We are here to discuss retained earnings in QB. In very simple words, Retained earnings are the year-end balance of your business. At the end of each financial year, all invoices expire and all bills paid and at that time the negative or positive balance for your business is assigned to a new account known as Retained Earnings in QuickBooks. Read the article to go through the steps to view profit and loss reports, working of retained earnings in QB, how to adjust, and many more; learn all these steps to enhance your abilities. For More Info. or help contact us toll-free: +1-855-525-4247

The transfer brings your business balance to zero for the new financial year and helps you keep track of how your business accumulates or loses capital.

Table of Contents

Working of Retained Earnings in QuickBooks

When you set up a new company with a software package, QuickBooks automatically establishes an equity account called “Retained Earnings”. Depending on the closing date you provide for your financial year, QuickBooks automatically transfers balances from other accounts in your business to retired income on that date.

For an accounting aspect, this transfer is required to guarantee that your numbers for the current financial year reveal only transactions and the performance of your business for the present period. The Retired Earnings Account also helps you track how much capital is in your business for new machinery-like expenses or payments to partners or owners.

How To View Retained Earnings Account Details

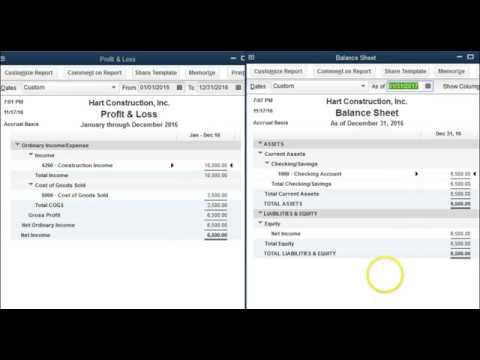

If you want to see what your retired earnings, you need to run a profit and loss report to see the details for the net income amount.

Retired Earning account reflects your company’s total income and all previous year’s expenses. By the beginning of the new fiscal year, QuickBooks Online automatically adds net income from the previous remaining year to your balance sheet as Retained income.

But, you cannot select the Retained Earnings from the balance sheet to see only the details. The Retired Earnings Account is a rollover of the net profit (or loss) of all previous financial years, and QuickBooks Online automatically and electronically transfers funds from your net income to the account and does not record any visible transactions for it.

Because of this reason, you need to run your last year’s profit and loss statements to see what are your retired earnings.

How To View the Profit and Loss Detail report

Follow these steps to view the Profit and Loss report:

- First, open Reports.

- Find and choose the Profit & Loss report.

- Select “All Dates” from the Report period drop-down list.

- Now, click on Run report.

- After, choose the Net Income amount to see the Profit and Loss Detail reports of all dates.

This Profit and Loss Detail report displays all transactions that make up the net profit or loss that QuickBooks Online automatically turns into your Retained Earnings account.

How To View the Profit and Loss Report by year

Follow these steps to view the Profit & Loss report by year

- First, open Reports.

- Find and choose the Profit & Loss report.

- Choose Customise option in the open Profit an& Loss report.

- Now, choose the Rows/Columns item in the Customise report panel.

- Then, click on Years in the columns drop-down list.

- Select Run report.

The report illustrates year-over-year amounts so that you can see the amount from the profit and loss transferred to the Retained Earnings account, as it happened.

How To Review the Quick Report of Retained Earnings Account

In case, the amount on the profit and loss report is different from the currently displayed amount for the Retired Earnings Account, only transactions affecting balance sheet accounts can be recorded against this account.

Follow these steps:

- First, find Settings ⚙ and choose Chart of Accounts.

- Look for the Retained Earnings account.

- Choose the Run Report under the Action column drop-down menu.

- After that select All Dates under the Report period drop-down list.

- Select Run report.

This report illustrates all the user-created transactions which affecting the Retained Earnings account structure.

How To View Retained Earnings in the Balance Sheet

Follow these steps to view Retained Earnings in the Balance Sheet:

- Go to Reports.

- Find and choose the Balance Sheet,

- In this open balance sheet report, examine all Retained Earnings item to see your company’s net earnings.

At the end of your fiscal year, you can also share Retained Earnings account amounts using journal entries. But keep in mind, whenever the Debit column will decrease, then that time the Credit will increase your Retained Earnings account. And also don’t forget to balance every debit with equal credit.

How To Adjust Retained Earnings in QuickBooks

QuickBooks enables you to withdraw from a Retained Earnings account by following methods like balance sheets, journal entries or by writing checks. Whenever you enter a new transaction in a balance sheet, you can specify the total amount and select Retired Earnings from the Account drop-down list to withdraw from the investment fund. You can also define the Retired Earnings Account while adding the entry in your general journal or after entering the check information after writing the check from the retired earned money. Make sure to save

Be sure to save or record the information each time you enter new data to adjust your retired earning balance.

Steps To Help Finding the Account

As we know Retained Earnings is an automatically generated account, if you are having trouble finding it, you may have deleted or deactivated the account.

Steps to view inactive accounts.

- Go to the “List” menu and select “Chart of accounts”.

- Choose the “Accounts” button and after click the “Show inactive accounts” button and remove the “X” next to the Retired Earnings to reactivate the account.

Apart from this, you can also create a new Retained Earnings Account by following these steps:

- Go to the “Reports” menu and select “Company & Financial”

- Next, click on the “Balance Sheet Standard” report.

- If the previous one has been removed, generating reports will prompt QuickBooks to create a new retired earnings account.

Frequently Asked Questions

I Hope, you admire reading this article and better understand the concept of Retained Earnings in QuickBooks.

In case if you still have any queries regarding the same or any QuickBooks-related issue, please feel free to reach us by dialing +1-855-525-4247 and get instant help from our certified QuickBooks ProAdvisor.