Are you puzzled about the pricing and additional features of the Intuit Payment Network? Don’t worry all your doubts will be cleared in this article. Intuit Payment Network (IPN) is an excellent product for small businesses and Freelancers also. The main purpose of this facility is to send and receive payments through the Internet. It is affordable, user-friendly, and also helps you to save plenty of time. Go through the article to get the complete stuff about IPN, and its specifications such as pricing, features & reviews. If you need the best QuickBooks payment support in a short time then dial the toll-free +1-844-405-0904.

IPN has the facility to receive payments via credit card or electronic check (ACH). It integrates with QuickBooks easily and is easy to use. Now, let’s visit these improvements provided to the service from the past few months.

- Credit Card Acceptance

- Guest Payments

- Branding of the Payment Request page

- Better Reconciliation(using QB 2012) without using Sync Manager

- Recurring Payments

You’ll find various ways to handle electronic payments with QuickBooks. These are some examples:

- Bill.com

- Bill & Pay

- Nelix TransaX

- Intuit GoPayment

- Intuit payment network

However, each of these has vivid methods of integrating with QuickBooks, advantages, and fees. And I’m sure you must be clearly aware that fees are the tough part for the small business. But your fees may be lower or more manageable if you handle a good volume of payments.

Intuit payment network’s Features

- IPN is quick and user-friendly.

- Easy to use and convenient.

- It provides the best rates in the industry.

Following are the various solutions, provided for the components of the fee structure:

Monthly Fee: For a small business, it can create a hassle. And, in some cases, you’ll find that there are two monthly fees where one is for a “merchant services” account and others for the ability to collect payments online and also manage the collection or payment process.

Per Transaction Fee: For each transaction, you’ll find that there is a fixed fee added.

Discount Rate: This has different functions. Gives the transaction’s percentage, and then becomes a considerable cost. Possibly you’ll find a variation in your discount rate based on the payment solution vendor.

Now, you need to first create an account at the Intuit Payment Network site and then enable your Payment preferences in QuickBooks.

After creating an invoice, you’ll find a checkbox in the lower corner.

There will be a payment link included, whenever you print or email the invoice. An email message is also included in the payment information.

Branding of the Payment Request Page

“Branding” is the recent improvement of the payment page. And, when you click on the payment link your company name is shown at the top.

Intuit Payment Network Reviews

According to recent surveys, many customers placed their reviews about the Intuit PamentNetwork. Let’s discuss them in detail;

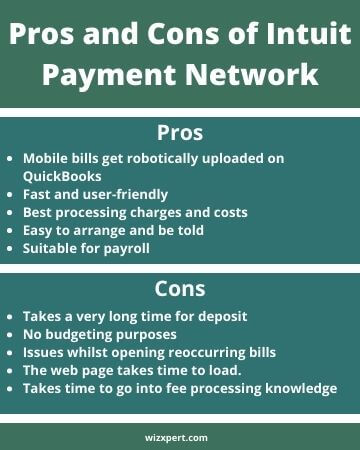

Pros inside Intuit

- Mobile payments are automatically uploaded to QuickBooks

- Quick and user-friendly

- Has best processing rates and fees

- Very easy to set up and learn

- Great for payroll.

Cons inside Intuit

- The deposit time is slow

- There is no budgeting function.

- Customer support service is not really good

- Unable to open recurring payments

- Takes time to load the page to enter payment processing information

Through ACH transactions it can send or receive electronic payments easily. It does not require monthly fees, only $0.50 per transaction needs.

According to the above discussions you have got an idea about the Intuit Payment Network and their features or price. If you need any further assistance then you can contact our QuickBooks support team. By just dialing our toll-free number +1-844-405-0904, you can ask all the queries, and our technical team will guide you accordingly.