Looking to enhance your knowledge of closing entries in QuickBooks? Read this article, as we’ve discussed how to close entries in QuickBooks. Also, we have discussed in-depth the details about what is the use, important points related to closing entries, as well as what is Income Summary Account. So, Don’t waste time, read the article to learn closing entries. If you need suggestions or help contact our QuickBooks ProAdvisor toll-free: +1-855-525-4247

So, let’s start with the definition of closing entries. Closing entries are nothing but the entries that are made at the end of a fiscal year to transfer the balance from income and expense accounts to Retained Earnings. The aim is to zero out your income and expense accounts and add your fiscal year’s net income to Retained Earnings.

Table of Contents

What is the use of QuickBooks Closing Entry?

The QuickBooks closing entry is used to consolidate transient accounts at the end of the year to transfer income and expense bills for retired profits. This is a very necessary element and should be done carefully. We are looking for and zero out ‘profit and expense accounts, after which upload the retained earnings to the financial year net income.

QuickBooks are various traditional software programs, as there is no proper completion at the start of the month/year. Your data is saved in QuickBooks for all time until you decide to condense it. Therefore, inadequately closed books indicate that the current facts are at the risk of all users who see it, the same employees can make changes to the previous year’s record.

What Accounts Do You Close?

Impermanent records are the kind of records that should be shut during these revealing cycles. Transitory records can be tracked down in the bookkeeping record, explicitly the overall record of records. This record is utilized to keep all exchanges over the particular bookkeeping period being referred to. This rundown of general record accounts with their equilibriums is known as the preliminary equilibrium.

Temporary accounts

- Earned interest

- Sales discounts

- Utilities

- Rent

- Miscellaneous expenses

- Dividend account

Brief records contrast with super durable records, which needn’t bother with to be opened and shut every period as they show the continuous monetary place of a business. Impermanent records can be tracked down on the pay proclamation, while super durable records are situated on the asset report.

Permanent accounts

- Accounts receivable

- Inventory

- Accounts payable

- Retained earnings

- Owner’s equity

- Shareholder’s equity

Hence, all records related to the business’ income and costs should be important for the opening and shutting process. On the off chance that your organization is integrated, any profit accounts for how your business dispenses the portion of the benefits to investors should be shut and opened every period over again.

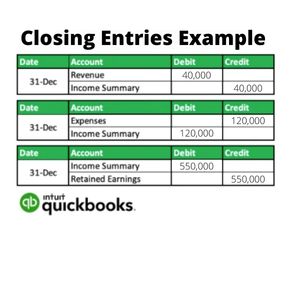

Closing journal entry example

The following are the essential sections your business should make to appropriately close their necessary records. Each record will have an end passage related to it for the finish of the bookkeeping time frame, making a charge balance and a credit balance for every section.

What do you mean by Income Summary Account?

Income Summary Account is a temporary account used during Closing. The Account has a company’s revenues & expenses for the present accounting period. In short, you can say that it is through this account we get to know the ‘ Net Income ’ attained after subtracting depreciation, business expenses, taxes, debt service expenses, etc.

Steps to close the Books Monthly in QuickBooks:-

- Select the Gear symbol and select Company Settings.

- Select Advanced.

- In the Accounting segment, click on the Edit symbol.

- Check the crate marked Close the books.

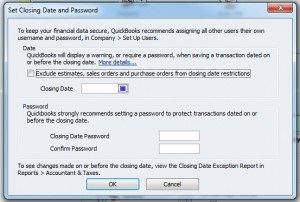

- Enter a Closing date. Exchanges dated prior to the end date can’t change without warning.

- Conclude what you believe clients should check whether they attempt to save an exchange that is dated preceding the closing date:

- Select Allow changes in the wake of review an advance notice to make an advance notice message show up.

- Select Allow changes in the wake of review of an advance notice and entering a secret key to require the client to enter a secret phrase too. Then enter the password in the fields below.

- Click Save, then Done.

If you have other questions, don’t hesitate to reach out!

Steps to Complete the QuickBooks year-end closing entries

You can use the below steps to completely close entries at the Year-end.

- Firstly, look for revenue accounts in the Trial Balance that have the revenue and capital accounts in the company ledger. There is a ‘credit balance’ reflected here and to zero it out you need to do a ‘debit entry’ for every revenue account. This action will move the credit balance to the Income summary account.

- Next, Locate the ‘Expense Accounts’ in the Trial balance, and you will see a debit balance. Make a Credit entry in the income summary account for every ‘Expense account.’ The Expense account total should be ‘zero’ now.

- In case the Income Summary Account has a credit balance after finishing the entries, or the Credit Entry amount is more than the debt amount, then there is Net Income. However, if you see that the debit balance exceeds the credits, then it means there is a Net Loss. To completely close the Income summary to the retained earnings account, make a journal entry where you debit the Income Summary account and credit the Retained earnings account.

- Finally, we need to close the ‘Dividend account’ to retained earnings. You can see that the Dividend account has a usual debit balance. Therefore, credit ‘Dividend account’ and debit ‘Retained earnings account.’ The retained earnings will show the amount of Net income that was given to it.

Solutions to Correct ‘Closing Date mistake in QuickBooks’

Accuracy in QuickBooks accounting books heavily depends on how correctly the ‘dates’ of the various transactions have been put in. If there are any discrepancies in inputting the date, it can lead to inaccurate accounting books. To correct this problem, you need to carry out certain steps for QuickBook’s year-end closing.

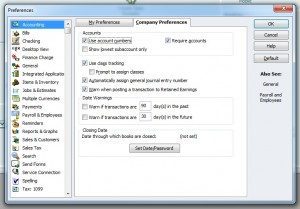

Firstly, set the closing date and password in the company preferences section. Here you can see your previous year’s info by entering the password. Once you are logged in then:

- Click edit

- Navigate to preferences to view the closing date option

- Now select ‘Company preferences’ in the ‘Accounting preferences’ tab

- Fill in the Date & password selected.

Four power Reports that can help in QuickBooks Closing Entry mistake Troubleshooting

QB has several reports that will assist you in troubleshooting entering opening balances in QuickBooks when you cannot identify the problem. These reports can be found by selecting the Reports menu, Accountant & Taxes.

Following are the four reports:

1. Audit Trail Report

It lists all transactions entered into the file and the complete history of changes, deletions, and voids to those transactions. However, if a client makes a change to a prior period transaction then the Audit Trail Report will show the effects of the change. With the help of Audit Trail, you will easily get to know who did what in the file. It is only possible when your client has set up a User ID for each person entering transactions into QB. But if every person is sharing the same User ID then the Audit Trail will only show a list of the transactions and changes to the file, but not who did those entries.

2. Closing Date Exceptions Report

It shows modified transactions or transactions changed or added on or before the Closing Date. Like the Audit Trail Report, the current status of the transaction, as well as the original transaction, are shown.

The Closing Date in QB is used to lock your data file to prevent users from making changes on or before a specified date.

3. Voided/Deleted Transactions Report

In 2005 or later versions of QuickBooks, it creates an activity log of all voided and deleted transactions. It also tracks all voided/deleted activity whether or not a closing date has been set or if a transaction is dated in a previous reporting period. You need to double-click on the transaction, to display more information about a transaction on this report. You will find that QB will then display the impact of the original transaction on General Ledger.

4. Retained Earnings Quick Report

In QuickBooks 2005 and more up-to-date forms, you can see the details of exchanges presented on Retained Earnings. Select the Lists menu, Chart of Accounts, and after that double tap on Retained Earnings account.

Recognize passages made in mistake to the Retained Earnings Account. Double-tap on a section to alter and revise the record doled out.

Necessary year-end Tasks

To help you in giving direction to your customers on the undertakings that they should finish at year-end. We have arranged a straightforward, simple-to-take-after agenda that joins the majority of the above tips and proposals, alongside some extra suggestions to productively and precisely shut your books for the year.

- You have to review the Working Trial Balance to discover changes made to earlier years’ exchanges that influence Retained Earnings.

- Review the Chart of Accounts for any recently made or pointless records.

- Review Accounts Payable by opening the Unpaid Bills report guaranteeing precision.

- Try to review Customers and Vendors to check for copies, missing data, or blunders.

- Review Payroll Transactions and Payroll Item Set-up for precision.

- Try to review the Audit Trail Report for any suspicious or changed exchanges.

- Review the Inventory Items Set-up, amounts, and qualities close by.

- Try to review the Retained Earnings QuickReport to guarantee that there were no adjustments in the record since the earlier year-end as well as passages made specifically to the record.

- Enter any Depreciation as pertinent.

- Reconcile Credit Card, Cash, and Loan accounts with the period-end explanations.

- If you are on the accumulation premise of bookkeeping, plan General Journal Entries to collect costs and incomes.

- Use the Cleanup Data File utility to gather the span of the document.

- Perform a physical stock on December 31 and enter an Inventory Adjustment exchange if essential.

- Set the Closing Date to the most recent day of the period (December 31).

- Print/Save and record the accompanying reports as of your Closing Date: Balance Sheet Standard, Profit, and Loss Standard, Statement of Cash Flows, Trial Balance, Inventory Valuation Summary (if material), and Fixed Asset Item Listing for the year.

- Prepare and send the IRS Form 1099 to every one of your qualified merchants with duplicates to the IRS.

- Back up your information document on an uncommon reinforcement drive, arrange server, or through QuickBooks Online Back-up.

Here are some points to note down related to QuickBooks closing entries

- It is important to know that closing entries are made after you record all adjusting entries. In case, the books are “closed” then you are not supposed to enter any entry for the fiscal year.

- Sometimes you will find that some programs will prohibit you from making an entry. Even if that entry will correct or make your books more accurate.

- QuickBooks Desktop gives you permission to enter transactions that affect the balance of the closed Fiscal Year. In that case, the program will either tell you that it is not recommended or it will ask for the closing date password if you set up one.

- Another point about QBD is that it does not have an actual transaction for closing entries that it creates automatically. When you run a report the program computes the adjustments.

- But it is impossible to “QuickZoom” on these transactions, unlike the manual adjustments that you recorded. And, in the end, these adjustments are tagged as “Closing Entry” which is not a real transaction in QuickBooks.

Automatic year-end adjustments from QuickBooks

It is simply based on your fiscal year’s start month. The goal of this program is to adjust your income and expense accounts to zero them out. And in this way, it allows you to start your new fiscal year with zero net income. The equity section of your balance sheet will show a line for net income, on the last day of your fiscal year.

QuickBooks Desktop increases your retained earnings equity amount by the previous year’s net income, on the first day of your new fiscal year and also decreases your net income by the same amount. The best thing about this is that it allows you to start your new fiscal year with zero net income.

How Do I Close My Year-End in QuickBooks?

Once your year-end is complete or you have sent your file to your CPA then closing the year in QB is an important step. You need to ensure that the data does not change. It is important to make sure you don’t enter data into the wrong period inadvertently. It creates more work for your CPA and happens frequently.

QuickBooks is different than some traditional software programs because you can close each period if you prefer to run your business this way. It means you don’t have to do a “hard close” at the end of a month or year. QB has features to keep your accounting data forever unless you condense your file, which you might do if it becomes too big.

Not properly closing the period: It means that there’s the possibility that you or employees can change, add, or delete entries made in the previous year.

Note: QuickBooks is driven by the date of your entry.

Solution:

So, to solve this problem, you need to use the Set Closing Date and Password option within Company Preferences. It locks the information from your previous period/year. So, it is impossible to change it without the password being entered.

You need to click Edit-> Preferences, to locate the closing date option. Now, select the Company Preferences tab under Accounting Preferences on the left side. And, this is the place where you enter the date and password you have selected.

One thing you should keep in mind is that the password you use should not be the same as your login password. It should be safeguarded so that only you and sometimes your CPA know this. Also, the password can be changed each month, a year, or whatever time framework for your business.

Anticipating Next Year

QuickBooks can encourage you and your customers to anticipate the year ahead, once the year-end work is done. Utilizing the Cash Flow Projector at year-end encourages you to set up a six-week review of all your approaching and active money. This data will enable you to extend up-and-coming deficiencies and plan distributions of money appropriately). The projector considers your money close by, records of sales, and records payable.

The Business Plan Tool in QuickBooks strolls you through a progression of inquiries to build up a nitty-gritty arrangement for your business. It goes out 5 years which takes after the configuration suggested by the U.S. Private Company Administration.

Lastly, make a Budget with your customer and enter the data into the Planning and Budgeting choice under the Company menu in QuickBooks. This will enable you to announce all through the next year contrasting your genuine outcomes with your planned numbers, by month, by class, or by the client.

FAQs

Can I Zero Out Retained Earnings in Quickbooks? If yes then how?

Yes, anyone can zero out retained earnings but remember that it needs expertise so follow the given steps carefully.

- Firstly you have to open the QuickBooks Account and go to the Edit Menu.

- Now the next step is to choose “Preferences” and then tap on the Accounting option.

- In the Accounting option, you have to select the company preference tab and then choose the set date or password option.

- Then you are on the next window, here you have to choose the closing date.

- Now the next step is to add the closing date password and verify it.

- After doing all the above steps you have to click on OK and select Save and close.

Can further entries be made to the fiscal period after the fiscal year’s books are closed?

The answer is no if you once close the books for the fiscal year. You cannot add other entries further, if you try to do so it will give you wrong outcomes with wrong calculations.

I hope this will help you understand QuickBooks’s closing entries. Contact our toll-free QuickBooks Support number +1-855-525-4247 to get help for all your QuickBooks-related problems.