For running a restaurant, there are a lot of factors required to keep the business running smoothly. With QuickBooks accounting software you can organize and manage the restaurant with ease.

Go through the article, here you can know, how to use QuickBooks for restaurants, features, and how QuickBooks plays a vital role in the restaurant business. In the meanwhile, you can contact the certified QuickBooks experts through the toll-free number +1-844-405-0904 to collect more info regarding this topic.

QuickBooks accounting solution is user-friendly, affordable, and follows the industry standard for the restaurant business. It also supports quality to focus on the other aspects of their business. For running a restaurant you have to make sure on stocking up on ingredients, schedule employees, get customer orders prepared, and pay your cooks and servers on time. This type of work is made easy only in QuickBooks.

Key Features Available in QuickBooks for Restaurant

QuickBooks consists of various automated features which help to make accounting for restaurants more faster and accessible. Knowing its benefits will help you decide how QuickBooks can play a major role in running a restaurant’s finances successfully.

- Managing Cost

- Control Costs and Organize Expenses: For a successful restaurant, you need to manage overhead, food costs, and labor. QuickBooks tracks and categorizes your expenses automatically to manage your money and plan ahead.

- Manage Labor Costs: Time tracking and payroll features help employees in logging their hours. You can run reports to see payroll cost by the kitchen.

- Sync with your Bank: You can automatically update, record, and categorize your transaction by connecting your bank account.

- Scan Receipts: You can snap a photo to add receipts and match the receipt to existing expenses or create a new expense in your books.

- Reporting

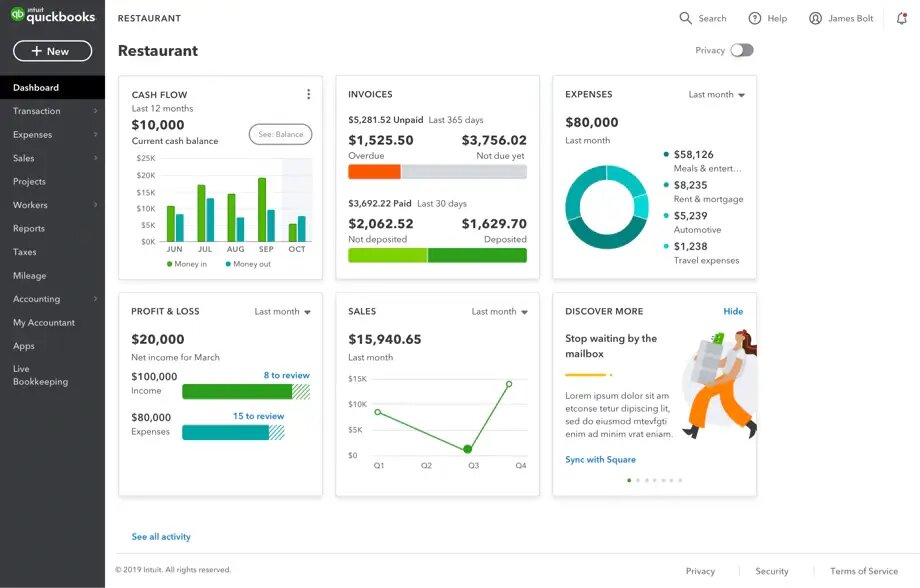

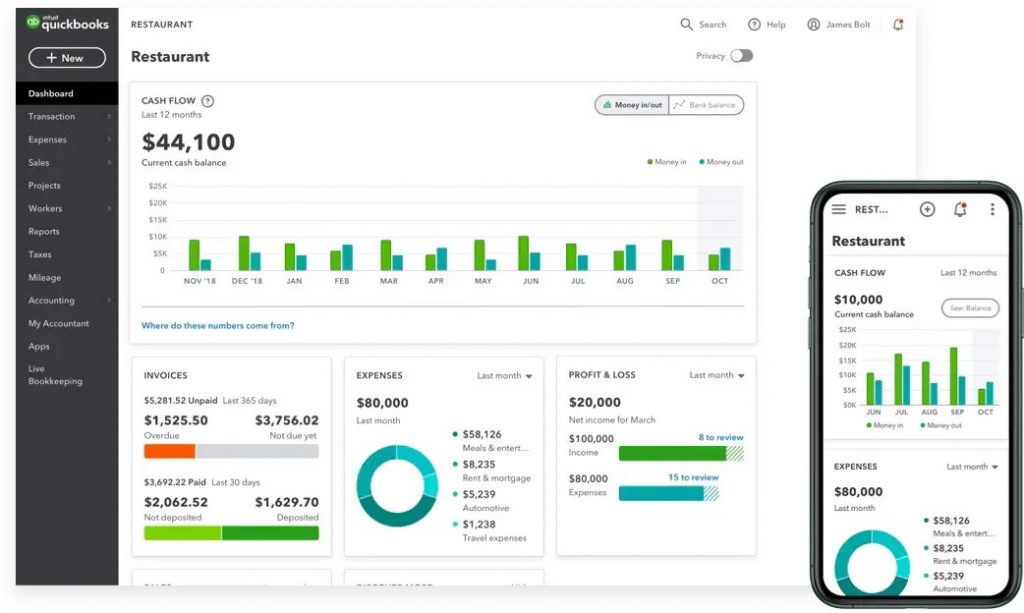

- Generate financial statements: It allows you to run financial statements and access your cash flow statement, profit and loss statement, and balance sheet.

- Get a clear picture of your business: You can customize your reports and view daily sales over time.

- Automate your reports: QuickBooks makes it easier to schedule and email reports to anyone.

- Manage cash flow: The cash flow dashboard helps in making business decisions as you can easily view your money-in and money-out trends.

- It allows you to automate and oversee inventory and order management.

- QuickBooks allows you to set up a purchase order.

- Interface with Point of Sale Apps

- Servers can take orders and enter from a tablet and send each table’s menu to cook with a single click.

- With the table layout programs, you can watch over the entire restaurant floor from one screen, and keep track of reservations and manage the customer waiting lists.

- Live Bookkeeping Help

- QuickBooks Live allows you to chat with a bookkeeper to run reports and review your books which gives you more time to run your restaurant. And do bookeeping in QuickBooks without having any kind of trouble.

- Integrations with Other Key Restaurant Software:

QBO has many applications which are helpful in running a business and it is highly beneficial for a restaurant to configure QuickBooks with other programs such as Square, Deputy, RestaurantOps.

- Square: You can integrate Square with QuickBooks, and can easy reconcile, import sales tax automatic, and can get tips, taxes, discounts.

- Deputy: Notify your staff of their shifts by SMS, email, or the deputy mobile app. Deputy’s intelligent scheduling ensures that you are scheduling the right person every time.

- RestaurantOps: Allow your employees to trade shifts by providing employee management and communication tools specifically for the restaurant industry.

How to Set Up QuickBooks for Restaurants

There are many paths for setting up a restaurant business account in QuickBooks. We have provided here the information regarding setting up QuickBooks for restaurants but also keep in mind each restaurant’s situation can differ slightly, but many of the below methods still apply.

Create a new business profile by launching QuickBooks and manually create your own chart of accounts. This will bring your accounting practice in line with the other thousands of restaurants.

- Create a taxable customer

In order to represent your daily sales, you can create a taxable customer. Then create individual items, you want to track and organize into general groups. One of the groups to cover sales. Classify these groups as services or payments.

- Build payroll accounting system

Create departments for each labor area of your restaurants such as kitchen staff, servers, and administrative staff by building a payroll accounting system. Classify your employees according to their department and fill in details for their compensation.

- Add details

Add other details to your QuickBooks account as per requirement. QuickBooks can be used to generate program sales receipts, reports, and track credit and debit card tips.

Restaurant Accounting KPIs in QuickBooks

You can easily calculate the KPIs to ensure the reliability of the financial success of your restaurant through QuickBooks accounting features.

The COGS for a restaurant is the total cost of each ingredient that is put into every item, used for making any item for sale. Nearly about, ⅓ gross revenue of restaurants gross is their COGS.

- Prime Cost :

A lower prime cost leads to more profitability, therefore full-service restaurants try to keep their prime cost below the 60% range. Prime cost is calculated by:

Total COGS + Total Labor = Prime Cost

- Earnings Before Interest, Tax, Debt, and Appreciation (EBITDA) :

The restaurant’s EBITDA can be improved by increasing sales through high-margin items and reducing costs by sourcing the highest-value ingredients. The formula to calculate the restaurant EBITDA is:

Net Income + Taxes + Interest + Amortization + Depreciation = EBITDA

QuickBooks is the first choice among the restaurant accounting software for many restaurants. Setting up your restaurant accounting with QuickBooks is a great way to save your time and money and to run your business more efficiently. If you have queries related to QuickBooks’s restaurant accounting, you can talk to our ProAdvisor at +1-844-405-0904.