Eager to know about QuickBooks sales tax Automation & how to set up & use it? Here is an article to cater you the process of setting up with complete details and usage. Read the article about QB sales tax automation, how it works, and the steps to set up QB sales tax automation. Go through the article and learn the process of setting up in easy steps along with the functions and usage of it with appropriate images. While following the whole procedure if stuck anywhere then you can also contact our Intuit certified ProAdvisor at our toll-free QuickBooks Support Number +1-855-525-4247 to save your time and effort.

QuickBooks offers the new feature of QuickBooks sales tax automation where it automatically calculates the sales tax of your invoices and receipts for simple and correct filing.

Then, it tells you when your tax payment is about to be made, so you can pay on time and avoid additional charges. It is a very straight forward method to get sales tax through new QuickBooks Automated sales tax features.

With this new automated sales tax feature, you don’t need to calculate your tax rate manually. Read this article to know how to set up and use Automated sales tax in QuickBooks Online.

Table of Contents

How QuickBooks Sales Tax Automation Works

Like the name suggests, the Automated Sales Tax aims to automate sales tax-related tasks as many as possible. You only need to answer some questions such as where are you located, what kind of products do you sell, and what’s your customer’s locations, and AST takes over from there. After getting the answer of these necessary questions, the tool utilizes the following information to discover the tax rate to be applied to the invoice.

- Your state name.

- Your permanent address within your home nation.

- The sales receipt or invoice with your physical address.

- Are items on the invoice subject to sales tax.

- Whether your customer is free from sales tax.

How To Set up Automated sales tax in QuickBooks Online

Follow this procedure to set up Automated sales tax in QuickBooks Online

- To set up an Automated Sales Tax, start by clicking Taxes after Sales Tax in the tab on the left.

- later, Insert your company’s physical address and then indicate if you sell products outside your home state.

- You will be asked to file the information when you started collecting tax in that jurisdiction and how often you file a tax return for that jurisdiction.

- If you have additional sales tax agencies that you need to set up, just click Add Agency and you will be prompted for relevant information.

- For each item you sell, you must indicate whether the item is taxable and if it is, does it have any special tax characteristics. Examples of special features include whether the item is food or drink and if so, whether it is a carbonated beverage, which is subject to special taxes in some jurisdictions.

Keep in mind, for every customer, you must register their billing address and their shipping address if it is changed. If your shipping address is supplied, it will be used to calculate sales taxes.

Additionally, you would indicate if a specific customer is exempt from sales taxes and if so, the nature of the exemption like government exemptions, religious organizations, etc. After all the above items are installed, you are able to start using Automatic sales tax.

How To Use Automated sales tax in QuickBooks Online

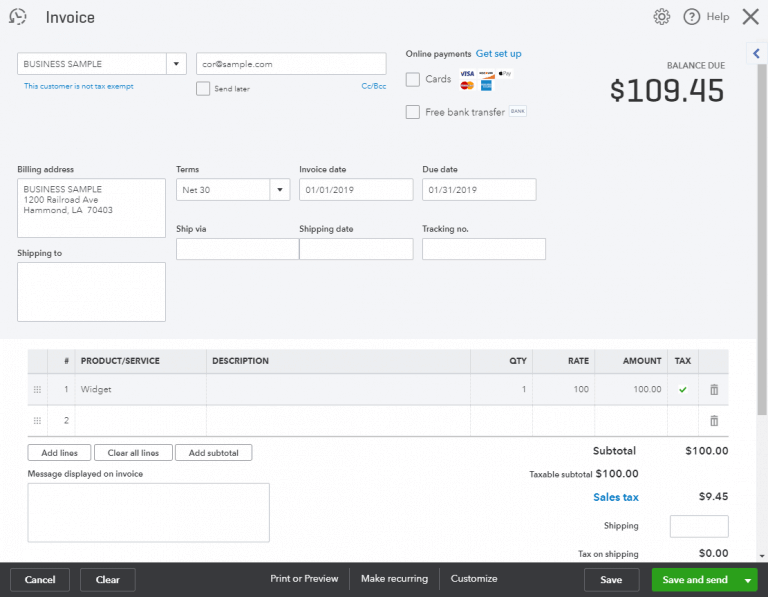

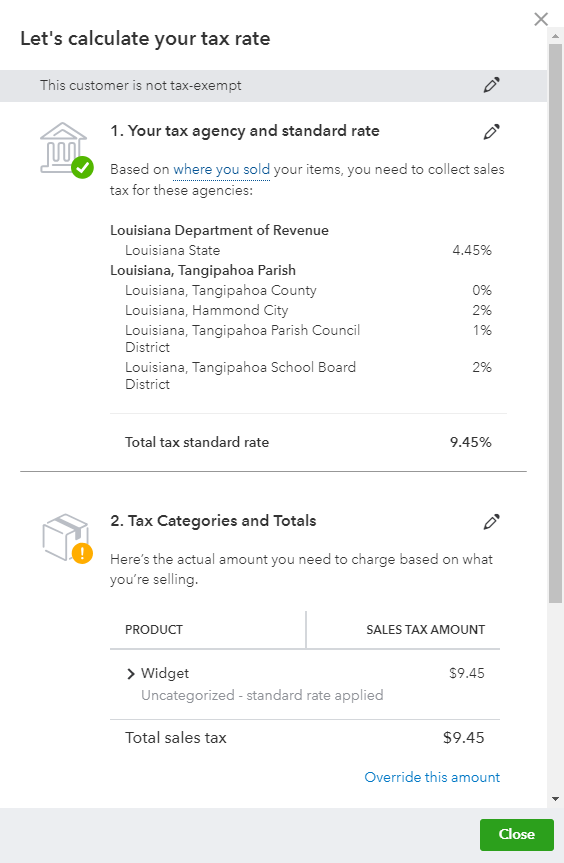

After configuring AST as earlier described, you issue your invoice (or sales receipt) to customers, as you’ve always done in QuickBooks Online. Only now, all taxes are calculated based on the information provided by Automated sales tax. Now here we will understand how to use AST with the help of an example: The customer’s $ 109.45 sales tax was driven by the billing address because no shipping address was given.

Go to the Sales Tax link near the right bottom corner of the invoice initiates the work pane shown in the picture below. As you notice, that pane presents a complete report of how the tax was calculated.

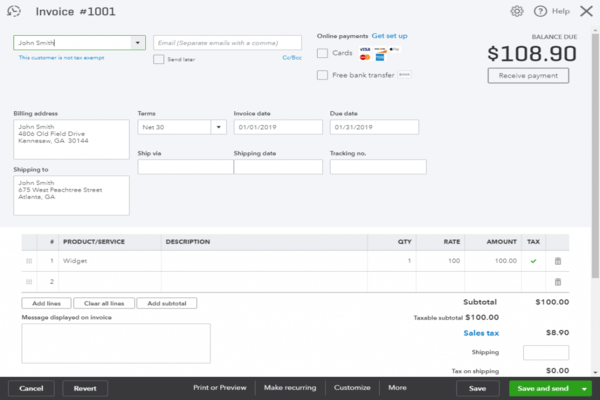

See in the picture below in the invoice, the calculated tax is based on the shipping address of the customer and not the billing address. Of course, it is because the shipping address field was populated in this illustration, while it empties into the first examples.

After you move to the new sales tax system, you have the option to use custom rates on invoices and receipts. You can use custom rates to manually track special taxes such as food or excise taxes. Or, use custom rates if you feel manually tracking more reliable sales.

How to enable the new sales tax center in QuickBooks Online

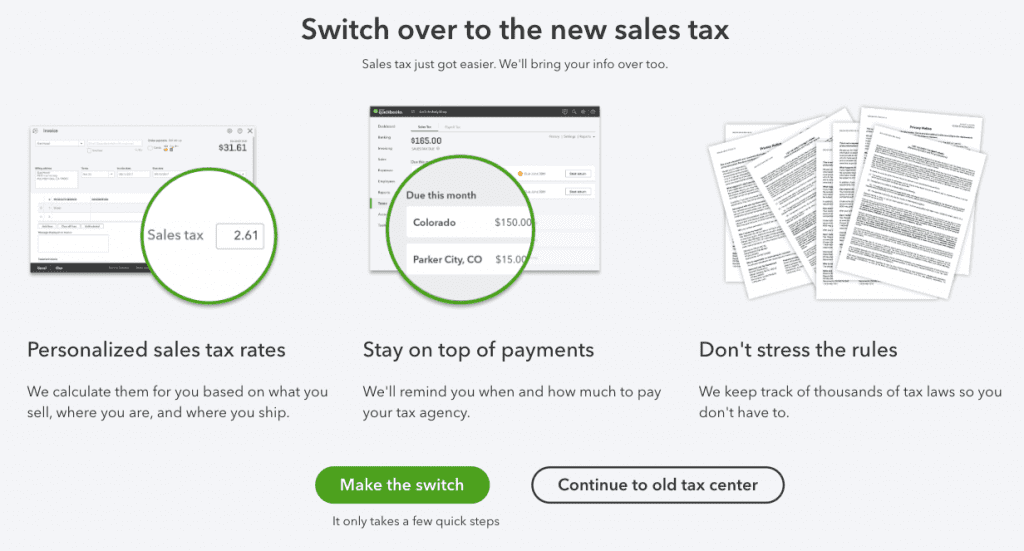

Here we will learn how to switch from manual to automated sales tax in simple steps: First, you need to simplify how you track your sales tax return. You can calculate the sales tax for each sale based on where you sell QuickBooks, where you sell, and where you ship. QuickBooks identifies all the tax rules, wheresoever you operate your business.

Here’s we will the steps to switch to the new sales tax system in QuickBooks Online. After the switch, you can see all your current sales tax information in one place.

Switch over to the new sales tax

- Continue to Taxes and then choose Sales Tax. If your QuickBooks is set to switch to auto sales tax then you will see this screen below.

- Choose to Make the switch. If in case you do not see the above screen and you need to view the old sales tax center alternatively, later choose Setup automated taxes at the top.

- Verify the address for your business if it is correct then choose Looks good else to choose the edit icon ✎ to update your address.

- QuickBooks identifies the official tax agency in your state. Match the official tax agency with the existing agency you established.

- Pick your filing frequency.

- If you want to pay another tax agencies then choose to Add Another Tax Agency.

FAQ Of Automated Sales Tax Service in Quickbooks

If you are using automated sales tax using QuickBooks financial software. There is no longer a need to select a tax rate. So, when you set up an invoice or other transaction- the system will by default do it for you!

Hope this will help you to understand QuickBooks sales tax automation services. To more help about any Query about sales tax, you can dial our toll-free number +1-855-525-4247.