Want to know QuickBooks payroll summary reports & how to run them? You are on the right page, we are to deliver you details of the QuickBooks payroll summary in this very article. The Payroll Summary report helps you to check the current pays for a month, half, or full year to the government for tax on pay. It also lets you view or print tax and wage summary reports on QuickBooks Desktop. Go through the article and learn to run QuickBooks payroll summary, and understand it well. Still, facing a problem contact our QuickBooks Proadvisor toll-free; +1-844-405-0904

QuickBooks Payroll provides the information related to your’s company employees and payroll expenses.

Table of Contents

What is QuickBooks Payroll Summary Report

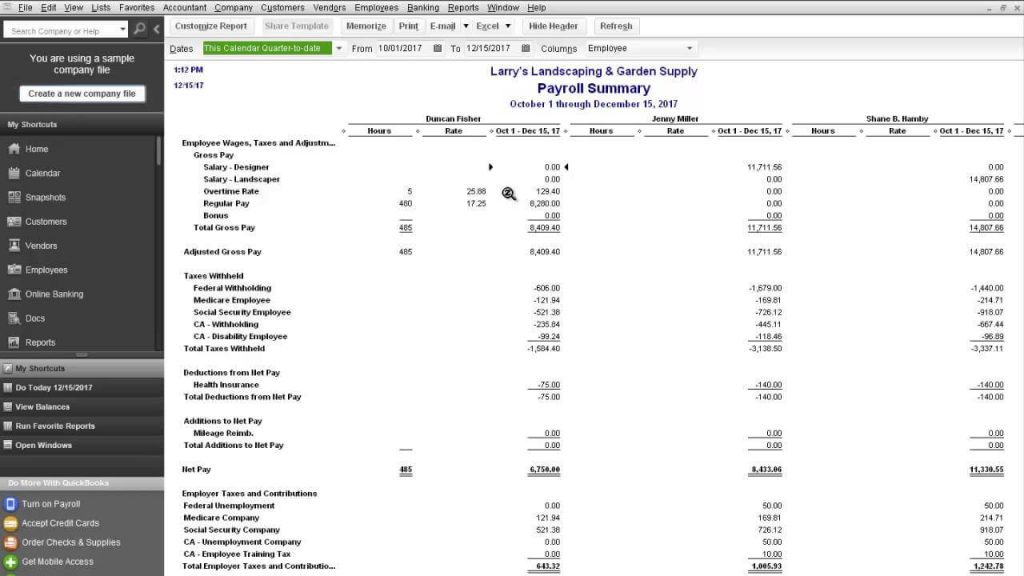

The Payroll summary report is a fast way to see the payroll totals by an employee for a selected amount of your time. This report shows the payroll things with a subtotal for internet payments, and all the company payroll taxes are shown by the employee.

A payroll summary reports collection of employee’s earnings, list of your current employees, paid time off balances and much more. It can be generated for any one period or for a period range

What does a payroll summary report consist of :

Its include followings items,

- Employee vacation and sick time

- Employee, Taxes adjustments and wages summary report

- Taxes and contributions.

- Net Pay of Employees

- QuickBooks quarterly tax reports

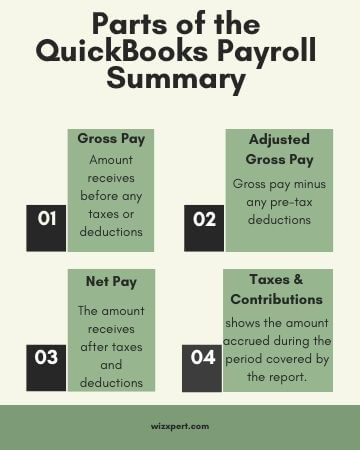

In these types of reports, Gross pay indicates the commission and other bonuses. When we decrease any pre-tax deductions like a contribution by an employee toward 401(k) plan the amount is called Adjusted Gross pay. Furthermore, the Net pay is the amount that an employee received after taxes and all other after-tax adjustments (like loan repayment and travel expense reimbursement)

To Create a Payroll Summary Report:

- In Reports Select > Employees & Payroll > Payroll Summary

- Set a date range.

- Select Refresh.

- Remove the Hours and/or Rate columns-

- Select the Customize Report.

- Clear the Hours and/or Rate checkboxes, in the Display tab.

- Select OK.

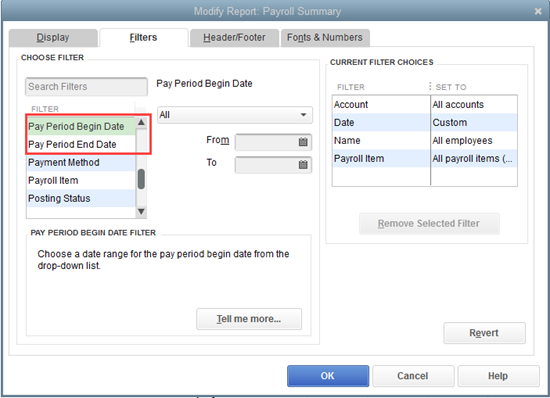

- Under the Filters tab, you can also add pay periods.

- Select Print > Report to print the Payroll Summary.

To run a report for a specific employee:

- Select Employees to open the Employee Center/Centre, from the home page.

- Choose the employee you want to run the report, On the left side

- Select the report you would like to run, in the upper right corner:

- Quick Report

- Payroll Summary

- Paid Time Off

- Payroll Transaction Detail

- Enter the dates you need.

- If the change in the printer is important then you can change settings, then click Print.

Editing the Payroll Summary Report:

If you want to edit and some changes on a report, after running the report,

- Go to the menu toolbar and click Edit on the menu toolbar.

- Amend the parameters as desired.

- Now, click Run Report to view again.

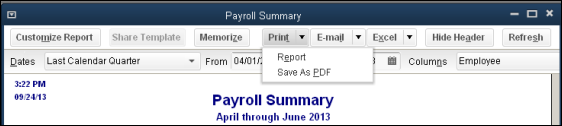

Printing the Payroll Summary Report:

- Print the current report by Click Print on the menu toolbar and you check the print preview of the report on the screen. Now, Print again to print out the report.

- Click Print on the menu toolbar and select page setup, you easily to set page margin or paper size as you want.

To export a payroll summary report to Excel:

- Click the Excel drop-down arrow, in the report.

- Select Create New Worksheet or Update Existing Worksheet.

- Click the Browse button to choose the workbook, if you select Update Existing Worksheet,

- Select the Advanced button.

- Clear the Space between columns checkbox.

- Select OK.

- Select Export.

View or Print tax and wage summary report in QuickBooks Desktop

The Quarterly wage reports is a medium to discover the information that is required to know the state and local taxes. For example when on tap on the name of a tax the report will tell you the amount of tax per employee according to their SSN (Social Security number). To print your quarterly wage reports you just need to follow the steps given below:

To print your quarterly wage reports from QuickBooks.

- Choose Employees in the section Payroll Center.

- Click the File Forms tab.

- Click on View/Print forms & W-2s.

- Enter Payroll PIN then Click OK.

- Click Filed Forms from the upper-left corner of the Payroll Tax Center window.

- Select the forms you want to view or print.

- At bottom of the list of filings, click Open/Save.

The withholding account sums are the sums that you recorded to date for the worker’s government pay charges withheld and the representative’s Social Security and Medicare charges, so QuickBooks needs to twofold these figures to get the real Social Security and Medicare charges owed.

View the Payroll Tax and Wage Summary report

You can see in this report the total and taxable wages which are subject to state and federal withholding.

Steps to See The Payroll Tax and Wage Summary report

- Click on the report from the left navigation bar.

- Search the report by clicking on the search box. A drop-down list will open. Now start entering the report name to find it on the list.

- Now choose Payroll Tax and Wage Summary.

- Choose a time period from the Date Range drop-down menu.

- From the work location in drop-down menu selects a specific work location to see a list of taxes and wages paid at that location.

- Click Run Report.

This is a great way to find the information you need for state or local taxes. For example, when you click the name of a tax in the report results, you can see all the information such as the amount of tax paid per employee by Social Security number (SSN).

I hope with the help of these you can easily create and run Payroll Summary Report, View, or Print the Payroll Tax and Wage Summary report.

If you have any queries, you can ask the technical support team of WizXpert. Get connected with them by dialing QuickBooks Error support number+1-844-405-0904.