In today’s article, we will discuss how to prepare the form in QuickBooks 1099 Wizard. If you paid contractors in the last year and use QB, the 1099 Wizard will help you to secure time and easily file your 1099-MISC forms. Read the article and get the simple steps to prepare the form along with other related details. Go through the article follow the steps and get all your query resolved. Hope you find this article useful. If you have any queries regarding this article or your QuickBooks is not working, then you can call us on QuickBooks Support Phone Number +1-844-405-0904.

You will be proficient to prepare, review, and file all the essential copies of your 1099-MISC forms(if filing by mail) to the IRS in a few simple steps.

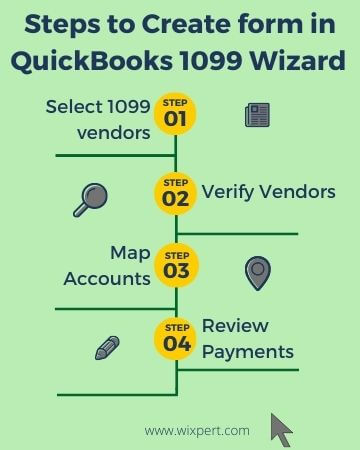

Steps to Prepare form in QuickBooks 1099 Wizard in details

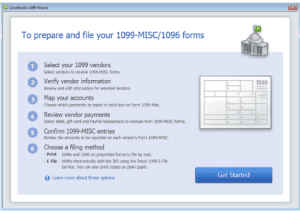

To access the 1099 Wizard, click Vendors, and after that Print/E-file 1099s and then 1099 Wizard.

Then click Get Started to proceed through the wizard.

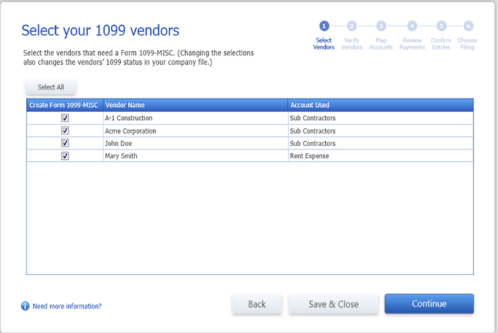

Select 1099 vendors

This list is taken from the Vendor List. Choose the sellers that need Form 1099-MISC, and then click Continue.

Note: Changing the selections here also changes the vendor 1099 status in your company file.

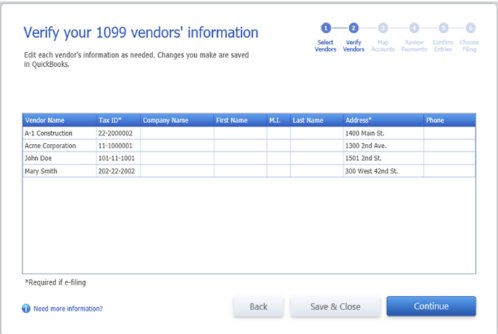

Verify Vendors

The information you see will be used on the 1099 forms. Values can be modified by double-clicking a cell within the table. Click Continue to proceed.

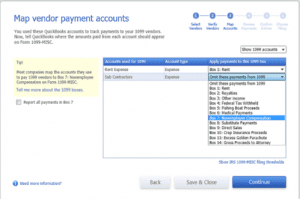

Map Accounts

Amounts will only be involved in reporting if they’re mapped to boxes. To map accounts or omit amount from 1099 forms, choose from the Apply payments to this 1099 box drop-down list. Or, if applicable, choose the Report all payments in Box 7 checkboxes. Click Continue to proceed.

If you see an alert in red that your settings don’t match the current IRS thresholds:

- First of all, click on the hyperlink Show IRS 1099-MISC filing thresholds.

- After that, click on the Reset to IRS Thresholds

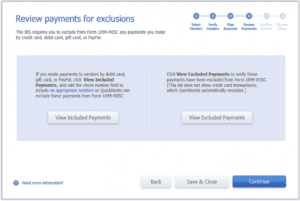

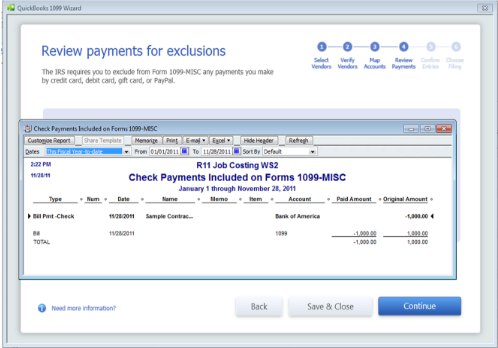

Review Payments

The IRS needs you to exclude electronic payments from being reported on Form 1099-MISC. These involve credit cards, debit cards, gift cards, or PayPal payments.

First of all, click on View Included Payments and then View Excluded Payments to review the QB report of the amounts that will be added and excluded. For more information, see Marking payments for exclusion from Form 1099-MISC.

Choose Continue to proceed.

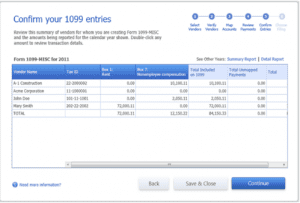

- Confirm Entries

Review the summary of the vendors. And the amounts that will be reported. This is the data that will be printed or sent to the 1099 E-File application.

Note: The amounts in the complete Un-mapped Payments column will not be added to the 1099 forms. This may be right, but it may also demonstrate that accounts are not mapped properly to the 1099 boxes.

Select Continue to proceed.

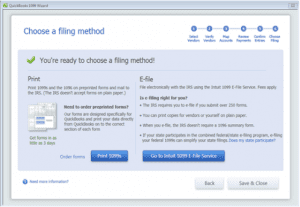

- Choose Filing

Using the Intuit 1099 E-File Service, you can file electronically with the IRS and print 1099 form copies on plain paper, if want(additional fees apply).

Important Notes:

- The IRS doesn’t receive forms on plain paper.

- QuickBooks only prints the seller data and not the actual form.

- QuickBooks may not be good with the free-print 1099 template off the IRS website.

Source of Ref: https://help.quickbooks.intuit.com/en_US/kb/1099-wizard/000004600_en_US:SALESFORCE.modal