Learn how to process late payroll in QuickBooks Desktop Payroll. To assure that your employees are paid on time, the QuickBooks Desktop payroll needs paychecks to be submitted to Intuit before 5:00 pm PT, 2 banking days before the check date. This limits you from any delayed fees or penalties. The article here contains the process, examples, and major checks to cater you a better understanding of to process of late payroll in QuickBooks Desktop Payroll. For instant QuickBooks Desktop Payroll support, you can contact the experts through the toll-free number +1-844-405-0904.

To determine whether your payroll is late depends on whether you use QuickBooks Assisted Payroll (full-service), or QuickBooks Enhanced Payroll (DIY).

- If you want to use QuickBooks Assisted Payroll then all payment checks will create in QuickBooks, which also covers paper checks or direct deposit checks, that necessitate being submitted before 5:00 pm PT to Inuit, or at least before the check date 2 banking days ago. If any payment check (except termination pay-check) is not sent 2 banking days before the checking date, then late payroll processing fees will be generated. This deadline lets the intuit to process payroll taxes on time and guarantee that tax filing is presented on your behalf.

- If you want to enhanced payroll, then only the direct deposit paycheck is needed to be deposited into Intuit before 5:00 PM PT, or also at least 2 banking days before the payment check date. Late direct deposit paychecks will limit your employees from receiving money on time, though, you will not be required any late processing fees. If you only make paper payment checks, you can make them on the same day they have their check date.

Note: Banking day refers to the banking working days (Monday to Friday) that do not occur on the Federal Reserve federal holiday, or a state or local holiday.

Here are the negative consequences of transmitting late payroll:

- It takes two banking days to post a direct deposit, so employees may not receive payment on time.

- If the filings were inaccurate, there could be a possible tax amendment, penalty, or interest. Fees, penalties, and interest payable will not be the responsibility of the intuit. You also may have to pay a service fee for filing an amendment.

- A late payroll processing fee will be evaluated for assisted payroll.

Table of Contents

Process Late Payroll In QuickBooks Desktop Payroll

Assumptions of not submitting direct deposit paychecks on time

Intuit and banks need at least 2 bank working days to process direct deposits. If not allowing 2 banking days indicates your employees will not receive payment on the check date. In many cases, the payment will display in the employee’s account 2 banking days after the payroll process. For example, if your check is dated for Friday, and you deposit directly to Intuit on Thursday, employees will not receive the money till the next banking working day (usually Monday).

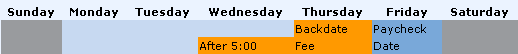

For Example: For Friday’s pay date, the paycheck must be sent to Intuit before 5:00 PM according to the Pacific Time zone on Wednesday. If you send a Payment check after 5:00 pm. Pacific time deadline is Wednesday or every time on Thursday or later, it is estimated late payroll because the day you transmitted paycheck and paycheck effective date was less than two banking days.

Note: Only for the Assisted Payroll Backdate fee is processed.

Sending late paychecks affects tax filings and payments

The effect of transmitting late payroll or recording a paycheck after pay is dependent on several factors, like:

- Your tax company and your tax payment regularity

- Whether you are processing the filing on your behalf or the Intuit is filing them for you (eg, if you are using the Assisted Payroll Service)

- Whether the late payment check is from a pre-filed quarter or the filing year (for example, you make a check-in July for a July payment date).

Because tax agencies calculate payments based on the date of the check, not the date of the payment period, a late paycheck usually results in late payments to state or federal agencies. Late payments can lead to agency notices, fees, penalties, and interest. Amendments may also be essential if tax filing is complete.

Important: Any fee, fine, or interest due to the agency will not be the responsibility of Intuit. Assisted payroll customers need to contact Intuit to process and file tax improvements. In failure to contact intuit could potentially void your service agreement with Intuit.

Conditions that qualify for payroll processing exceptions

- Termination Checks: Employers are often required to create a single day check for employees who are issued. Customers will not need to pay extra backdate fees if the below conditions are met:

- Payroll run employees have dates issued in their profile settings.

- The date of the check is not in the past (so it is the date today or tomorrow).

- Same-day pay: If an employee needs a paycheck for the same day and is not a released employee, consider using the payroll advance and repayment feature in QuickBooks Desktop.

- Payroll corrections: Some payroll errors can be adjusted or rectified on subsequent paychecks or through undetermined payroll.

- Performance-based pay: Some employees, like corporate executives, may receive a salary that is based on the company’s revenue or quarterly profit. Your accountant wants to wait till quarterly revenue is calculated to make a paycheck, and then ask you to date your delivery checks so that they fall at the end of the quarter or financial year. You have to work with your accountant to examine options to avoid making a paycheck after the expected sired payment date.

- Prior Quarter Payments: You may have to add a salary to an employee for work done in an earlier quarter. These payments require to be recorded in the quarter that they were taken which might occur in tax amendments. Please verify with your accountant to ensure that late processing or backdate payroll is required.

- Cash Flow: You are needed to backdate payroll checks due to cash flow problems. For assisted payroll, because to the two-business day processing needed to process payroll, you may need to examine other Intuit payroll offerings that enable you to process your payroll and tax filings.

Intuit will not charge waiving fees for late payroll processing for QuickBooks Desktop Payroll Assisted except it is due to an Intuit error or arranged in advance with Intuit.

How to find a late payroll processing fee in QuickBooks

For Assistant Payroll Only: You can get late payroll processing fees below the expenses tab on the QuickBooks Desktop Service Liability Check. There you will get payroll service fees.

What not to do if you can’t avoid getting paid late

It is essential not to do any of the following:

- Always remember not to give your employee a paper check with a date earlier than the date in the paper that you have sent to the Intuit.

- Do not allow a paycheck outside the payroll module. If you require to create a paycheck for an employee, always do so by the payroll module.

If you do not provide an accurate salary report for your employees, the information you send to Intuit will not meet the dates that the employees were paid. If you are directed to an audit through a government company, it can be recognized as tax fraud, despite intent, as it may seem like an try to evade payroll taxes. You may be subject to fines and interest for inaccurate or late filing and payment.

Hope this article will be helpful for you to process late payroll in QuickBooks Desktop Payroll. If you have an inescapable reason before doing so or have any issue regarding this topic, please contact the Intuit Certified ProAdvisors team by dialing our toll-free +1-844-405-0904 and get quick help for your query. We will help you with the method of making it as simple as possible for you. Our certified team of experts is 24*7 available with the assistance of customers.