Learn here QuickBooks loan manager record a loan payment in QuickBooks. The article here is to deliver the details of the QB loan manager, and a guide to aid you to record a loan payment in QuickBooks. Read the complete article to understand the loan manager and its recording loan process; go through the article you will get all your solutions arranged in order along with the images to depict the actual workflow and offer you a better understanding. For instant QuickBooks payment service, dial the toll-free number +1-855-525-4247.

QuickBooks Loan Manager makes a successful plan for the term of the credit, indicating the amount of every installment is connected to the chief, intrigue, and escrow (extra charges identified with the advance). It likewise enables you to make installments for either the standard booked sum or extra installments. And also to run “consider the possibility that” situations to look at changed credit decisions.

As each progressive installment is influenced the enthusiasm to partition steadily diminishes and the primary segment increments. Since the Loan Manager, figures the sum plan and naturally monitors the present portion. Due and additionally the remarkable adjustment of your credit.

Prepare to track loans in loan manager:

Before utilizing QuickBooks Loan Manager, you need to set up the side-by-side records and handler in QuickBooks Desktop.

- Make a handler for the Bank or Financial Institution issuing the credit, if none as of now exist

- Record the underlying credit sum as an opening equalization (utilizing New Account window) or as an exchange like diary passage, Also try to utilize the credit start date. On the off chance that installments have just been made against the advance, now you have to enter these as checks, bills or dairy sections.

- Set up an Expense sort represent fix installments and Fees and charges, if none as of now exist.

- Make a security account if fundamental.

How to record Payments in QuickBooks Loan Manager:

1: From the Banking menu, click Loan Manager.

2: Select the Add Loan.

3: Enter Account Information of the advance and Tick Next.

- Record Name: Loan Account that you already set up.

- Loan specialist: dealer to which installments will be made.

- Beginning Date: Date from which the credit starts.

- Unique Amount: Full starting measure of the credit.

- Term: Time it will take to refund the advance in full in weeks, months or years.

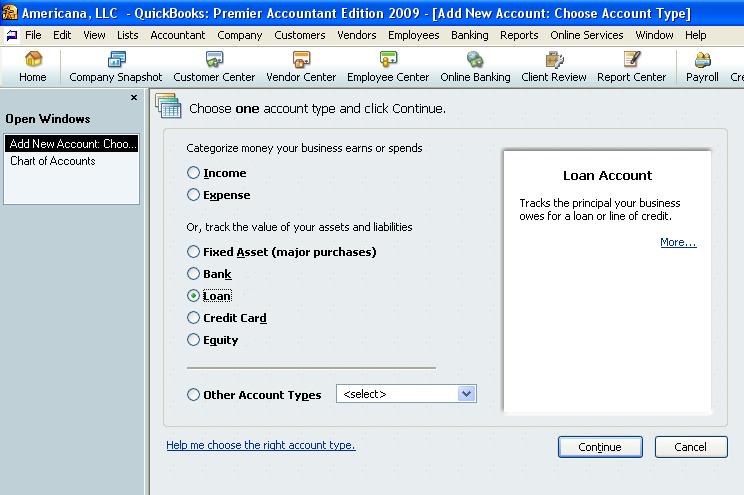

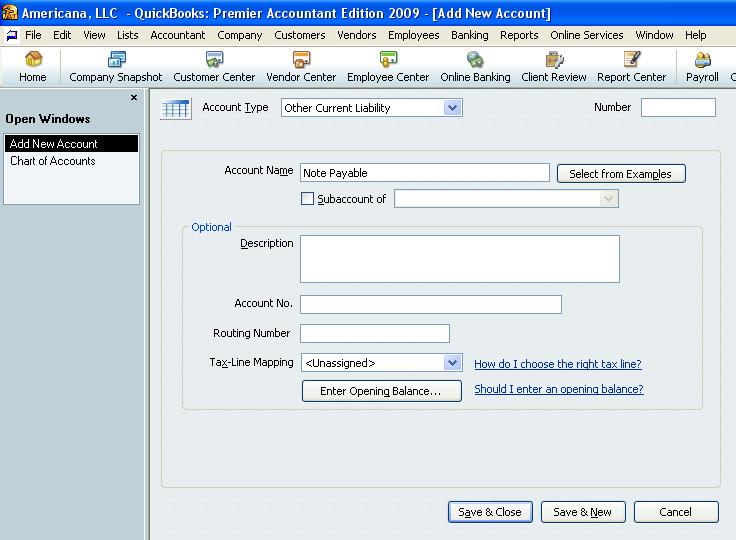

- Select “Credit” as the sort of record that you are including and squeeze proceed. On the following showing up window, essentially sort for the sake of the record and record number. In the event that you wish to turn over one:

- Select “Save and Close”.

- Next record the advance in QuickBooks, attributing the total dollar add up to the Note Payable record. That you just added to your outline of records. And charging money or the proper resource gained by the note. You should include a handler for the bank or monetary establishment issuing the credit in the event. That it doesn’t as of now exist as a seller in QuickBooks.

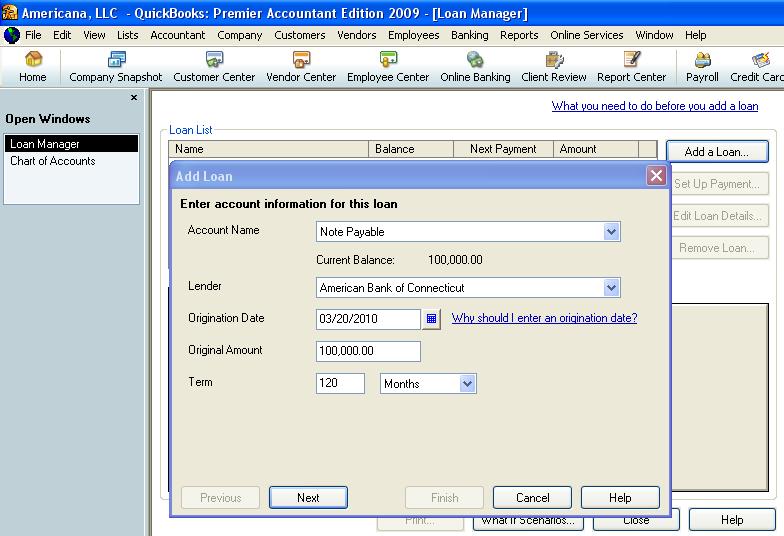

- Presently you are currently prepared to include the credit in the “Advance Manager” to get to this component in QuickBooks. just go to the “Keeping money” drop-down menu situated on the best bar. And look down to “Advance Manager”, which will then load once chose. Basically select “Include a Loan”. And in the “Include Loan” data box which shows up, fill in the “Record Name”, “Moneylender“, “Start Date”, “Unique Amount”, and “Term” of the credit; and after that select “Next”.

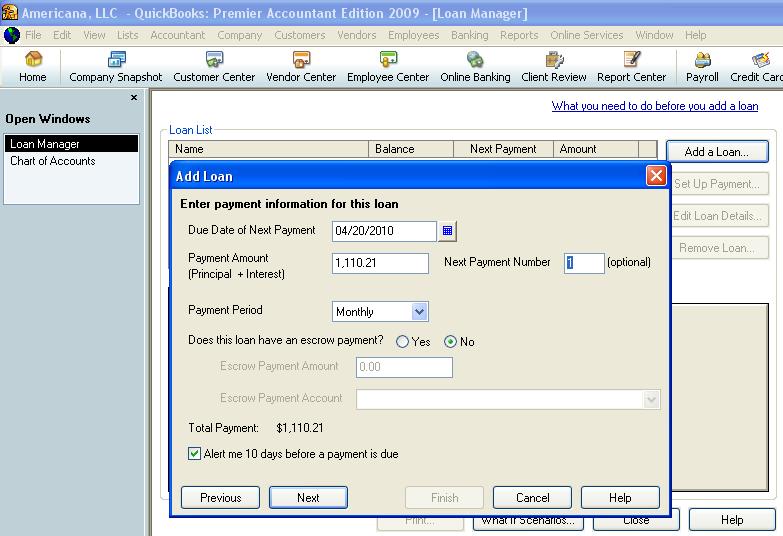

- In the following screen enter the “Due Date of Next Payment”, “Installment Amount”, the “Following Payment Number” defaults to “1”, enter “Installment Period”, and select “Next”.

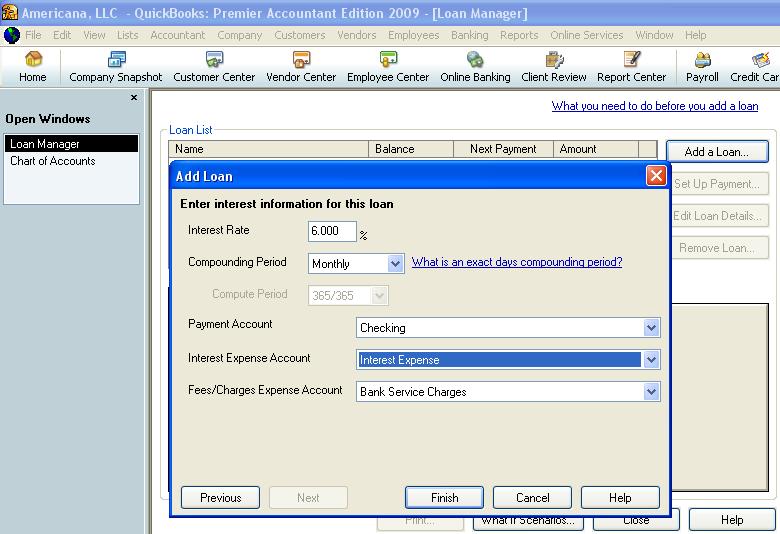

- Next step will be Enter the “Interest rate%”. After that next option is “Compounding Period” here is one Drop Down list Button. You have to select according to the computing period like yearly, monthly, and Quarterly. The next option is on this page “Payment Account”. Select the checking and feather step is “Interest Expense Account”. Here also select the Interest Expense from the Drop Down List button. Next is “Free/ charges Expense Account”. Here select the Bank Service Charges then after click on the “finish Button”.

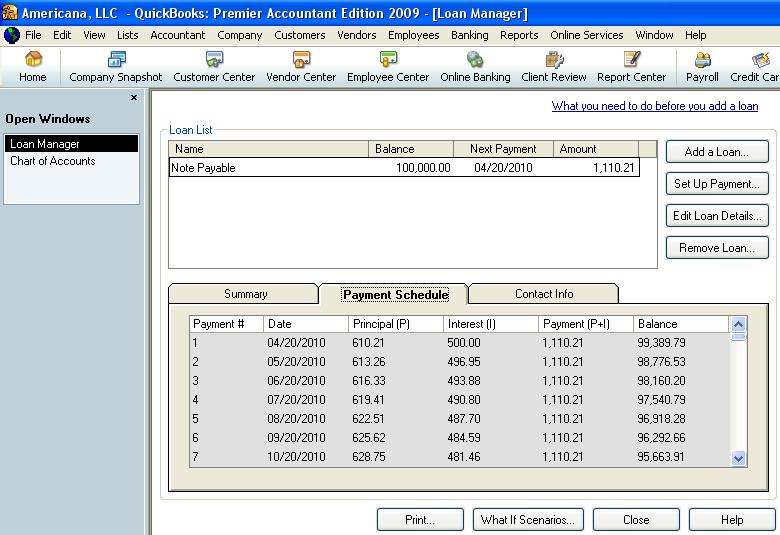

- Select the “Finish” button. If you follow our step and Instruction, your loan amount is set up in the Quickbooks loan Manager, follow the screen show

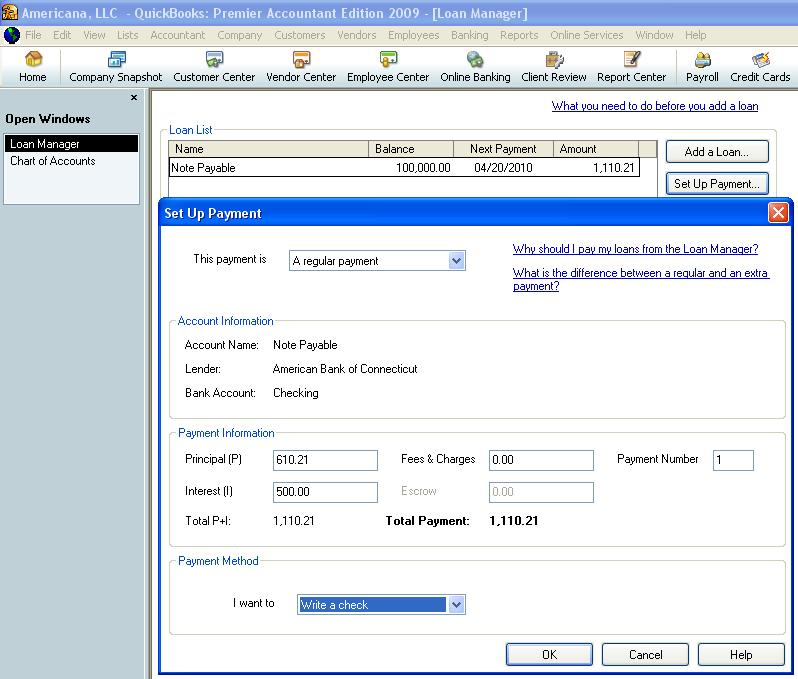

- At the point when the primary installment is not paid, never enter the installment outside of the Loan Manager. As this will make an error between the credit adjust appeared in Note Payable on your books in QuickBooks. And that in the Loan Manager plan. To make a portion installment on the advance, dependably enter Loan Manager. And in the open window, select “Set Up Payment”.

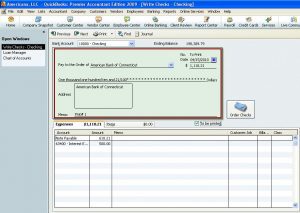

- In the window that shows up, see that key and fix are rank. And it will be connected accurately to Note Payable and Interest Expense in your general record. Press “alright” and the Loan Manager naturally forms the check for your present advance portion installment. With the right check number, date, payee, sum, and sums presented on Note Payable and Interest Expense.

Now your document is ready, you can print the check and you are finished. QuickBooks Loan Manager is the best tool that use in the Quickbooks very much, but the user does not describe the step of the Quickbooks Manager loan.

Our team consists of qualified and certified ProAdviser, you will get getting a fix guaranteed with the help of our devoted and skillful 24×7 support system and magnificent QuickBooks support service. Follow the Steps Shown above hope so, you will have no problems and if you are still facing problems then you may dial our Support Phone Number +1-855-525-4247.