In QuickBooks, you can record and track the loans issued by your company by creating a separate account. Here, in this article, we’ll teach you how to record loans in QuickBooks depending upon the purpose of the loan. You need to create an Other Current Asset account if the loan is paid to be within the current fiscal year otherwise you need to set up a Non-Current Asset if the loan will be repaid after the current fiscal year. All such related information is contained in this article, go for it and read it thoroughly and learn to record loans in QuickBooks. If you have an issue related to it contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

Table of Contents

Enter a Loan in QuickBooks

Create a Loan Account

Create an Other Current Asset account if the loan is to be repaid within the current financial year otherwise create a Non-Current Account.

- Click on the gear icon from the top right corner and then select ‘Chart of Accounts’.

- Click on the New and select the Current Asset from the account drop-down menu.

- Under details type, select Loans to others and then select Next.

- Name the loan account and click on the Save and Close. (Don’t enter the opening balance.)

Create a Transaction

- Click on the +New icon and then select the Cheque option.

- In Bank Account, select the account you’ll be using to fund the loan.

- Next, select the account you’ll be using to track the repayment of the loan.

- After reviewing, click on the Save and Close.

Record Loan Payments

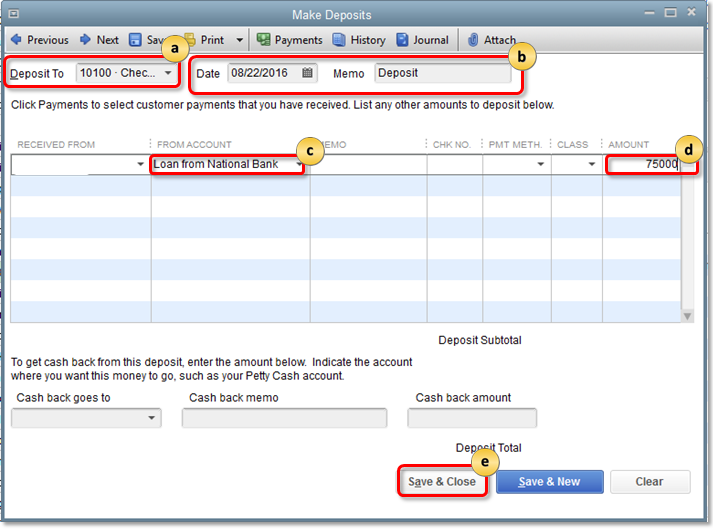

- Click on the +New icon and select the Bank deposits option.

- In the Deposit To field, select the appropriate account for the loan.

- After that, fill the required information under the New Deposit field.

Received From: Enter the name of the customer or company to whom the loan is issued.

Account: Enter the customer loan account name.

Memo: Add a brief description of the loan.

Payment Method: Method of paying a loan like a cheque, cash, etc.

Ref No. Enter the Cheque number.

Class: Provide information, if you use class tracking.

Amount: Enter the amount on the cheque.

- If you are charging the interest for the loan issued then you need to separately enter the terms of interest in the second line.

- At last, after reviewing all the filled information once. Click on the ‘Save’ button.

Record a Loan used to Close all Open Invoices in QuickBooks

In this part, we’ll show you how to record loans in QuickBooks if the loan is used for closing all open invoices under an account in QB.

Create Loan Account

Other Current Asset: Create this account if the loan is to be paid within the current fiscal year.

Non-Current Asset: Create this account if the loan is to be paid after the current fiscal year.

- Click on the Gear icon at the right top of the screen.

- Next, select the ‘Chart of Accounts’.

- Then, click on the ‘Next’ and select the ‘Current Assets’ option.

- From details type select ‘Loan to Others’ and select Next.

- Add an appropriate name.

- At last, click on the ‘Save and Close’.(Do not enter the opening balance.)

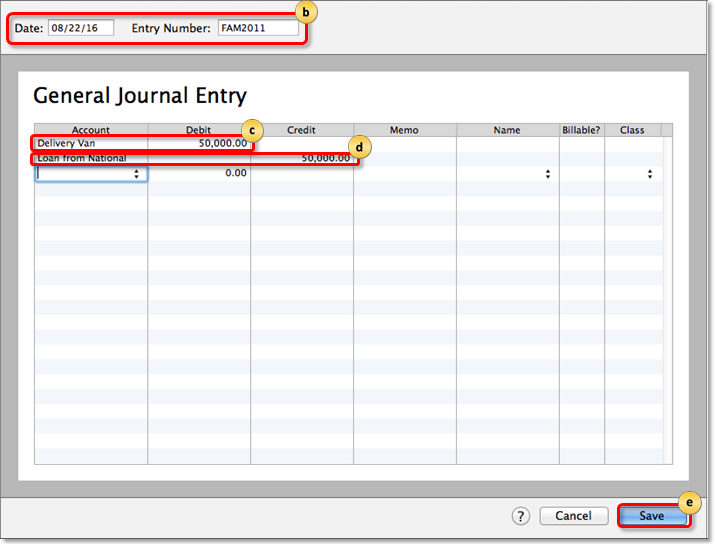

To enter the opening balance you need to create a Journal Entry and you also need to create a credit in the A/R for the customer, so the loan can be used to close the open invoices.

- Click on the +New icon and select the Journal Entry option.

- In the first line of the Account field, enter the loan account name of the customer and amount of loan in the Debit field.

- In the second line of the Account field, type Account Receivable.

- In the credit field, enter the loan amount and name in the customer name field.

Create Recurring Invoices for the Monthly Loan Repayment

In QuickBooks, you can also create monthly recurring invoices to send it to the customer for the loan repayment. For this, you need to follow the below steps.

Create a new Product item

- First, click on the gear icon at the top right corner.

- Then, select the Products and Services option.

- After that, click on the New and then select Non-inventory.

- Type Loan Repayment in the Name field or you can also choose another name.

- From the Account drop-down menu, select the customer loan A/R you created earlier.

Create a recurring invoice for loan repayment

- Click on the gear icon and then select Recurring Transactions.

- After that, click on the New and then select Invoice.

- Select the customer name and then from Products and Services, select the Loan Payment that we created in the previous step.

- In the Amount field, enter the due loan amount.

- After that, select Edit Schedule and then in the Intervals, Enter the starting date and ending date if applicable.

- Click on the Save button and then Save Template.

Enter the Loan Payment

- Click on the +New button and then click on the Receive Payment.

- Then in the Deposit To field, select the Undeposited Funds and Click on the Save.

Conclusion

We are hoping that you’ve now learned how to record loans in QuickBooks. Above mentioned are the simplest way to enter, record, and track the loans receivable in QB accounting software.

But if you are still facing the problem in understanding the features of QB and you want to learn more then you can have assistance from our team of QuickBooks ProAdvisor. Our team consists of certified and experienced QuickBooks professionals who can instantly solve any issue related to accounting and bookkeeping. Call us at our 24/7 toll-free customer support number +1-844-405-0904 to know more.