Did you really think that you can handle the Payroll for the company in a better way? I think not, because there is a question that always arises how can a company handle the payroll? Let’s deeply talk about it and interact with each part of the payroll related to the creation of the Payroll plan. As we know that it is very complicated and its job is to make the trustworthiness of the client and handle the payment system of the company more effective and efficient. Here we have a solution for that, so go through the article and troubleshoot it. For further QuickBooks Online Payroll support, contact us at the toll-free [quckbooks].

Table of Contents

Intuit Online Payroll Customer Service

QuickBooks payroll is particularly designed for small business owners. Basically, it is designed for 50 employees but due to potential fees, it is best suited for 15 or fewer employees.

The application provides three plans and you can move to the next plan if you want to get more product functionality. Remember, it is not necessary to use the QuickBooks application if you want to use QuickBooks payroll.

Features of Intuit QuickBooks Online Payroll

The feature “full-service payroll capability” makes QuickBooks payroll unique among its other competitors. It currently offers three plans, i.e. Core, Premium, and Elite, and with that all, it provides the following features:

- Direct Deposit

- Employee Portal

- Unlimited Payroll Runs

- Automated Tax Calculation

- Automated Tax Filling

No need to pay extra if you want to run additionally due to the feature of unlimited payroll runs.

The application provides the feature of automatic calculation and processing of taxes. Also, it automatically files payroll tax forms including tax deposits. It also includes a free direct deposit.

Below given the following features of QuickBooks Online Payroll:

Auto Payroll

Without additional entries, you can run payroll by the feature of auto payroll provided in all QuickBooks payroll plans. QuickBooks payroll allows you to preview payroll before processing so that you can make the required changes.

QuickBooks Workforce

QuickBooks online payroll provides a new feature of QuickBooks workforce which is the replacement of the previous feature paycheck record option. It gives access to the employees of important information like pay stubs and W-2s, current tax information, etc.

Benefits

The benefits option in QuickBooks online payroll provides quotes and sign-up for medical, dental, and vision insurance easily.

Reports

Intuit QuickBooks Payroll offers a wide range of variety of reports. You can also create and save custom reports to use in the future.

Pros & Cons Of QuickBooks Online Payroll

Pros of QuickBooks Online Payroll

- Clean, simple user interface

- Accelerated setup

- Smooth payroll process

- Automatic payroll

- Deep integration with QuickBooks Online

- TSheets integration

- New HR support from third-party providers

Cons of QuickBooks Online Payroll

- Expensive

- Slim employee portals

- Online help files are not focused enough

- Extra charge for 1099s

- Mobile apps don’t replicate the desktop experience

Handle the complication of the Payroll

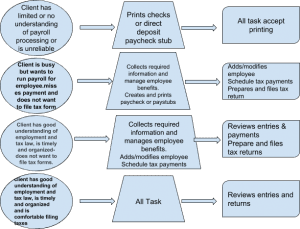

In this modern era, there are different types of clients exist. These clients can be different in size, shape, knowledge, confusion, etc. We have to handle these clients and this is our responsibility to not only listen to the client but also know the problem deeply and should understand all the related issues that arise before and after and also provide an effective solution.

Some client thinks that they know each law and their obligation related to payroll, but they even don’t know that they have the wrong knowledge or they can be misguided or the client is not up-to-date with the new updates. Other clients like, those who are much more vigilant to stay always up-to-date and manage their Payroll obligations. Some clients are unpredictable due to forgetting deadlines or missing required payments. Which causes penalties and other related issues like paying costly fees amended returns or interest.

Feel burdened about payroll?? Don’t worry here is a solution that can fit each type of client it’s the matter that they want full service or they want to be fully involved to manage the payroll taxes and don’t want to pay penalties or other costly fees. These problems can be avoided with the help of QuickBooks Online Payroll. Here we are mainly focused on the comfort of the accountant who really doesn’t want to involve payroll taxes and is not able to manage the compliance aspect due to a busy schedule.

QuickBooks Online Payroll is a better choice for these accountants. It provides more flexibility to create or control the Payroll system for me as well as the accountant. The most important feature of QuickBooks Online Payroll is that it can monitor compliance and can access and use the data due to everything being in one place. Which is easy for the client as well as me to use it. So be happy with QuickBooks online services and keep using them.

Now, come to the main point:

How to create and save your time easily

Follow the steps given below:

Step 1:- Know about your client

To know how much your client is vigilant about Payroll follow these factors that include some easy questions:

- Does the client is irresponsible about cash flow issues and always postpones making the required Payment?

- Is the client have a more busy schedule and he/she is forgetful?

- Does your client have the necessary skill to do their own returns?

While examining these factors be obliged to understand the client because some client claims that they can handle the payroll but they don’t even know how to make payment timely. So be practical and convince the client that they need help.

Step 2:- Decide the role in payroll

We know that once we identify the problem we can easily solve it similarly once we understand the client which part a client can do easily and in effective ways. On the basis of the determination, QuickBooks Online Payroll provides flexibility in Payroll processing as it includes many features you can log in to QuickBooks Online Accountant as per your need. And also you can use the Employee tab where you can use additional features like Setting up reminders and monitoring your client activities that they completed the required task on time or on time.

Payroll Processing has four distinct roles:

- Set up and maintenance of employee and Payroll

Here we maintain the required information and make entries and set up the employee for new hires. - Payroll execution

- Pay required payments like takes, contributions, and other obligations.

- Filing of payroll tax returns.

Some possible ways to decide the responsibility:

| Situation | Client | Practitioner |

The QuickBooks Online Payroll services are very easy to use and due to being web-based you can guide the client from anywhere and provide better guidance. It also includes additional features like it notifying from time to time about the filing by e-mail. If the client missed the mail the QuickBooks Online Accountant becomes red which shows that some problem occurs. This help in reminding about forgetting to file and other missed payment etc.

Step 3:- Give the training to the client on the procedures for their portion of the payroll plan

The main part of this is to make the client satisfied with practicals. This causes better utilization and we should make sure that the client doesn’t have any doubt about the use and handling of payroll. Here we should train the client as much as he understood and be confident about handling payroll. Behalf of that it provides some cool features which are given below:

- On the Employer Set Up page, the SS-4, state registration forms, and new hire reporting forms, are available for download in the Taxes and Forms section o

- The UI for setting up payroll is intuitive and well-designed. It is structured as a checklist of things that must be done before processing payroll.

- You can put up more reminders if you can have numerous payroll schedules.

- Do Add-ons that include free direct deposit, pay-as-you-go workers’ compensation insurance, and 24-hour direct deposit.

- Multiple work locations can be tracked in different states.

- Compliance reminders via E-mail, QBO’s Payroll Center Payroll keeps the client informed of any changes to tax or employment law that may have an impact on them so they can stay current.

Hence, QuickBooks Online Payroll is the most interesting interface that interacts with the client and provides a better way to understand the clients and collaborate efficiently with the client.

Step 4:-Things to consider when choosing a salary versus hourly

Here are some things to pay employees hourly or with an annual salary:

A salaried employee is one that is paid a fixed rate at set intervals for a job whereas hourly employees are paid by the hour for work performed. There are advantages and disadvantages to paying salary vs hourly. We’ll examine the advantages of each kind of employee pay, for example, the simplicity of organization and accuracy so that you can choose what works best for your small business.

Step 5:-Industry and Role

Conventions may differ based on the industry and position. Such as hourly pay is appro[riate for a restaurant waiter or convenience store cashier, but likely not for the restaurant general manager. Similarly, the salary might be more appropriate for a marketing associate at a Pr firm or a writer at a publication. You can find out more about your industry by examining conversing and talking to fellow business owners.

You may lose the ability to your competitors based on your choice of hourly versus salary. Say you have a small marketing agency but you want to pay hourly (which isn’t normal for the industry).

How to Pick the Best Payroll Product for Your Client

You need to consider many factors that help you in choosing the right payroll product for your client.

Which product is good for them and what do they use?

You must be aware of the type of software your client employs in order to choose the appropriate payroll subscription, Is it QuickBooks Online (QBO) or QuickBooks Desktop (QBDT)? To software according to their company size and their requirements and their budget.

Who Will Submit Payroll Tax Returns and Pay the Payroll Taxes?

This question is important who will submit payroll taxes, it may possible that your clients have no time to pay the payroll taxes, or they are not tech savvy. In that case, it is recommended to take full-service payroll where Intuit takes the responsibility.

Do it Yourself Payroll: In this, the client itself files the payroll tax return. But clients should be aware of the consequences of mistake tax filing. It will become costly if clients do it without proper knowledge.

Full-Service Payroll: In full-service payroll, Intuit will be responsible for filing payroll tax returns and paying payroll taxes that make it possible for your client to stay in compliance, lowers the price of fines, and gives him or her more time to concentrate on running the business instead of worrying about data entry and labor-intensive payroll management.

Finally, don’t wait just go for the QuickBooks Online Payroll.

Call our Toll-free QuickBooks support number +1-844-405-0904 to get any help related to your QuickBooks payroll.