Looking for how to set up pay vacation & sick time in QuickBooks Desktop? Then you are on the right blog here, we will assist you with all the possible steps to help you with the same. QuickBooks Desktop allows you to either pay a fixed amount at the beginning of the year or select one of the two types of paid time which is sick and vacation time. And it can be used while paying employees. Read the article to get the related information and stay with as to learn new with ease. Still, having trouble setting up contact our Quickbooks ProAdvisor toll-free: +1-844-405-0904

As we all know very well, QuickBooks is a very traditional accounting software in the market for small and medium-sized businesses. QuickBooks employees are displayed for greater visibility on payment stubs due to sick and vacation time disturbances, balances, and deficiencies.

It also provides better compliance with state-mandated maximum periodic rates. If you are also trying to set up pay vacation and sick time in QuickBooks and you don’t understand how to set up and pay.

Table of Contents

Steps to Set up Pay Vacation and Sick Time in QuickBooks

Here, are the main steps to set up pay vacation and sick time in QuickBooks.

Set up the sick/vacation payroll item

- Select Payroll Item List on the top menu bar

- Choose Payroll Item in the bottom left corner and click on New.

- Now, select Custom Setup and then, click on Next.

- Choose the Wage (depending on whether you have salaried or hourly employees, Select either Annual Salary or Hourly Wages)and select Next.

- After, select Sick Pay or Vacation Pay, and then click on Next.

- Now, type the name of your item, and click on Next.

- At last, select the expense account wisely, that you want this item to report to, and click on Finish.

Change the company sick and vacation defaults

- First, go with the edit Option and click on Preferences.

- After, click on the Payroll & Employees< select company preferences tab< Click sick and vacation button.

- And now fill in the defaults, that you want to set up and make sure to check the Do not accrue boxes on the bottom.

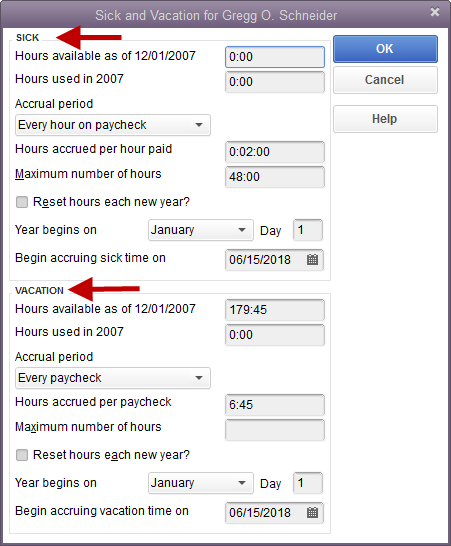

How to Add or Change sick and vacation accruals on the employee profile

- First, go to the employee center and double-click on the employee name

- Choose Payroll Info and click on the Sick/Vacation option.

- In the Hours available as date field, enter the no of paid sick hours that are available for the employee to use.

- Click on the accrual period drop-down menu and choose any one of the accrual days for sick time. There are three different methods to get sick and vacation in QuickBooks Desktop:

- The beginning of the Year:

- Every Paycheck:

- Every Hour on Paycheck

- In the Hours Accrued field, enter the number of hours that will be collected (according to the selection in step 5)

- Enter the maximum balance of sick hours in the Maximum number of hours for field employees.

- If you want sick hours to reset to zero when a new accrual year begins then choose then check Reset hours each new year option on the screen.

- Now, enter the start date of the year as the accrual year.

- If the employee arises from sick time on a calendar year then, Enter January 1.

- If the employee arises from sick time on a different record or day then enter the day that year begins, for example, an anniversary year.

- Enter the date when sick time should begin accruing.

- If you want to define accrual information for vacation hours, repeat steps 4 to10 for the Vacation section of the window. To record your changes click on OK.

How to add the sick or vacation time to the Paycheque

- First, open the Preview Paycheck window,

- Under earnings, click on the drop-down sign in the Item Name column.

- Now, click on the sick or vacation item you created.

- For hourly employees, enter an hourly rate in the hour’s column, and the number of hours

- For paid employees, enter the number of hours worked next to the usual salary income item in the Hours column. In the hour’s column, In the hour’s column, the number of hours paid for sick/vacation time next to sick / vacation pay.

- Once you entered all the correct no of hours, QuickBooks Desktop itself distributes the salary rate subsequently.

- Now, go with the Continue option to create paychecks.

How do you get the accrued sick and vacation time to appear on pay stubs?

- On the QuickBooks Desktop top menu bar, select Edit

- Select Preferences at the bottom < select Payroll & Employees< company preferences< click on Pay Stub and voucher printing option.

- Mark a checkbox with sick used and sick available boxes.

- Simply click on OK.

Frequently Asked Questions (FAQs)

How do I track vacation time in QuickBooks?

To get the sick and vacation time to appear on pay stubs, follow the following steps:-

- On the left-hand side, click on Payroll& Employees then after go with the preferences option.

- Set a checkmark for Vacation used and vacation available and Sick used and sick available boxes.

- Now click on OK, and again click on OK to close the preference windows.

How do I enter sick leave in QuickBooks?

- First, select your company name in the top-right corner, and then click on Payroll Settings.

- Click Vacation/Sick/PTO, under the Payroll settings.

- In the Sick Leave Policy box, click on Create and add policy

- After, click on OK.

Hope this article will help you to set up pay vacation and sick time in QuickBooks. After reading or follow the above instructions, if you are still facing some problem with the same please feel free to call our expert ProAdvisor and also directly reach us on our toll-free +1-844-405-0904.