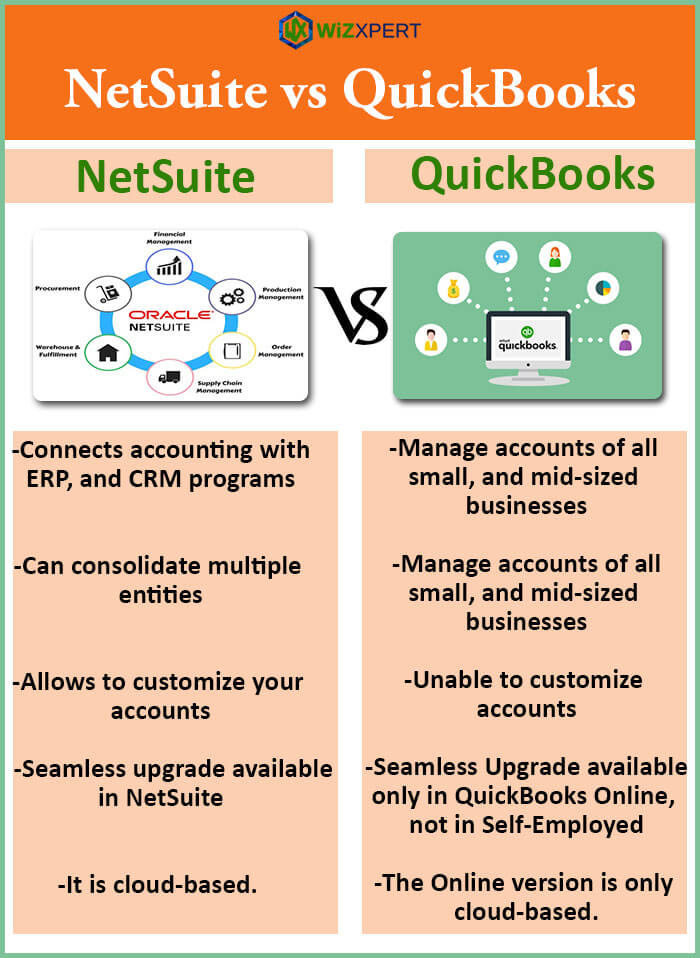

Searching for alternatives of QuickBooks accounting software? This article is here to help you. It’s a complete analysis guide covering in-depth details about the best QuickBooks Alternative software (paid and free) available in the market, along with their advantages and disadvantages. Read the full article to get the solutions to all your queries, here we will discuss the best QuickBooks Alternative available in the market. Still, having a related problem then contact our QuickBooks ProAdvisor toll-free:+1-844-405-0904

Accounting is a standard process of identifying, recording, summarizing, interpreting, and communicating financial information, etc. It discloses profit or loss for a given period, and the value and nature of a firm’s assets, liabilities, and owners’ equity.

Table of Contents

Branches of Accounting

| Financial Accounting | You can make periodic reporting |

| Management Accounting | Analysis of the accounting information within the organization |

| Auditing | Examination and verification of company accounts |

| Internal Auditor | It is responsible for company management |

| External auditor | It presents fairly the financial position of the company |

| Tax Accounting | It is based on laws enacted through the legislative process |

| Fund Accounting | It is used for nonprofit entities |

| Forensic Accounting | It analyzes the financial evidence, and then give expert testimony in court |

Financial Statements of Accounting

| Balance Sheet | It tells you whether the company can pay its bills on time |

| Income Statement | It tells you both the earnings and profitability of a business |

| Cash Flow Statement | It shows the flow of cash in the business |

| Statement of Changes in Equity | It shows the changes in equity as per time and year |

Factors of Accounting Software

- Multi-User Access

- Multiple Business Support

- Cloud-Based Software & Mobile Access

- Easy to use

- It notifies me when invoices are viewed

- Accountant-friendly

- Add-on Services

- Provide 24*7 Customer support Service

Best Alternative To QuickBooks

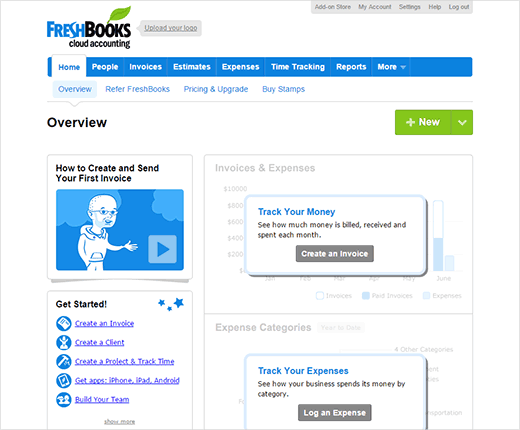

FreshBooks

It is a cloud-based accounting software service designed for small businesses that send invoices to clients and get paid for their time and expertise. It was developed by Mike McDerment and Joe Sawada in 2003.

Freshbooks is accounting software that is used by business firms or companies for their each and everyone growth of the business. Recently, in the market, it is one of the best QuickBooks alternatives.

Advantages of Freshbooks

- Save Time Billing

- Easy to Use

- Send Invoices in Seconds

- Multi-Currency Invoicing

- Payment Reminders

- Add Expenses to Invoices in a Flash

- Easily Connect with Other Apps

- It tracks working times and expenses simultaneously.

Disadvantages of Freshbooks

- It still lacks some enterprise-grade capacity.

- Some users don’t seem to know that their invoices won’t be automatically transferred from other systems such as QuickBooks and that they will have to enter them manually in order to modify them.

- Minor bugs come in between while the user is working with the Freshbooks which leads to an interrupt in the transaction of data.

For more information: Read Freshbooks vs QuickBooks

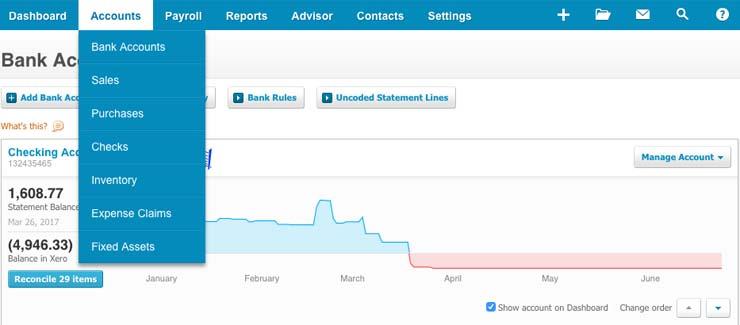

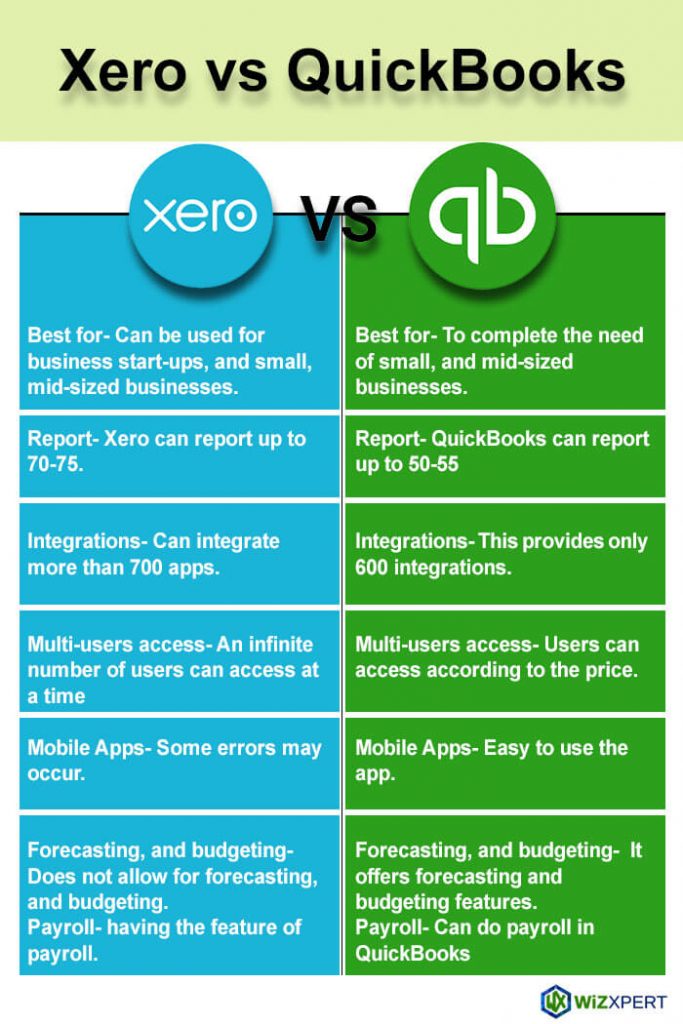

Xero

It is one of the best free Quickbooks alternatives and is also online accounting software. It provides businesses with a real-time view of their financial position in a way that’s simple, smart, and secure. Xero manages the tedious, repetitive works for them, and then gives powerful insights into the state of their business.

Financial institutions, government departments, and large enterprises can connect seamlessly with Xero.

We’re building a financial web-centered on small businesses and connecting them with the entities and information they need to thrive.

What’s a direct feed?

A direct feed is a primary connection between a financial institution and Xero. It’s a reliable electronic transfer of account transaction data from a financial institution to Xero.

How is the data transferred?

When the financial institution has processed its regular transactions, a batch file of data for multiple buyers is sent to Xero. Xero compares the data with individual customers and uploads it to their Xero account.

| Automated (via internet banking) | Manual (via a paper form) | |

| Set-up process |

|

|

| Benefits |

|

|

Advantage

- Support more clients in less time.

- Real-time financial reporting.

- Backup of each and every transaction.

Disadvantage

- Limited payroll processing

- Limited to 2 tracking categories.

- It is based on the cloud only.

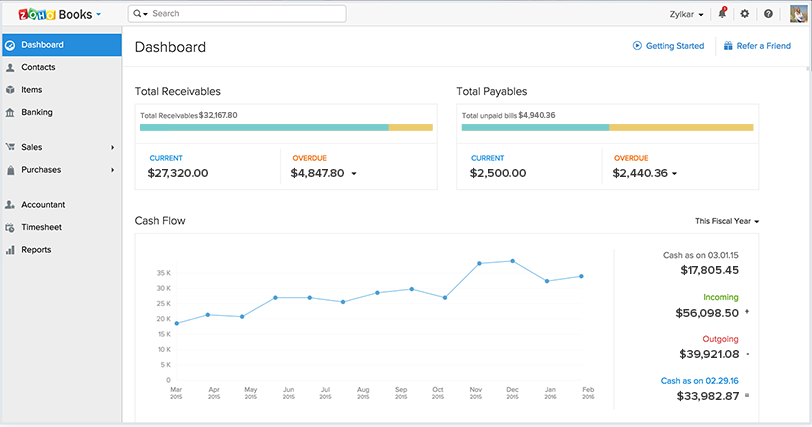

Zoho Books

It is an online accounting application that gives you complete visibility of your finances. It also helps you to manage the money moving in and out of your business.

Advantages

- The real-time collaboration.

- It helps to send professional invoices to customers and begin receiving online payments from them all from a single platform.

- It is easy-to-use.

- It helps to regain control over the company’s finances.

- It helps you to manage finances per project, where you can add tasks, assign members, and follow processes using your mobile device.

Disadvantages

- It offers fewer integrations than other accounting software.

- It doesn’t include payroll services.

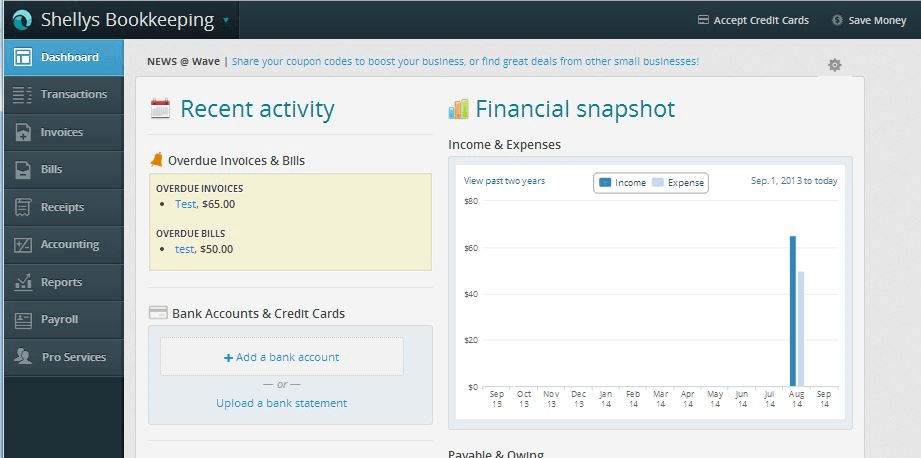

Wave

This is cloud-based accounting software. It provides you real double-entry accounting for small businesses. Wave Accounting permits you to access your details from anywhere, add unlimited collaborators and work on all of your businesses from a single login. It also eliminates data-entry and puts the financial reports as your presentation.

Advantages

- It is freely available to use by companies or firms.

- It has a user-friendly interface environment to work on.

- It allows for the integration of bank and credit card accounts.

- You can invite collaborators. For example, an accountant or business partner can access your accounting.

- All your data is in the cloud, which makes access from anywhere simple.

- The transactions are saved in a categorized file, which is then fairly simple to categorize by choosing the appropriate account.

Disadvantages

- There is no time tracking function.

- It does not permit a great deal of customization.

- There doesn’t show to be any inventory functionality.

- You can’t transfer balances and transactions from other accounting software. This has to be done manually.

- There is no allocating or prediction capability.

Sage Intacct

Sage Intacct is a cloud accounting software based on customer satisfaction. It helps to access integrated management and financial reports across their business entities. It also helps to deliver the automation and controls around billing, accounting.

Advantages of Sage Intacct

- It has a built-in report template.

- Sage Intacct is designed to handle the processing related to credit cards and bills.

- It is easy to use.

- It helps to segregate user access controls.

Disadvantages of Sage Intacct

- It does not provide an integrated solution to the accounting package.

- Automatic marketing & sales force management is not provided.

- It does not reveal the financial status.

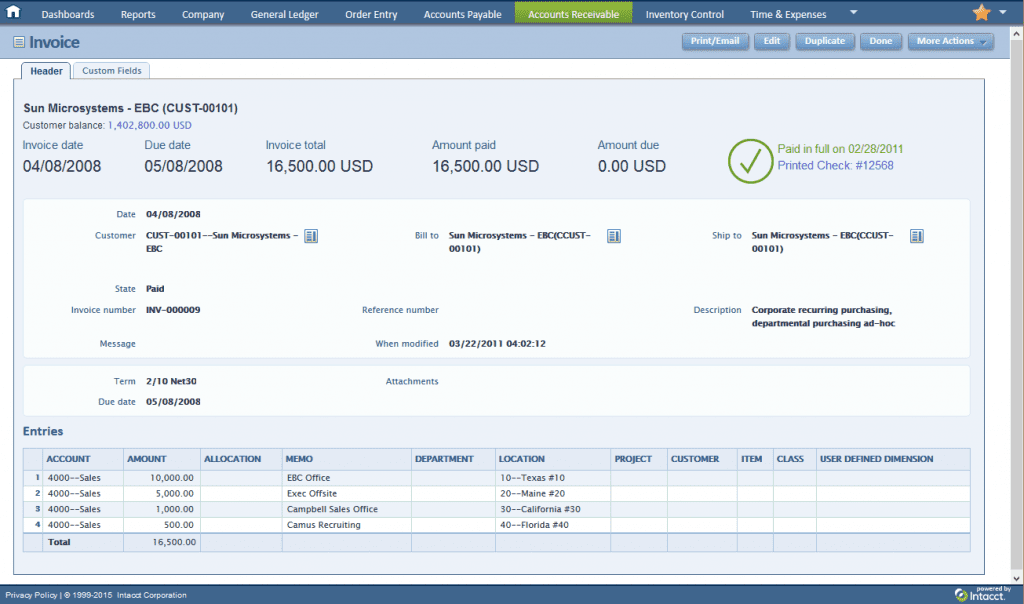

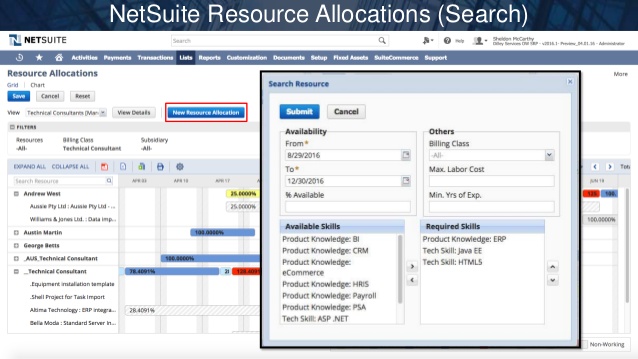

NetSuite

This software is an American cloud computing company based in San Mateo, California. It is to sell the group of software services used by the manager of business Financials, operations, and customer relations.

The advantages of NetSuite are as follows:

- It is flexible in nature.

- It provides a distinguishable difference from other ERP

- systems.

- It is a native small client solution developed for on-demand internet delivery.

- It provides good lead distribution.

The disadvantages of NetSuite are as follows:

- It is difficult to use the system.

- Charging an additional recurring fee of 22.5%to 37.5% for users who need support via email.

- It is very expensive compared to other accounting software.

Fusebill Subscription Billing

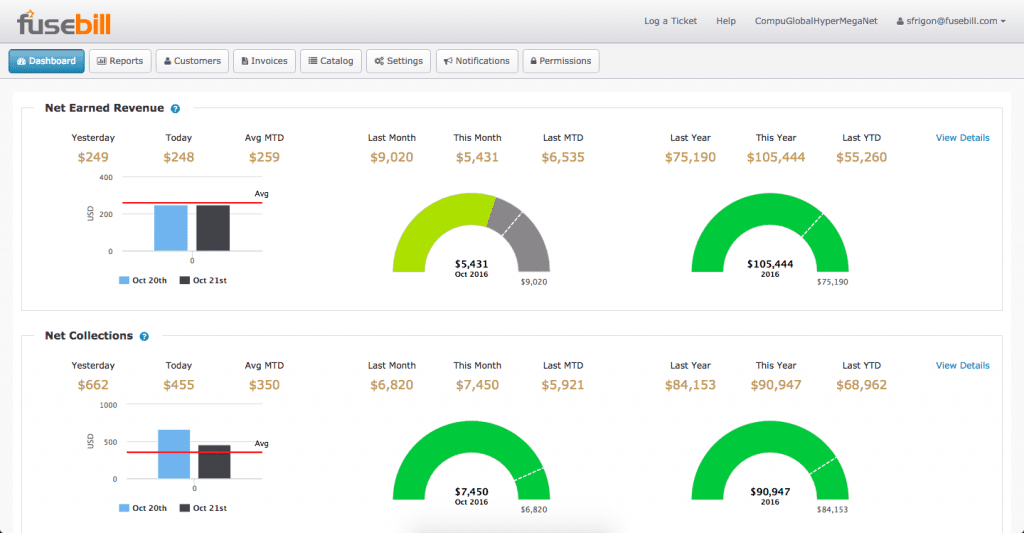

Fusebill Subscription Billing gives you automated invoicing, billing, and group for subscription-based companies. It simplifies the subscription by automating much manual accounting. It is a cloud-based platform.

Advantages of Fusebill Subscription Billing

- It is easy to create & deploy new offerings.

- You can simply track the results in elegant dashboards, all without any IT involvement.

- It can simply determine which products, services, and bundles are working.

- You can simply track all of your key ledger details in real-time and fully exportable to other systems.

- You can simply handle worldwide taxation requirements.

- It helps the entire organization from the back office to customer service.

Disadvantages of Fusebill Subscription Billing

- It is a very expensive software of accounting as compared to other software.

- You need to constantly update the accounting software to work on it.

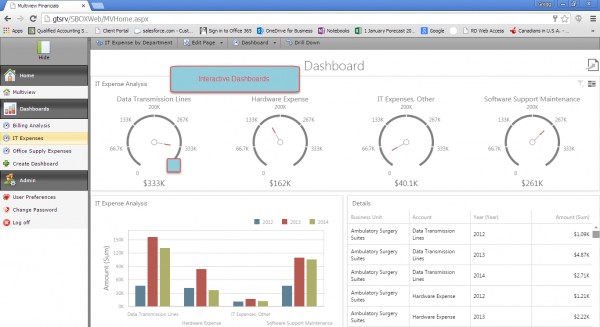

Multiview

Multiview is a company of accounting experts. Its purpose is to build interact seamlessly with each other. We ensure that each implementation is handled by a team of experts. It delivers multiple options and provides user-friendly to work on. It provides highly scalable solution standards with powerful tools to deliver effortless intercompany, multi-currency & multi-level reporting.

Advantages of Multiview

- It is a user-friendly environment to work in.

- All the results of the transaction are accurate.

- It automatically routes the tasks.

- It helps to create budget approval workflows and then compare the budget to actual results.

- Multiview helps to eliminate errors & extra work.

- It gives you complete control over the payments.

- It enhances that there is a relationship with the vendor.

Disadvantages of Multiview

- Multiview is not publicly available.

- It doesn’t span a great deal of accounting functionality.

- It is very expensive compared to other accounting software.

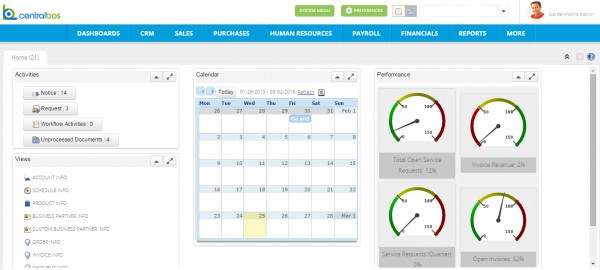

CentralBOS

CentralBOS is cloud-based accounting software that is used in accounting. It helps small businesses to make better decisions in real-time. It helps to keep all the transactions in a systematic order, so that they may be referred in the future.

Advantages of CentralBOS

- It automatically generates the payments and then checks all the due bills.

- It automatically gives invoice alerts based on the preset rules.

- They will give you the remainder of the due payment.

- You can customize financial reports.

- It helps to improve the inventory.

- The payroll data are automatically uploaded in the general ledger after each payroll process is closed.

Disadvantages of CentralBOS

- It is very expensive compared to other accounting software.

- There will be a risk of data while the transaction of data in CentralBOS.

- You need to maintain the CentralBOS accounting software once a month before any work on it.

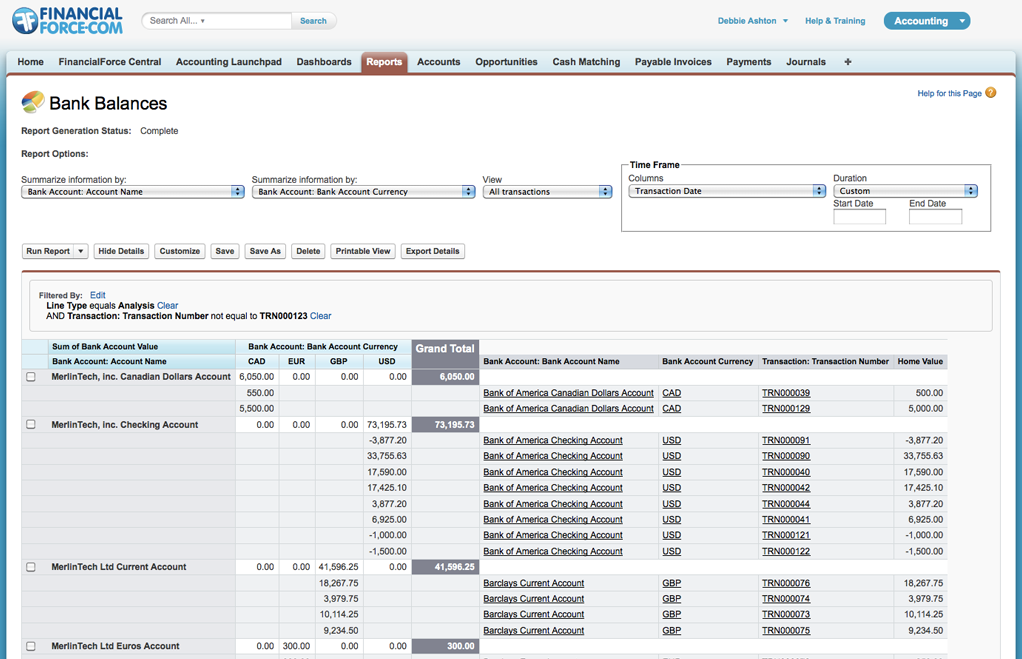

FinancialForce Accounting

Accounting is accounting software that is used to keep the accounting transactions of a business or firm. It also allows you to accommodate the most complicated and diverse financial needs.

It helps to enable your accounting operations by cutting it in half.

Advantages of FinancialForce Accounting

- It processes the order of financial accounting in a sequential way.

- FinancialForce Accounting helps to store financial data with the most accurate model.

- It also supports multi-dimensional financial analysis.

Disadvantages of FinancialForce Accounting

- The company doesn’t use purchase orders.

- There is no current application offered to support FinancialForce Accounting.

- It is very expensive compared to other accounting software.

AccountEdge Pro

AccountEdge Pro comes with many features like DIY or outsourced payroll services that help you to link accounting to payroll, pay your employees, track time and prepare payroll taxes. And the best part for the Retailers is its inventory-management suite integrates with the popular e-commerce platform Shopify. AccountEdge Pro works on both Mac and Windows platforms.

Bench

The bench is an online platform that provides bookkeeping software and services to small businesses. The company estimates that its AI-enabled platform can automate 75 percent of a bookkeeper’s typical tasks. It syncs with your business bank and credit card accounts, provides monthly financial statements with visual reports, and offers support to your CPA at tax season. When you have questions about your finances, you can contact your dedicated bookkeeper and receive a response within one business day.

Free QuickBooks Alternative

Here is the following list of free QuickBooks alternatives, some are free forever but some give you the free- trial versions to use. The list is as follows.

- Wave

- ZipBooks

- SlickPie

- GnuCash

- CloudBooks

- TurboCASH

- xTuple PostBooks

If you don’t want to take the trial version of QuickBooks alternative then you can go for the QuickBooks Desktop trial version.

We hope, after reading this article you got a clear idea of QuickBooks Alternative in the market. And now you easily identify which alternative best for you according to your business need. If you still have any query related to choosing the best alternative, then you can take help from our certified QuickBooks Proadvisor or directly reach us by dialing +1-844-405-0904. Thank you for staying with us!