You want to find out the differences between QuickBooks Online vs Desktop whether you’re using QuickBooks for the very first time or you want a change for your QuickBooks Accounting software. Here in this article, we have mentioned all the features, pros, and cons of both versions of QuickBooks, Read the article to get your comparison ready and go for one which fulfills your requirement. For any assistance or help contact us toll-free: +1-844-405-0904

If you want to compare QuickBooks Online vs Desktop then there is one important difference that you should know, the installation process, where desktop requires installation on a computer but online doesn’t. The QuickBooks desktop is much better for typical work with inventory needs for Product-based businesses. But if your business is service-based or you need multiple devices to manage your business then you must choose QuickBooks Online.

There is a large number of small businesses that use QuickBooks desktops. But there is another fact that most small businesses are moving to the online version of the accounting platform. And the fact you don’t know about is that 80% of new QB users are always confused before purchasing QuickBooks products.

Here are the Differences between QuickBooks Online vs Desktop:

Table of Contents

Compare QuickBooks Online with QuickBooks Desktop

Well, both QuickBooks product features are common it totally depends on you which one would you choose for your company. And, maximum decisions are taken by the users based on their company’s needs. So, let’s know some more facts about them that are common in both:

- Both provide online banking and access to credit card payments.

- Have memorizing transactions and report features.

- Includes reports, budget, and company snapshots.

- Have facilities for billing and invoicing.

- And, also provides access to tax reforms.

| QuickBooks Online | QuickBooks Desktop | |

| Price | Available at $30 to $200 per month | Available at $549.99 per year |

| Max. users | Max 25 users can use | Max 40 users can use |

| Accessibility | Cloud-based | Locally Installed |

| Best for Industry | Small and medium-sized business | Best for small and medium industry |

| Customer Support | Phone support (callback only), chatbot, and self-help guides | Free training, Phone support, Live Chat |

| User Interface | User-friendly Interface | User-friendly Interface |

Now, if I talk about job costing and document management these features are also available in QB Online and Desktop. Multi-user access is also available in both but that can depend on the kind of software you use. There might be questions in your mind where do the products differ? Where do they excel? So, to know the answer let’s find out more.

Overview & Features

Read the following to learn the overview, and features of QuickBooks Desktop, and QuickBooks Online;

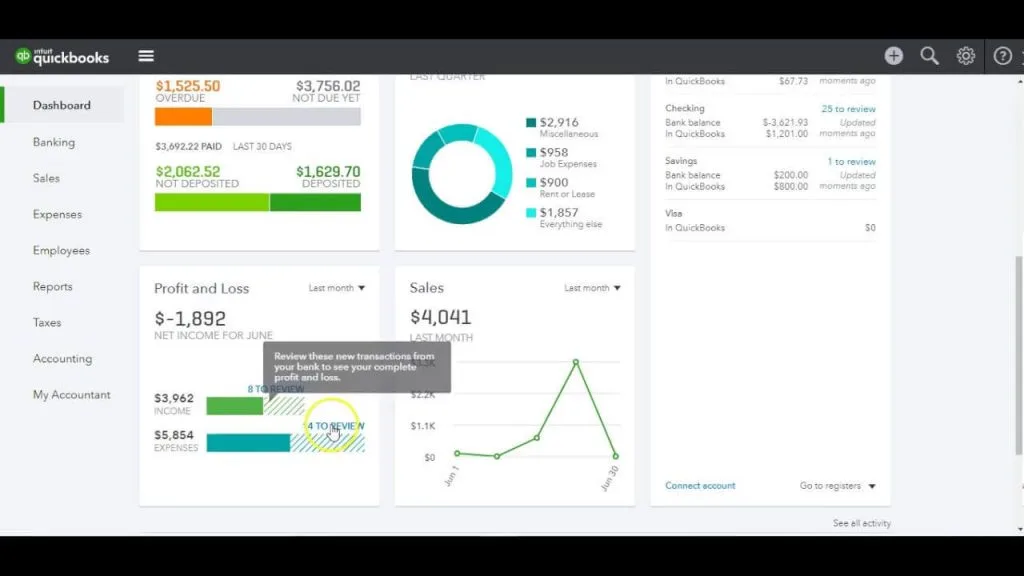

QuickBooks Desktop

In business, it is difficult to manage large amounts of inventory and job costing. But, Quickbooks Desktop provides special features and advantages so that no such problems are faced by the users. You will find many features that QB Desktop provides but QB Online does not.

One thing you should keep in mind is that the features provided below are not supported in Quickbooks Pro. It is only supported in QB Premier and Enterprise.

- Data Entry

- It includes Price Levels.

- Has the ability to create Invoices in Batch.

- Provides Billing Rate Levels.

- Batch Enter Transactions and Timesheets.

- Job Costing

- Progress Invoicing and billing features.

- Has a Job Costing Module & Reports feature.

- Includes Payroll job Costing and Labor Burden Costing.

- Provides Mileage Tracking.

- It can change orders on Estimates and also the Markup Column.

- Reporting

- It has an Industry Specific Reporting feature.

- Provides multiple Vendor Shipments to Addresses.

- Includes Business Planner, Forecasting, and Balance Sheet by class.

- Inventory

- Offers the Average Cost Inventory Valuation Method.

- Provides Set and Maintain Inventory Reorder Points.

- Has features of Build Assembles or Manufacturing.

- Includes Sales Orders and Units of Measure.

- Accounting

- Has a Backup and Restore feature.

- Provides Client Data Review tools.

- Includes QB Statement Writer.

- It does not provide the facility to post to Additional AR/AP Accounts.

Generally, a higher number of reporting options are available to the user.

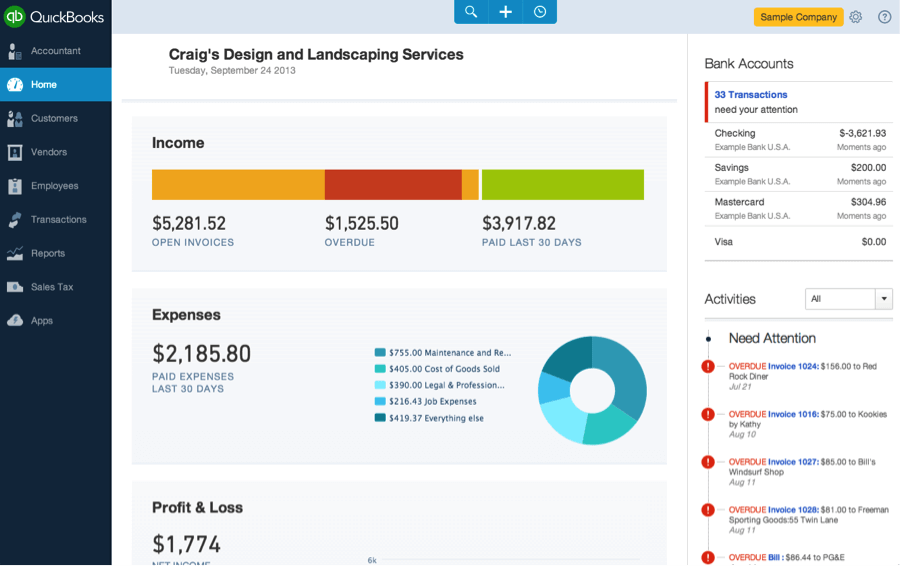

QuickBooks Online

Moving further, let’s find out the benefits of QuickBooks Online that cannot be found on the Desktop. The best part about QB Online is that it provides free unlimited customer support and lower overhead costs.

- Automatically schedule, and send invoices and reports.

- It is easy to attach documents, images, signatures, and also more to transactions using a mobile device anywhere.

- You can use Audit Log to review actions and easily track changes over time.

- Provides automatic upgrade of the software.

- Includes multiple budgets per fiscal year.

- Has seamless integration with 3rd party apps.

- You can use Management Reports to build a presentation.

- Provides the facility of Auto-add to register and is implemented by Bank rules.

Pros And Cons

For QuickBooks Desktop

| Pros | Cons |

|---|---|

| Strong features | Customer support |

| Traditional accounting | No remote access or mobile apps |

| Probably more secure | Expensive license structure |

| 200+ integrations | Less automation than QBO |

For QuickBooks Online

| Pros | Cons |

|---|---|

| Cloud-based Service | No sales orders |

| Easy to use | More expensive than other SMB products |

| Monthly Pricing | Fewer features than Desktop |

| Powerful features | |

| Built-in lending | |

| 500+ integrations apps |

Plans & Pricing Comparision

Read the comparison of QuickBooks Online and QuickBooks Desktop for pros, and cons;

QuickBooks Online

QuickBooks Online comes up with five plans according to your business need, i.e. Simple Start, Essentials, Plus, Advanced, and Self-Employed. It all depends on your business’s particular accounting requirements, estimates, budgets, and nature of business. All editions enable you to track income and expenses, Catch and organize receipts with your smartphone; Accept invoices and payments from your smartphone, and run reports, such as your profit and loss statement and balance sheet.

Let’s discuss the five plans and pricing for QuickBooks Online

- Simple Start

Simple Start is the basic QuickBooks Online plan. It enables only a single user to run general reports, track revenue and expenses, bill and receive payments, track sales, and sales tax data, and catch and manage receipts. Users can also use this Simple Start plan to manage the tax reductions and possibly enhance savings at the time of tax as well as help you to manage the 1099 contractors and track mileage. You can get this by paying $15/per month(for the first three months). This is the very cheaper plan available for small businesses that only require accounting but can manage without the features offered in the higher tiers.

- Essentials

This Essentials plan provides access to up to three users to add a simple start plan (with the ability to produce more augmented reports) and the ability to track bill status, Record payments, From anywhere, create on-demand checks, And set up recurring payments.

The plan enables you to track employee hours and billable hours by customer or employee, as well as data integrated by QuickBooks to manage bills by an employee scheduling and time tracking app. The required plan is $27.50 per month for the first three months.

- Plus

It is the most common QuickBooks online plan. It provides you with many additional features and functions than an essential plan, the Plus plan has a maximum of five users and the ability to track project profitability and inventory. You can buy this plan for $ 42.50 per month.

- Advanced

QuickBooks gives you many advanced options, including a dedicated account manager, on-demand online training, and business analytics and insights, and also enables the opportunity to import and send batch invoices and the capability to automate workflows. If you want to get a subscription to QuickBooks Advance then you have to pay $100 per month.

QuickBooks Desktop

A major difference when comparing QuickBooks Online vs Desktop is the fee structure. Unlike QuickBooks Online’s monthly fee, you only have to purchase software for the QuickBooks Desktop program once. While five plans are available to choose from online, the desktop version provides three options:

- QuickBooks Desktop Pro Plus 2024

This software enables you to track the performance, income, and liabilities of your businesses, execute various tasks, such as importing data from a spreadsheet, Registering automated reporting (such as profit and loss), and paying 1099 contractors.

The latest version also offers the option to consolidate multiple invoices into a single email and an enhanced customer service experience with easy access to help content using automated customer payment reminders, products, and live expert advice. QuickBooks Desktop Pro Plus 2024 is currently registered at $ 549 (for a single user) and you can install three computers.

- QuickBooks Desktop Premier Plus 2024

In addition to the features described in the low-cost desktop version, the plan also provides forecasting and industry-specific features that make it feasible to track profitability and run industry-specific reports at the client, project, or product level. QuickBooks Desktop Premier Plus 2024 is available at $ 799 (for a single user) and you can install up to five computers.

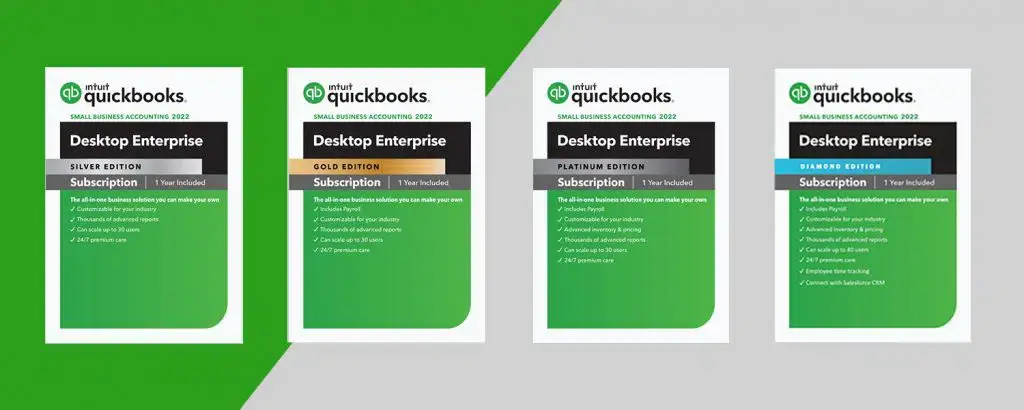

- QuickBooks Desktop Enterprise 24.0

QuickBooks Enterprise 2024 provides you the enhanced features than Pro and Premier. With this version, you can install up to 40 computers. The Enterprise version is available in an annual subscription and you can purchase four Silver, Gold, Platinum, and Diamond plans.

Gold: This version provides enhanced payroll functions as well as advanced reporting capabilities. This edition can help users to generate limitless paychecks, file payroll taxes, and generate W-2, among other common payroll requirements. You can purchase this plan at $ 1281 per year.

Platinum: The Platinum QuickBooks Enterprise software includes advanced inventory capabilities and more features in addition to advanced pricing features. You can purchase this plan at $1350 per year.

Diamond: QuickBooks Enterprise Diamond is the most advanced plan of QuickBooks Enterprise in 2024. It includes all of the facilities, and features of Silver, Gold, and Platinum. The minimum cost of Diamond in core cloud access is $ 2664 per year

Pricing Structure

Another important differentiation is that QB Online has a monthly SaaS pricing structure, while QB Desktop follows the licensing structure. You can buy a license for QuickBooks Desktop for three-year subscription or you can also pay for an annual subscription, but there is no option for monthly payment options.

Feature Comparison Chart

| Features | QuickBooks Online | QuickBooks Desktop |

|---|---|---|

| Invoicing | ✅ | ✅ |

| Contact Management | ✅ | ✅ |

| Lead Management | ✘ | ✅ |

| Expense Tracking | ✅ | ✅ |

| Inventory | ✅ | ✅ |

| Project Management | ✅ | ✅ |

| Ease of Use | Good | Poor |

| Customer Support | Fair | Fair |

| Reviews & Complaints | Fair | Good |

| Integrations | Excellent | Good |

| Reports | 80 | 130 |

QuickBooks Online vs Desktop: What’s your choice?

Well, we can help you out with that. According to me, the easiest way to make the right choice between them is you need to first look at the features that QuickBooks Online vs Desktop doesn’t have and then ask yourself to make the right decision:

- Is the organization focused on the services or on the inventory?

- You need to ask yourself whether you need flexibility and mobility of access from any location, or the comfort of access in a stable workplace, such as the main office.

- What would you prefer user-friendly software with simpler operations, or a bit more complex?

These are some questions, and after answering them you will get a better idea of which software would work best for you and your company.

Note: You need to remember one thing Intuit is investing more in their mobile products as compared to their desktop products. That’s the reason their online products will only get better and better. Generally, online software is better in various ways.

It includes your own communication with your bookkeeper or accountant and also provides internal communication.

Although we know it’s not an easy task to answer. But we would suggest you that always consult with your bookkeeper or accountant before deciding.

Need more help on this topic or any query related to Accounting and Bookkeeping, contact our QuickBooks Support toll-free +1-844-405-0904.