Do you possess QuickBooks Desktop payroll but are still unaware of how to change the bank account for direct deposit in QuickBooks? Read this article below, we have shared the necessary details on changing direct deposit. You’ll get to know about the requirements, steps to change the payroll bank account in QB, and further, we’ll discuss how to activate, set up, and modernize a bank account in QB. Go through the article and learn the steps to change direct deposit bank account in QuickBooks. For more info contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

Direct deposit is an easy way to save time on payroll and it’s fairly simple to set up direct deposit. If you have QuickBooks Desktop Payroll Basic, Standard, or Enhanced with Direct Deposit, you have the option to modify your bank account from which your direct deposit payroll funds are withdrawn.

Table of Contents

Steps to change your direct deposit bank account in QuickBooks

Requirements to perform the processes below:

- Your existing Intuit Account.

- The Direct Deposit PIN you use to send payroll.

You can also hire our expert to quickly resolve the problem for you. Discuss your problem with them. Dial QuickBooks support number+1-844-405-0904 now.

Steps to Change Direct Deposits Bank Account In QuickBooks?

The below-given steps can help you to change direct deposits bank deposits in QuickBooks

Step 1: Add The New Bank Account In QuickBooks Desktop

Follow the below steps to add new bank account to the QuickBooks Desktop Chart Of Account:

- First, go to the QuickBooks Lists, and click on the Chart of Accounts.

- Next, look for the Accounts button, and then click on the New.

- Now, you need to click on Bank and next click on select

- Add all the essential information about your bank that you need to add

- Last, click on Save & Close to save all the changes.

Step 2: Update Your Bank Information On Payroll

QuickBooks Online Payroll Update the information in the QuickBooks Payroll Account Management Portal to avoid an incorrect bank account issue. Go with the steps given below:

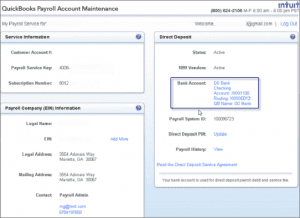

- In your QuickBooks Payroll Account Management Portal, go to the Employees and next click on My Payroll Service, next click on the Accounts/Billing Information.

- Now, you need to log-in with Intuit account login credentials.

- Next, look for the Payroll Info segment and click on Edit from under the Direct Deposit Bank Account.

- Later, you have to provide your payroll PIN, later select

- Insert all the new bank account information, and later select

- Now, you need to wait for the confirmation and next click on Close.

After updating your bank information on payroll, you can now proceed to the next step, which covers verification of new account.

Step 3: Verify Your New Direct Deposit Bank Account

In QuickBooks, you need to verify your bank account for a Direct Deposit feature, to do this go with the below-given steps:

- First, go to the Employees tab, and click on My Payroll Service, and later click on Account/Billing Information.

- Next, log-in to your Intuit Account with the correct login credentials.

- Later, go to the Payroll Info section and click on Verify from under the Direct Deposit Bank Account.

- Insert and confirm your payroll PIN.

- Click on Submit to complete the task.

Note: You need to change the direct deposits bank account to QuickBooks desktop by default while generating a paycheck in the application.

Update Your Bank Account Via Fax Or Email

If you do not want to change the QuickBooks Online Direct Deposit account within the application, you can choose an alternative way to update it via fax or email.

If you need to debit a new bank account for direct deposit, then you have to activate your account. You cannot make any payment until your account is activated and verified. If your account is not verified, you will need to issue paper checks.

Set up and modernize the bank account in QuickBooks

- In QuickBooks Desktop Set up the new bank account in the Chart of Accounts, if you haven’t created it yet

- First of all, Choose Lists and click Chart of Accounts.

- After that, click the Accounts button and choose New.

- Now, select Bank and click continue.

- Then enter your bank account information.

- Finally, click Save and Close to save your changes.

Update the bank account information on the QB Account Maintenance page.

- In QuickBooks Desktop, go to Employees. Select My Payroll Service and then click Accounts/Billing Information.

- After that Sign in using your Intuit Account login.

- In the Direct Deposit section, click on any of the Bank Account details.

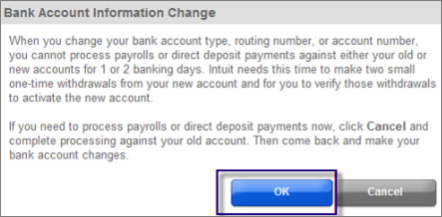

- Click OK on the message that appears.

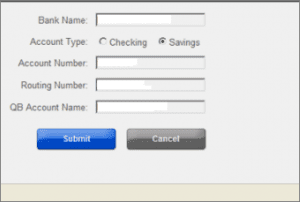

- Then enter your payroll PIN and click submit.

- Enter the new bank statement details and click submit.

- Wait for the confirmation and click continue.

Intuit will send two test debits to your new bank. It may take up to two banking days for the test debits to post on your bank declaration. You will require to finished the steps in the section below to activate your new bank account before sending your Direct Deposit payroll.

- Choose the bank account where QB Desktop should post transactions returned by the Intuit service.

It is important that the bank account(Chart of Accounts) where direct paychecks and fees will post to is modernized when doing a bank account modify.

- First of all, from Employees on the top menu, select Send Payroll Data.

- After that, On the Send/Receive Data window, click Preferences.

- Then click on the Account Preferences window, choose the new bank account from the drop-down list.

- Click OK to save your changes, then select Close on the Send/Receive Data window.

Note: If you cannot modify your bank account details in QuickBooks Desktop, you have the choice to Download the form and send it to Intuit via fax(877.699.8996) or email (SBPFCSOperations@intuit.com). You will require activating the new bank account if you want your upcoming Direct Deposit payroll to debit from the new bank account.

If you need to pay your employees but have not finished the bank account verification and activation steps, you will require issuing paper checks.

Activate your new Direct Deposit bank account

- After two banking days, check your bank statement and create a note of the two small one-time withdrawals made by QuickBooks Payroll Service.

- Enter these 2 test debits in the QuickBooks Account Maintenance page. See the steps below:

- Go to Employees, Select My Payroll Service, and then click Account/Billing Information.

- After that Sign in using your Intuit Account login.

- Then click the Verify link next to your Direct Deposit bank account information.

- Now, you need to enter the 2 test debit amounts to verify your new bank account.

Have any Questions? Just call QuickBooks Support +1-844-405-0904 get the best support for QuickBooks Desktop payroll. We are always ready to help our users so you can contact us anytime.