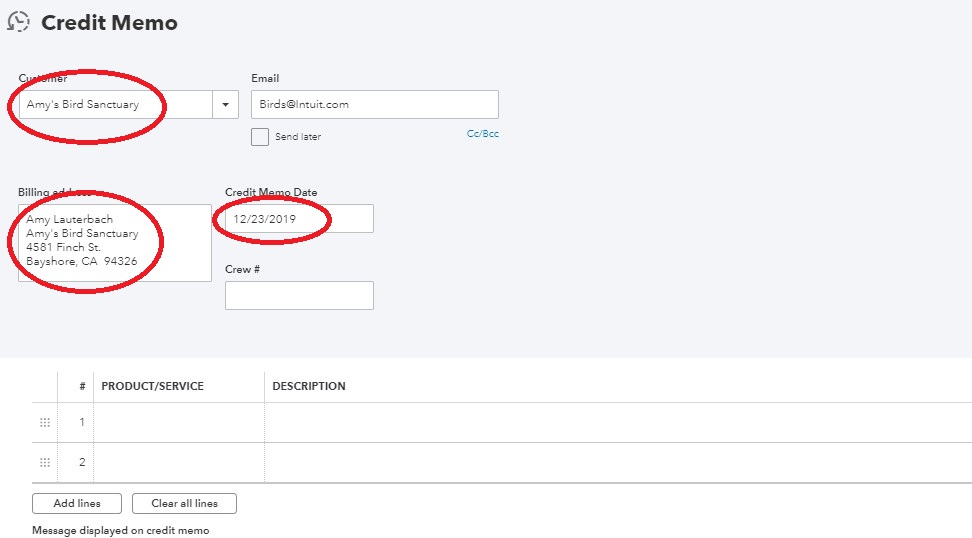

- In the Credit Memo window, fill in the customer name, billing address, and date at which you are writing off the invoice.

- For creating a bad debt item, go to Products and Services and then ‘Add new’.

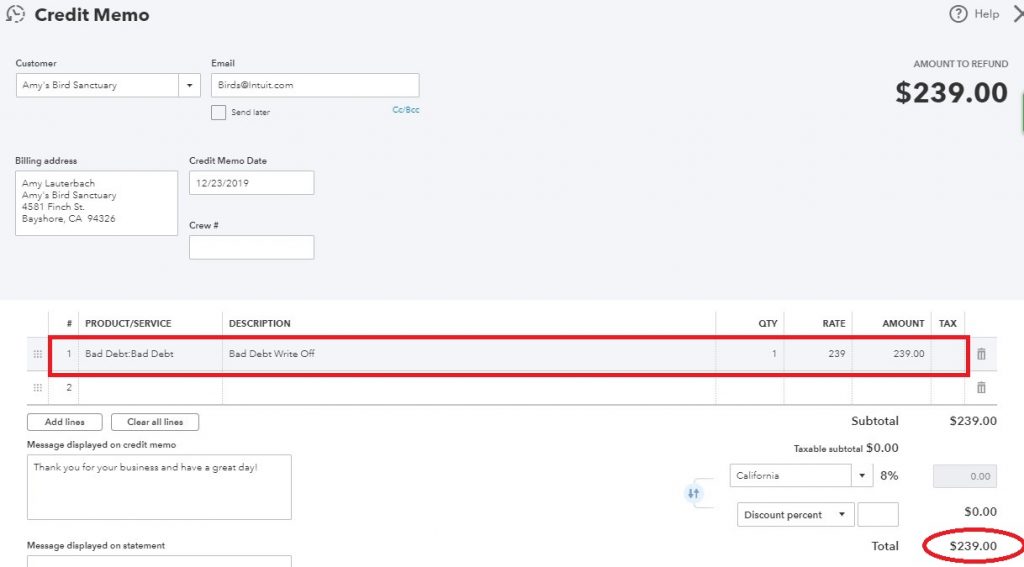

- After that, a new window will come up. Here enter ‘Bad Debt’ in the name field and choose ‘Bad Debt’ in both category and account type.

- The next thing you need to do is click on the ‘Gear’ icon and select Product and Services. Then add a new product where in place of the name enter ‘Bad Debt’ and select the ‘Bad Debt’ account you created earlier.

- Now enter the amount of the invoice you are writing off. You can enable the sales tax option and then ‘Save and Close’.

- The last step is to implement the credit memo.

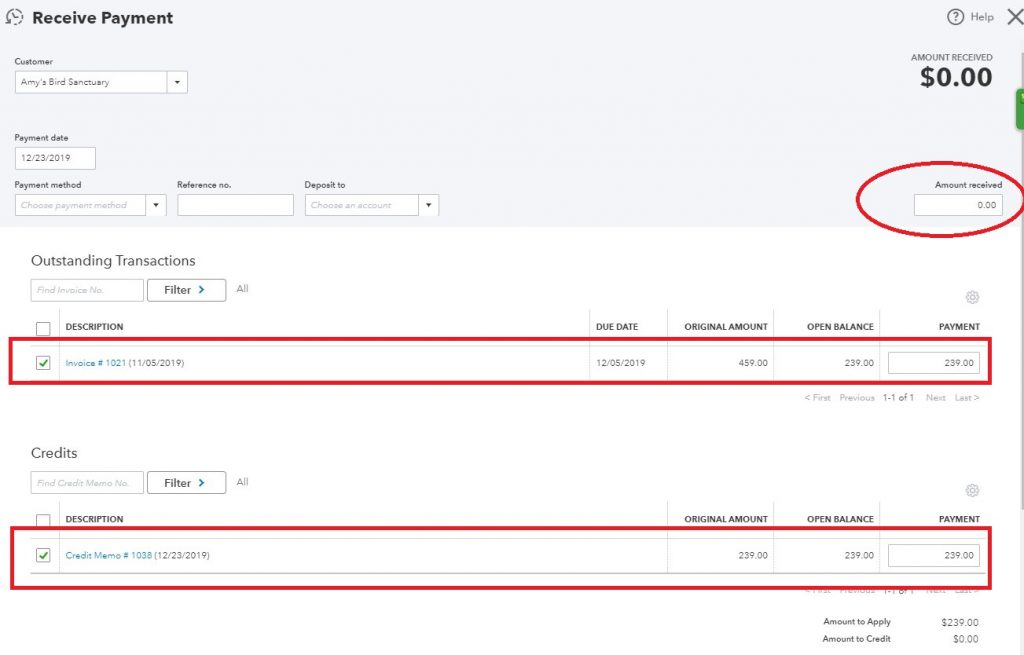

- Click on + New and then Receive Payment. Then select the customer and the invoice you want to write off in the Outstanding Transaction.

- Next, in the Credit section select the credit memo that you created earlier.

- The amount after applying the credit memo should be zero.

- If everything seems in place you can now ‘Save and close’.

How to Write off invoices in QuickBooks Online Accountant

- The First step is to go to the Accountant tools.

- Then next, choose Write off invoices.

- Now you have to set some filters that as Invoice Age, To date, and Balance less than.

- Next, tap on Find Invoices.

- After that check the name in the customer column.

- Then you can see the checkboxes for the invoices, and select whichever you want to write off.

- Click on Write off.

- Then go to the Account drop and select the account used for bad debts.

- Then next Select Apply.

Frequently Asked Questions

How many days do Clients have to Pay their Invoices?

30 days (NET30) is the standard for most of the invoices to pay the invoice amount. It could also depend on the payment amount of invoices and types of businesses like NET10, NET20, and NET60.

Do you have to Pay Tax on the Unpaid Invoice?

According to the IRS rules, for a tax deduction on the amount of unpaid invoices taxpayer must include the amount of the invoice in the previous year’s tax return. Let’s say if you created an invoice in December 2019 and the payment due date is in January 2020. Then you have to include the amount in the 2019 tax return file.

What Happens if We Delete the Invoice rather than Use the Write-Off feature?

Deleting the invoice can remove the customer and product details. It would be better if you write off an invoice instead of deleting it.

Writing off an unpaid invoice will save you from paying the tax on income you never actually earned. There are numerous methods available on how to write off an invoice in QuickBooks but by using the above-mentioned methods there will be no effect on your financial statement whatsoever. For more information and assistance related to this, call us at our 24/7 toll-free customer support number +1-844-405-0904.