In this article, we’ll show how you can record and track QuickBooks Online reimbursable expenses for employees so you can easily manage the business’s financials. For helping you with this, QuickBooks offers you options through which you can record and track the reimbursed expenses in QuickBooks. The article is with a detailed process to record and track reimbursed Expenses in QuickBooks, the related images also inclosed with suitable references. Go through the complete article to learn the process. If you need any suggestion or help contact us :+1-855-525-4247

In business, it is normal that sometimes employees use their own personal funds to buy the goods and products for the company. This practice is very common is usually followed no matter the business is small, medium, or large scale. Expense reimbursement is simply a method of paying back your employees who have spent their own money on business-related expenses.

But if you are doing this it is important to record the payment so that you can track and repay the employees.

Record Reimbursed Expenses in QuickBooks

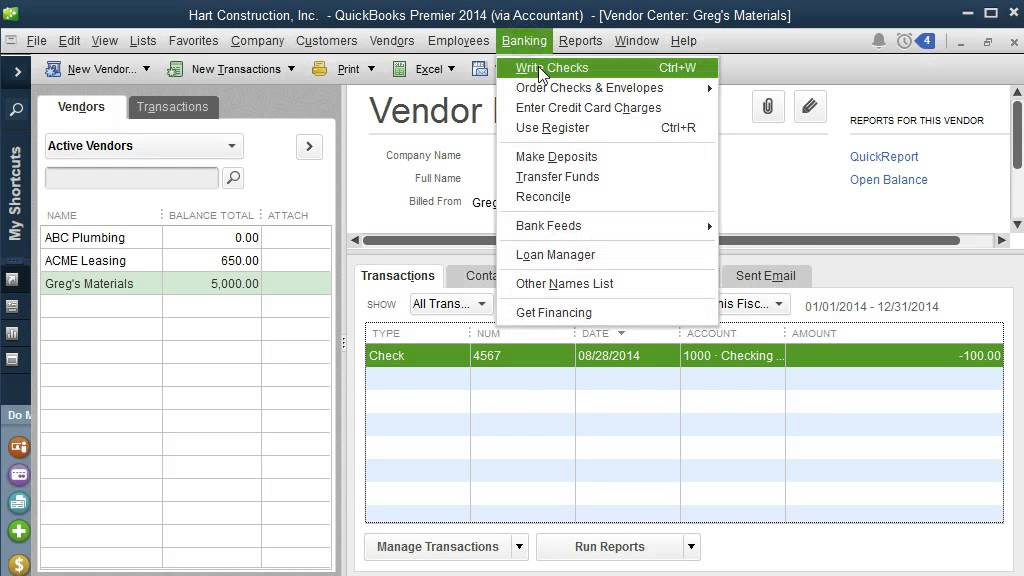

Here, we’ll be using the Write Checks feature to record the reimbursed expenses in QuickBooks. Below are the steps that you need to follow carefully to record and repay the employee expense.

- Open QuickBooks and then from the menu bar at the top select the ‘Banking’ option.

- Then, from the drop-down menu select the ‘Write Checks’ option. After that write check window will open.

- In the Write Check window, click on the ‘Bank Account’ option and then from the drop-down menu select the checking account from which you wan to pay for the reimbursement amount of employees.

- In the ‘Pay to the Order of’ field, enter the name of the employee you want to pay the reimbursement amount.

- After that enter the amount of reimbursement in the ‘Amount’ field with the “$” icon.

- The next step is to select an expense account that you want to use for tracking the transaction. For this, go to the ‘Expense’ tab and choose the account.

- In the Memo field, you can add brief information about the reimbursed transaction.

- After reviewing all fields, click on ‘Save’.

Record Reimbursed Expenses in QuickBooks for Future Payments

If you want to record the expenses for future payments then you need to record expenses as Journal Entry and then pay the employees later at the end of the month.

- The first step is to click on the ‘+New’ from the top right corner and then select the ‘Journal Entry’ option to enter employee reimbursement money.

- In the first line i.e. Account, create an account for tracking the amount you owe to the employee. Name this account for example ‘Employee Reimbursement’ and then select enter.

- After that in the ‘New Account’ window, select the account type as ‘Other Current Liabilities’.

- In the Credit field, enter the reimbursement amount you owe to the employee.

- Now, in the second line enter the account that employees used to make the purchase of goods and products.

- After that, enter the amount of purchase in the ‘Debit’ field.

- Finally, enter the name of the customer and after reviewing all the information last time click on the ‘Save’.

How To Track QuickBooks Online reimbursable expenses

Reimbursed expenses are the amount that employees pay from their personal funds. These expenses include travel or hotel bills, purchase of any goods and products for the business. Employees can reclaim these expenses later on.

Therefore, it is important to keep track of such transactions. You can use the expense account to track the reimbursed expenses in QuickBooks.

Follow the below steps carefully to successfully track these transactions.

- Open and login QuickBooks with the administrative username and password.

- From the menu bar at the top click on the ‘Edit’ option and then select the ‘Preference’ option from the drop-down menu.

- Next in the Preference window, select the ‘Time and Expenses’ option.

- In the next window, select the ‘Company Preferences’ tab.

- Then, checkmark the box stated ‘Track Reimbursed Expense as Income’ and then click OK.

- After you enabled the tracking for the reimbursement expenses, now you’ll be able to select this option for all the expense accounts.

- Again from the menu bar at the top click on the ‘List’ option and then select the ‘Chart of Accounts’ option.

- Then, select the expense account for which you would like to enable tracking.

- From the bottom of the list click on the ‘Account’ button and then from the drop-down menu click on the ‘Edit’ option.

- In the Edit window, checkmark the box stated ‘Track Reimbursed Expenses’.

- And lastly, select the account which you want to use for tracking the income from the reimbursement expenses.

Frequently Asked Questions

If you use the Journal Entry to record the reimbursement then changes in the funds of the employer will be like an increase in the check amount of the Bank i.e. Debit and a decrease in the reimbursed expense account i.e. Credit.

Revenue means the amount of money a company or business earned from all of their income sources while the reimbursement can be referred to as revenue but technically it means the income which needs to be repaid to the employees or clients.

Conclusion

In this article, we’ve covered all the topics on how to record and track reimbursed expenses in QuickBooks for employees.

By tracking the reimbursement transactions you can easily manage the financials of a company or business. Therefore, it is important to record and track these expenses perfectly.

If you want any help related to QuickBooks reimbursable expenses or any facing issues in accounting or bookkeeping then you can have assistance from our certified QuickBooks Proadvisors. Call us at our 24*7 toll-free customer support number +1-855-525-4247 for more information.