Want to know, create, and prepare 1099 forms in QuickBooks Online? In this article we have provided all the related stuff, It is important to prepare 1099 tax forms because it has the information on what you’ve paid to the independent contractors in a calendar year. In this article, we’ll show you how to prepare 1099 forms in QuickBooks Online so you can E-file them to the IRS without any errors. Go through the article to get all your queries resolved. Still, a problem contact our Quickbooks ProAdvisor toll-free: +1-844-405-0904

Table of Contents

Do you need to file 1099?

Before filing the 1099 form you should know whether you need this 1099 form or not. The IRS only requires filing a 1099 form for non-employee only if:

- If paid in cash $600 or more during the previous year.

- The IRS doesn’t permit specific electronic installments to be accounted for on Structure 1099-MISC or 1099-NEC. These installments incorporate Visa, charge card, gift voucher, or PayPal installments. QuickBooks Online naturally rejects these for you. The installment organizations will report those installments so you don’t need to.

- Under the Backup withholding rules, it restricts federal income tax.

Know the need of filing in your state?

The 1099 E-file service is only for federal 1099-MISC and 1099-NEC filings. See File your state 1099 forms for more details on which states support combined filings or demand a 1099 filing. Contact your state for more information and learn how to file.

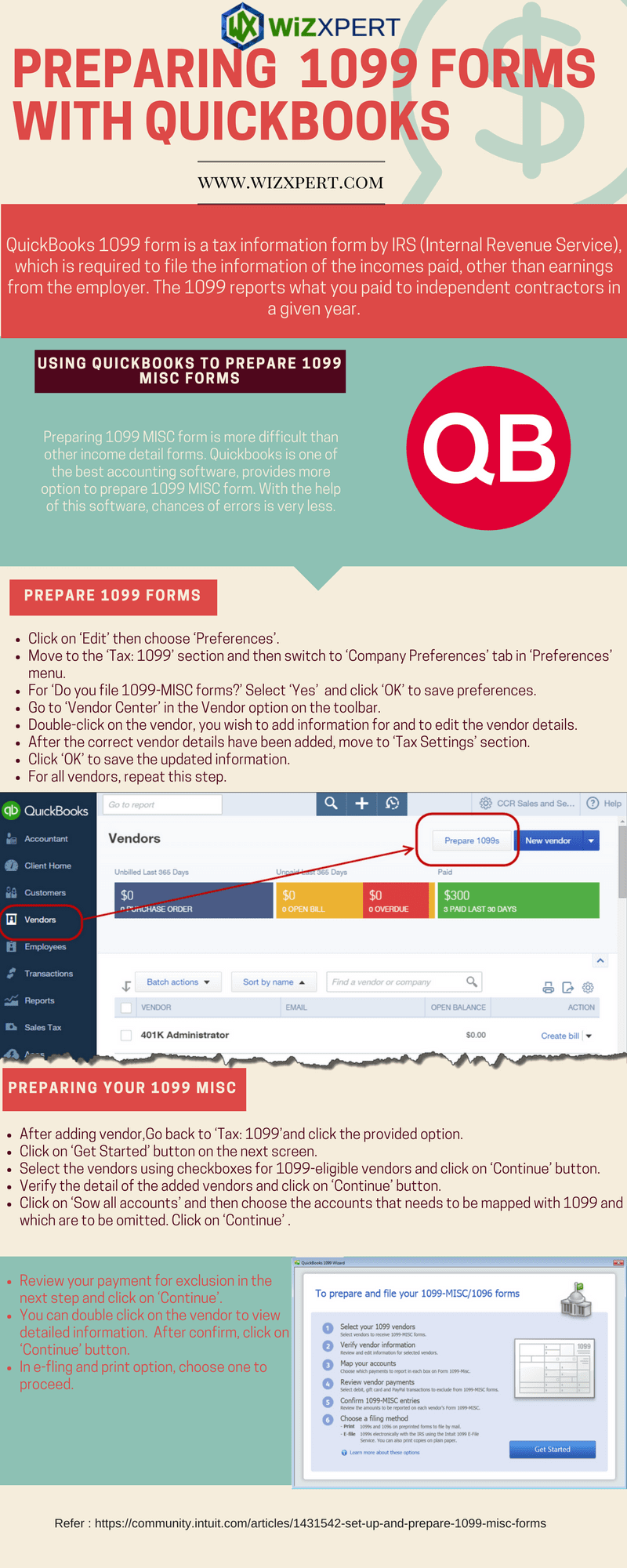

Using QuickBooks to Prepare 1099 MISC Forms

Preparing a 1099 MISC form is more difficult than other income detail forms. Quickbooks is one of the best accounting software, providing more options to prepare a 1099 MISC form. With the help of this software, the chances of errors are very less. QuickBooks automates a number of associated tasks for better features of adding 1099 eligible vendors.

When someone does work for you as an independent contractor then you’ll need to send those 1099 at the end of the year so they can report their income to the IRS as per general guidelines. If the contractor does the work of an employee but they aren’t an employee or a corporation then you have to create a 1099 form for them at the end of the year.

Create 1099 Forms in QuickBooks

First, review your company details and make any changes. Now you need to assign the expense account you used to pay the contractor. To prepare the 1099 MISC form for your business, you can follow the following steps.

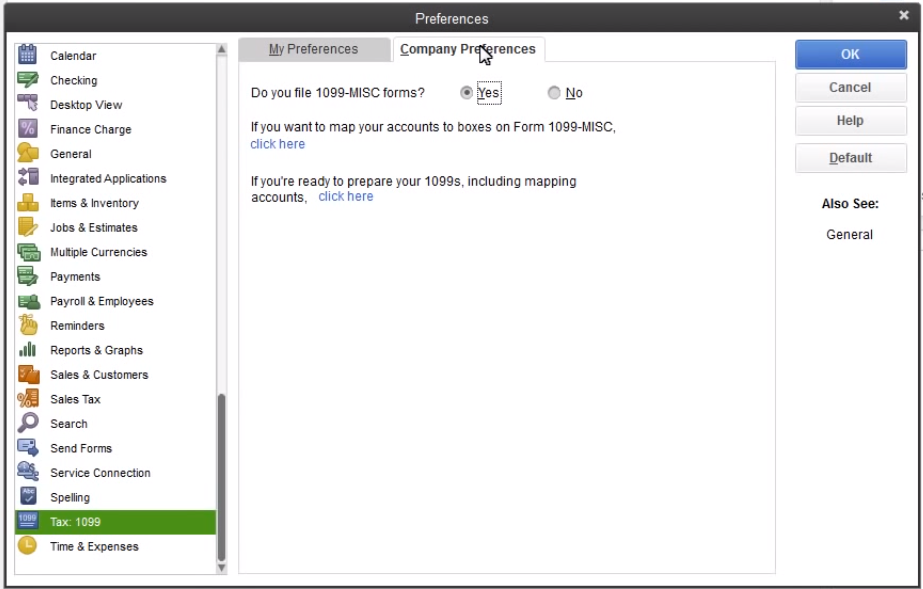

- Click on ‘Edit’ then choose ‘Preferences’.

- Move to the ‘Tax: 1099’ section and then switch to the ‘Company Preferences’ tab in the ‘Preferences’ menu.

- For ‘Do you file 1099-MISC forms?’ Select ‘Yes’ and click ‘OK’ to save preferences.

- Go to the ‘Vendor Center’ in the Vendor option on the toolbar.

- Double-click on the vendor, you wish to add information for and to edit the vendor details.

- After the correct vendor details have been added, move to the ‘Tax Settings’ section.

- Click ‘OK’ to save the updated information.

- For all vendors, repeat this step.

Prepare and File Your MISC

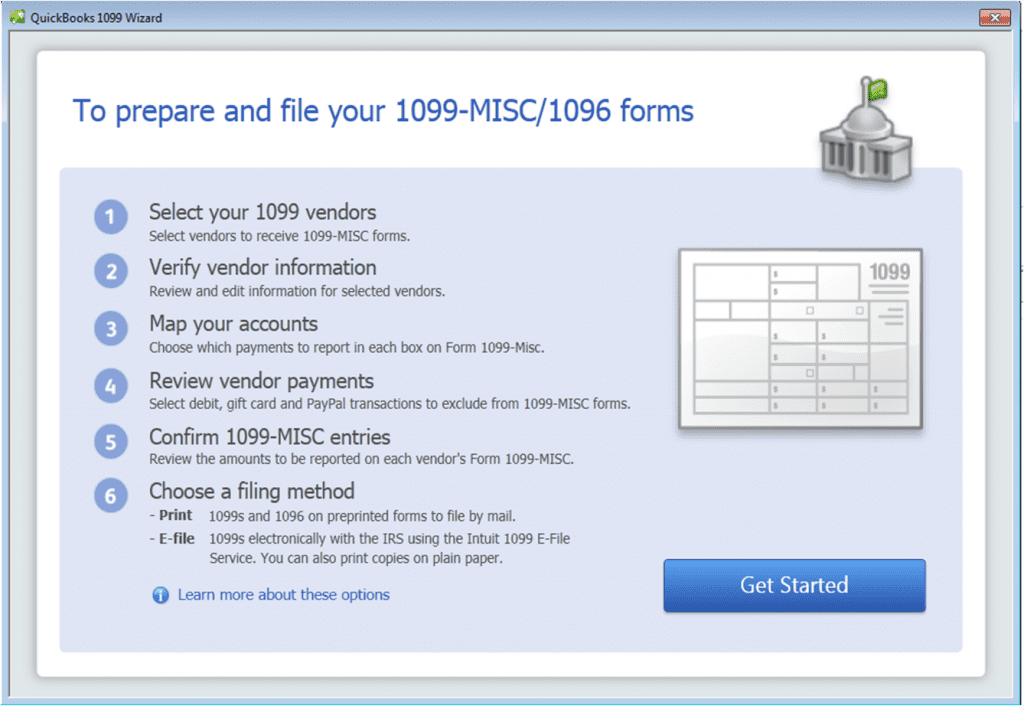

- After adding the vendor, Go back to ‘Tax: 1099’and click the provided option.

- In the QuickBooks 1099 Wizard, Click on the ‘Get Started’ button.

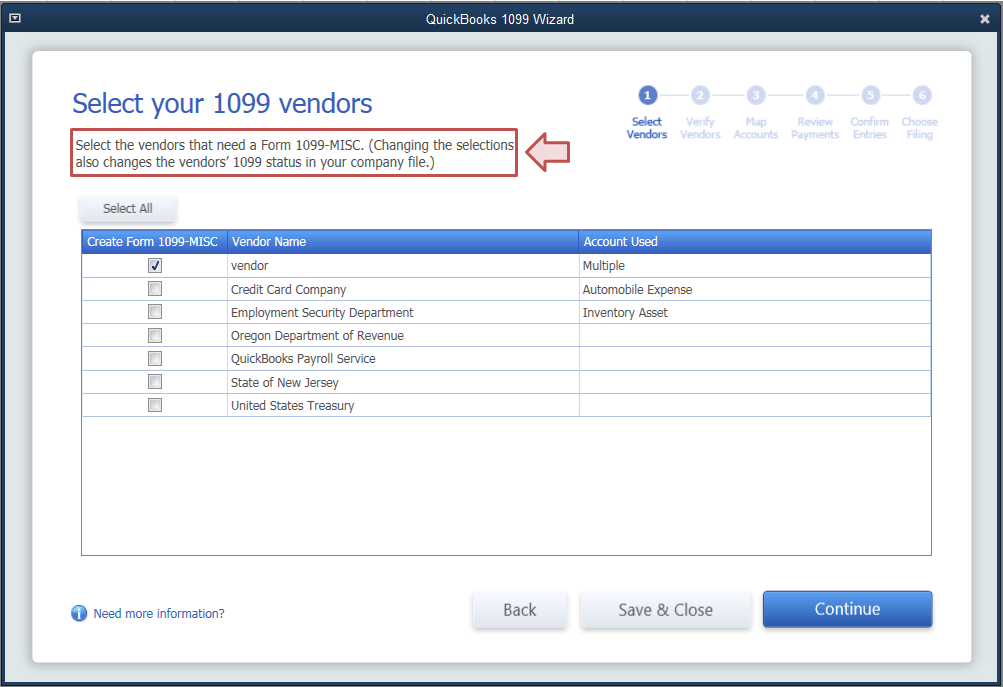

- Select the vendors using checkboxes for eligible 1099 vendors and click on the ‘Continue’ button.

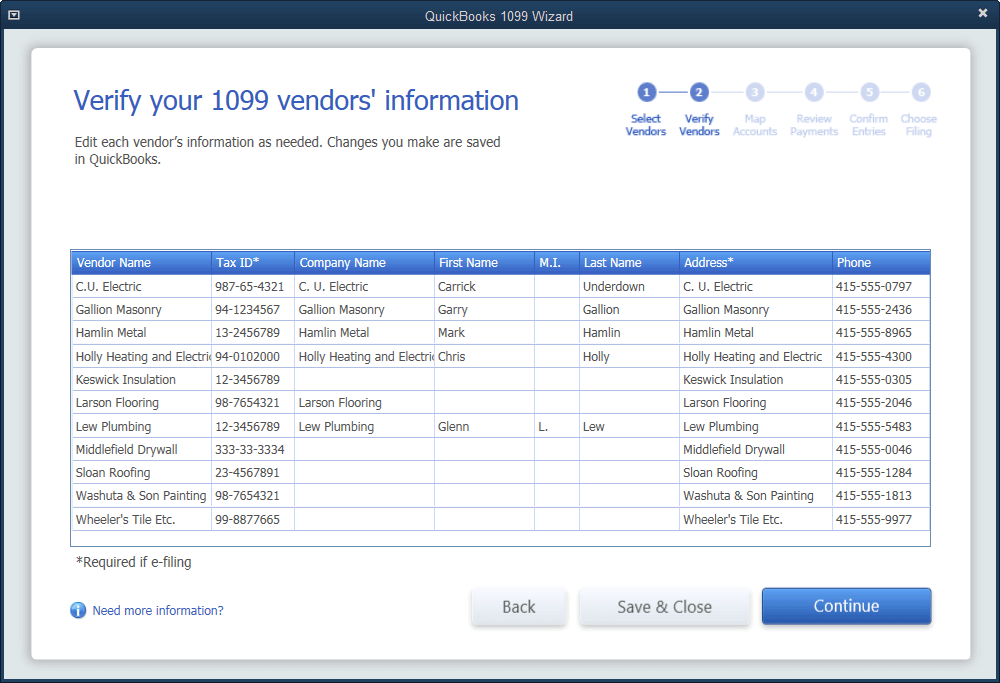

- Verify the detail of the added vendors and click on the ‘Continue’ button.

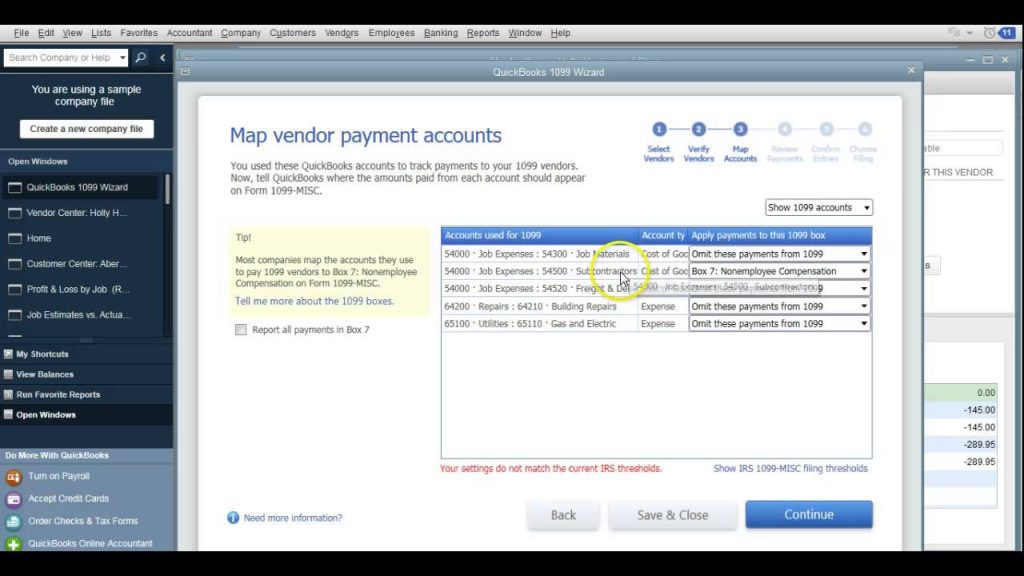

- Click on ‘Show all 1099 accounts’ and then choose the accounts that need to be mapped with 1099 and which are to be omitted. Click on ‘Continue’. If you want to map accounts that you used to pay 1099 vendors then checkmark the box stating ‘Report all Payment in Box 7’.

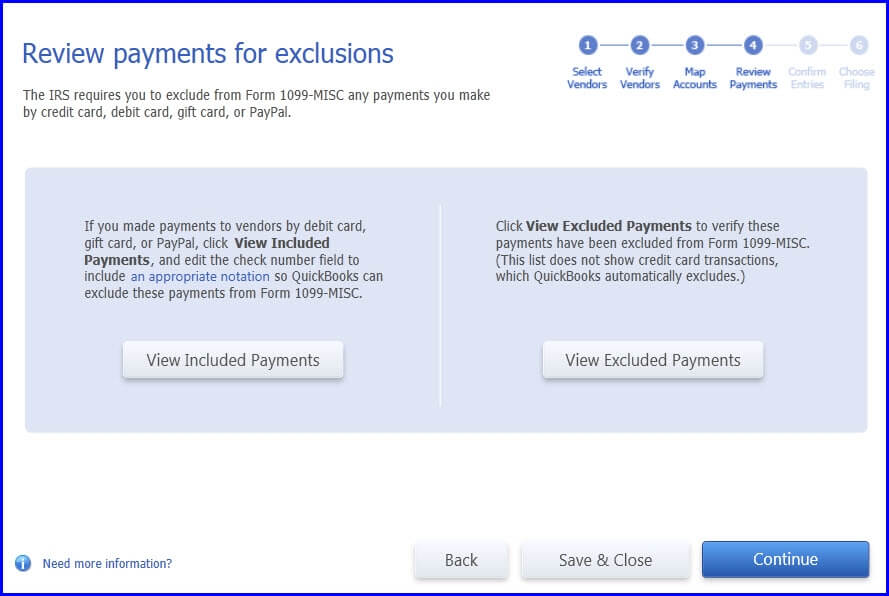

- When you file 1099 Form to IRS, you need to exclude the payments that were made by Debit Card, Credit Card, Gift Card, or PayPal. Review your payment for exclusion in the next step and click on ‘Continue’.

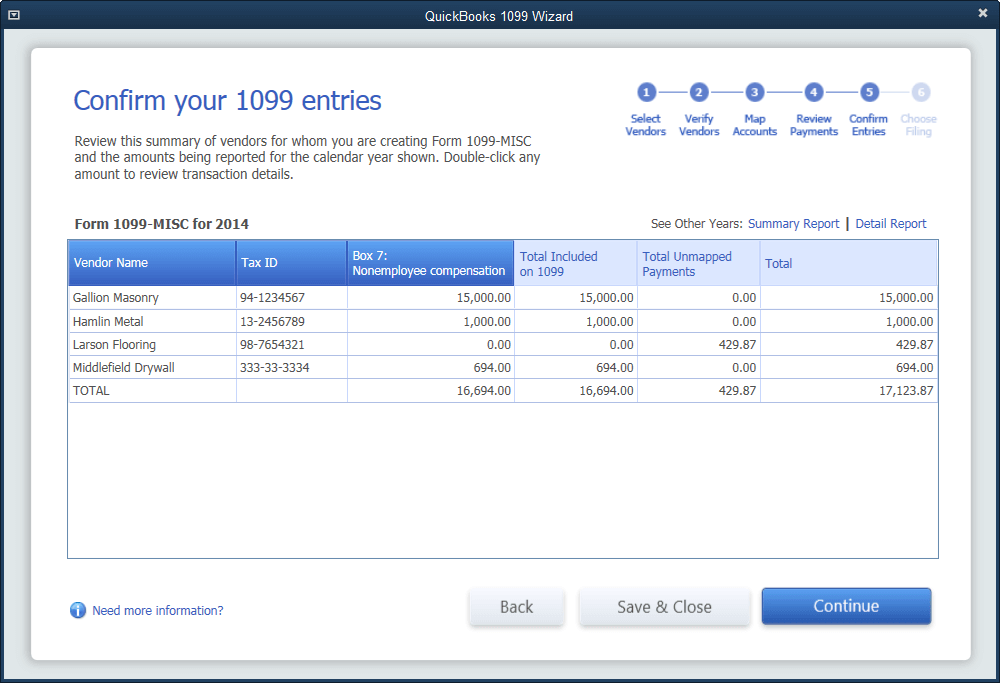

- You can double-click on the vendor to view detailed information. After confirming, click on the ‘Continue’ button.

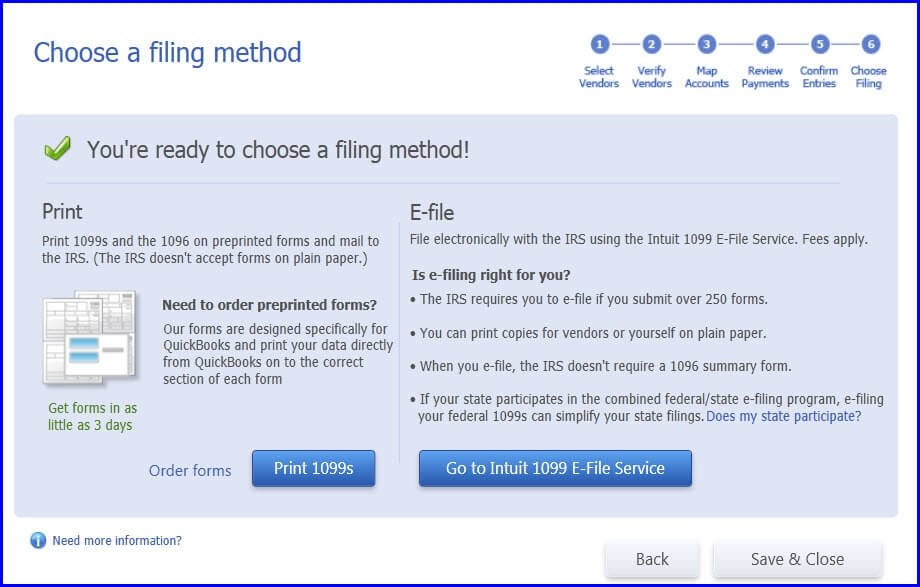

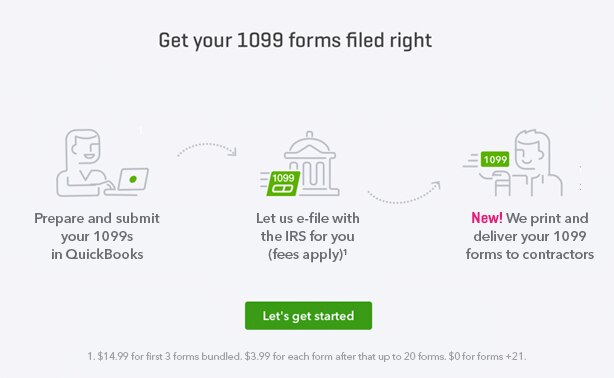

- Click on the ‘Print 1099s‘ option, if you have preprinted 1099s form or select the ‘Go to Intuit 1099 E-File Service’ if you want to use the Intuit E-File service to file electronically.

NOTE: If you opt to E-File the 1099 forms then you can print copies for the vendors and yourself on plain paper.

New QuickBooks 1099 Features: E-delivery and Contractor Self Setup

Intuit has introduced a new feature that will help clients in collecting, enter, and report the 1099 tax information of independent contractors without spending much time.

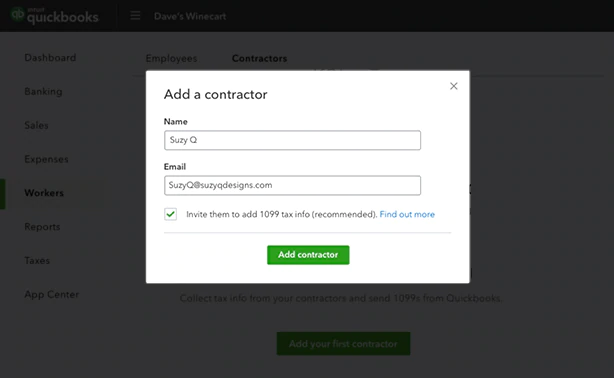

1099 Independent Contractor Self Setup

This new QuickBooks feature allows you to invite independent contractors to fill out their 1099 information. The only thing you need to do is to enter the contractor’s name and Email address and invite them to provide their details.

- Once, you sent an invitation then the contractor will be asked to create a free Intuit account on QuickBooks Self-Employed.

- After that, contractors can fill out their 1099 tax information.

- Then, added 1099 tax information will be available in QuickBooks Online automatically.

QuickBooks 1099 Form E-Delivery

After, Intuit E-filing your 1099 tax forms to the IRS now Intuit also takes care of delivering the copies of the 1099 to the independent contractors for you without any extra charges.

When you choose to E-Deliver the 1099 Forms to the independent contractors then tax forms directly go into the Email inbox which reduces the chances of theft and misplacing the forms.

Set up and file 1099 forms

1099 is a series of forms used to report non-salary income or the money earned from self-employment, independent contractors, etc there are several types of 1099 forms, whenever, the most common and the ones that you usually need are the following:

1099-MISC: The 1099-MISC tax form is used to report the miscellaneous income by Non-Employee individuals such as independent contractors by the end of a calendar year. The 1099-MISC form is issued by the payee or business and paid by the recipient i.e. independent contractor. The misc income should be reported by the contractor before 31 March as per IRS (Internal Revenue Service) guidelines. If you are a QuickBooks Online user then you can either report through QuickBooks 1099 E-File feature or you can print 1099 Forms on preprinted forms and then mail them to the IRS manually.

1096: The compilation of all filed 1099-MISC forms. Quickbooks allows the printing of 1096 forms on a pre-printed form.

1099-K: Report every electronic transaction made between organizations. This is documented NOT by QuickBooks clients yet by electronic installment organizations like PayPal, Mastercard, Visa, and American Express. Announced in the 1099-K are credit/check card and electronic installments for all non-representative pay that meets IRS edges.

The Bottom Line

Have a question about this? You can always get the correct advice and solution to every problem from our experts. If you have any error while preparing the 1099 forms in QuickBooks or any issue related to accounting and bookkeeping then you can contact a certified QuickBooks ProAdvisor via a 24/7 toll-free number +1-844-405-0904.