The current pandemic has highlighted the importance of electronic payment. Transferring money became a one-click process that also eliminated time-consuming paperwork. QuickBooks also offers custom solutions to help you meet your business’s accounting needs and expand to new heights. QuickBooks ACH payments can mitigate your accounting concerns in the most effective way possible. Here is a detailed article to process and record ACH payments in simple steps. Contact our ProAdvisor to get the QuickBooks payment support at the toll-free number +1-844-405-0904.

The larger the trade, the lesser is the time for bills. That’s the reason why automation is such an important strategy for day-to-day modern tasks. Recurring payments will assure that vendors are always paid the right amount, at the right time. This is what makes QuickBooks an outstanding tool for all businesses, big and small. You can set up recurring payments for your bills and schedule ongoing customer payments. View and manage ACH recurring transactions, schedule payments automatically, or prevent recurring ACH.

Table of Contents

Process an ACH Bank Transfer from a Customer

Know how to process an ACH bank transfer for the customer’s sales receipt or invoice in QuickBooks Online. Do free yourself from the hectic bank run and paper checks. Just get your customer’s authorization and can accept QuickBooks ACH payments right in your QuickBooks. You can select the save option to save their bank information, so you don’t need to enter that in the future. Let’s take a walk to the following steps:

Note: Set up QuickBooks Payments now so it will be easy for you to accept bank transaction payments in your QuickBooks Online account.

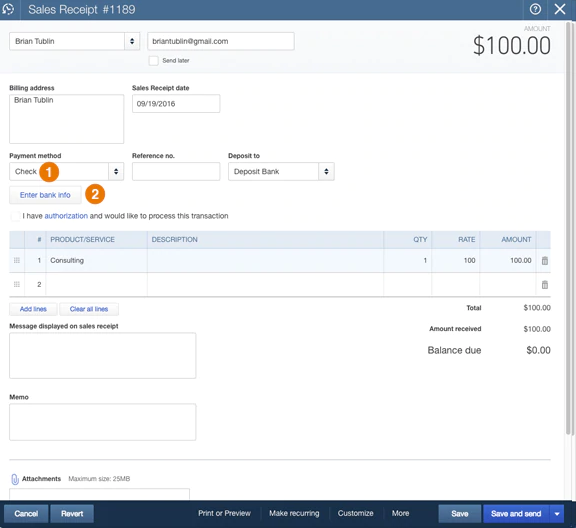

Step 1: Select the Transaction to Receive the Payment for

You can easily process a bank transfer payment now for an invoice and sales receipt. Or enter your customer’s bank information to a recurring sales receipt.

- Sales receipt or invoice

- Choose the Create icon.

- Choose Receive Payment or select Sales Receipt.

- In the Payment method drop-down, choose Check or QuickBooks Payment-Bank.

- Recurring sales receipt

The work of the sales receipt is to process the ACH payment to its next scheduled charge date.

- Choose the Gear icon.

- Select Recurring Transactions in the Lists.

- Search for a customer’s recurring sales receipt from the list, and then choose Edit.

- Select Check or QuickBooks Payment-Bank from the Payment method drop-down.

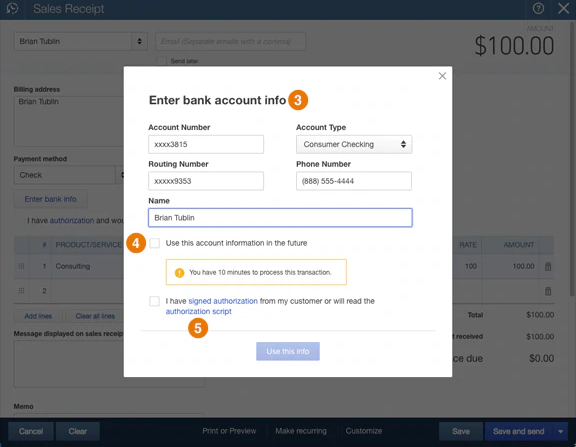

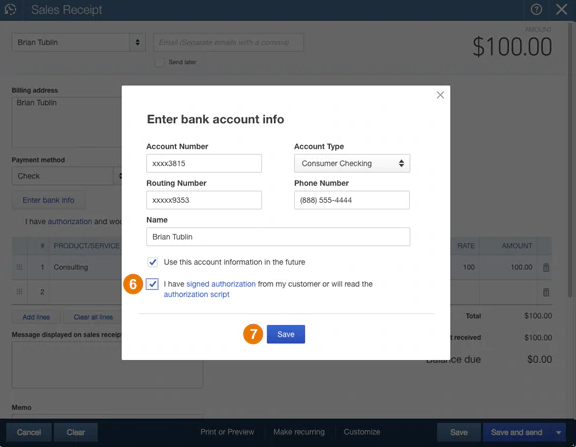

Step 2: Enter your Customer’s Bank Info

Now you have to enter all the necessary bank details of the customers.

- Choose Enter Bank info.

- Then enter your customer’s Account Number, Account Type, Routing number, and Name.

- Choose to Use this account information in the future.

Note:

- Make sure that you are selected this if you’re adding payment information to a recurring sales receipt.

- If you don’t save the bank info, then you have the 10 minutes to process the payment.

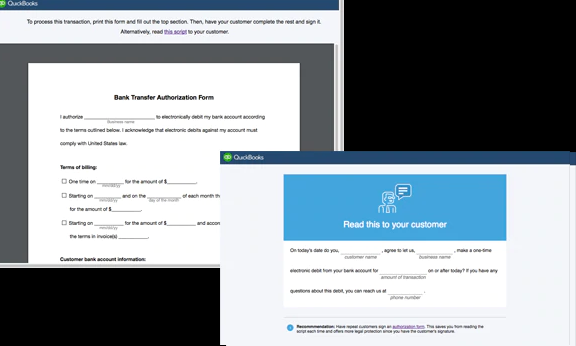

Step 3: Get Authorization

Remember that you get your customer’s authorization, whether you save their account information for future use or not.

- Choose Signed authorization to print an authorization paper that your customer can fill out and sign. Or choose and review the authorization script to get them instead.

- Choose I have signed an authorization checkbox to show you’ve received authorization.

- Choose the Save option.

If you are updating the recurring sales receipt, then choose the Save template to save the customer’s payment information.

You can use step 4 as optional. The receipt will process ACH payment at the next schedule charge date automatically.

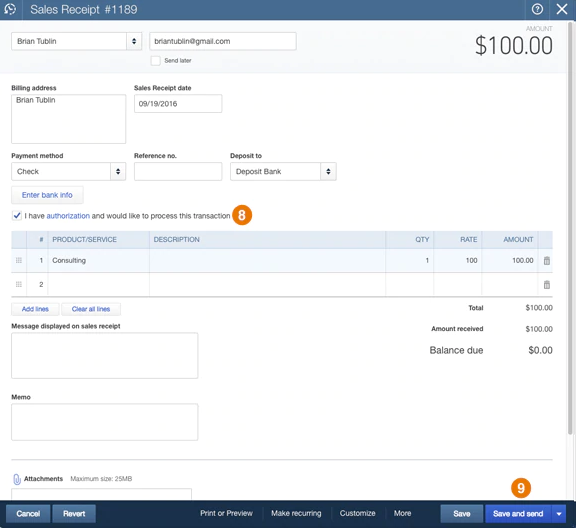

Step 4: Process the Payment

- Select I have authorization and would like to process this transaction in the transaction form.

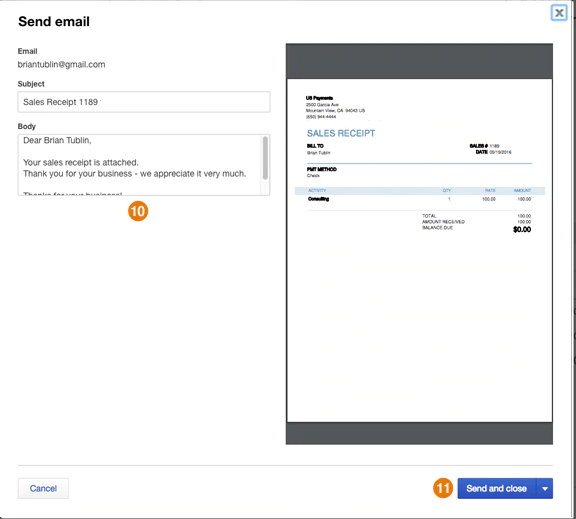

- Verify the transaction, then Save and Send it.

- Make the changes to the email message to your customer, then click on Send and close.

How to Record an ACH Payment that was Made to an Invoice

There are a few points you have to follow to record QuickBooks ACH payments from invoices in QuickBooks Online:

- Select the Sales tab in the left navigation tab.

- Assured that Invoices are chosen at the top of the page.

- Select Receive payment near the invoice you want.

- Then Receive payment page will be open. You can also select to add any outstanding transactions here.

- Choose Save and new option and click on the drop-down to select Save and Close.

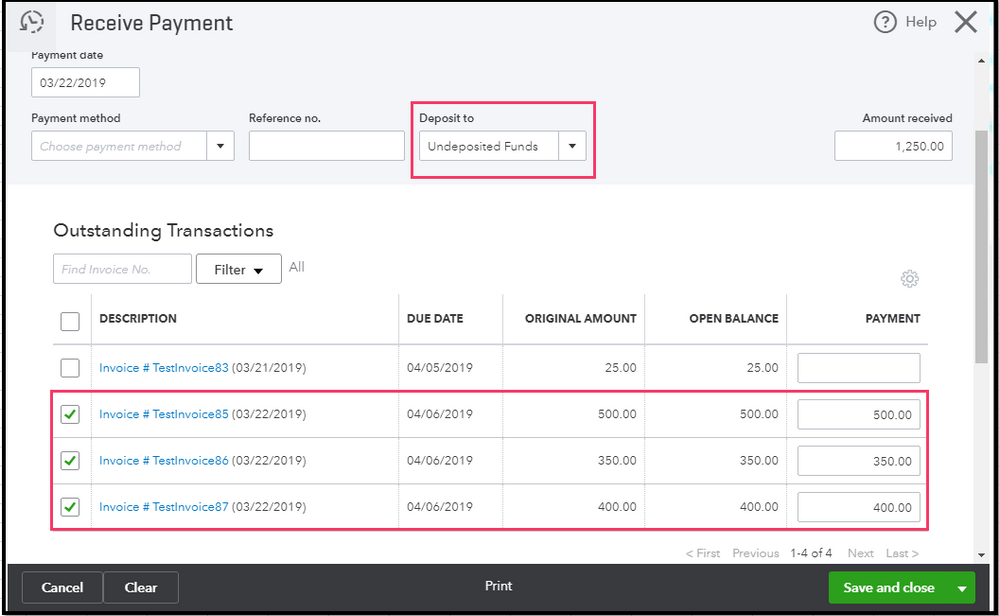

Recording Split ACH Payment Received

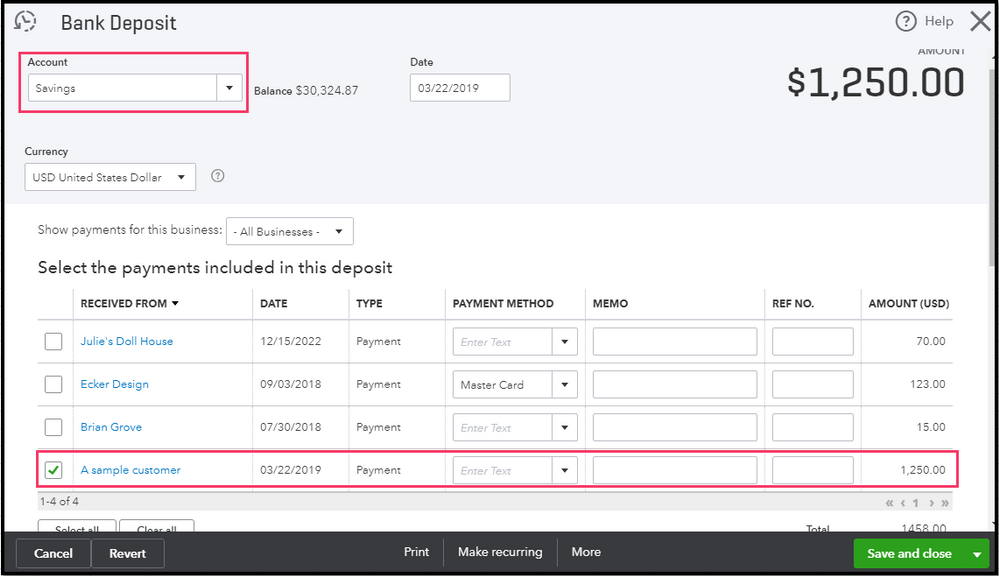

To record split ACH Payment Received is to create a bank deposit for the three payments and deposit them into the right account.

After completing you will find a match for downloaded transactions, then correct the differences in your banking feeds. In this way, you will be able to see the reminder and deposit in your account.

Let’s see the steps for further guidance:

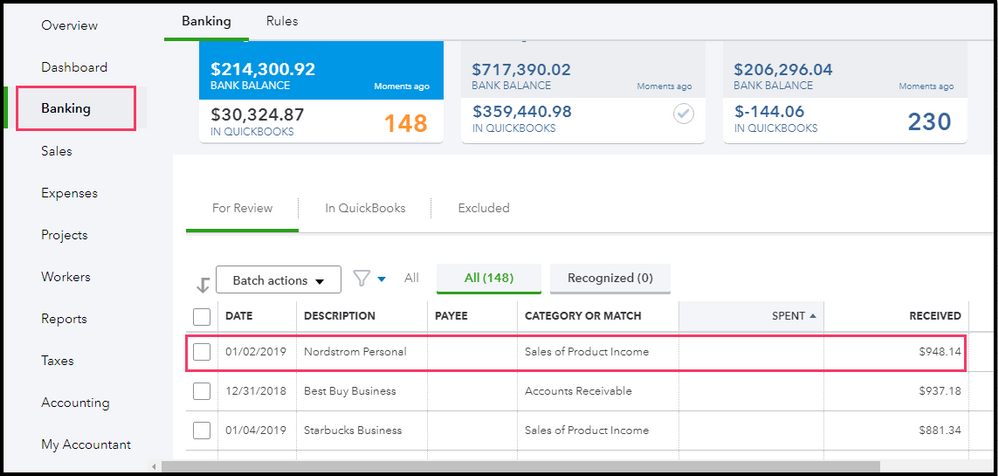

1. Click on the Banking option from the left panel.

2. Choose the bank where the payment was deposited to.

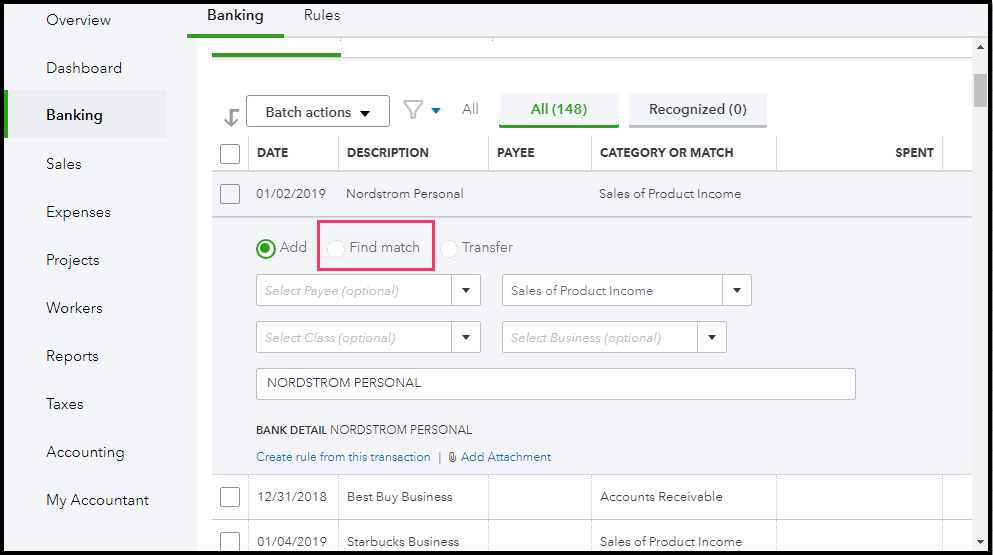

3. Go to the Payment option, then select Find a match to take the transaction.

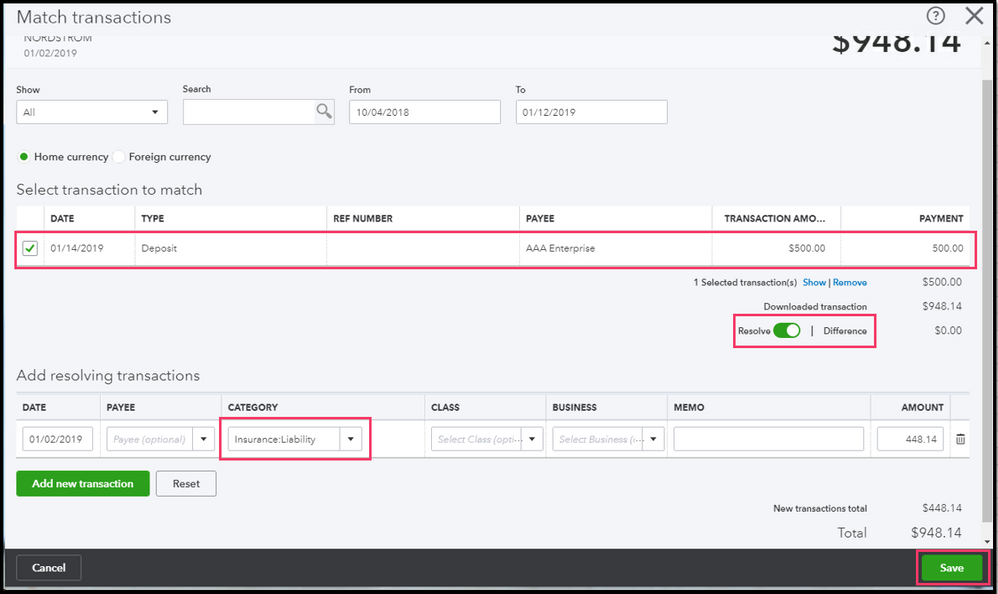

4. Tick the deposit by doing a checkmark in the box.

5. Then enable the Resolve Difference option.

6. Click on Save after you are ready.

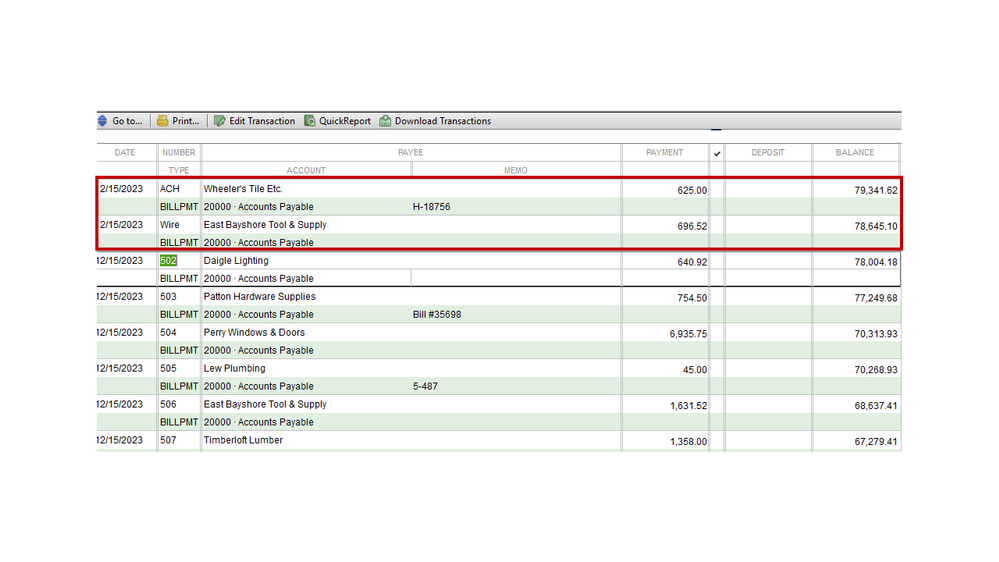

How to Record ACH Payments and Wires to Vendors

See if the bills are inserted as individual transactions, try to pay them one at a time. But if there is a wire transfer for bulk payment, then please choose each entry to match what’s on the bank statement.

Remember that bill payment will not automatically display as an ACH. You have to manually enter Wire or ACH to easily identify the transaction.

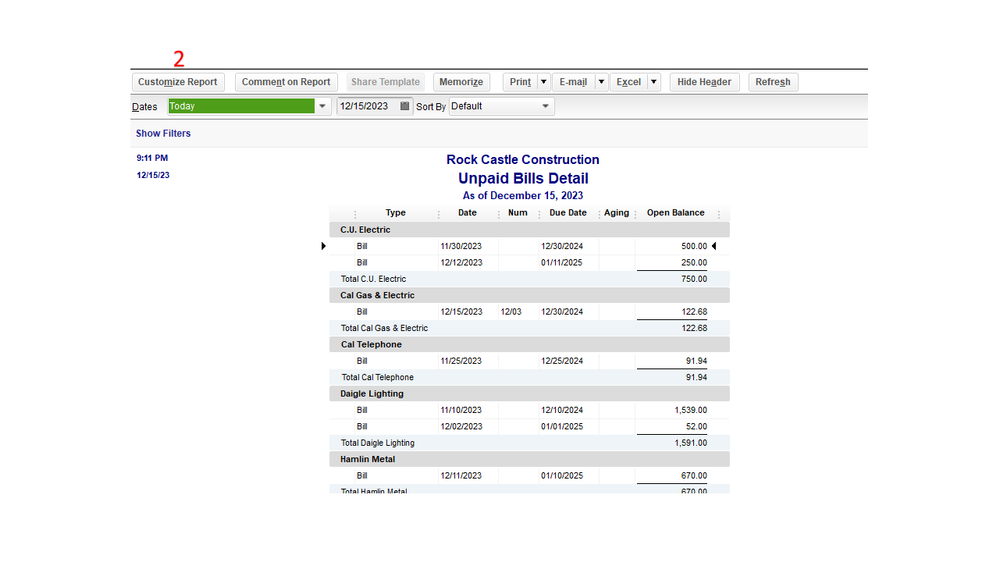

Let’s check out the following reports to determine what is the reason there are no invoices you can apply the A/R wire and what will happen to the bills:

- Transaction List by the Customer Report.

- Unpaid Bills Details.

First, list all transactions related to customers, like invoices, customer payments, etc. Meanwhile, the last show all the bills and payments regarding each vendor.

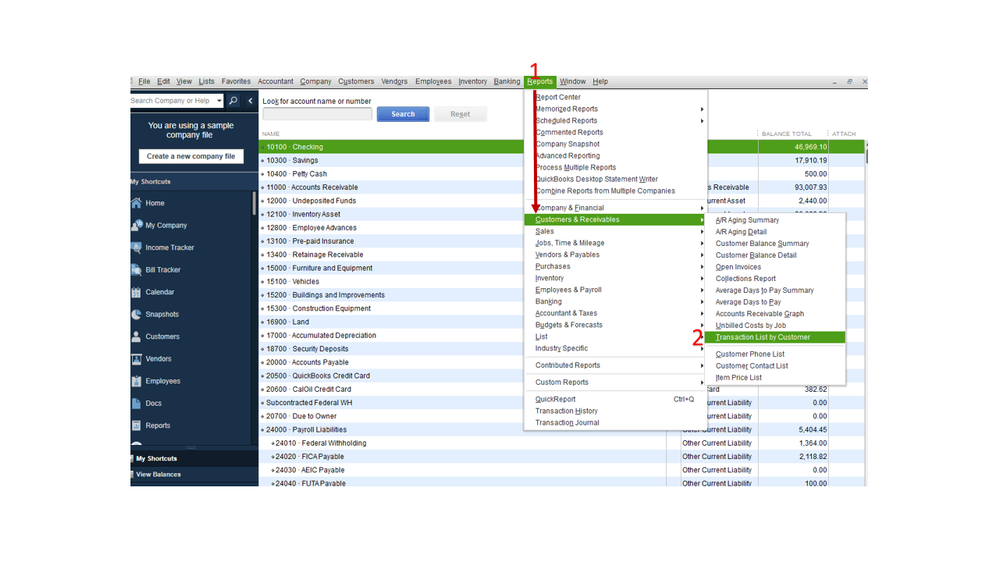

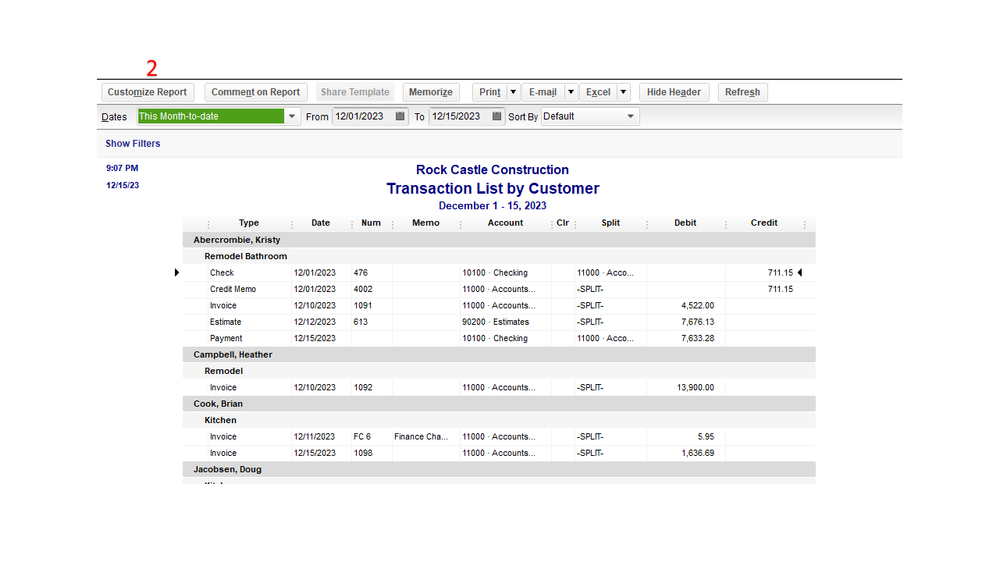

Transaction List by the Customer Report

The total balance shown in the balance column are all your company’s unpaid balance. Follow the steps to open the transaction list by customer report:

- Select Customer & Receivable by navigating to the Reports menu at the top of the screen.

- Choose Transaction List by Customer Report from there and click on the Customize tab to filter the information display on the statement.

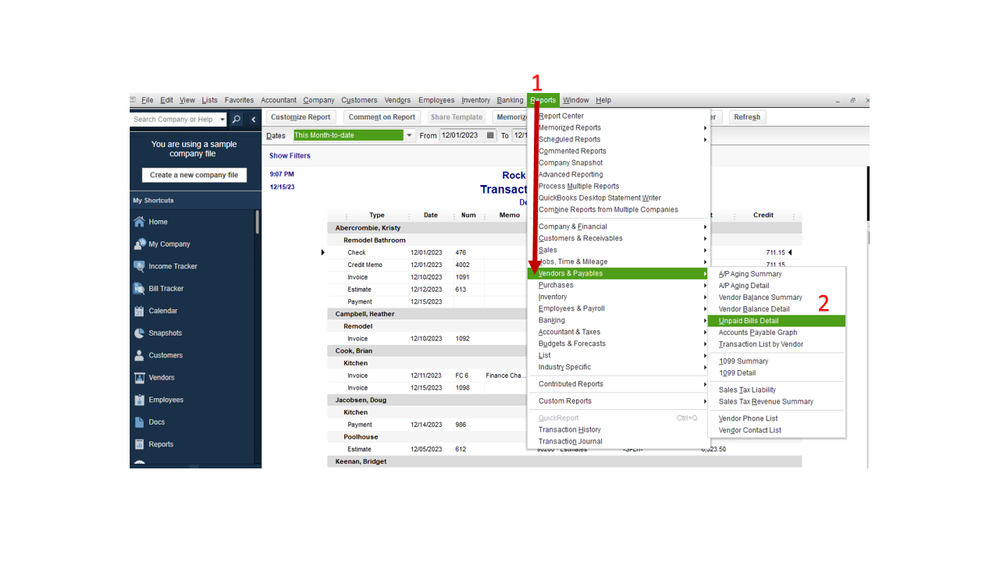

For the Unpaid Bills Details:

- Click on the Reports menu at the top of the screen and select Vendors & Payables.

- Click Unpaid Bills Details from the list and select the Customize tab if you want to refine it.

Frequently Asked Questions

What are the Benefits of ACH Payments?

You should set up and record ACH payments in QuickBooks for your business as it conveniently transfers all the electronic funds. Also, the processing fees are very less and it increases retention.

How Can I Record Joint Payments?

If a situation comes where a customer pays an invoice and for another customer, you can receive the payment as-

1. Go to Create icon and select Receive payment.

2. Enter the name of the customer, amount, payment method, and reference no. (Note the check number in reference no).

3. Mark an entry in the memo field that this payment is included in the check.

4. You can deposit the money either to your checking account or to the undeposited funds’ account.

5. Now Save and Close.

Repeat the steps for the second customer. See that the check number is the same and that you enter a descriptive memo so that they show as one deposit on the register

How Can I Record Partial Payments?

QuickBooks Online keeps the track of the open balance as-

1. Go to Create icon and select Receive payment.

2. Select the customer name from the drop-down menu.

3. Select your payment method and the reference number.

4. Enter the amount of payment under Amount Received.

5. From the Outstanding transactions, select the transaction, you would like to apply for the payment.

6. You can deposit the money either to your checking account or an undeposited funds account.

7. Now Save and Close.

Which type of transactions are used in ACH payments?

The ACH payments can be used for different types of transactions, some are listed below:

Payroll

Tax refunds

Online bill payment

Credit card payments

Interest payments

Money transfers

Annuity payments

Mortgage and loan repayment

Employer reimbursements

Person-to-Person (P2P) transactions

Business-to-Customer (B2C) transactions

Business-to-Business (B2B) transactions.

How ACH payments and credit card payments are different?

The difference between the ACH payments and the credit card payments are given below:

Fees: ACH fees are generally lower than credit cards. ACH processing fees are flat and averaging.

Processing times: ACH payments may take 5 days and more to process. While credit cards can process fast and only take up to a few business days.

Payment Guarantee: If a credit card payment posts, the funds are guaranteed to be available. In cases like if the card numbers are changed, the card is lost or stolen, or if the account is maxed out; recurring payments can be stopped. To transmit funds, ACH payments use bank account numbers. The account and routing numbers don’t change till the account is active, ensuring uninterrupted payments. If the account is closed or if there are insufficient funds in the account, the payment will not be processed.

What is the cost of ACH processing?

You will be charged a fixed rate or a percentage for ACH transfers. Standard ACH fees range from $0.20 to $1.50 per transaction and the percentage charges range from 0.5% to 1.5% per transaction. In the case of a high-risk business, it may also have to pay a higher amount.

If you are facing any problem related to ACH payments, our QuickBooks help desk is 24*7 available to solve the issues. You can call us at the toll-free number +1-844-405-0904 and find a ProAdvisor to resolve your issue.