Intuit introduces a new version of QuickBooks so it’s easy to say goodbye to an earlier version of QuickBooks and work with the latest version of QuickBooks. Intuit announced the date May 31, 2017, for the discontinuation of QuickBooks 2014 version, after this date it’s no longer supported. So, it is better to upgrade if you are using QuickBooks 2014. Now the QuickBooks announced the discontinuation of QuickBooks Desktop for Windows 2017. Let’s discuss the QuickBooks Service discontinuation policy. Here in this article complete details are mentioned, read it! For any suggestion or help contact our Quickbooks ProAdvisor toll-free:+1-844-405-0904

Table of Contents

When does service discontinuation happen For QuickBooks Desktop 2017?

After May 31, 2020, access to add-on services for the QuickBooks desktop for Windows 2017 will be discontinued. It covers all the versions of QuickBooks Desktop Pro, Premier, and Enterprise Solutions 2017.

If you are not using any add-on services in QuickBooks Desktop 2017, then your product will proceed to work for you. You will not be authorized to subscribe to Live Technical Support or any other intuit service that can be integrated with QuickBooks Desktop.

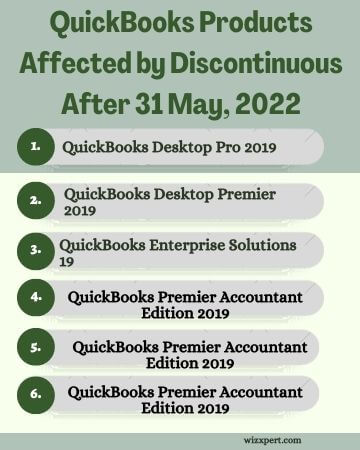

With QuickBooks Desktop for Windows 2017, there are several other Intuit products that are affected by the discontinuation of add-on services.

What does QuickBooks service discontinuation mean?

Your access to other services through QuickBooks Desktop Payroll Services, Live Support, Online Backup, Online Banking, and QuickBooks Desktop 2017 software will be discontinued after May 31, 2020. It also indicates that you will no longer get important security updates starting June 1, 2020. If you get any security-related updates before this date, install them.

Calendar Year 2020 Discontinuation Policy For QuickBooks Desktop 2017 Products

Here, we will discuss the products affected by service discontinuation after May 31, 2020. If you are using any product that is listed below in the table and you require to proceed with the same add-on services, then update to the latest version of QuickBooks Desktop.

| Fully supported products | Products for which services will be discontinued after May 31, 2020 |

| QuickBooks Desktop Pro and Premier 2020, 2019, 2018 | QuickBooks Desktop Pro 2017 QuickBooks Desktop Premier 2017 (General Business, Contractor, Manufacturing & Wholesale, Nonprofit, Professional Services, and Retail) |

| QuickBooks Enterprise Solutions 20, 19, 18 | QuickBooks Enterprise Solutions 17 |

| QuickBooks Desktop Accountant 2020, 2019, 2018 | QuickBooks Premier Accountant Edition 2017 |

| Products for which services will be discontinued after February 2, 2021 | |

| QuickBooks Desktop Point of Sales 18.0 and 19.0 | QuickBooks Desktop Point of Sale 12.0 payments services |

What happens to my payroll service if I don’t upgrade QuickBooks by May 31, 2020?

For Basic Payroll: Users will have an incorrect payment due to some tax calculations being zero. You will also be incapable to send payroll to Intuit for processing with direct deposit. Your payroll subscription will be deactivated, followed by a refund for the remaining part of your payroll membership.

Standard and Enhanced Payroll: Users will have an incorrect payment due to some tax calculations being zero. You will be unable to send payroll to Intuit for processing, including payment and filing using direct deposit, e-file, and pay. Your payroll membership will also be deactivated, followed by a refund for the remaining part of your payroll membership.

Assisted Payroll: Users will be incapable to send payroll for processing, with direct deposit. After 31 May 2020, Intuit will no longer be liable for filing payroll tax returns and W-2s for 2020. The paycheck tax calculation will be inaccurate and your payroll service will be canceled.

- Intuit will be not responsible to file and pay your 2nd Qtr Taxes.

- If you want to terminate the payroll service from your company file in QuickBooks, First click on Employees and later click on Send Payroll Data, later click on Send.

Annual Support Plans: Any yearly support plans that you currently release will continue to work till your annual subscription expires, at which point, you will have to upgrade your QuickBooks software to continue using a support plan.

How can I avoid the deactivation of my payroll service?

If you wish to continue on basic, standard or enhanced payroll service, you will have to do the following by May 31, 2020:

- Buy a supported version of QuickBooks Software.

- Install the software and now you need to register it with your account, keep in mind, you need to use the same company information that you are using for payroll service.

- Now, Run your payroll in the supported version of QuickBooks Software.

If you wish to remain on the Assisted Payroll Service and continue to file Intuit payroll tax returns on your behalf, you must do the following by May 31, 2020:

- Buy a supported version of QuickBooks Software.

- Install the software and need to register it to your account.

- Send a $0 payroll.

After May 31, 2020, will I still be able to create paychecks?

Yes, but this is not acceptable. Your paycheck calculation will be inaccurate due to some tax calculations being zero. To keep your paycheck calculations correct, upgrade and register a new version of QuickBooks.

QuickBooks 2014 Discontinuation Policy

After discontinuation, you will be restricted with the following features:

- Basic QuickBooks 2014 product will continue working

- If you want to use new features of QuickBook’s latest version so you upgrade the latest version of QuickBooks.

- Live technical support does not exist after the date of May 31, 2017.

- Also, Intuit will not provide good support to register products or retrieve keywords after the date.

This decision will be affecting the following Intuit products:

- QuickBooks Pro 2014

- QB Premier 2014

- QuickBooks Accountant 2014

- QB for Mac 2014

- QuickBooks Enterprise Solutions V14

What will be the Effect of after ending Intuit QuickBooks 2014 discontinuation?

- Employer Organiser: You have no longer accessible with this information.

- Basic, Standard and Enhanced Payroll: you will no longer automatically calculate correct payroll taxes, provide update forms, or send your payroll data because QuickBooks 2014 stop working.

- Workers Comp: QuickBooks 2014 will no longer support the process Workers Comp Payments through QuickBooks 2014.

- ViewMyPaycheck: This facility no longer supports for you and your employees.

- Live Technical Support will longer be work with you.

- If your support plan expires so Online Backup will no longer be available.

- Online banking facilities like, downloading transactions or sending/receiving online payments, will no longer work.

- Otherwise, if you attempt to download, so QuickBooks is unable to verify the financial Institutions Information for this Download.

- QuickBooks Merchant Services: This service should no longer process Credit card transactions through QuickBooks 2014. You use the credit card through the terminal. If you are a terminal download customer, you just can’t download them to QuickBooks 2014.

- 1099: 1099 wizard, you might not be able to launch. And you continue to work on and able to use an add-on 1099 e filing services.

- Automatic credit card Billing: This service does not work and you won’t be able to download transactions. Also, you don’t see the user profile related information and you will not be able to access the data you entered here.

- QuickBooks 2014 does not longer support Intuit Check solutions.

- Bill pay facility no longer be available.

- No longer support for the Accountant’s Copy File Transfer(ACFT) service.

- Contributed Reports: You should not be able to access any new reports on that platform. And you also not be able to contribute reports.

- QuickBooks email also should no longer be available for services listed earlier.

Why You Need To Upgrade?

Intuit adds some extra features with the release of every new version.

- New & improved features of QuickBooks Pro

- New & improved features in QuickBooks Enterprise 2018

- QuickBooks Accountant Desktop Plus 2018

- Users have the difficulties related to how the password system works. Now, hopefully, you will find the resolution.

- Have the system requirements changed? System requirements depend on our needs when we are not compatible with the oldest version of a system, so we change it. Update the windows 8 in windows 8.1 and if you are using windows 7 you have moved up to Windows 7 Sp1.

- QuickBooks 2017 is not supported by Windows Vista or Windows XP, it only supports Windows server 2012 R2 and Windows Server 2008 R2 SP1.

- Converting your QuickBooks Company file, after upgrading QuickBooks data should be relatively painless going from QB 2014 to 2017.

- Firstly you make the backup of the company file if facing a problem related to the database, its help you. You take the help of a consultant if you have any problems related to updating. You install the QuickBooks after updating it and open the old file in a new program and you see the QuickBooks 2017 will handle the conversion automatically.

- If you are a QuickBooks consultant, don’t be afraid of the new features of QB 2017. You are able to help the client and provide a better suggestion for the understanding of QuickBooks latest version. Sometimes new things are difficult but we try to ease them for others and you do extra efforts for taking more advantage.

For further assistance with QuickBooks problems, Dial our QuickBooks support Number +1-844-405-0904 toll-free.