Here, we’ll discuss how you can create your Quicken budget and what instructions should be followed. So, just go through the article and enhance your knowledge regarding Quicken Budget. Now, talking about the budget in Quicken then it creates the budget automatically which is based on your recurring expense categories. And, if you want to add or remove categories according to your needs then you can easily do that afterward. Go through the article and learn to create the quicken Budget. for more details contact us toll-free:+1-844-405-0904

As we all know Quicken is a personal financing software tool by which you can easily track every penny you earn and spend. And, the best thing about Quicken is that it helps in managing your finances and budget in every possible way.

To Create a Quicken Budget, follow the Instructions:

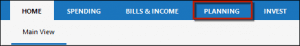

- First, you need to click the Planning tab.

- Next, select the Budgets button and tap on it.

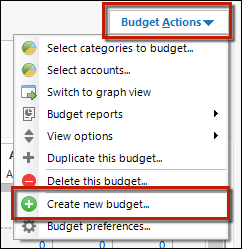

- Now, you need to click the Get Started option and then choose Budget Actions > Create a new budget.

- After that, type a budget name.

- After the budget name, you have to select the Automatic budget.

- Next, you need to click OK to create your New budget.

- What type of budget create: Quicken reviews your spending of five top categories and then creates a budget but keep in mind that it does not include any transfer and income categories. So, if you need to add the transfer and income categories then you can add them in the Advanced Budgeting window.

- Used date range: Quicken creates the budget on the basis of the previous 12 months’ transactions. In case you don’t have data or transactions in the last 12 months, it can provide you on the basis of the previous three months.

- Used Budgeting method: Quicken always uses your average monthly expenses to create the budget.

- Quicken always use the rounding figure which is nearest to the dollar while creating a budget.

- The accounts and categories used: Quicken also creates the budget which is based on personal expense transactions in all of your accounts except Quicken Invoice and Sales Tax. It creates the budget after reviewing the personal expenses categories having the most spending.

- It excludes income categories, special investments, and paychecks categories like “_401contrib”. It also excludes Interest exp, Misc as well as Not sure categories. Some categories have tax line assignments that are also excluded such as Schedule A includes home mortgage interest, W-2 includes Federal tax withheld, medicare tax withheld, local tax withheld, Soc, Sec. tax withheld, and state tax withheld.

- And, after doing all the mentioned steps you can work with your budget in the Budget window.

Things you can do in the Budget window

- Change the budget range: By selecting the date range from the top of the budget window you can view the last three months or last year’s budget.

- View Budget details: for getting more budget details you have to click on Budget categories.

- Can change budgeted amount: If you want to change the budgeted amount then you have to select the budget category and then click the arrow to increase or decrease the budget. But keep in mind that you can only change the budget amount for the current month only.

- Add budget category: For adding the budget category, you have to click on the add category that is at the bottom of the budget window. If you want to add a category that still doesn’t exist then go to the Tool menu and then click on the category list after that click on new. After doing this you have to return the budget and then assign the budget amount to it.

- Remove a budget category: If you want to delete any category then you have to click on the red circle located just next to the category name. But keep in mind that you can only remove the budget category that is from the current month.

- Manage Rollover amount: For managing the budget rollover you have to select the budget category and then click on Rollover.

- Use advanced budgeting feature: you can choose the advanced budgeting feature through advanced budget setup which is located in the budget window. It helps you in using spreadsheet format and gives more flexibility to fetch the data.

- Review the budget for the prior month: You can view the prior month’s budget through the date range selector. If you need to view the different months then click on the arrow button that shows the budget for different months.

Create Budget Report

For creating a budget report, you have to go to Budget actions and click on that and then click budget reports or monthly budget reports. You can compare the expenses of a specific date range that have been budgeted for the specific date range.

You can find a very slight difference between the Budget report and the Monthly budget report. In the budget report, you can calculate on the basis of the category and transfer account and see the difference in the actual and budgeted amounts. But in the Monthly budget report, you can calculate the difference between the actual and the budgeted amounts according to the months for every category.

How to copy your current budget to next year?

The first time you view a prior year’s budget in a new year, Quicken asks you if you want to extend it to the new year. Just click OK and Quicken creates a new budget for you automatically, copying all of your current budget categories and budget values to the new budget.

What If you want to get an early start?

If you want to create next year’s budget before the start of the year, or if you want more control over how the budget is created:

- Use the date control at the top of the budget window to change the year

- Quicken asks you how you want to create the budget:

- Copy your budget categories and budget values to the new budget.

- Copy your budget categories and actuals as budget values to the new budget.

- Select and copy budget categories only to the new budget.

- Click OK to create the new budget.

Notes

- Your new budget will report income and expense actuals based on transactions from the year it represents.

- You can edit your new budget without affecting your previous budget.

- You can also create a budget for prior years.

We have discussed all the possible steps to create a Quicken budget. But, if you are still puzzled with your queries, and need Quicken Support then don’t hesitate to dial our toll-free number +1-844-405-0904. Our experts will technically assist you to solve your queries.