Want to know, how QuickBooks invoicing is an important aspect of running a successful business? Here, we have covered the features of QuickBooks invoices and important elements to keep in mind while creating a professional invoice. If you want to know more about invoicing in QuickBooks, you dial our toll-free number +1-844-405-0904.

QuickBooks invoicing software let you send invoices anywhere, make customer payments easy, craft professional invoices, send payment reminders, and keep track of expenses. By issuing an invoice to a customer you can easily track a sale of a product for accounting, tax, and inventory control. With QuickBook’s unique invoicing features you can streamline the payment process for your clients, create professional invoices and automatically enter transactions into your bookkeeping records.

Functions of QuickBooks Invoicing

Let’s now have a look at the features listed below:

- Send Invoices to Get Paid Faster

- Lets your customer pay faster by credit card by just double-clicking on the Pay Now button.

- You will get notified about your payments through real-time alerts. It will inform your customer about the due payment by sending reminders.

- With progress invoicing you can take bigger projects and get paid faster.

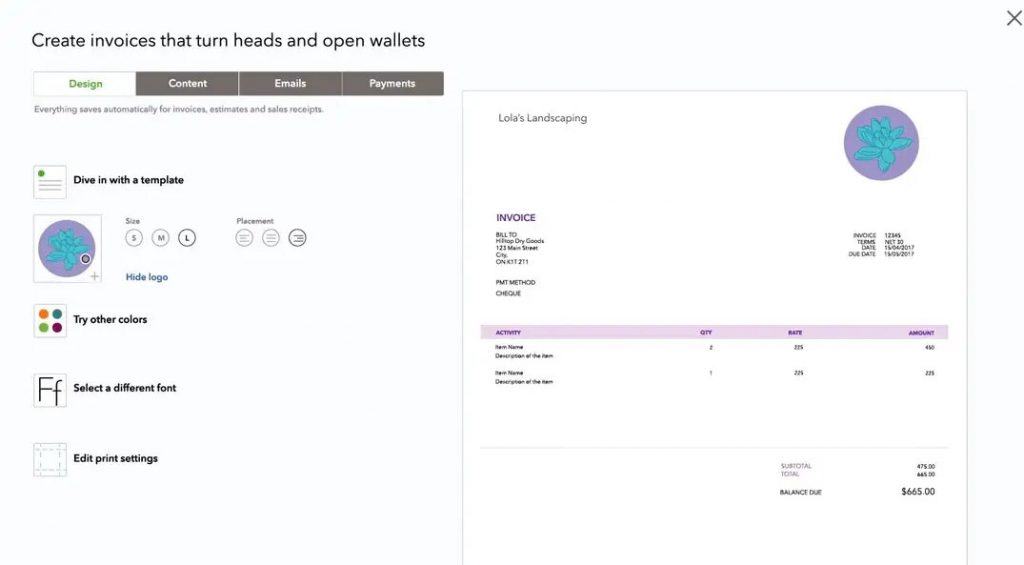

- Create and Customize Professional Invoices

- Get modern templates and choose the font and accent colors you like. You can also add your logo to give it a professional look.

- Set preferences for your customer’s language and send invoices in their language such as English, Spanish, French, Italian, Portuguese, and Chinese.

- It is easy to set up and can use multi-currency. It makes it easy to send invoices in different currencies and assign specific currency types.

- Automated Invoicing

- Lessen your burden with automatic invoices send schedule recurring invoices.

- QuickBooks automatically matches the payment with the invoice in your books when an invoice is paid to save you time and keep everything updated.

- It will automatically calculate the sales tax and will keep a track of your money.

- Turn Estimates into Invoices and Add Billable Expenses

- Through the QuickBooks app, you can pay bills, track your invoices and payments.

- You can easily create estimates and quotes that include discounts, payment terms, etc.

- You can link your billable expense to the invoice and get your money back which incurred an extra cost while doing a job for your customer.

How to Create Professional Invoices in QuickBooks

QuickBooks streamlines the process of creating professional invoices for your business and brand and also highlights the value of the work you provide. Given below are the important elements to include in your invoice.

- Company information: At the bottom or top of the invoice, list your contact information with the customer’s details such as their legal name, business address, phone, and fax number.

- Header: At the top of your document, include the title ‘invoice’ so that customers can fastly identify the communication.

- Date, invoice number, and a unique identifier: The invoice must include issuing date, invoice number, and unique identifier. This can be a unique billing code, simple file number, or date-based purchase order number.

- Customer purchase order (PO) numbers or billing codes: Include all the unique details such as internal PO number or billing code to keep track of payments.

- Itemized list of goods and services: Include name, rates, dates, and the quantity of the goods and services provided with price modifications, descriptions of items, and your work processes.

- Payment terms: Include the due date and clarify the penalties or late fees of the total bill.

- Itemized fees: list taxes, handling fees, and other charges on a separate line to various budgets and balance your internal bookkeeping.

- Total due amount: Include the total amount due, which should be clear and visible.

- Instruction for payment: Give a clear set of instructions on how to accept payments

Invoicing in QuickBooks Payments

You can get your money faster with flexible QuickBooks payments. QuickBooks payment sends invoices by email with a Pay Now button which makes it easy for your customers to pay directly within the invoice. Some of its features are:

- Accept credit and debit card payment directly through the invoice by a single button.

- Settle invoice on-site and take payment with mobile app and card reader.

- Customers can pay digitally instead of by email through ACH or eChecks.

- Schedule recurring invoices to be automatically sent and paid.

Payment Terms and Conditions on Invoices

It is essential to mention all the payment terms and conditions on invoices to know when the payment is expected and how the customer can pay.

| Invoice Payment Term | Meaning |

|---|---|

| Terms of sale | Terms agreed by buyer and seller such as amount, cost, delivery taxes, payment mode, and payment due date. |

| PIA | Payment in advance. Let the customer know that the full payment is expected in advance, before starting work. |

| CIA | Cash in advance. Know when you expect the payment and how you will accept the payment. |

| Immediate payment | Payment is expected at the same time as the product or service is delivered, or the seller has the right to repossess the product or service. |

| Upon receipt | Expect payment as soon as the customer receives your invoice. |

| Net 7 | Payment is due 7 days after the invoice date. |

| Net 10 | Payment is due 10 days after the invoice date. |

| Net 21 | Payment is due 21 days after the invoice date. |

| Net 30 | Payment is due 30 days after the invoice date. |

| Net 60 | Payment is due 60 days after the invoice date. |

| Net 90 | Payment is due 90 days after the invoice date. |

| Net EOM | Payment is due at the end of the month. |

| 15 MFI | Month Following Invoice which means payment is due on the 15th of the month following the invoice date. |

| 2/10 Net 30 | 2/10 Net 30 means if the customer makes the payment within 10 days, they will receive a 2% discount. |

| 50 Percent upfront | The customer must pay 50% of the total invoice amount |

| Line of credit pay | Settle invoices over a period of time by purchasing the product/service on credit. |

| Quotes & estimates | proposed prices for your products/services. |

| Recurring invoices | used for ongoing services, typically with monthly or quarterly payments. |

| Interest invoice | An interest invoice outlines the fees associated with the interest charged based on a past due payment. |

| Invoice factoring | sell your unpaid invoices to a third party |

| Cash account | Payment on a cash account is collected via cash only–no credit. |

| Letter of credit | documented credit confirmed by a bank/financial institution. |

| Bill of exchange | Customer promise to pay at a later date, typically supported by a bank/financial institution. |

| COD | Cash on delivery. |

| CND | Cash next delivery. |

| CBS | Cash before shipment. |

| CWO | Cash with order. |

| 1MD | Monthly credit payment of a full month’s supply of goods/services. |

| 2MD | Monthly credit payment of a full month’s supply of goods/services, plus an extra calendar month. |

| Contra | customer’s payment is offset against the value of supplies purchased. |

| Stage payment | Payment made on an agreed amount. |

The above information is about QuickBooks invoicing and how it helps businesses to grow and get paid faster. We have also mentioned the important terms mentioned on the invoices with their meaning to give you more insights about invoices. For more information, you can contact our Proadvisor at +1-844-405-0904.