We often heard the proverb, “Cash flow is the lifeblood of a business” but in reality, we cannot agree more because observing your cash flow closely shows you how strongly you can meet future expenses, service debt, and reinvestment in your company.

Apart from this, making consistent cash flow estimates will help you prepare for future growth and forecast possible losses in your cash position that require your attention. Your online bookkeeping service provider can also take care of these requirements on your behalf to make certain that you have the most reliable and up-to-date information available. The article holds some important factors necessary to increase the cash flow in your concern.

Table of Contents

What is Cash Flow in QuickBooks?

Cash flow allows you to understand the difference between the cash arriving into your company at the starting of an accounting time and the cash dropping at the time of accounting time. Cash arrives when your customers pay for the services you provided, when you borrow money or when you sell a property such as real estate. Cash drops the business in the form of payment for day-to-day expenses, rent, and other accounts, as well as service loans or property purchases.

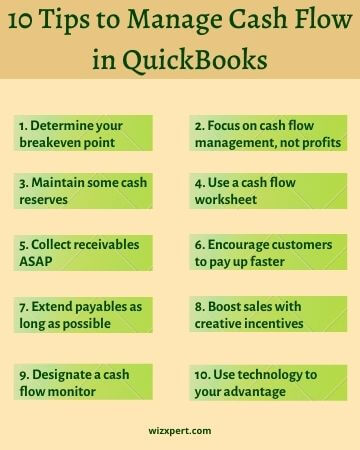

Some QuickBooks Cash Flow Management Tips

Every business wants consistent cash flow for surviving. Some expect poor cash is often referred to as one of the reasons for business failure. Without cash being moved into your business, you’ll see it difficult to develop, or even work successfully. Fortunately, there are ways you can deal with your cash flow to ensure your business flourishes.

- Analyze your cash flow and make predictions: Take a look at your business and find places where the money is coming in and going out. This should include your operating expenses, inventory held, and accounts receivable.

- Review your processes: check the processes that could be costing you and the ones you can improve on. Some accounting devices, as QuickBooks have automatic invoice functionality and online payment (with payments partners PayPal and Square). It makes the procedure easier for you and your customers.

- Minimize your expenses: implement a few cost-saving activities to help improve revenue and keep cash flow. This could be as straightforward as decreasing service charges by ensuring lights and electronics are turned off. Cut back on the lease by sharing office space when possible or working for some time. Assess your monthly memberships and charges to ensure the things you’re paying for are all still necessary expenses can include.

- Negotiate better payment terms with suppliers: There is usually a better deal to be made, so regularly negotiate with the suppliers to ensure you are the getting best one. Consider their payment terms in your negotiations, as how much time you have to pay can greatly influence your cash flow. Find out the quarterly increments, expand the payment days, or start the payment term simply after conveyance.

- Ask for a deposit: If you offer items or services that require substantial money or effort before you convey, think about approaching customers for a deposit. This won’t just help to instantly increment your cash. But it will act like a safety net issue that may delay full payment.

- Build a cash reserve: you never know if you’ll fall on hard times, and for that reason, it is wise to have a backup plan. Attempt and set away cash every month in an individual bank account, just to be utilized for crisis circumstances. An overdraft or a revolving credit office can likewise go about as a ‘plan b’ in the event that you need it. You’ll rest better realizing you have a type of cushion.

Create a Statement for Cash Flow in QuickBooks

The statement of cash flows is classified into three sections to highlight the point that businesses can create cash in various ways:

There are three types of Cash Flow in QuickBooks:

Operating Cash Flow

It is also recognized as cash from operating actions, this line item contains the amount of cash produced by a company’s core business actions like providing services or selling goods. This is an important measure because it symbolizes how a company produces enough concrete cash flow to manage and grow its services.

Investing Cash Flow

As same the name implies, this line item changes the cash position of the company as a result of the purchase or sale of property equipment, assets, or subsidiaries in addition to any gain (or loss) from investing in financial instruments. Changes in the reflected items in the asset section of the balance sheet are recorded here.

This region is necessary because it sheds light on the company’s growth trajectory. For example, an increment in capital investments means that the company is investing in future actions, although it also represents a decrease in the cash flow required to do so.

Financing Cash Flow Other Useful Articles:

It shows outflows related to transactions with line items, cash, and owners who are providers of financing with company owners or lenders. Financing cash flows activities comprise:

- The emergence of stock (positive cash flow)

- Gains from borrowing debt (positive cash flow)

- Compensation to creditors (negative cash flow)

- Payment to partners in the form of shares (negative cash flow)

This is an important line item because it can uncover significant roots of cash when a company is encountering negative or low cash flow from operating actions. To make a cash flow statement, review your income and expenses in each of these three areas. You can then organize this information into a spreadsheet that can be easily updated as needed.

As your business grows, you may need the help of online bookkeeping professionals who can prepare accurate financial statements on your behalf.

Steps to Run a Statement of Cash Flow in QuickBooks

It is necessary to recognize that the cash flow statement draws many key numbers from both the income statement and the balance sheet. Therefore, before running your cash flow report in QuickBooks, do the following:

- Update all income and expenses in your QuickBooks

- Assure that all assets and liabilities are recorded in QuickBooks.

- Check that all the information included in your income statement report is correct.

- Reconcile all your bank accounts.

- If you need, seek assistance from your online bookkeeping provider.

Now, let’s proceed further and know the steps to run the cash flow report.

- Start QuickBooks, go to the reports, and select All reports.

- Choose Business Overview.

- From the drop-down menu find the statements of your Cash Flows.

- Choose the time period you need to analyze.

- See the report that QuickBooks creates based on your receivables, payments, and bank account information

- Print the report or send a copy to your team members by email.

Recheck your statement of cash flows each month to assure that you do not miss any details like your forthcoming invoices, which can lead to a short-term cash crisis.

How to Forecast Cash Flow in QuickBooks

As we discussed above, regularly putting together cash flow projections is important to ensure the long-term viability of your business. Viewing past performance is an outstanding starting point. But, one should be sure of anticipated changes as your business develops. Such changes may include the launch of a new product line or the role of a special promotional and marketing campaign. You must also include external data such as the impact of your competition to sure that your estimations are as genuine as possible.

Make sure that potential lenders will require to view your cash flow estimates and explanations of how you came up with the numbers. Overall, it is important to be traditional in your estimates, reduce your expected income, and improve your expected expenses. It is always good to depreciate and distribute it then reverse it. You just need to download the free cash flow forecasting tool in Excel to understand your cash flow forecasts.

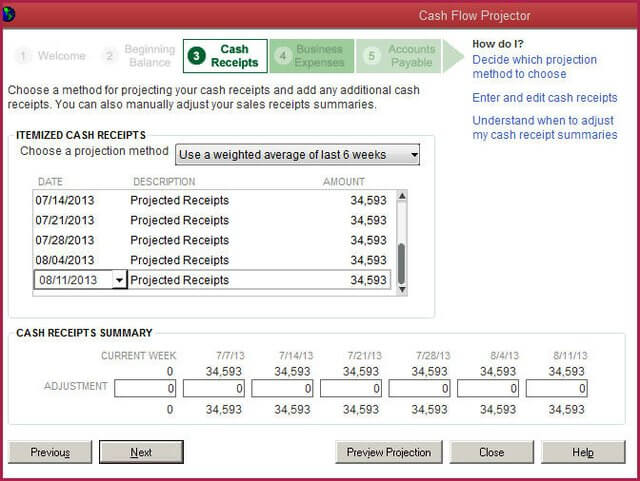

QuickBooks presents a simple but powerful tool called a cash flow projector that can help you forecast your cash flow. This feature actually lets you perform situation analysis and view estimates without making changes to the data in your actual QuickBooks ledger.

Important: The tool Cash Flow Projector is only compatible with QuickBooks Desktop and not QuickBooks Online.

Steps to Forecast Cash Flow

- Open QuickBooks and go to the company option and look for Planning and Budgeting, click on it.

- Here in the drop-down menu go with the Cash Flow Projector option.

- Select the bank accounts that you want to use for your forecasts.

- Projecting cash receipts. There are several methods to forecast your cash receipts for the subsequent six weeks. This is especially useful for businesses that have seasonal cash flows. you can use the cash projector.

- Design cash receipts manually and use an aggregate of the last 6 weeks and a weighted average of the last 6 weeks.

- Utilize the same 6 weeks last year period and the average of the same 6 weeks last year period.

- Evaluating Business Expenses: You can choose forthcoming business expenses like salary with the frequency of payment.

- Forecasting Accounts Payable: This screen will give the details of your QuickBooks and all the open accounts payable data with due dates.

- At last, print the statement or export it to PDF.

After reading the above tactics, you can gain things related to cash flow in QuickBooks management. Many small business owners ought to wear many hats in his/her business. It is advisable to have the right protective hat like QuickBooks Software. Bring in the right evolution of your business using the best deals online.

How to use the cashflow planner in Quickbooks

The cashflow planner is used for forecasting the income and expenses that shows how much money goes out and how much money goes in. Through this, you can add and adjust the items according to the forecasting which helps you to keep away from loss. Here, we’ll discuss how to edit, create and delete the items after setting up the planner.

- Setup your account: The very first step is to connect your bank account and the credit card account. Through this, QuickBooks fetch the data of your money in and out automatically. It also tracks your due dates transaction.

- Add a new Item: It gives the option to add items manually for generating and forecasting the potential income. For adding items you have to do the given steps.

- Firstly go to the cash flow and then select the planner.

- Now click on the Add item.

- After that, you have to select the Money In and Money out options. If the item is an expense then Money is out and vice-versa.

- Name the item you enter and enter the amount.

- After doing all the above-mentioned steps you have to select Save.

- Edit & Delete Item: This option helps to see how much changes in your projected cash flow.

- Edit an Item

- You have to go to cash flow.

- After that, you have to select the planner.

- Now you can select the items that you want to edit.

- Now you are able to change the name, amount field, money in and out, and also change the date.

- Now you have to click on update to save.

- Delete an Item

- If you want to delete an item then again go to the cash flow.

- Then select the planner and select the item you want to remove or delete it.

- Now select the Remove option. If you want to delete a single item then select only the item option otherwise select the entire series.

- Then select update to save changes.

- Edit an Item

Thanks for visiting us. You are always welcome here to visit if you have any other queries in your mind. In case you want more discussion on this topic or you need any kind of QuickBooks support you can contact us anytime, anywhere all over the USA at our toll-free number +1-844-405-0904, and talk to our Certified accountants.