In this article, we’ll guide you on how to record owner investment in QuickBooks. Owner investment as the name suggests is the personal money invested by the owner or its partner to the business either to start it or to keep it running. It is very essential for businesses, especially at the initial stage. It helps them to hire more employees, research and development, buying equipments, etc. Read the full article to get such information to set up an account, investment, and many more to learn. Still having trouble contact our QuickBooks ProAdvisor toll-free:+1-844-405-0904

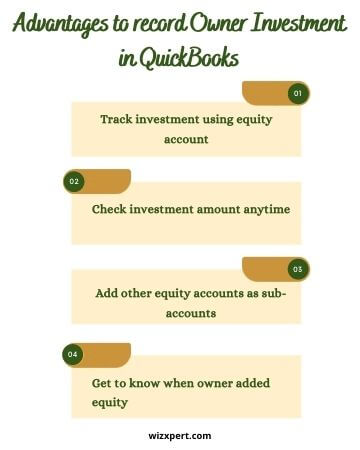

In QuickBooks, you can easily enter your own invested capital or business partner investment and track them accurately. This way the information is correctly recorded on your financial reports. So here are the steps to follow:

Table of Contents

Setup an Owner or Partner in QuickBooks

To track the capital that you or your partner has invested in the business, the first thing you need to record is yourself, the owner, or the partner as a supplier in QuickBooks.

- Go to the ‘Expenses’.

- Then, select the ‘Suppliers’ menu and click on the New Supplier.

- Fill the required information and then Save it.

Setup an Owner’s Equity Account

After setting up the owner or partner as a supplier in QuickBooks. Now, you need to create an equity account for the business owner or partner so that you can see how much has been invested.

- First, click on the gear icon and then select the ‘Chart of Accounts’ option.

- Next, click on the ‘New’ button.

- Select ‘Equity’ from the Account-type drop-down menu.

- Select ‘Owner’s Equity’ or ‘Partner’s Equity’ as per your requirement from the Detail Type drop-down menu.

- Fill the remaining information and then, Save and Close.

If you want to create multiple equity accounts for the owners and partners then you need to set up an equity account first. And after filling the information of the other equity account, just select Is Sub-Account, and then in Parent Account enter the account you created earlier.

Record the Owner Investment

Follow the steps below to record an Owner deposit into the equity account.

- Click on the +New icon and then, select the ‘Bank Deposit’ option.

- Now, select the bank account in which you want to deposit the owner’s investment, from the Account Drop-down menu.

- Enter the date on which the money was deposited.

- After that, in the Add funds to this deposit section, enter the name of the investor i.e. Owner or Partner in the Received From field.

- Next, from the Account drop-down menu, choose the equity account (i.e. Owner’s Equity or Partner’s Equity) that you created previously.

- Select the Payment Method and the amount of investment in the Amount field.

- Select Save and Close.

Record Owner Deposit Money into Business Journal Entry

You can also record owner investment in QuickBooks using Journal Entry. In this method, you can also record the initial capital you invested in your business. It can be a direct cash investment or cash used for buying assets, machinery, or inventory.

Follow the steps to learn how to record owner investment in QuickBooks using a journal entry.

- From the top menu bar click on the ‘Company’ and then select the ‘Make General Journal Entry’ option.

- After that, a new window will open with a similar layout like a spreadsheet.

- The window will have five columns as Account, Debit, Credit, Customers, and Class.

- In the Account column, from the first row click on the Owner’s Equity and select the appropriate equity account. In the second row, enter the account in which you want to deposit these funds.

- In the Debit column, select one of the savings or checking accounts.

- In the Credit column, enter the same amount as the initial investment.

Frequently Asked Questions

Conclusion

We hope that you learned how to record owner investment in QuickBooks by setting up an equity account as well as using Journal entries.

Although, QuickBooks doesn’t provide a standalone feature to record and track the owner’s contribution to the business you can use any one of the above-mentioned methods to the job done.

But after all this, you still find difficulties in performing these accounting tasks then you can take assistance from our team of QuickBooks ProAdvisor that consists of certified and experienced QB experts. To know more about the service we offer give us a call on our 24*7 toll-free customer support number +1-844-405-0904.