In this article, we are going to discuss Quicken 2020 reviews of pricing, features, and alternatives. So, what you need to do is just go through the article in order to increase your knowledge regarding Quicken. Here in this article, we have mentioned all the related stuff to deliver you better content and here we have come up with the data related to pricing, features, and alternatives along with the pros and cons of the software. For any further detail or help contact us toll-free: +1-844-405-0904

Table of Contents

Quicken 2020 Reviews

Every year Quicken comes with a new release, with new advanced features also. As we know in 2018 Quicken came out with the biggest new feature of mac and in 2019 Quicken came with advanced features where you can web access from any browser. Now let’s discuss the Quicken 2020 advanced features.

Features of Quicken 2020

- More reliable and focusing on multiple customers requested bugs & fixes.

- Startup and loading time is very less as compared to other versions.

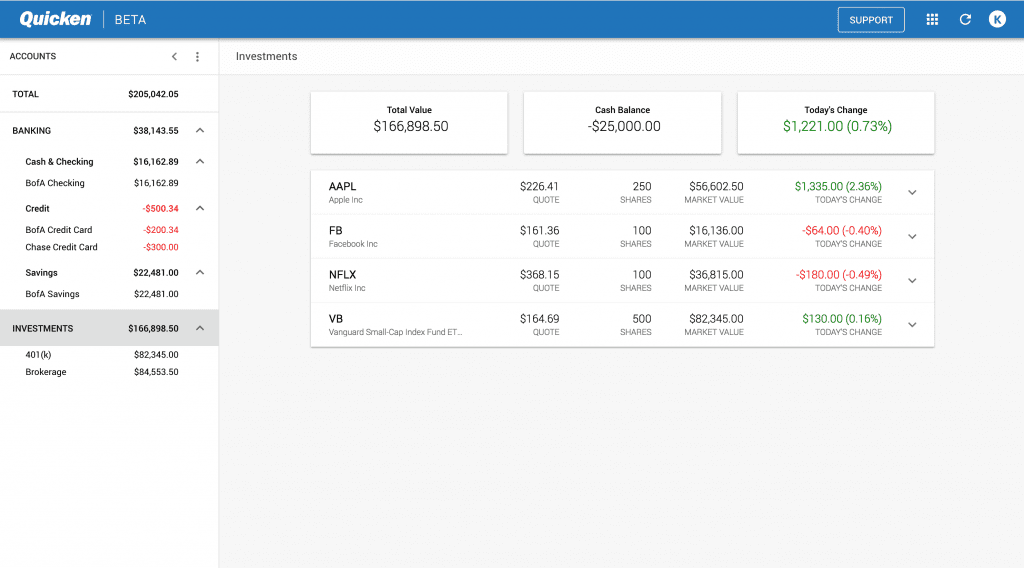

- It provides you a better experience for managing investments.

- You can report email directly from Quicken.

Pricing of Quicken 2020

- Quicken Starter Pack: $34.99/year.

- Quicken Deluxe Pack: $29.99/year.

- Quicken Premier Pack: $44.99/year

- Quicken Home & Business: $ 59.99/year

Quicken 2018 Overview

The best thing about Quicken is that it Organize and optimize your investment portfolio. You can see changes in assets, liabilities, and also net worth with one click. And then you can maximize your portfolio and make more informed investment choices.

With Quicken, you can make better-informed buy or sell decisions. It identifies your top-performing investments and compares your portfolio to the market.

It results in making smart decisions on buying or selling. Simply minimize taxes on your investments. Using Quicken Premier you will get the maximum tax benefits. It also tracks estimates capital gains on, cost basis. And also it exports your data directly to TurboTax for fast and accurate tax preparation.

Quicken 2018 Pricing

Its pricing starts at $49.99. It has a One-time License pricing model.

Quicken Pricing Reviews

Pros

- Provides accurate tracking of activities in your bank account and credit cards.

- It is very affordable, simple to download and economical.

- For many years, it has been a life-saver and easy for tax purposes and bookkeeping.

- Also easy to use and update.

Cons

- Interestingly, there are no cons with this product as yet. Users are happy with this product.

- The price tag is a bit high.

Quicken Features

- You can easily view your accounts in one place.

- It minimizes taxes.

- Easily organize and optimize your investment portfolio.

- Provides free mobile app.

Most people get confused when it comes to choosing accounting software because every software has something different to offer than others. Like if you have to choose between Quicken and QuickBooks which one you should go for? Therefore for easing the process, we come up with a blog that compares features, pricing and system requirement of both software side by side.

Quicken alternative

This is our editor’s choice for Quicken alternatives. This free software automatically tracks your savings, spending, investments, net worth, and more. These are easy to use and the free price tag makes it an excellent replacement for Quicken.

Following best alternatives to Quicken

Personal Capital: it is our favorite money management software of all time. We have used it personally for a year, and we continue to be amazed by this powerful software.

Tiller: it is a relative newcomer as a money management software program. This financial tracking tool is used in conjunction with Google sheets (Gmail account required). So, if you are into spreadsheets, tiller might be just your things.

YNAB(you need a budget): is an excellent choice for anyone who wants an easy-to-use and effective budgeting app. YNAB doesn’t offer an entire suite of cash tools like Personal Capital. It focuses on two things: building a realistic budget and tracking your spending. That is alright because it does them both very well.

Mint: is a comprehensive financial tool that Quicken enthusiasts will likely appreciate. In fact, Intuit acquired Mint in 2010 in the blink of an eye before they dropped Quicken from their suite of financial tools. Stew on that for a moment and think about which program Intuit thinks is better.

Count About: when you use count about on a computer, there’s no app to install; you simply log in to their website. They do offer a mobile app for iOS and Android, but not all the features are available through the app.

Use count about to create a customizable budget; then sync it to your bank account to automatically import your transaction and track your spending. You should get a snapshot of your financial activity with widgets, or general full financial reports.

Moneydance: Money dance interface kind of resembles a check register, where you see a record of all your transactions. Those transactions should be imported automatically by syncing with your online banking, or you can enter them manually. If you choose the automated route, you can also manage bill payments through Money dance.

Banktivity: it is an individual money manager made for Mac clients. The newest version, Banktivity 7, is structured specifically for macOS Sierra. And – like Moneydance – when you turn to Banktivity as a Quicken substitution, you can import your information for a consistent change.

With Banktivity, you’ll sync your financial bank account and use it to assemble budget plans, track your spending, pay your bills, and monitor your investments.

Good budget: it is a simple budgeting app that helps you plan and track your spending through a digital version of the envelope method.

If you’re new to the envelope strategy, this is a style of planning where you utilize an envelope for each spending classification. To begin with, you’ll plan the amount you’ll spend on every category(through the month). At that point, you allocate money for those expenses in each category designated envelope.

Dollarbird: it is the simple, no-frills budgeting app that makes for a good alternative to Quicken, this app is unique in that it’s calendar-based rather than category-based. What this means is that Dollarbird focuses on tracking your income and spending by day, rather than by category.

MoneyWiz: it is another choice to Quicken that works with Apple, Android, and Windows gadgets.

With this application, you can easily sync all of your financial data into one spot. It also boasts a live synchronizing feature which enables you to sync up data between device continuously.

GnuCash: it is a free open-source financial management software that running on certain Windows and Apple working frameworks.

The application utilizes the double-entry accounting strategy to help you to monitor your accounts. A business owner should as of now be acquainted with this idea as it is the favored strategy used for adjusting books and keeping exact money related records for organizations.

Every dollar: gives you a chance to spending plan your pay into adaptable spending classifications, at that point enter your exchanges and track your spending. The free form doesn’t a connection to your online records, so you enter your exchanges physically. (On the off chance that you need to naturally match up to your online records, you’ll need the paid adaptation.) That’s not a major issue, yet one thing I’ve seen is that the application doesn’t appear to recall the classification related to a payee that is recently been entered. Including that would be a pleasant touch.

I hope the given information is enough to make you understand the Quicken 2020 reviews, Pricing, features, and its alternatives. But, if you still have any queries related to Quicken then you can contact our customer support team. Our Quicken support team is available 24*7 hours to help the customers. You simply need to dial our toll-free number +1-844-405-0904.