What are the best options for nonprofits when it comes to QuickBooks? What is the role of QuickBooks for nonprofits, and which version is best for your nonprofit organization? We will answer all of your questions here in this article. So read the article till the end to find your all answers. During this time, you can drop a call to this toll-free number +1-844-405-0904 for further assistance.

QuickBooks is a great option if you are looking for accounting software for nonprofits. It tracks your donations, bookkeeping, invoices, and other accounting tasks. In this article, we will show you why QuickBooks is the best option for your company. We will look at features, pricing, and more to help you decide if QuickBooks for Nonprofits is right for your organization. Let us explore the QuickBooks for nonprofit solutions including QuickBooks Desktop and QuickBooks Online.

Table of Contents

QuickBooks Online for Nonprofit

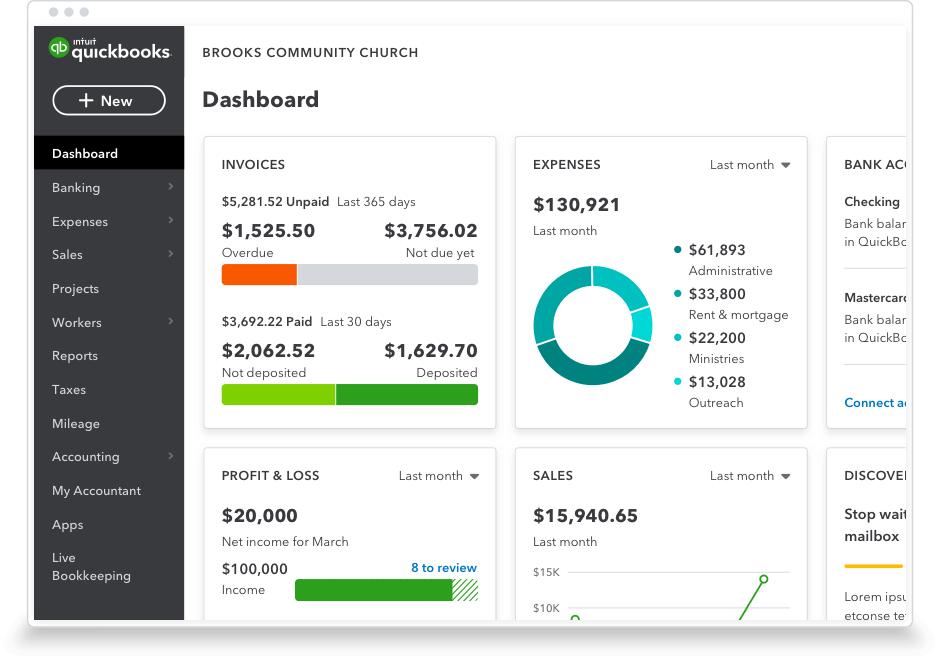

QuickBooks Online is the best option for nonprofit accounting software as it meets the needs of nonprofit organizations in many ways. By setting up your QuickBooks Online for nonprofits account, you can change customers to donors and income and expenses to revenue and expenditures. You can also use fund accounting and manage settings for donations, pledges, membership dues, and gifts in kind. With QuickBooks Online for nonprofits, you can also integrate with third-party tools.

You can categorize revenue expenditures by the fund and create custom data with QuickBooks. Track your budgets by funds or programs with QuickBooks Online Plus and QuickBooks Online Advanced. You can also track financial reporting, donor management, bank reconciliations, and more. Upgrading to QuickBooks Enterprise nonprofit will help you to store and access many donors, vendors, and items.

Let us have a look at the following capabilities of what QuickBooks Online can do for your non-profit organization.

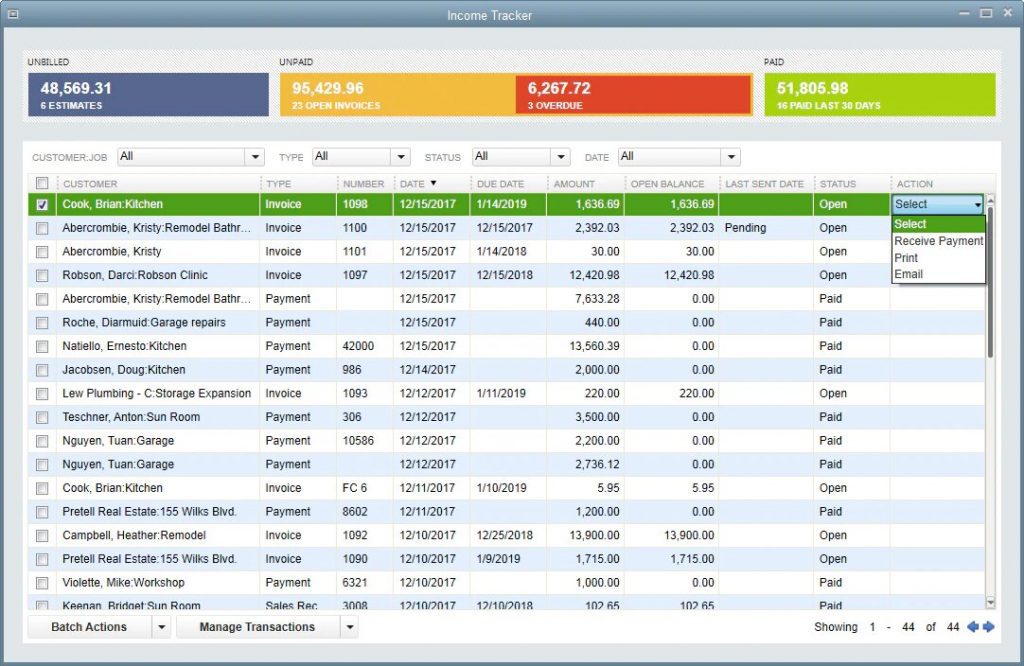

- Track donations: QB Online non-profit accounting software helps you accept donations through cash, bank transfer, check, credit card, and debit card. You can record money on your mobile device through the mobile app. Non-profit QuickBooks software lets you import transaction details from other apps.

- Sync your bank: You will get an instant update for expense tracking and cash flow by connecting your bank. With QuickBooks fund accounting software, financial management becomes very easy.

- IRS compliant: It handles and manages nonprofits throughout the year, to make you ready for tax time.

- Create specialized reports: QuickBooks can generate any type of report you require and keep everyone informed with custom board members, donors, and grant reports.

- Automates your reports: Set up automatic reports like statements of financial position, statements of financial activities, budgets vs. actual, and more to be created and emailed to your team.

Connect Apps to QuickBooks Online for Non-Profit

You can connect NeonCRM, DonorPath, and Kindful apps to QuickBooks for a smarter software solution.

- NeonCRM– You can access constituent contacts, enter donations, review activities, membership, events, and store purchases from your mobile device.

- DonorPath– DonorPath connects you with a virtual fundraising coach and provides you with a simple and elegant dashboard where you can find new opportunities, automate reports, and view donor wealth scores.

- Kindful– Kindful helps nonprofit organizations raise money by providing fundraising automation, online donation management pages, donor CRM, and reporting tools.

QuickBooks Desktop for Non-Profit

You can choose from QuickBooks Pro Plus, Premier Plus, or Enterprise when it comes to QuickBooks Desktop. Each of these apps is like its web-based counterparts and has a slew of features that nonprofits will appreciate. QuickBooks Enterprise, in particular, gives you the option of choosing a nonprofit-industry edition, which includes features tailored to nonprofits. Now, have a glance over the following features and capabilities of QuickBooks Enterprise for non-profit organizations.

- More Flexibility: You can get access for 5 to 30 users and work in two organizations at a time. It let you effortlessly combine reports from multiple files in order to get deeper insights.

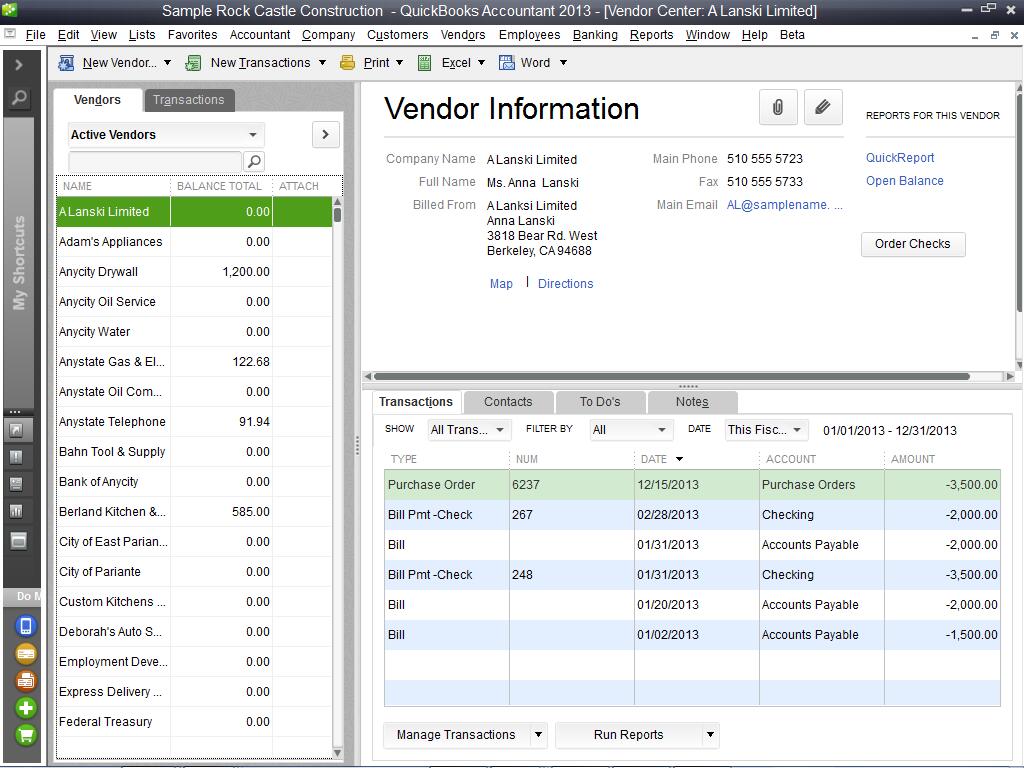

- Store donor information securely: Secure your donor information and easily fine-tune levels of access which enables only volunteers to see the information. It helps you to grow your vendor, donor, and item lists without compromising processing time.

- Keep Board and the CRA up to date: Keep your information in one place to manage fundraising campaigns, donors, employees, and volunteers.

- Technical support: Get unlimited technical support and training during weekday hours.

- Budget by programs: By program or project, compare specific budget items to actuals.

- Statement of financial income & expense: By program or project, see how specific budget items compare to actuals.

- Donor & grant reports: You can see all of your donor and grant contributions in one place, and the biggest donor report will show you who is having the biggest impact.

- Statement of financial position: Compare your current balance sheet to the previous year’s.

QuickBooks Pro Plus Features Tailored for Nonprofit Organizations

QuickBooks Pro Plus can be a good option for nonprofit organizations. It has many features which let you manage your nonprofit finances and accounting needs. Some of the features are listed below:

- Track revenue and expenditure

- Accept payments and donations

- Sync nonprofit bank accounts

- Create a list of members and donors

- Allow access for up to three users

- Track sales tax

- Manage bills and accounts payable

- Track inventory and create purchase orders

- Create and send custom estimates and invoices

- Run over 100 different financial reports

QuickBooks Premier Plus Features for Nonprofit Organizations

QuickBooks Premier Plus has a specific edition for nonprofit organizations. It has a steep learning curve and many specific features. However, you can check the features mentioned below:

- Suitable for small to medium-sized organizations.

- Allow access to up to five users

- Tracks costs for product and inventory

- Create sales order

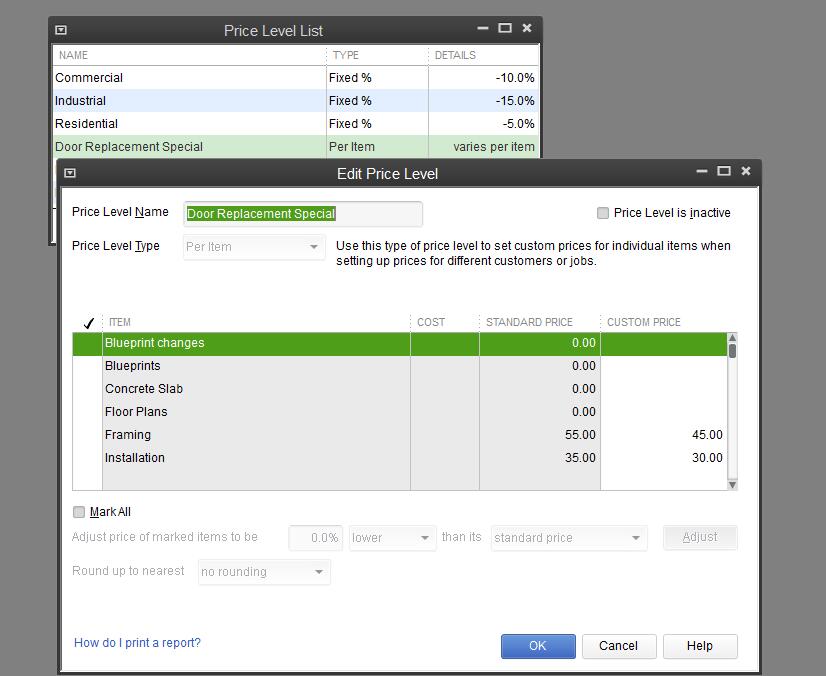

- Set product and service price by customer type

- 200+ integration

QuickBooks Enterprise Features Tailored for Nonprofit Organizations

QuickBooks Enterprises can be customized for nonprofit organizations which are having the following features included in them.

- Professional forms and statements: You can set minimum stock levels to determine which item needs to be reordered. This can be done by adding your quantities and clicking auto-create to do all your purchase orders in a single step.

- Microsoft integration: With the help of Microsoft Word templates, you can prepare letters and QuickBooks pre-populates the letters with your data, so there is no need for retyping.

- Set up accounts for nonprofits: The most common accounts that nonprofits deal with are pre-filled in the Nonprofit chart of accounts. It also includes the Unified Chart of Accounts, allowing you to transfer data directly into CRA forms quickly and accurately.

Frequently Asked Questions (FAQs)

Which QuickBooks is Best for Nonprofits?

The version of QuickBooks that is best for nonprofits is determined by the organization’s size and needs. QuickBooks Premier is best for small to mid-sized nonprofits, while QuickBooks Enterprise is better for larger organizations because it supports up to 40 users. Sign up for QuickBooks Online and use nonprofit integrations to get the most out of the software. If you prefer cloud-based software, then it is easy to learn and use.

What are the Benefits of QuickBooks Nonprofit?

The features of QuickBooks Nonprofit include budgeting, donor and grant tracking, and important financial reports, which will appeal to nonprofits. Payroll, time tracking, contact management, and other basic and advanced accounting features are available to you.

Does QuickBooks Offer a Discount for Nonprofit Organizations?

Yes, QuickBooks offers discounts for nonprofit organizations which you can get from a nonprofit tech market place i.e. TechSoup, a nonprofit tech marketplace.

My nonprofit has to file IRS Form 990 every year. Can QuickBooks help?

Anyone who needs to report where the money came from, how it was spent, and why it was spent only needs to file an IRS form. In QuickBooks, you can report how each dollar is spent for each program by tagging expenditure to fundraising, programs, or general admin. All of your data is organized in one location so you can prepare IRS Form 990 in less time.

It was all about the QuickBooks for nonprofits. Hopefully, you are now clear which QuickBooks version is right for your non-profit business. Still, if you have any kind of doubts regarding this topic then contact our QuickBooks ProAdvisor through the toll-free number +1-844-405-0904, they will solve your problem in a short while.