Do you know how direct deposit works with QuickBooks? This article will guide you on how to activate the QuickBooks Direct Deposit Payroll feature in QuickBooks Desktop Payroll. Direct deposit saves time on the payroll but how does it work without knowing it. In this article, you will get the costing requirements, benefits, how to edit, and remove the direct deposit from the employee’s profile. Go through the article and get all the details. If you have any doubts contact our QuickBooks ProAdvisor toll-free number +1-844-405-0904.

You can activate your own Payroll Feature to pay your employees via DD in QuickBooks Payroll. Employees need not have cash papers or checks to get their paychecks.

This feature has become popular nowadays to pay employers wages than paying via cash or check. Most employees expect their paychecks via DD because it is safe and convenient.

Table of Contents

Why Activation of QuickBooks Direct Deposit is Required

You can get a lot of benefits after activating the direct deposit in QuickBooks. Here are some of the points, that will know you, why should you activate QuickBooks direct deposit;

- No cost to sign up.

- No need for a minimum number of employees or paychecks is required.

- If you use the service you pay for it, otherwise no.

- You can schedule QuickBooks Direct Deposits payments up to 45 days in advance.

- Your employees can be paid on schedule.

- No minimum or monthly fees.

How Much Does it Cost to Do QuickBooks Direct Deposit?

For QuickBooks Payroll, activating direct deposit costs is not applicable as it is basically free.

Let’s discuss some information in detail:

Although, QB activation of direct deposit is free. It will cost you per paycheck for the bank to bank transactions or by the transfer fee paid by the employer.

This charge is then processed at the time of the payroll run. This charge can also vary according to the product subscription.

Usually, the fees are $1.75 per paycheck sent according to the bank-to-bank processing or transfer fee.

As far as the monthly subscription is concerned flat charges of $39.00 a month are applicable. This includes additional services like automatic calculation of the federal tax as well as state tax etc.

Things you Should Do Before Using Direct Deposit:

Before using, or activating the direct deposit in QuickBooks, you should take some primary steps. And the primary steps are:

1) Verify your Bank Account

For security purposes, At the time of sign up when you gave your primary bank details, Intuit performs two small withdrawals of less than $1.00 each from the bank account you set up for DD. Examine your bank account for the sums and verify them in QuickBooks.

After verified, You become an authorized user of the account, And the bank account is ready for authorized payroll transactions and fees. Once your bank account is confirmed, Intuit automatically refunds two small test debits within 7 working days from the original debit date.

2) Set Up the Account details of the employers in your QuickBooks Payroll Account

Collect bank account detail from workers who like to be paid by direct deposit. The worker must give written approval to you for direct deposit of their paychecks.

- After doing all these things, You can create Paychecks for your employees by using Direct Deposit.

3) DD Processing Timeline:

- Direct deposit is forward to Intuit QuickBooks before 5:00 pm PST and it takes two banking days before the check date.

- The status of the transaction during this stage is still pending.

- You may void any previously sent paychecks or send additional paychecks if needed.

- At 5:00 pm PST, payroll offloads, two banking days before the check date.

- Note: Paychecks can be forwarded 45 days in advance.

- Holiday reminder.

- The payroll is offloaded.

- Typically, direct deposit payroll is offloaded two banking days before the paycheck date at 5:00 PM PST.

- Intuit cannot stop the DD transactions at any point without having a fault.

- QuickBooks Direct Deposit payroll is electronically sent to ACH (Automatic Clearing House) for processing.

- Intuit will charge your bank account on a working day before the paycheck date which can arise within 24 hours.

- Funds are posted

- Funds are deposited to your employee’s account on the paycheck date.

- The information about DD posting time or availability of funds is checked by the employee’s bank and is not controlled by Intuit.

- If the paycheck date falls on a non-banking day, the funds will be posted to the employee’s bank account on the next banking day.

- The Employee’s bank has until 11:59 PM on the day of the check date to post the funds to the employee’s bank account.

Note: Nominal per transaction and per payroll transmission charges may apply. Terms & Conditions, Price, Feature Services Options, and Support can be changed without any notice.

4) Arrange All Needed Requirements:

Having all the needed items would be an easy sign-up for the users.

- Check QuickBooks version you are using is supported for direct deposit or not.

- Active QuickBooks Desktop subscription.

- Add EIN(Employer Identification Number) to QuickBooks Payroll to use the direct deposit feature.

- Easy Internet access.

- You should have a Bank account that can manage all the transactions related to Automated Clearing House(ACH) within the United States.

5) Remember All of These Points :

- You can transfer payroll information to Intuit before 5:00 p.m. in the Pacific time at least 2 business working days before the check date.

- You can send your payroll information to Intuit up to 45 days in advance of the check date.

- Direct Deposit requires internet access. Your QuickBooks Desktop application and DD service issue a secured Internet connection that protects against unauthorized access to your payroll data while it’s being transferred.

- DD can be delivered to an intuit pay card.

- If two business working days have passed, But the check date falls on a non-working day or a Federal Reserve holiday, the funds will be deposited in the Employee’s bank account on the next working day.

Steps to Set up and Activate Direct Deposit in QuickBooks

Before using direct deposit, first, you need to set up your company payroll bank account. You must have the U.S. bank accounts that are set up for ACH transactions.

Step 1: Collect your business, bank, and principal officer info.

To set up direct deposit, you’ll need some info regarding your company. Read the following and collect the information.

- Business name, address, and EIN.

- Principal officer’s social security number, home address, and date of birth.

- Online bank credentials or bank routing and account number.

Step 2: Connect Your Bank Account

The next step is to connect your bank account with QuickBooks.

- Open QuickBooks and sign in as admin.

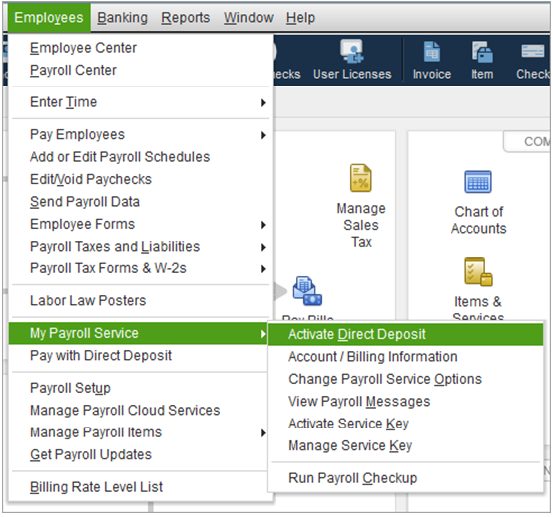

- Click on Employees and select My Payroll Service then Activate Direct Deposit.

- Click Get Started. If the get started button is not available, follow the given steps:

- Click on the option I’m the admin, and I’m the primary person who can… and enter the admin’s user ID and email address.

- Select Continue. If you are not signed in to the Intuit Account, click Sign In. If you haven’t an account yet, select Create an account link.

- Click Get Started.

- On the business tab, select Start and enter the info. Select Next.

- Fill in the Principal officer info and click Next.

- Click Add new bank account.

- Enter your bank name and online bank credentials.

- Create your PIN and confirm it twice. You need to enter this pin every time you send the payroll to QuickBooks.

- Select Submit and Next then Accept and Submit.

- After prompting, confirm the principal officer’s full social security number and click Submit.

Now, you’ll see one of the following messages.

- Thank you for signing up for QuickBooks Direct Deposit. If this message appears, it means you need to verify your bank account. Move to step 3.

- Your bank account is connected. This means that your bank account is connected and you are ready to pay your employees by direct deposit. Move to step 4.

Step 3: Verify Bank Account

- Regularly check your bank account in 2 business days for the debit amount of less than $1. It was debited by the Intuit QuickBooks Payroll to verify your account.

- Once you find the amount, sign in to QuickBooks as admin.

- Click Employees, then My Payroll Service.

- Click Activate Direct Deposit and sign in to your Intuit account.

- Enter the debit amount twice and click Verify.

- Enter payroll PIN and click Submit and then OK.

Step 4: Set up Direct Deposit for Your Employee

Here is the procedure to set up the direct deposit for an employee in QuickBooks;

- Firstly, select Employees and then select the Employee Center to open the employee list.

- Now, double-click on the employee’s name.

- Then, select the Payroll Info tab.

- After this, choose the Direct Deposit button.

- In the Direct Deposit window, click on Use Direct Deposit for [employee’s name].

- Choose whether to deposit the paycheck into one or two accounts.

- Enter the employee’s financial institution information that includes the Bank Name, Routing No., Account No., and Account Type.

- If you wish to deposit to two accounts, then you need to enter the amount or percentage that the employee wants to deposit to the first account in the Amount to Deposit field. The remaining amount is deposited into the second account.

- Choose OK to save the information. When prompted, enter your direct deposit PIN.

Step 5: Update Employee’s Direct Deposit Information

You need to edit the bank account information of the employee before creating a paycheck for him/her. Paychecks that are created before updating the employee’s account information will be deposited directly to the old bank account. To avoid this, you can delete and reform the paychecks before sending them to Intuit, by following the below steps:

- First, you need to open the paycheck and go to the Paycheck Detail window.

- Now, uncheck the Use Direct Deposit option on the paycheck detail and select Save and then Save & Close.

- In the end, open the paycheck again and choose the Use Direct Deposit option. After this, click on Save.

To Remove Direct Deposit Permanently from an Employee’s Profile

If you added an employee to the payroll by mistake, just remove the account of the employee. Follow the given procedure to delete the profile.

- Firstly, choose Employees and then select Employee Center.

- Double-click on the name of the employee to edit that profile.

- If the employee is not on the list, Go to the Show drop-down and click All employees near the drop-down list.

- Click Delete this employee.

- Click Delete to confirm.

It was the complete activation process of direct deposit in QuickBooks Desktop Payroll. And hopefully, this article will be a knowledgeful source for you. You can take help from our certified QuickBooks ProAdvisors, for QuickBooks Desktop Payroll support. Feel free to dial our toll-free number +1-844-405-0904.