QuickBooks is accounting software, while using it you must be aware of its usage and benefits it. you may observe your business, and earn benefits but all these happen when the health of your business is proper. So how to track the health of the business in Quickbooks Online, this article is all about this. Here you may learn to maintain the health of your business. If you want more info. contact our QuickBooks ProAdvisor to consult you. Toll-Free No.+1-844-405-0904

Our editorial team is again here with another article. Know how you can keep eye on business health in QuickBooks. When you own a business. It’s important to keep an eye on the health of your business. The most important information for any business is to see what you’re really making and spending.

QuickBooks Online is more than just an online bookkeeper. It can help to improve your cash flow, your customer relationships, your inventory readiness, and your future.

if you are already using QuickBooks Online, you know how much effect its bookkeeping abilities have had on your company’s accounting tasks.

Once you’re connected to QuickBooks, it helps you categorize the previous month’s transactions. The first transaction you see is an expense if possible with books filling in who you paid and what it was for.

You can change this information if you need to in this case the office applies is correct. So, add it to your books. This is where QuickBooks starts to help you out if found other expenses that look like the one you just added and have assigned them all to the same category. If all this looks good to you add them all.

Steps to Check Your Business Health in QuickBooks Online

Here are some steps through which you can check your Business’s Health, especially in QuickBooks online.

Connect Your Bank and Credit Card Accounts

You are able to see the health of your business just by connecting your bank and credit card accounts and Start learning QuickBooks that you need to categorize your transactions. You can already connect your bank and credit card accounts when setting up QuickBooks. But if you have not done so, you can do so by clicking on the Connect account. QuickBooks automatically downloads all the transactions, once your bank and credit card accounts are connected.

Classify Your First Expense

The first transaction activity is an expense. If feasible, make a record of whom you have paid and what is the case, the category is office supplies. if needed, you can modify this information. In this case, the office supply is right, so you will click Add to add it to your books.

Review Your Transactions

QuickBooks downloads your transaction for the first time, it’s up to you to analyze and classify your expenses. Go to the Profit and Loss section on your dashboard and then choose Review Transaction.

QuickBooks Finds Same Expenses

This is, where QuickBooks begins to support you. It’s got other expenses that look similar to the ones you’ve added and assigned them all the same category. If all of this sounds right to you, click Add them all.

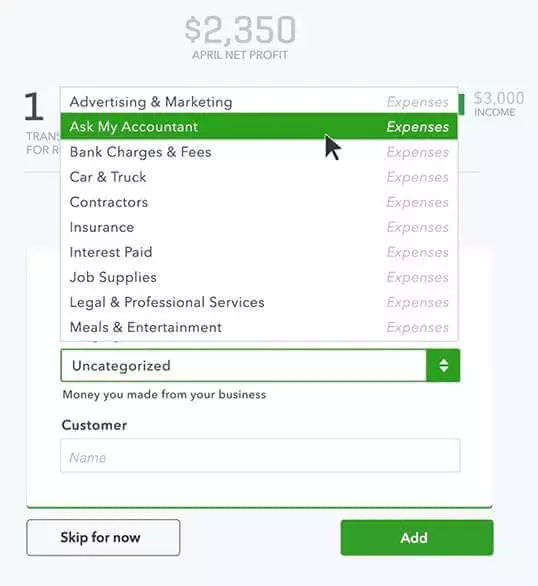

Ask Your Accountant

If you are not confident about a category, you can choose to “Ask my accountant”.

Add Your Deposits

Now the customer’s check you deposited here QuickBooks classifies it into a sales account. Add it so that you can keep a record of this income.

See Your Updated Dashboard

After reviewing all your expenses, go back to your dashboard to view what you are doing.

Examine the Rest of Your Expenses

On our dashboard, look at the bank account area. If there is a number, the number of transactions is left for review. To do this, click on the number.

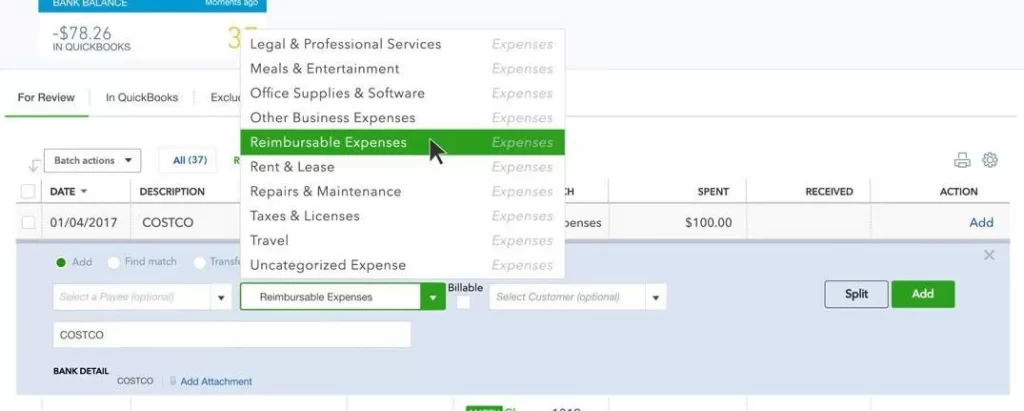

QuickBooks Learns to Categorized Your Expenses

Transactions in green mean QuickBooks understands that you have classified a similar transaction in the past, so it automatically assigns the same category to you. If you can see a category in black, QuickBooks is the best guess for classifying transactions. Select Add next to any transaction to add it to your books.

Not The Right Category?

Sometimes your guess is wrong then just change the category which is learned by QuickBooks for the next time.

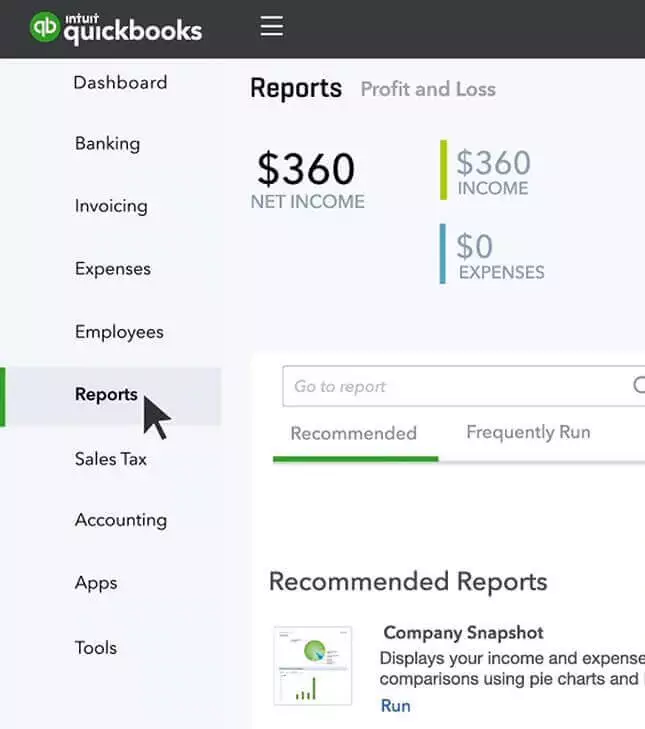

Look at Your Profit and Loss Report

Reports such as profit and loss reports display more details about how your expenses are classified. To look at reports, go to the report, and then click on profit and loss.

Customize your QuickBooks Online as per your need

Now here’s a check from a customer you deposited QuickBooks categorizes it to a sales account. Add it so that you have a record of this income if Quick Books isn’t sure about a category for an expense. It’ll leave it as uncategorized you can pick a category or choose to ask my accountant to file it away to go over with your accountant later.

Congratulations. Now you can see what you made and spent last month. Now that you’ve reviewed last month’s expenses and income. It let you know if you have earlier expenses that need to be reviewed as you categorize more expenses. QB learns from you.

So, it can help a transaction in green means it recognizes that you categorized a similar transaction in the past so it automatically assigns the same category for you. If you see a category in black. That’s QB is the best guess for how to categorize, and match this transaction. If it’s a wrong guess just change the category and QuickBooks learns for next time.

Reports like the profit and loss report show you more detail about how your expenses are categorized. You can even see your expenses as a percentage of your income. This is very helpful to measure business health and to understand where your money is going now it’s your turn to see the business health in QuickBooks. Still, if you have any confusion regarding this topic then you can get our certified QuickBooks support by dropping a call to us [QuickBooks].

What are the main factors for the health assessment of your business?

Insufficient or Excessive Inventory: If your business is manufacturing products or selling products then you have to care about the total stock that is stored in your company. Businesses may lose money in both conditions, if you have an excessive inventory then you have to bear the cost of its storage and if you have an insufficient inventory then you’ll lose your revenue so you need to be careful about the stocks.

Accounts Receivable: Accounts receivables are the balance of money that has not yet been collected against the products and services you delivered to your customers. Uncollected receivables hinder a company’s expansion and can necessitate unforeseen bank loans. So, you have to pay close attention to signs including the aging of receivables, credit policies, cash collection schedules, and accounts receivable turnover.

Working Capital: Current assets less Current Liabilities equals Working Capital. The ratio of net sales to net working capital is an important calculation since a company cannot function without adequate working capital. This gauges how effectively working capital is being put to use to meet company goals.

Sales Activity: Sale activity is one of the important factors that can be helpful in analyzing the health of your business. Read between the lines when analyzing the growth rates of sales and profitability to determine whether the growth rate is the result of higher prices or more volume of sales. Observe the overall market as well. Sales may be static if the market appears to be mature, which may be why the seller is trying to sell the business.

Fixed Assets: If your study indicates that the company has overspent on fixed assets, such as plant property and equipment, be sure to understand why. Equipment left unused could be a sign that demand is waning or that the company owner underestimated the need for manufacturing.

Net Income: Net income is also one of the important factors in measuring the health of your business which indicates how much you may be able to spend. Net income is the sum of money that remains for a business after all costs have been met. Knowing your net income, also known as net pay, can help you create a budget and identify areas where you can reduce your expenditure. Additionally, it can give firms a picture of how much profit a certain company is making.