QuickBooks Budgeting & Forecasting Reporting helps you to observe how properly your company is working and also help to analyzes your original income and expenses with your company’s budget amount. So here in this blog, we will discuss in detail QuickBooks Budgeting vs Forecasting Reporting as well as learn how to use your data to create budgets and forecasts. Go through the complete article to use QuickBooks in the easy possible way. If you have any issue then contact us on our toll-free number: +1-844-405-0904

You can use these reports to recognize possibilities for cost savings, opportunities for expansion on revenue sources, and errors or imperfections for incorrect accounting entries with these reports.

Table of Contents

Steps to Create QuickBooks Budgeting & Forecasting Reporting

Step 1: Review last year’s data

Make sure before setting up a budget or forecast, you have to set your fiscal year correctly.

- Choose My Company from the company Menu.

- Under “My company” you can pencil icon select it and then click on Report Information.

- Here, you have to make sure the first month of your financial year is exact.

Later, you need to review the last fiscal year’s reports.

- First, open the Reports menu and select Company & Financial.

- Depending on the forecast or budget you want, select the profit and loss statement or the balance sheet statement.

- Select Last Fiscal Year, from the Dates dropdown.

- Choose Refresh.

- You can also record this report for the future(optional).

Step 2: Set up a budget or forecast

Hope, now you have your reports, and you can easily set up a budget or a forecast.

Create a Budget

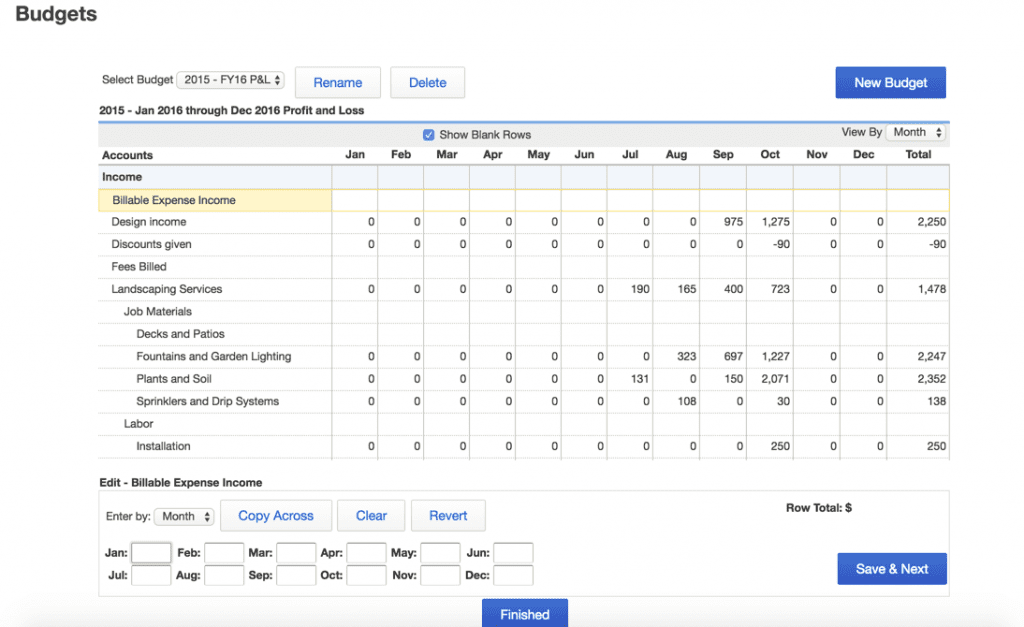

- Open the Company menu and select Planning & Budgeting and after that, choose Set Up Budgets.

- Pick Create New Budget.

- Later, fix your fiscal year for the budget and select Profit and Loss and Balance Sheet. Then choose Next. If you want to pick Profit and Loss then you have to add additional measures like jobs tracking or class tracking.

- If you choose profit and loss, choose both create budgets from scratch or create a budget from the actual data of the previous year.

- Choose Finish.

Note: If you change the name of the account used to create the budget, it removes it from the budget. You will have to recreate the budget using the new account name.

Create a Forecast

If you are using QuickBooks Desktop Premier, Accountant or Enterprise then you can easily generate forecasts to predict future profits and cash outflow. You can make a financial forecast from scratch, or also from last year’s data.

- Open the Company menu and select Planning & Budgeting and after that, choose Set Forecast.

- Choose to Create New Forecast.

- Later, fix your fiscal year for the forecast. If you want then you can also define additional measures like jobs or Class tracking, keep in mind this is optional.

- Choose each Create forecast from scratch or create a forecast from the actual data of the previous year.

- Choose Finish.

Step 3: Review your budgets and forecasts

You can easily review your report by clicking the Reports menu and choose Budgets and Forecasts.

5 Simple Steps to Create a Small Business Budget

Step 1: Tally Your Income Sources

The first component of a good business budget is to find out how much money you bring on a monthly basis. Start with your sales figures first (which you can easily achieve using the profit and loss report in QuickBooks), and then move forward by adding other income sources you can use to run your business.

Step 2: Define Fixed Costs

Fixed costs are those costs that are charged every month at the same price. As you can imagine, organizing is the simplest part of making your business budget.

Examine your previous bank statement. You will be able to easily pay your fixed bills and the total amount, which they pay you every month.

Step 3: Add Variable Expenses

Items that do not have a fixed price tag each month are called variable costs. Many of these purchases can actually be made using your monthly profit up or down depending on the state of your business. Each month your profit will be determined by the earnings you have left after paying all your costs. Therefore, if your business is better than your forecast, you can use the additional funds to increase variable spending so that you can grow faster.

Step 4: Predict One-Time Spends

A big reason for making a budget is that now you will be able to be a better factor in lump-sum purchases. While some of these items may come up unexpectedly, such as for the purchase of a laptop to replace the person who crashed, others may be budgeted for months in advance, such as the business you are looking at to protect your business from financial burden.

Step 5: Pull It All Together

The first four phases of this post detail the elements of a good business budget, so the last phase is simply pulling it together. Create your budget by using these checklist examples. It will help you to create your budget without any problem.

INCOME SOURCES: Hourly Wages, Goods Sales, Investment Assets, Loans, Profits, Others

FIXED COSTS: Rent/Lease, Service, Wages, Internet, Government and bank fee, Cell phone, Website hosting, Accounting Services, Legal Services, Insurance

VARIABLE EXPENSES: Raw Elements, Entrepreneur Wages, Commissions, Advertising, Other Marketing Costs, Transportation, Travel & Events, Printing Services

ONE-TIME SPENDS: Computer, Furniture, Software, Office Equipment, Gifts

Hope. this will be helpful to Create QuickBooks Budgets and Forecast Reports. But if you still have any confusion or query related the same then, feel free to contact us on +1-844-405-0904 and get help from our expert ProAdvisor team. We will always be ready to help you at any point of time.