Have you studied “How to Get Reports for Previous Reconciliations in QuickBooks Desktop?”. Here, we will discuss this topic basically for those who seek solutions for this issue. For reviewing past transactions, you need to get Reports for previous reconciliations in QuickBooks Desktop. Read all the statements and steps of this article very carefully to get a complete solution. If any problem occurs then contact our QuickBooks ProAdvisor through Toll-Free No. : +1-844-405-0904

Do you require information from a past reconciliation to encounter your current reconciliation? If you are interested then you must need to know, A Previous Reconciliation Report gives you complete details helping you in finding dispensaries and other issues.

You can learn a Previous Reconciliation Report. Whenever you get it, use it to fix your reconciliation.

Table of Contents

Steps To Get Reports for previous reconciliations in QuickBooks Desktop

Check out the below steps to run previous reconciliations in QuickBooks Desktop

How to Run a Previous Reconciliation Report

You should note that you can get complete reports for the last 120 reconciliations in QuickBooks Desktop Premier, and Accountant. Although, the Previous Reconciliation Report represents your most recent reconciliation in QuickBooks Desktop Pro. We are always advised to save the Reconciliation Reports as PDFs or export them to Microsoft anytime after reconciling the account.

- First of all, Open “QuickBooks” and then visit their “Reports”. Hover over “Banking” and choose “Previous Reconciliation”.

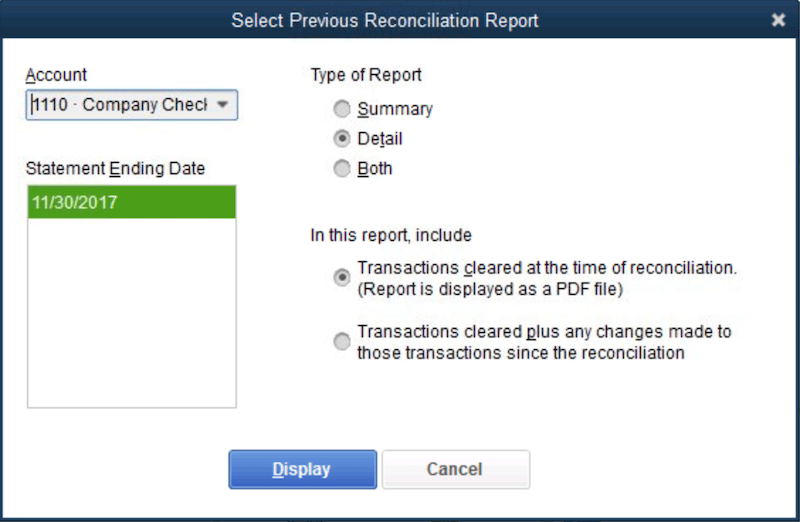

- From the “Account Drop-Down” Menu, choose any want which you want to reconcile

- In the “Statement Ending Date” Section, pick the reconciliation period which you want to review.

- Choose “Detailed” or “Both” for the Report type. We advised you to pick “Detailed” if you are using a Report to fix the Reconciliation.

- Choose the transactions which you want to see on the Report:

- The transaction cleared at the time of Reconciliation: This will offer you a screenshot. It only appears in your transactions in the account while reconciliation.

- Transactions Cleared Plus any changes made to those transactions: At the time of reconciliation, it appeared transactions in the account. It only specifies the location where they are currently in your accounts.

- When you want to run the Report, Choose “Display”

- At the alternate facility, you will get to review the Report for issues or dispensaries. For getting more and narrow information on specific details, simply customize the Report.

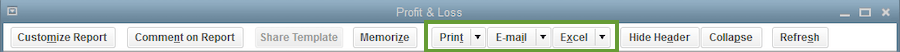

- Also, you can print the Report or Export it, it in the form of a pdf or to Excel.

But if you are trying to apply the above steps on your PC and will get an error issue. Then, follow the step-by-step procedure to troubleshoot the Reconciling issues quickly. If you are one of those who want to know the complete procedure to Fix the Reconciling issues in QuickBooks Desktop, then don’t worry, you will get the respective details here.

How to fix issues that occur while Reconciling in QuickBooks Desktop

At the time of reconciliation, you have to check the QuickBooks Transactions with the same entries as your Bank Transaction.

Note: Always keep in mind that the difference between the balance of two records must be $0.00

If it is not matched and the difference balance is greater than $0.00. Look at the steps you need to follow when QuickBooks Desktop is not matched with the Bank statements at the end of the reconciliation.

Review your Opening and Beginning Balances

If you are already Reviewed and everything is fine then ignore this, If not then ensure that your Opening and Beginning balances must be accurate. Once you know that the balances are correct then go for the other steps and solutions to fix the issue.

Look for Added, Changed, and Deleted Transactions

You will see multiple reports in QuickBooks, once you can Add, Change, and Delete Transactions. A proper history will be generated in QuickBooks.

Running of Reconciliation Discrepancy Report

You will get any transactions that will change before the last Reconciliation in Reports. All the transactions are sorted by their statement dates.

- Firstly, Open “QuickBooks” and then visit their “Reports”. Hover over “Banking” and choose “ Reconciliation Discrepancy”.

- After that, choose the account you want to reconcile, and then hit “OK”

- Then, Review your Reports for finding any discrepancies

- Ask your questions to the person who made changes in the Report. The person surely has a reason to make those changes. If you want to make some corrections in a modified transaction, then edit the transaction as needed.

Running of Missing Checks Reports

The Missing Check Reports represent any missing checks. It might occur due to throwing off the ending balance of your Reconciliation.

- In the first step, Open “QuickBooks” and then visit their “Reports”. Hover over “Banking” and choose “ Missing Checks”

- After that, pick the account you want to reconcile, and then hit “OK”

- Then, Review your Reports for checking out the transactions on the Report that are not present in your Bank Statements. If you don’t get the transactions in your Bank statements then they must not be on your Reconciliation. If you mistakenly get it, just Remove it from Reconciliation.

Running of Transaction Detailed Report

Use Transaction Detailed Report if checking any transactions that were changed.

- In the initial step, Open “QuickBooks” and then visit their “Reports”. Hover over “Banking” and choose “Transaction Detail”

- After that, choose the “Display” Tab

- Go to the “Date From” field, Choose the earliest date in QuickBooks for the account

Note: This is not a mandatory field, you can also leave it blank

- Go to the “Date To” field, choose the date of your last reconciliation

- Now visit the “Filters” Tab

- Pick the account you want to reconcile in the “Account” tab

- It’s time to set the “Date From” to the date of your last reconciliation. In the same way, Set the “Date to” to today’s date, you can make these changes through the “Entered/Last Modified” field

- Hit the “Ok” button to run the report

- Now check for discrepancies and the transactions won’t match your Bank statements.

- Contact the person who made changes in the Report and ask your queries related to it. The person surely has a reason to make those changes. If you want to make some corrections in a modified transaction, then edit the transaction as needed.

Your Accountant will help you in fixing the issue.

Tip: We recommend that, if you require to add or change/modify transactions that are previously reconciled, you have to perform Mini Reconciliation. Then reach out to your accountant to get the quantitative details as per your query.

Check the Reconciliation adjustments

In several cases, you will make the Reconciliation adjustments forcefully for your accounts in QuickBooks to match your bank records. Don’t do any modifications in reconciliation adjustments forcefully without your accountant’s guidance, it will affect your QuickBooks account. Adjustments will never fix the errors, later on, if you use adjustments it will only cause some problems.

Review your account and ensure that no one can add inaccurate data in adjustments.

- Visit the “Lists” menu and then choose “Charts of Accounts”

- After that, click on “Reconciliation Discrepancies” to open it

- Visit the “Date” field, no set date for a few of your last reconciliations.

- If any transaction appears to you that makes your account balance incorrect then reach out to the person who made these adjustments.

Tip: Always check that your corrections will never conflict with the adjustments.

Finish Reconciling

Once all the issues you had faced are fixed then finish reconciling.

Points to Remember: If you are not getting any issues in your accounts, then you are required to Undo the Previous Reconciliation whenever the opening Balance is accurate.

If any transaction is deleted or modified by someone from years ago, you are required to Undo your reconciliations for past New Year’s to go to the actual location where the opening balance is correct.

In the End

We hope this article will help you to Get Reports for Previous Reconciliations in QuickBooks Desktop. If you require additional information related to the same issue then, you can get help from our QuickBooks Support through the toll-free number +1-844-405-0904 and be ready to get complete support and assistance. You will get quick support from our intuit certified professionals along with satisfactory results.