In this article, we will discuss how to record and make bank deposits in QuickBooks Online and how you can merge multiple transactions into a single record so QuickBooks matches your real-life bank deposits. Here the article covers complete details in simple steps with real-time process images to offer you a better understanding of recording and making a bank deposit in QuickBooks. For more info contact us on +1-844-405-0904

When you deposit in a bank, you usually deposit payments from multiple sources simultaneously. Your bank regularly records everything you deposit as a single record. If you enter these payments as a personal record in QuickBooks, they do not meet your deposit.

For this type of case, QuickBooks has a unique way of merging everything for you, so that your records will match your real-life bank deposits. Keep the transactions that you have to add to your undefined fund account. Then after recording a bank deposit to combine them. Now let’s discuss how to record and make bank deposits in QuickBooks Online.

Table of Contents

Steps To Record and Make Bank Deposits in QuickBooks Online

Step 1: Add transactions into the Undeposited Funds account

If you have not previously, enter the invoice payment and sales receipts that you want to add to the undeposited fund account. This account transacts before you record the deposit.

Note: If you are using QuickBooks Payments feature for processing customer transactions then you do not need to record bank deposits because QuickBooks automatically creates bank deposits for you. And pending payments only display on your deposit screen. You just need to review the work. But if you want to merge payments received outside QuickBooks payments then you have to follow the given steps in this article.

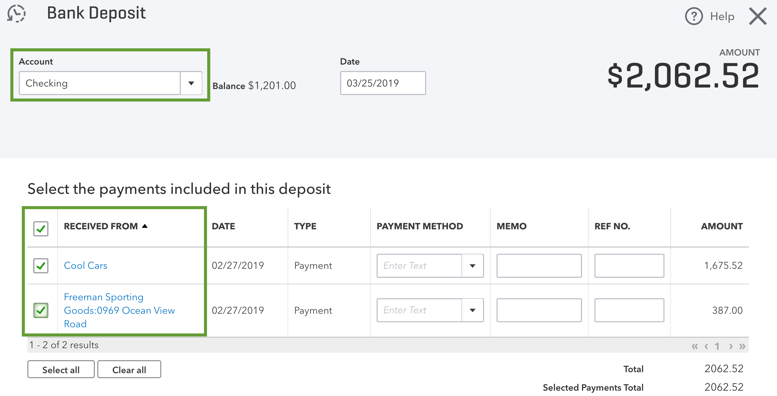

Step 2: Record a bank deposit in QuickBooks to combine payments

Every bank deposit generates a discrete record. Make one deposit at a time for every of your deposit slips.

- Open QuickBooks Online and click on + New.

- Now, later click on Bank Deposit.

- Pick the account that you need to deposit the money from the Account drop-down▼menu.

- Pick the box for every payment that you need to merge. It is compulsory to match your deposit and your selected payment deposit slip. Always use your deposit slip as a reference. Keep in mind, only choose the payment you want for every deposit.

- Click on Save and quit or Save and new.

Important: Currently, the only transactions in your Undeposited fund account will show in your bank deposit window. If you do not see what you want to add then place it in the account of Undeposited funds.

Steps to include a bank or processing fee

Several banks deal with service fees and processing fees. There is no need to edit the original transaction in QuickBooks. Alternatively, you can combine charges in the bank deposit window:

- Drag down and look for the “Add funds to this deposit” segment.

- Now you need to insert the fee as a list item.

- Select who the fee was from (ex. the bank charging you). Then select Bank Charges from the Account drop-down▼menu. See the tip below if you don’t see this account.

- Choose the fee that was charged to you (e.g. the bank charges you). Then choose Bank Charge from the Account drop-down from the menu. If you do not see this account, see the point here.

- Insert the payment as a negative number and re-examine the deposit total with the bank fee.

- Choose to Save and terminate or Save and new.

Tip: If you do not have the Bank Charges account earlier, here is the steps how-to create bank charge account:

- From the Account drop-down menu, click on the + Add New

- On the account creation window, select Expenses as the account type and Bank Charges as the detail type.

- Now go to the account creation option, click on Expenses as the account type, and choose Bank Charges as the detail type.

- Give a simple name to the account as “Bank fees.”

Step 3: Manage your deposits

Steps to review past bank deposits.

Here are the steps to view past deposits and joint transactions by you:

- First, you have to go to the Reports menu.

- Now, scrolling down and look for the “Sales and customers” segment.

- Click on the Deposit Detail report.

The report records all your full bank deposits. You can choose individual deposits to notice more details.

Steps to remove a payment from a bank deposit

Go with the below steps if you need to remove a particular payment from a deposit:

- First, you need to click on the Sales menu and then later click on the All Sales tab.

- Navigate and open the payment that you need to remove. The state must be “Closed.”

- Click on the blue date link near the client’s name. This initiates the bank deposit

- Now, untick the box for that payment which you need to remove.

- Click on Save and new or Save and close.

All payments on your deposit go back to your undeposited fund account. You can start and make a new deposit.

Steps to delete a bank deposit

If you want to initiate and withdraw a complete bank deposit:

- First, you need to go to the Accounting menu and click on the Chart of Accounts.

- Look for the bank account containing the deposit and then later click on the View register.

- Now, look for the deposit option and choose it for extra features.

- Lastly, click on Delete.

Hope, you have found this article helpful and understand the steps on how to record and make bank deposits in QuickBooks Online.

If you have any kind of concern and question then feel free to contact our Intuit Certified ProAdvisors by dialing our tollfree +1-844-405-0904 at any point of time and get instant help for your query. We are 24*7 available in the assistance of our customer.