Going to be a certified QuickBooks expert? But don’t know, how much does it cost to get QuickBooks certified? We will give you the complete detail of the QuickBooks certification cost in this article. Here you can also know about the benefits of certification, types of courses, and the way to access the course. Meanwhile, you can take help from the QuickBooks ProAdvisor through the toll-free number +1-844-405-0904 for further assistance.

Table of Contents

Cost of QuickBooks ProAdvisor Certification

To be a QuickBooks ProAdvisor, you need a certification to prove that you are eligible to manage accounts with QuickBooks at any time. For that, QuickBooks conducts a QuickBooks ProAdvisor certification exam. If an aspirant cracks the exam, he/she got the QuickBooks certification. And it is a very good thing that, QuickBooks doesn’t charge any amount to provide QuickBooks certification. QuickBooks provides all of the exams and study materials free of cost. But, if you want to attend some special classes in QuickBooks for exam preparation, you have to pay for that. We will describe the plans of classes below.

Certification Exam Preparation Classes

QuickBooks provides some classes for the preparation for the examination. Read the following to know, what are the classes are provides by QuickBooks for the exam preparation;

QuickBooks Live Class

You can join the live classes in QuickBooks at the cost of $679.95. It allows you to join the 2-day live class with the guidance of a teacher. You can add on an extra $156 to one exam, and retake. In this live class, you can get your all answers from the instructor during the class.

QuickBooks Self paced Class

You can join the self-paced class at the cost of $579.95, and add an extra $156 for the testing fee w/1 retake. This is the way, where you can learn at your own pace in a 2-day class. here you can’t get any answer to your questions.

QuickBooks VIP Membership

This comes with the cost of $679.95, you can also add $29.95 per month for live services (after 30 days). If you want to take the advantage of 5 exams w/1 retake then you need to pay $780. Instructors are available for 44 hours per week to provide answers to your questions. Self-paced classes PLUS weekly Certification preparation courses are available in the VIP membership.

Types of QuickBooks Certification & Courses

QuickBooks certification is available for four QuickBooks products;

- QuickBooks Online

- QuickBooks Desktop Pro/Premier

- QB Enterprise Solutions

- QuickBooks Point of Sale (POS)

QuickBooks Online certification is the most popular certification. Most of the candidates prefer to get this certification because of the following reasons;

- Can learn commonly used services to serve clients better.

- The idea about sales, purchase as well as payment management.

- Understand reporting and troubleshooting.

- To take ultimate knowledge to provide the best service available

- Manage typical as well as more complex dialogues.

- Also, understand more advanced features of QB online.

- Advance reporting and problem resolving.

How to Access QuickBooks ProAdvisor Certification Courses

If you want the QuickBooks Desktop certification then you can easily find out the 2022 certification on your account, if you already signed up for the ProAdvisor Deluxe membership. For the QuickBooks certification 2023, wait for April. In the month of April to August, you can get the 2023 new update of QuickBooks certification.

On the other hand, if you want the QuickBooks Online certification, then you can access the free online program. Use the supported browsers to access the online program successfully; Chrome, Safari version 11, and later (Mac only), Firefox, Microsoft Edge. And don’t run the program in Opera, Netscape, RockMelt, Internet Explorer 11.

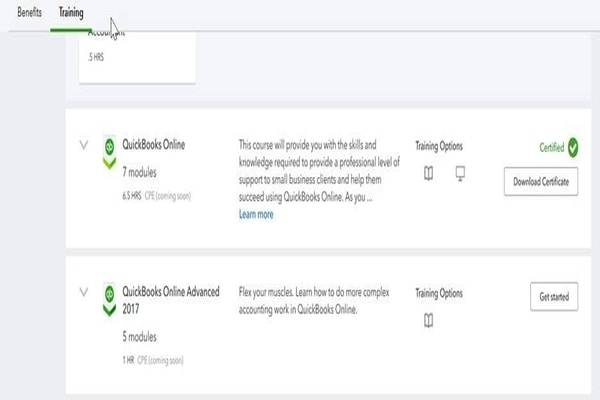

Now follow the steps to access the course online;

- Sign up or login to QuickBooks Online Advanced.

- Visit the ProAdvisor tab, under the Your Practice option from the left menu. (In the ProAdvisor tab, you will get a list of available training modules.)

- Click on the Training tab.

- Choose a Resume to proceed with any previously-started course.

- Read the specifications of the available courses listed to recognize a course to take.

- Choose one of the available Training options to see training cards for a particular module in the course.

- Go for a Get started to begin a course and follow the prompts to complete the task. After being ready to complete the certification exam, choose to Take the Exam option.

You can download and print the badges and certificates after completing the course. They have great use of marketing materials or on your website.

Access Certification History

Follow the procedure to access the certification history in QuickBooks;

- Log into QuickBooks Online Accountant US or QuickBooks Online Accountant Canada.

- Select ProAdvisor from the left menu. There you will see all the certifications that are available to you.

- Choose the Training tab.

- If you are searching for current certification, badge, or exam, then select Certified, and go for Download Badge or Download Certificate.

- And searching for the previous certification, choose Training & certification history.

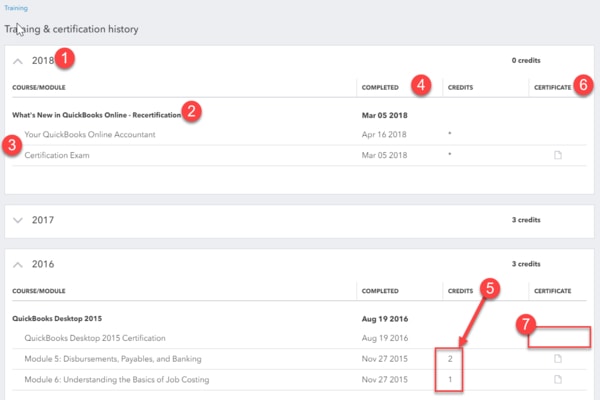

How to Navigate the Training & Certification Screen

This map will better help you to understand the Traning & Certification History screen.

- Certification history filled with certification completion year.

- Courses appear in bold.

- All the course modules appear following certifications.

- The certification and their related modules both will be bucketed based on the completed date of it.

- Qualified course modules for CPE credits will show the CPE credits amount earned within the Credits column.

- Completed certifications and modules will have to differ certificates. The module will show the amount of confirmed CPE credits, the Field of study, and the Delivery method.

- Certificates only appear for active ProAdvisor certifications. The certification icon will be removed if no it is no longer active. But the completion date will remain to print out your course module.

Benefits of QuickBooks Certificate Programs

You will get a free firm company, after signing up for the version of the ProAdvisor program. Here you can get a lot of benefits, and take the advantage of working with QuickBooks. Here we have mentioned some of the benefits below, have a look;

- Client List: This helps you to co-operate with your all QBO clients.

- Your Books: You will be able to operate your own finance firms free.

- Practice Management: Keep yourself at the top in your day-to-day work.

- Wholesale billing: You can get a discount on QuickBooks companies for your clients.

- The ProAdvisor tab: Easy access to your certifications, discounts, and software.

These were the basic facility of the certification program. After getting the QuickBooks certification, you will be able to unlock the rest of the benefits like;

- A better ProAdvisor tier-from Silver to Gold

- Get help from US-based experts.

- The listing on the Find-a-ProAdvisor site, so it is easy for your client to find you.

- After becoming certified as a ProAdvisor your tier incremented from Gold to Diamond, providing you with better quality support and top rank in the Find-a-ProAdvisor list.

- You can visit the certification page in QuickBooks Online by selecting “ProAdvisor” on the left-hand navigation menu, and choose Certification.

- By showing their skills they win gold, silver, and elite membership.

- There are some special guides, templates, and marketing resources of the new Intuit market, which is only used by ProAdvisor.

- You can also provide some workshops to increase your practice and masterclasses to improve your business.

What you Can Learn in the Certification Program

- Work on the data transformation process.

- How to create a file using the opening balance.

- It also provides Payroll advanced features.

- Learn what is the way of unusual transactions process.

- How to operate the adjusting transaction in your client’s file.

- Manage users and company settings.

- Manage table of accounts.

- Advanced feature on bank rules and online banking in QuickBooks.

- Budget setups feature.

- Can learn different tips and tricks to growing your business.

How to Earn Points from Clients for Services

As a QuickBooks ProAdvisor, it is necessary to learn how to earn points for the exact service. So that, you can ask the client for the right payment. here you go for the information.

- If you are activating QuickBooks Self-Employed client subscription then you can earn 25 points for each.

- You can get 50 points for the activating of QuickBooks Online Payroll client subscription (Core Premium), and QuickBooks Online client subscription individually.

- For the activation of QuickBooks Payroll Elite client subscription, and QuickBooks Online Advanced client subscription, you will get 75 points for each subscription.

- 100 points is applicable, if you are purchasing ProAdvisor Premier or Enterprise for Desktop (once per year) for your client, and for the current certification of QuickBooks Online, QuickBooks Desktop, and QuickBooks Desktop Enterprise.

- You can get 200 points, if you are providing the current advanced certification of QuickBooks Online to your client.

Frequently Asked Questions (FAQs)

Is a QuickBooks certification worth it?

QuickBooks certification is the certificate, which shows your ability, that you have the capacity to manage accounts with QuickBooks. Personally, you get a lot of benefits through this certification and get advanced knowledge that how QuickBooks works. With this certification, you can get more clients for your work. So, it is actually worth having the QuickBooks Certification.

What are the different QuickBooks Certifications?

QuickBooks offers different certifications for different QuickBooks versions. Mainly, there are four certifications; QuickBooks Desktop Pro/Premier, QuickBooks Enterprise Solutions, QuickBooks Point of Sale, and QuickBooks Online.

Can bookkeepers do tax returns?

Yes, bookkeepers can perform tax returns. If the bookkeeper is a certified accountant, and able to prepare accounts for sole traders, then it is possible to get back the tax returns.

Is the QuickBooks online certification exam open book?

The official QuickBooks exam is an open book exam. You can use your study resources, test accounts, and US QuickBooks community during your exams.

How hard is the Certified Bookkeeper exam?

It is pretty difficult for the beginner who neither has accounting skills nor is familiar with the functions of QuickBooks software. But for the one who has knowledge of both, it is relatedly easy to get certified.

Once I’m certified, how do I maintain my certification?

Once you are certified, Intuit won’t ask you to submit ACE credits to maintain your Intuit certification status. You need to take a shorter recertification exam each year based on your certification level. The recertification exam focuses on the changes in QuickBooks since the last time you took the certification.

Hopefully, now you have no doubts about the QuickBooks certification cost, and about its training cost. These certification courses make it easy to get comfortable reach with QuickBooks accounting products and develop skills at your speed. Choose from videos, webinars, virtual conferences, and in-person events to gain more confidence and earn your clients’ trust. Still, if you need any help regarding this topic then dial the toll-free number +1-844-405-0904 to get QuickBooks Support.