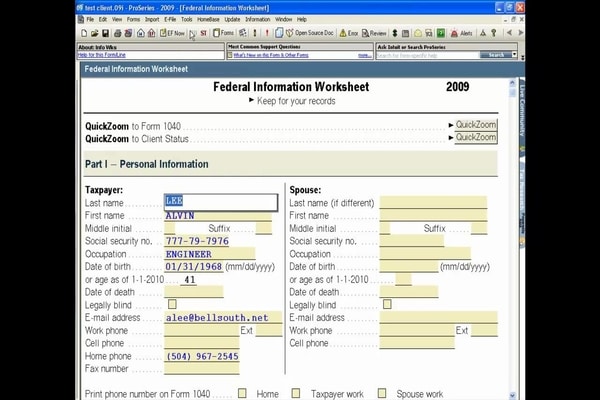

Are you looking for handy Tax Management Software? Intuit ProSeries is here for you. Read this article further to know the details about ProSeries Professional Tax Preparation Software, its features, utilities, tools, and pricing. Intuit ProSeries is the Cloud-Based tax software. This is best suitable for small and mid-sized financial businesses. Go through the article to learn the details about Intuit ProSeries and get prepared for professional tax preparation, stay connected with us to learn new. For More Info. contact our QuickBooks ProAdvisor toll-free:+1-844-405-0904

This software is helpful in many ways with Intuit ProSeries Tax software tax professionals can view, track, and manage e-filed returns, and also help in file returns, manage tax submissions, track the progress of returns, and many more.

The solution (Intuit ProSeries Tax Software) absolutely added with various accounting software like QuickBooks, Quicken, and TXF to import financial data directly into ProSeries.

First, we are going to discuss the features of Intuit ProSeries Tax Software.

Table of Contents

Features of Intuit ProSeries

Intuit ProSeries provide you with the feature to keep away all your worries related to your tax that keeps you up day and night, and you can better deal with your clients. So, here is the list of some features:

These features are divided into three parts and these three parts are further divided into subparts.

1. Accessing Data

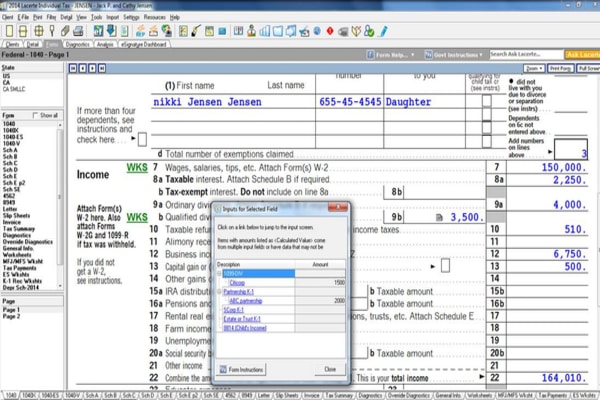

1. Line Sensitive help

Track the source data and then get to know about what information should be included in a particular field

2. Download next year’s product

You can use this year’s ProSeries to download next year’s product automatically.

Downloading current or previous year ProSeries software and updates. You can get ProSeries Software and software updates from within the program or download from My Account.

- First, Sign In to My Account

- Then from the Dashboard Tab click the Download YYYY (tax year) button.

- For prior-year software downloads, click on the Previous Years link option.

- Then click Download YYYY (tax year) link to download that year’s product.

3. Constant on-screen help

You can take constant help/support while working on a return.

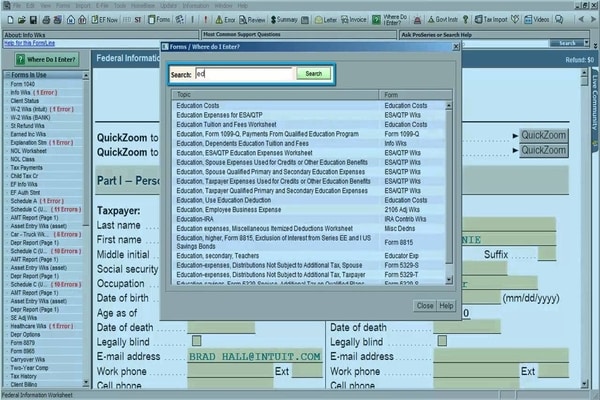

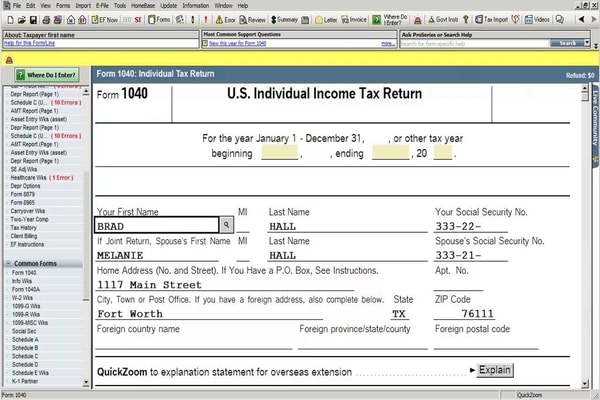

4. Where do I Enter?

If you are not sure where to enter certain data in a return. Then use Where Do I Enter? In the federal 1040, 1065, 1120, 1120S products to search the right form and field.

5. K-1 Data import

Data transfer automatically to individual returns. K-1 Transfer users save 20 minutes per return.

6. Tax return input guidance (Basic only)

Guidance in three places:

- Left-side navigation categories of input.

- Checklist to easily select types of input based on the client’s situation.

- Tabs for forms that require input/output.

7. “Forms” bar (Professional only)

Use the “Forms” bar for tax return guidelines, determine errors and fix them quickly. This robust feature is helpful in more efficient in locating tax forms and entering data.

8. Quick entry sheets (Professional only)

Entering data faster without scrolling many forms using Quick entry sheets, such as Schedule D and Schedule K-1. Quick and easy toggle between quick entry mode and form entry mode by using Ctrl+M.

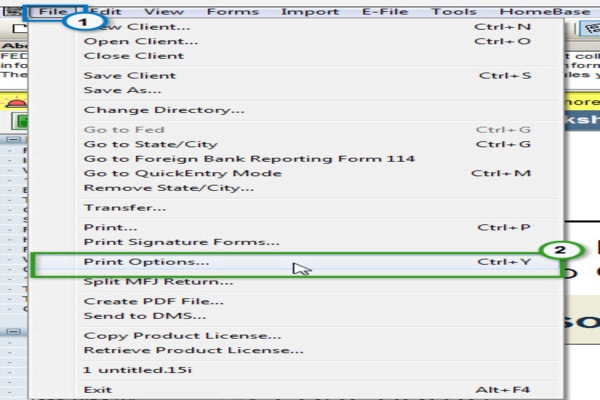

9. Splitting married filing joint returns (Professional only)

Splitting married filing joint returns feature helps you to split a married filing collectively individual return into two married filings individually returns for the taxpayer and the spouse. You don’t need to calculate manually, prepare multiple returns, or change the original returns.

2. Managing clients

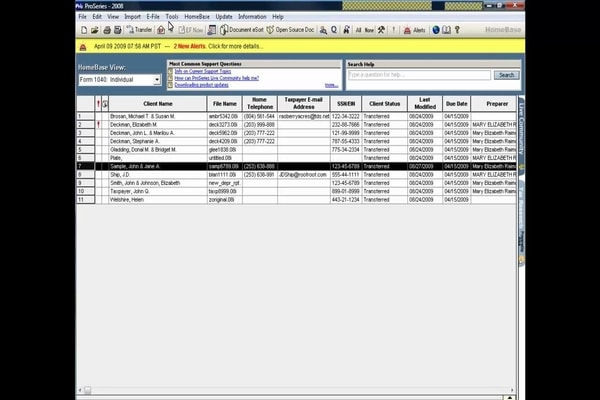

1. E-file status

View, track the status and manage e-filed returns.

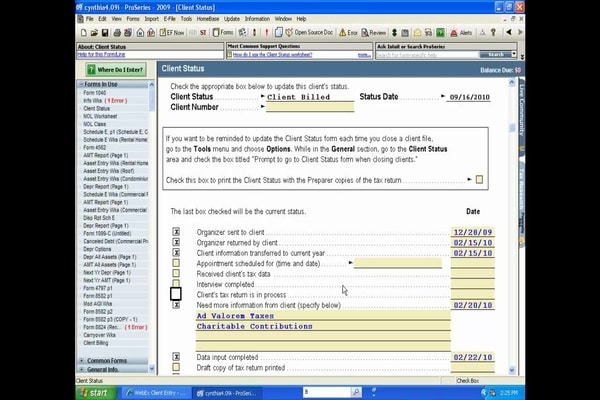

2. Client status

Keep track of the status of a client’s return. This tool is also helpful as a planning tool, as a status report or as a checklist for complete events.

3. Missing client data (Professional only)

You can find or track all missing client data in a return. To receive an update on missing data track the status, and email clients and request to quickly link to the field location.

4. Intuit Link

Intuit provides you a portal to make the document collection simple. This feature helps your clients to deliver their tax on time, in a personalized or organized form.

5. Client checklist (Professional only)

Based on last year’s return make a list of items you needed for this year’s returns. Email facility also for the encrypted version of the list.

6. Client-specific billing options (Professional only)

Using different billing methods like flat fees, hourly fees or charges perform to set up client-specific billing options. It also adds a billing clock and an editable invoice.

7. Client presentation

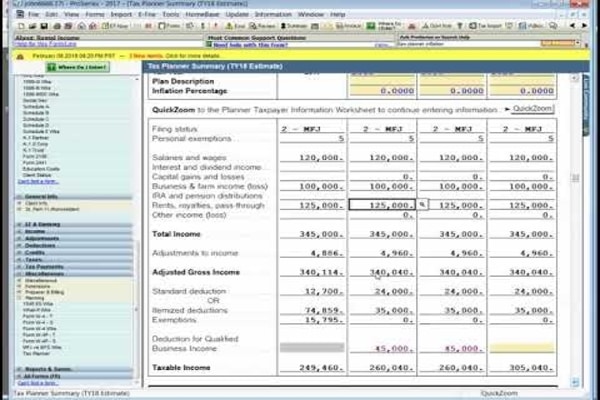

Feature of visual charts and graphs that help to show the client’s bottom line, income, and deductions, comparisons to previous years.

8. Client advisor

Option to make 73 tax planning suggestions that helps your clients to reduce their future tax.

9. Tax planner

Plan tax payments, withholdings, income, expenses and more for 1040 returns in future years.

3. Utilities and tools

1. Hosting for ProSeries

With the help of the Hosting feature, you can access your ProSeries software anywhere and on any device. Cloud hosting doesn’t break your workflow and collaboration with your firm. You get the Offers to work from any remote device including a Mac or tablet.

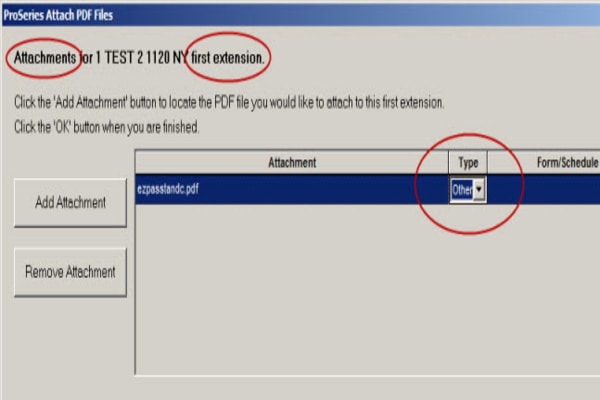

2. PDF attachments for e-filed returns

Attached PDFs with governmental and state e-filed returns.

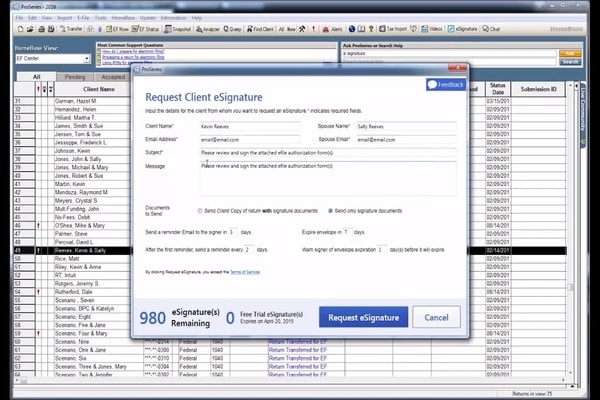

3. e-signature (Professional only)

IRS-approved electronic signatures for Form 8879, for saving you and you’re and your client’s time.

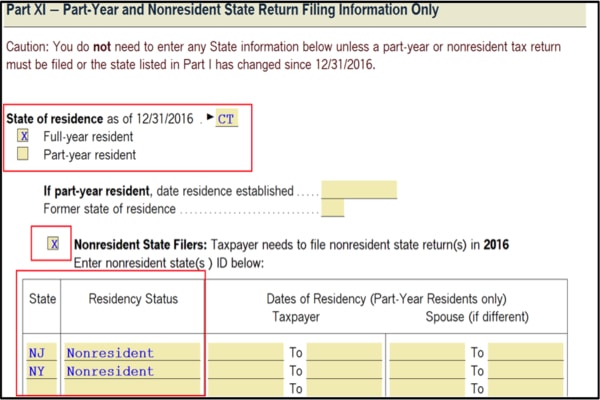

4. Multi-year e-filing

Generally, E-File returns for the current year and for two years back. For all governmental and state returns supported for all electronic filing.

E-filing for previous is only possible if the IRS and State tax agree to accept electronic returns for those years.

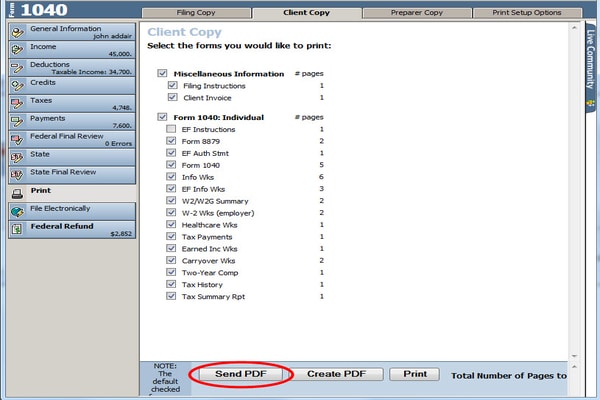

5. Password-protected PDFs by email

The client gets a password-protected email in which returns go directly from ProSeries.

- ProSeries Professional

- ProSeries Basic

6. Task scheduler (Professional only)

Schedule your ProSeries software that it can automatically download updates to the software for any program and form changes, and for e-file acknowledgments and tax alerts.

7. Client snapshot (Professional only)

The client snapshot feature helps you to quickly access and analyze summary information on the client’s return.

4. Integration with applications

1. Importing from Fixed Asset Manager (Professional only)

Import assets into various activities in ProSeries. You can import in Schedule C and Schedule E, and directly from ProSeries Fixed Asset Manager.

2. Importing from QuickBooks, Quicken and TXF files

You can directly Import financial data from key resources of the ProSeries, including QuickBooks, Quicken and TXF (Tax Exchange Format) files.

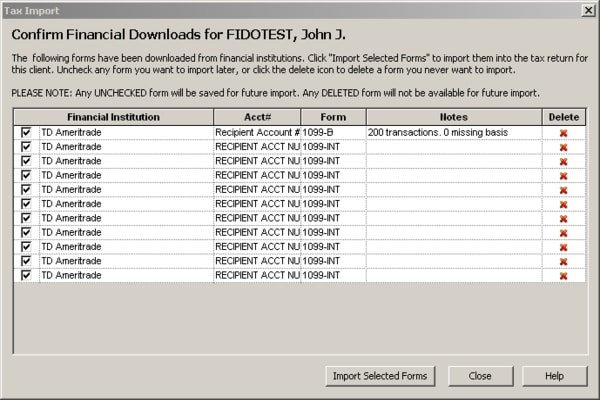

3. Downloading data from financial institutions

Directly download your clients’ 1099-B, 1099-INT and 1099-DIV data from participating financial institutions through a website that’s easy in use for you and your clients. It’s fully unified and included with ProSeries.

As we discussed the features now we will learn about the Intuit ProSeries Versions/Package.

Intuit ProSeries Packages and Its prices

Choose the right one with the right features and price that matches your requirements. All packages come with e-file, training, support and many more. Pick your own favorable package with many options for business returns.

Now we will discuss all the packages in details:

ProSeries Basic 20 returns and 1 state

This the perfect ProSeries package to start on the most common 1040 returns and schedules supporter. Proper guidelines with step-by-step which help you in preparing 1040 returns.

Basic 20 Features:

- Free e-filing

- Twenty federal 1040 returns

- There is the option of the checklist that helps you to directly to the forms that you want.

- Intuit Link client portal provides the information to your client in an organized and convenient way.

- Provide you with one screen facility that your client easily sees all the status at one location.

- You have access to the Pay-Per-Return for the previous year.

- Guide to you for the general information you need to collect from your client and other sections like income, deductions, credits, and so on. So, it will be easy for you to input and identify the forms category.

ProSeries Basic 50 returns and 2 states

Best option to start for the most common 1040 returns and their supporting schedules.

ProSeries Basic 50 returns features

- Fifty (50) governmental 1040 returns.

- The checklist provided you that help you to choose the right form.

- E-filing free

- Fifty (50) individual state returns (in two states).

- Intuit provides you with the Intuit Link portal that is helpful for your client to get data in an organized and convenient way.

- You can download current tax year financial year data from financial institutions.

- The option of Pay-per-return pricing for additional federal 1040, state 1040, and business.

ProSeries Basic Unlimited and 4 states

Best option to start for the most common 1040 returns and their supporting schedules.

Guided to prepare a 1040 return. At pay-per-return price business returns are available.

Features

- E-filing free

- The checklist option helps you to take directly to the forms you need.

- Download Current tax year financial data from financial institutions.

- Additional federal 1040, state 1040 and business returns available on Pay-per-return pricing.

- Pay-per-return access for the previous tax year.

- Intuit provides you with the Intuit Link portal that is helpful for your client to get data in an organized and convenient way.

- Proper guidelines to collect general information from your clients to other categories like income, deductions, credits, etc. That helps to identify or inputs the correct form according to your needs.

ProSeries Pay-Per-Return license

Feature of pay-as-you-go pricing. Support individual and business forms both with network facility for multi-user access.

Pay-Per-Return license features

- Feature of Pay-as-you-go pricing for selective 1040 and business returns.

- Intuit Link Portal helps your clients to get organized and convenient information.

- Download current tax year financial data directly from financial institutions.

- ProSeries Unlimited’s all the forms, schedules, and capabilities.

- Client service tools are helpful for you to work with clients more in a more effective way and show them your value as a tax professional such as client checklist, client presentations, and client advisor.

- Free e-filing

- For previous tax year’s Pay-per-return access.

ProSeries Choice 200

Up to 200 returns with the sequence: with 1040, 1040NR, Federal and State Business returns and Estate and Gift returns (1120, the 1120S, 1065, 1041, 990, 709, 706)

This the perfect option for tax professionals who have fewer than 200 returns for various needs.

One more feature of this package supports both individual and business forms with multi-user access.

ProSeries Choice 200 features

Pick up the right option which is best for you:

Get up to 200 tax returns with the combination of individual, business, gift, or estate returns. Eac federal return is included with all states. You can choose any of the combinations of up to 200 returns including.

ProSeries 1040 Complete

Including federal 1040 and state return package, excepting 1040NR. This the best option for a task of more than thirty 1040 and state returns. This can support both individual and business forms including network functionality for multi-user access, but business is in pay-on-go.

1040 Complete features

- It includes over 3,700 forms and schedules

- Business-to-1040 transfers import K-1 data.

- To work with your clients more effectively and prove yourself as a tax professional by providing a Client checklist, Client presentation, and Client advisor with the help of Client Service tools.

- Free e-filing included.

- Included Pay-per-return for business returns.

- Intuit Link Client Portal helps the client to get information in an organized and convenient way.

- Option to download current tax year financial data directly from financial institutions.

- The previous tax year is available on Pay-per-return.

ProSeries Power Tax Library

ProSeries Power Tax Library supports individual and business forms including network functionality for multi-user access.

Power Tax Library Feature

- Unlimited 1040 returns including more than 100 federal forms and schedules.

- Including 45 states and local forms unlimited individual returns for all states.

- 1120, the 1120S, 1065, 1041, and 990 Unlimited federal business returns.

- With 1120, the 1120S, 1065, 1041, and 990 unlimited state business returns.

- It also provides unlimited gift and tax returns including 709, and 706.

- Power Tax Library comes with over 3,700 forms and schedules.

- Including free e-filing

- Previous tax year Pay-as-you-go access

- Client Organizer and Fixed Asset Manager free add-on solutions.

- Power Tax Library import K-1 data for business-to-1040 transfers.

- Work with your clients in a more effective way and prove them you are valuable tax professionals including Client Checklist, Client Presentation, and Client Advisor.

- Intuit provides you Intuit Link Portal that is helpful for your client to receive organized and convenient information.

- Intuit provides Intuit Link client portal to get your client information in an organized and convenient way

- Option to download current tax year financial data directly from financial institutions.

- Power Tax Library compatible with e-signature for 8879 forms.

Intuit ProSeries Pricing in short

Intuit ProSeries comes with two different plans, Intuit ProSeries Basic, and Intuit ProSeries Professional. So, it has different pricing labels for different plans. Let’s check, how much does ProSeries cost for every plan annually.

| Intuit ProSeries Plan Types | Sub-Plan Types | Intuit ProSeries Pricing (Annual) |

|---|---|---|

| Intuit ProSeries Basic | Basic 20 | $420 |

| Basic 50 | $740 | |

| Basic Unlimited | $1,170 | |

| Intuit ProSeries Professional | Pay-Per-Return | $300 |

| Choice 200 | — | |

| 1040 Complete | $1,950 | |

| Power Tax Library | — |

The pricing of Intuit ProSeries, vary with the features, and number of user. And mostly the following features are included in it;

- State business returns

- Guided workflow for first-time user

- Refund transfer capability

- Financial institution download

- Multiple user access

- Electronic 8879 signatures

- Client presentation

- Client Advisor

- Fixed asset manager

- Client Invoice

- Client letter

- Number of states included for 1040 returns

All of the features are already mentioned in the above, here we have mentioned all the points only to revise them for one more time.

Comparison between ProConnect Tax Online, Lacerte, and ProSeries

This is the comparison between Intuit professional tax solutions. Basically, you don’t need to much worry about which tax solution you choose, as you’re strengthened by the power of Intuit. Here is the chart which helps you to find out the difference in each of the professional tax products.

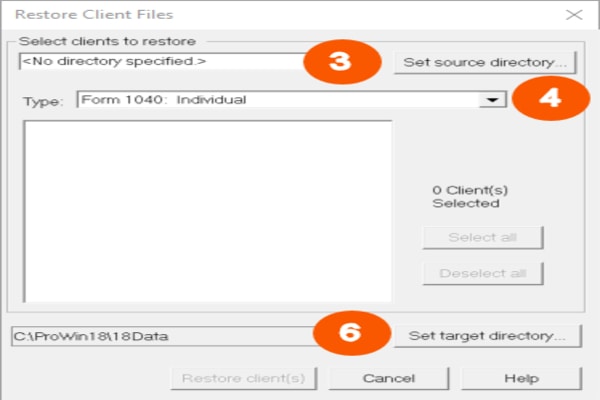

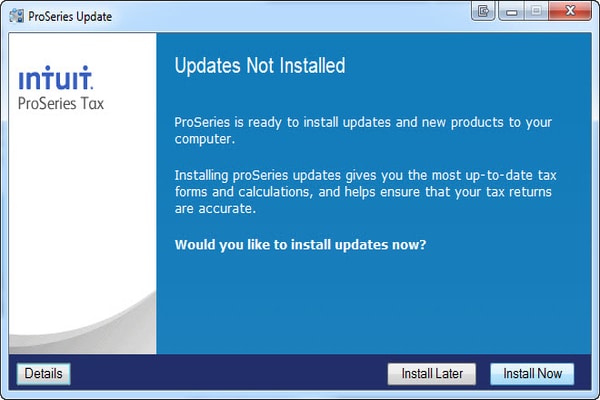

Download and Updates Current or Prior year Intuit ProSeries Software:

You can download or update current or next/previous year ProSeries software from My Account.

- First, Sign In to My Account

- Click the Download YYYY (tax year) button from the Dashboard Tab

- If you want to download prior-year software, click on the Previous Years link.

- Then select Download YYYY (tax year) option to download that year’s product.

Update in within software:

- Click Update in Homebase

- Select Update Installed Products if you want to update current forms

- For getting additional forms Select and Download New Products

For downloading Next Years Product from within the software:

- Select Help, from Homebase

- Then click Download Next Years ProSeries Product.

- Follow the instructions on the screen to start the download and update process.

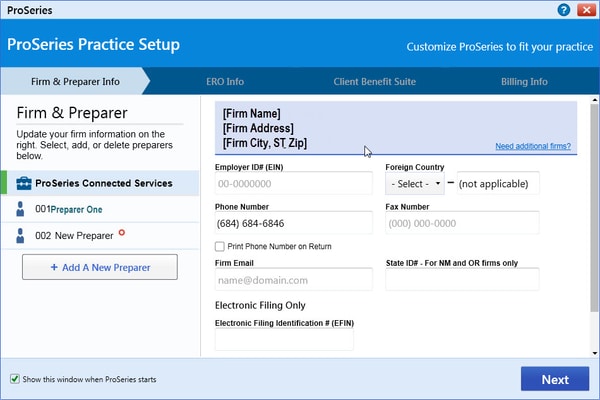

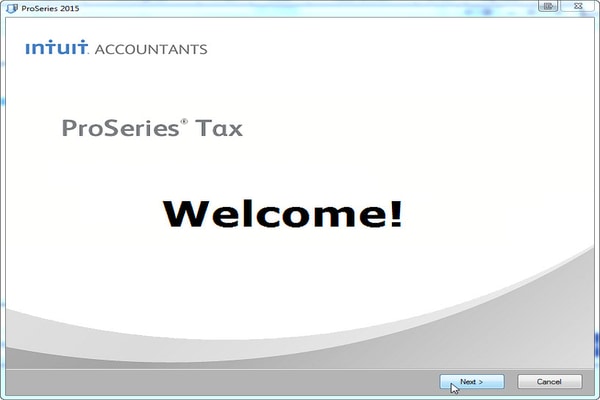

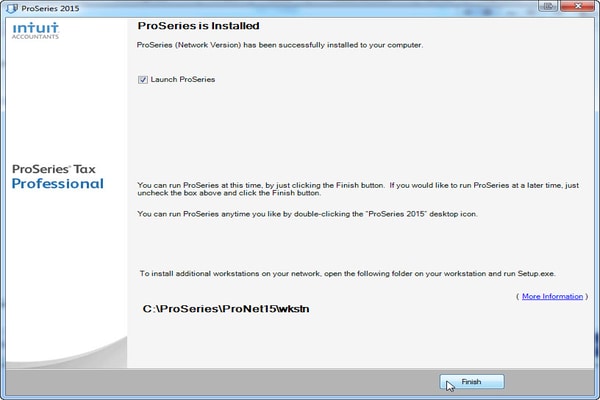

Installation of Intuit ProConnect ProSeries to a network

There are two types of installation of Intuit ProConnect ProSeries. First, Peer-To-Peer Network installation and the Client-Server network installation. Peer-To-Peer Network installation work when there is one system is enough for installation. Means, single system work as both a user workstation and will store the shared ProSeries files locally. And on the other hand Client-Server Network installation is used when there are two separate systems are used one as a server for file storage and all the workstations are connected to the network to access shared ProSeries.

Points to note before installation:

- Previously, if you are using mapped drives in the last years, you need to continue it for the new version of ProSeries.

Peer-To-Peer Installation:

It is divided into parts

Part 1: ProSeries Network Install-Admin Computer (Only)

- First login into My Account

- Then Download and run the ProSeries Professional installer

- And then to further processed click Next.

- After reading all the license agreement, then select the I accept and click Next.

- Select the Network Option and then click next on the Installation screen.

- After changing the name on the workstation name screen, after that select the product only you want to intent to use.

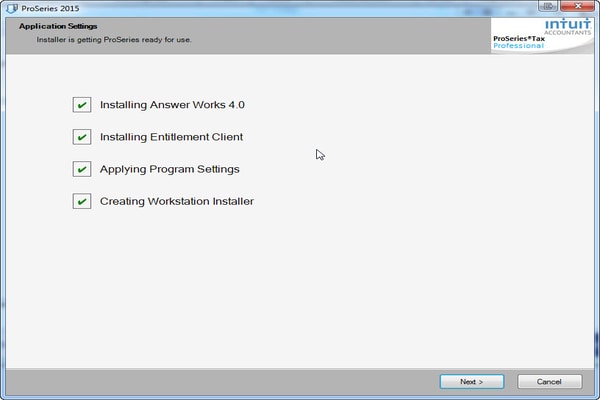

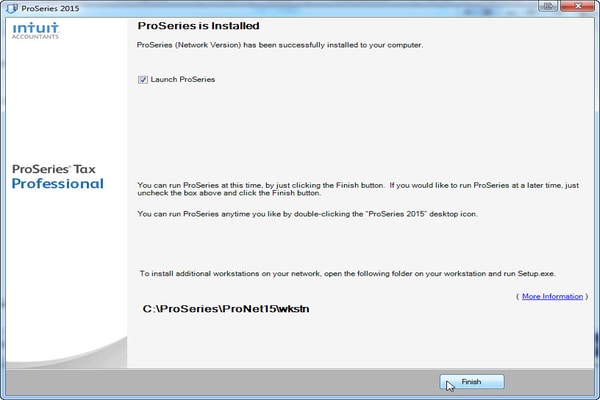

- Then click on the Application settings and checked all boxes. And then finish the installation.

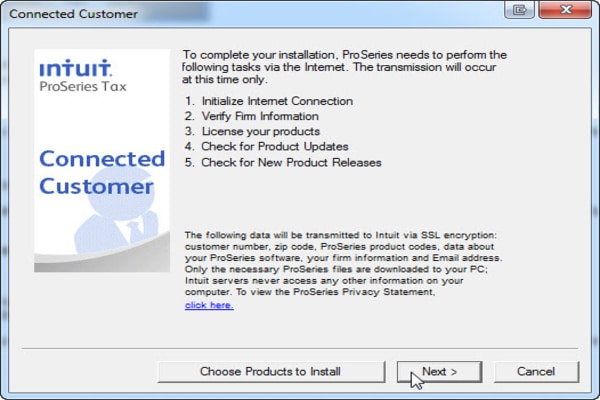

Part 2: License ProSeries/ Updates/ Connected Customer/ Admin Computer

- To start Connected Customer setup click Next.

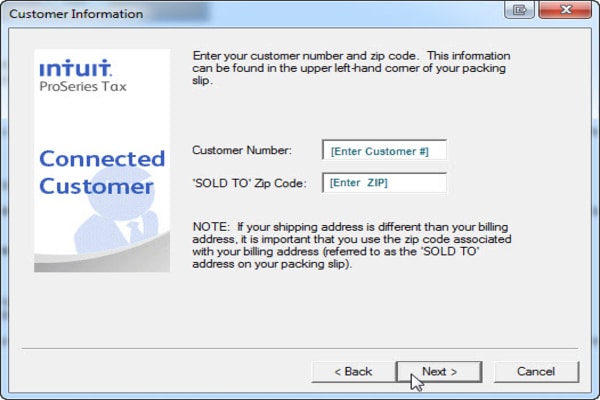

- For next step enter your Customer Account Number and Zip Code

- After review license assets complete the installation by clicking of Install Now option.

- And complete the practice setup.

Client-Server Installation

Part 1: Shared Network folder

- Choose a location where you want to keep the ProSeries network shared files then create a New Folder named ProSeries.

- After renaming Share the ProSeries folder

- Set all users to have Full Control level of user permissions.

Part 2: Map Network Drive / Admin Computer

- Choose the system for the ProSeries Admin workstation.

- Then Map a Network Drive to the ProSeries folder which is previously created and shared on the server.

- Make sure that the network drive is mapped to the ProSeries folder and ensure the ProSeries Admin workstation can now open this mapped network drive.

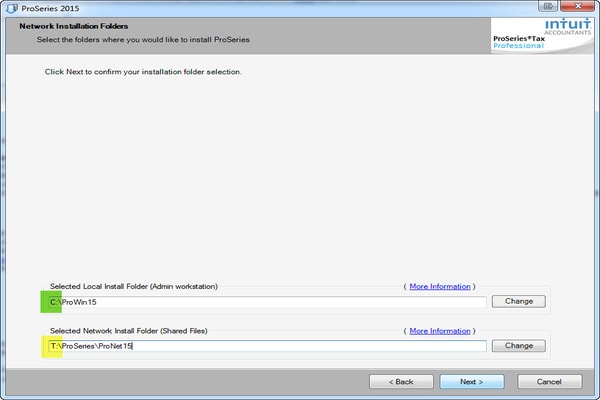

Part 3: ProSeries Network Install / Admin Computer (Only)

- First, login into My Account

- Then Download and Run the ProSeries Professional installer.

- Click the Next button.

- Select the Network option on the Installation Type screen and then enter Next.

- After clearing all the steps then On the Network Installation Location screen, the Local Install Folder location should be set to the local drive. The Network Install Folder should be set to the ProSeries shared network drive, select Next.

- Then in the last click Finish button after all the four boxes are checked.

Wrapping Up Summary

I hope this article is helpful to you for making an easy decision about why to choose Intuit ProSeries tax software. And if you want to free yourself from all the tax-related issues then I suggest you take Intuit ProSeries Software as on the license agreement. Intuit also provides another tax based software Lacerte or ProConnect Tax Online. So, according to your needs, you can choose any of the three software provided by Intuit.