Learn here in this article how to do payroll in QuickBooks Online and Desktop. QuickBooks Payroll is the best option for small business owners who cannot hire a professional accountant at the early stages of their business. Although setting up QuickBooks with payroll for the first time might take some time but after that, it will be very convenient to run payroll for paying employees. In this article, we’ll tell you how to do payroll in QuickBooks, and then you can pay your employees using QuickBooks Payroll. If you need any technical support, contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

QuickBooks by Intuit offers three different types of payroll services, i.e.

- Basic payroll (In here, you can choose to do it yourself or you can hire an accountant.),

- Enhanced Payroll (In this, QuickBooks will help you in performing the tax-related forms only.)

- Assisted Payroll (In this type, you have to pay your employees, and Intuit will help with tax forms and payments.)

Table of Contents

Things you need to do before setting up QuickBooks Payroll

This is the information you need to have before setting up payroll in QuickBooks Online and Desktop.

Employer’s Information

- Bank Account Information: Account Number, Direct Deposits, and electronic payment method( like ACH, credit card, debit card, etc.)

Employee compensation and benefits

- Compensations: Employee’s hourly wages, bonuses, salaries, commissions, tips, or any other additional compensations you provide.

- Benefits: Any benefits you offer to your employees, like Health insurance, retirement plans, sick/vacation leaves, etc.

- Additional Allowances: Child support garnishment, mileage, travel reimbursement, etc.

Employee’s Information

- W-4 Form: This IRS form is prepared for the employer to deduct some amount of money from the paycheck as federal tax.

- Tip: If you don’t provide tip, then enter “Single” and “0” allowances. If you want, then change these values later.

- Pay Rate: How much you pay your employee per hour or the salary of each employee.

- Paycheck Deduction: Employee’s contribution to health insurance, pension, or retirement plan. This amount is deducted from the paycheck.

- Pay Schedule: After how many days you pay to employees like every week, after 2 weeks or monthly.

- Date of Hiring/Termination: Hire date of each and every employee.

- Sick/Vacation hours: If this service is applicable then you need to enter this information too.

Tax Information

- Federal Employer Identification Number(FEIN) and state agency identity number: You need to add EIN to QuickBooks Payroll and to file & pay taxes. For this, you need to contact the IRS or state agencies to apply for this unique ID.

- Electronic Federal Tax Payment System: It’s compulsory for you to enroll (EFTPS) for online payment of Federal tax deposit. But if you are using one of Enhanced Payroll or Assisted Payroll then QuickBooks will deal with this process.

- Filing Requirements and deposit schedule for payroll taxes: The requirements for filing and depositing payroll taxes are different. The companies that have more payroll tax usually file and pay more frequently than other companies. You may have to contact the IRS (Internal Revenue Service) to learn more about your tax requirements.

- Other Tax information: For example, surcharge, tax deposit schedule, state unemployment, administrative or training tax rate, assessment, and local or other taxes. (If any of these apply to your business.)

Direct Deposit

If you are using the QuickBooks Direct Deposit feature for the payroll to be deposited directly into their bank account, then you need to have the employee’s bank account number and routing number as well.

Prior Payroll

If in this calendar year, you have already paid some of your employees, then you need to record that amount in QuickBooks so that it can accurately calculate the new paychecks and complete tax forms as well.

- For the Current Year: You need to enter the payroll information for each paycheck.

- For each prior quarter of this calendar year: You need to provide a summary of all employees and total company payroll.

- Year-to-date totals for each employee: Summary of the employee.

- Year to date totals for each employee as of the last paycheck in the previous quarter: summary by the employee.

Liability Payroll

- You need to submit all the copies of the payroll liability check for the current quarter.

- Summary of payroll liability payment for each prior quarter of this year.

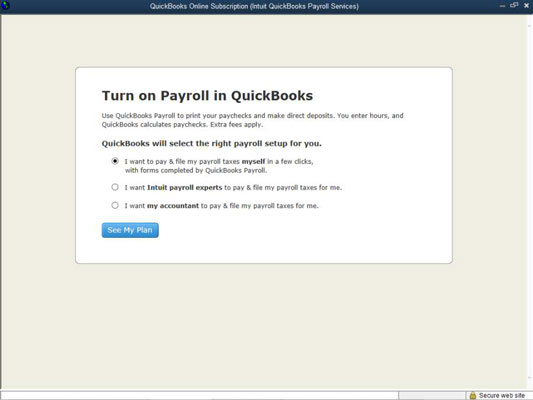

How to Set Up Payroll in QuickBooks

You first need to set up a payroll service before learning how to do payroll in QuickBooks and for this, you simply need to follow the procedure step by step.

- In the navigational panel on the left side click at the ‘Employees’.

- If you already have a subscription for QuickBooks Payroll then you can simply set up payroll by clicking on the ‘Get set up’.

- But if you don’t have any payroll subscription yet then you need to click on the ‘Add Payroll’ and then select one of any three listed payroll services. (Basic Payroll, Enhanced Payroll or Assisted Payroll)

- In the next window, you need to answer some questions when you are setting up payroll in QuickBooks. This will be a one-time process.

- The first question is ‘Have you paid any W-2 employee in 20XX?’ select ‘No’ if you didn’t pay any employee other ‘Yes’.

- The second question is ‘When will you first run payroll with QuickBooks?’ select the date accordingly.

- The last and third question is ‘How did you pay your employees?’ select one option from Paycheck or direct deposit (withheld taxes) and check or cash (without taking out taxes).

Company Information

If you use features like Direct Deposit and Electronic Tax payment then you’ll need to have your Employer Bank Account.

NOTE: QuickBooks Direct Deposit usually takes 4 to 5 business days to activate therefore if you are planning to use this feature to pay your employees then you may have to pay your employees using a check until the direct deposit is activated.

As we mentioned above you also have to provide the tax information of the company like Federal EIN number, State ID Numbers, etc while setting up payroll in QuickBooks.

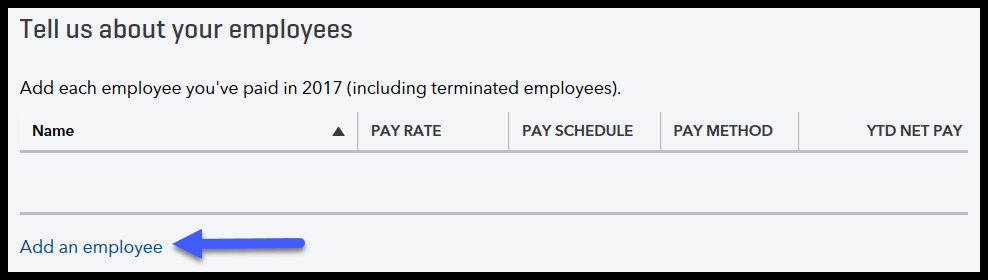

- Now you need to add employees to whom you’ve paid in that year. Remember you also have to add terminated employees.

- You have to fill numerous fields related to the employees in the information section.

Employee Information

- Employee’s withholding: Personal information and allowances deduction.

- Pay Schedule: After how many days you pay to your employees i.e. daily, weekly, after every 2 weeks (bi-weekly), monthly, etc.

- Pay Rate: How much do you pay to the employee. For example, if you pay them hourly then select it from the drop-down menu and then enter the per hour rate.

- Paycheck Deduction: Select deduction if there is any like health insurance, retirement plan, etc.

- Mode of Payment: Select one method from the direct deposit or paycheck from the drop-down menu. Then select the account type of employee and enter the routing number and bank account number.

- Enter the prior pay details: how much you did pay the employee so far in 20XX?

After filling all the employee information correctly you can review it in the sample paycheck.

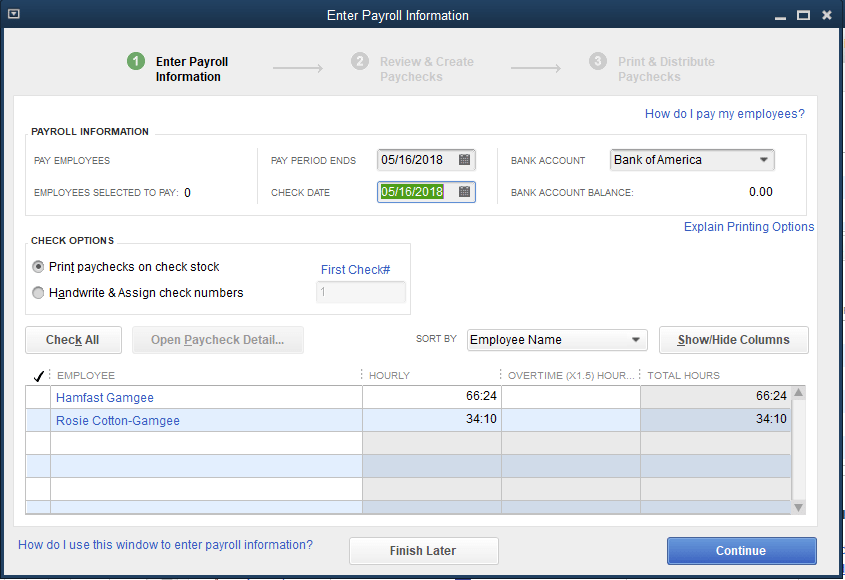

How to Run Payroll in QuickBooks

Finally, after setting up all the information in QuickBooks now we’ll show you how to do payroll in QuickBooks.

- From the left side navigation panel, click on the ‘Employees’.

- In the ‘Employee center’, click on the ‘Run Payroll’ button in the top right corner of the window.

- Select an employee to whom you want to make a payment from the list of employees that you set up in the previous section.

- In the next window, select the bank account from which you want to make a payment.

- The Pay Period field should be filled automatically as you set it up.

- In the Pay Date, enter the date you will pay your employee.

- In the Pay Hours, you need to enter the number of hours an employee has worked.

- Salary will be automatically calculated according to the per-hour rate/annual salary you previously entered.

- Before submitting, you can have a final review of the payroll information, like (Employee’s name, pay period, working hours, etc) for the mistake-proofing.

If you find everything all right, then you can click the ‘Create Paycheck’ button at the bottom right corner of the screen to send and print the paycheck. You can also print pay stubs or send them to the Intuit ViewMyPaycheck website so employees can have it anytime.

What are the Benefits of QuickBooks Desktop Payroll?

Payroll can be a tough task for business owners. Performing payroll on your own is a little bit stressful. Because some things keep changing always like tax rules, employment law, and government regulation. overwhelmed with the changes in tax and employment laws, and in dealing with government regulations.

Payroll software helps workers to pay the right amount at the right time. It makes the whole process automatic, like essential tasks, ensuring that employees get paid accurately on time. The major advantages of using payroll software such as QuickBooks Desktop Pro are as follows:

- Automated Tax Calculations and Filing: QuickBooks Desktop Payroll can manage payroll tax calculations, filings, and payments easily. It automates tasks and minimizes the chances of errors.

- Organized Employee Information: Keep all the details of your employee, like pay rates and employment status, in one location.

- Easy Benefits Management: Managing employee benefits, such as insurance and paid time off, becomes easy.

- Payroll Reminders: You’ll receive automated alerts, so you will never miss a payday or tax deadline again.

If you are curious about how QuickBooks payroll works or how to handle payroll in QuickBooks. Make sure that this software makes the whole process easy to do and reliable. QuickBooks Payroll will not only save time but also protect your business from costly errors.

Frequently Asked Questions

How much does Intuit charge for QuickBooks Payroll services?

The cost of Intuit’s QuickBooks Payroll services is as follows

- QuickBooks Basic Payroll: $22.50/month + $4/employee per month.

- QuickBooks Enhanced Payroll: $37.50/month + $8/employee per month.

- QuickBooks Assisted Payroll: $62.50/month + $10/employee per month.

How to use QuickBooks Payroll without a subscription?

For using the Payroll service in QuickBooks Desktop without a subscription. First, you need to go to ‘Company Preferences’ and then in the QBD payroll feature click ‘Full Payroll’.

After that, press F1 and type Manual Payroll, then select Calculate Payroll manually. You need to set up company file before proceeding further.

Final Words

Now that you know how to do payroll in QuickBooks, you can easily set up and run payroll services to pay your employees on time and conveniently. It is important to understand that using payroll is not only about paying employees; you also need to do some tax filing work, and for this, you also need to be familiar with the federal tax rules and regulations.

But you don’t need to worry about it, you can hire an Intuit’s Intuit-certified accountant QuickBooks ProAdvisor who’ll take care of all the accounting and financing work. Call us at our toll-free number +1-844-405-0904 to know more about the service we offer.