If you come here to know how to write off bad debt in QuickBooks Online & Desktop, then surely you are in the right place. In this article, you can learn what bad debts are and how to write off bad debt in QuickBooks Online and Desktop. The article provides you detailed method with several steps to learn the write off bad debt along with the definition of the same to cater a better understanding. So, read the complete article and learn it, and in case you have any related trouble then let us know, call us toll-free: +1-844-405-0904

Table of Contents

What Is Bad Debt?

When a person or a company lends some amount of money to another business but for some reason, the borrower is not able to pay off that debt then the amount of money will fall under the category of bad debt.

By writing off the bad debt you can easily track this transaction and use it for tax purposes. For this, you need to create a different register for bad debts otherwise your regular register will become messy.

Overall bad debt is a terminology used when you sell goods on credit, but the customer has not paid the amount he has to pay you. This is known as bad debt or irresponsible expenses for the company.

In QuickBooks, it is very important to write off bad debt otherwise you may have to face issues during the bank reconciliation and it will also help in avoiding discrepancies and Profit/Loss statements.

Important Points to Know Before write off bad debts

Before starting the procedure of the bad debts in QuickBooks you should know some of the important points.

- Users can write off bad debts as deductions also.

- One of the main points is that you can get acquainted with all the different types of bad debts and unpaid invoices upon creating a bad debt account.

- To write off overpayments you can utilize QuickBooks accounting software.

Need to Write Off Bad Debts in QuickBooks

In an organization, if the amount that is supposed to be received from the customers fails to be recovered then that amount is known as bad debt. So it is necessary to write off the bad debts to track the profits get to know about accurate financial records and also get the tax benefits. It may complicated if you do write off bad debts manually so with the help of QuickBooks software you can do this conveniently. You don’t need to hire any expert accountant as QuickBooks is very user-friendly.

It is also needed due to the underpayments by your customer on the invoice. Due to under-payments, there is a gap in the total amount between the invoice and the payment you received so to get rid of this clerical error you need to write off bad debts.

How To Write Off Bad Debt in QuickBooks Online

It is a lot different to write off bad debt in QuickBooks Online than it was in the desktop version. So you need to follow every step carefully.

STEP 1: Check Account Receivable(A/R) aging report

- From the left side navigational panel select the ‘Reports’ option.

- Here find the Account Receivable(A/R) aging report.

- In the list select the invoice which should be written off as Bad Debt.

STEP 2: Create an Expense Account named ‘Bad Debt’

- Go to the ‘Settings’ and then ‘Chart of Accounts’.

- Now create an expense account from the New button.

- In the ‘Account type’ select expenses and in ‘Details type’ enter Bad Debt.

- Save and Close

STEP 3: Create an Item as Bad Debt

- For this again go to ‘Settings’ and this time select ‘Products and Services’.

- Then in the ‘New’ select ‘Non-Inventory’.

- Name item as ‘Bad Debt’.

- From the drop-down menu of Income account select ‘Bad Debt’.

- Save and Close

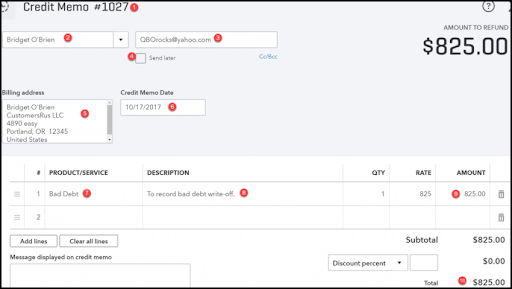

STEP 4: Create a Credit Memo for Bad Debt

- Click on the +New icon.

- Then in the Customer section select the ‘Credit Memo’.

- From the drop-down menu select the customer for whom you created as bad debt.

- In the ‘Products and Services’ select the item you previously created as bad debt.

- In the amount field, enter the amount of bad debt you want to write off.

- Save and Close

STEP 5: Apply Credit Memo to Invoice

- Click on the +New icon.

- Then select ‘Customers’ and after that click on the ‘Receive Payment’ option.

- Select the customer appropriate for a bad debt from the drop-down menu,

- From the ‘Outstanding transactions’ select the invoice you want to write off as bad debt.

- From the ‘Credit Section’, select the credit memo that you previously created in step 4.

- And at last Save and Close.

Once you’re done writing off the bad debts you can run a report to check all bad debts and unpaid invoices. For running a report click on the ‘Settings’ icon then ‘Chart of Account’ and after that in the Bad Debt column click on Run Report.

STEP 6: Run a Bad Debts Report

- First, you need to go to the settings option.

- After that move to the Chart of accounts.

- Now in the action column of the bad debts account, choose run report.

- Then go to the sales menu and then go for the customers.

- After completing the above steps you have to choose the customer’s name.

- Then go for edit and type in bad debt or No credit after the customer’s name.

- Now the final step is to click on Save.

How To Write Off Bad Debt In QuickBooks Desktop

Here are the simple steps to write off Bad Debt in QuickBooks Desktop. So follow them carefully to get the job done.

STEP 1: Create an Expense account named ‘Bad Debt’

- Go to ‘List’ in the top navigation bar and then select the ‘Company’ option.

- Now go to ‘Chart of Accounts’.

- To create a new expense account click on the ‘Account’ and then ‘New’.

- Now in new select ‘Expenses’.

- Type ‘Bad Debt’ in the ‘Account Name’ field and then ‘Save and Close’.

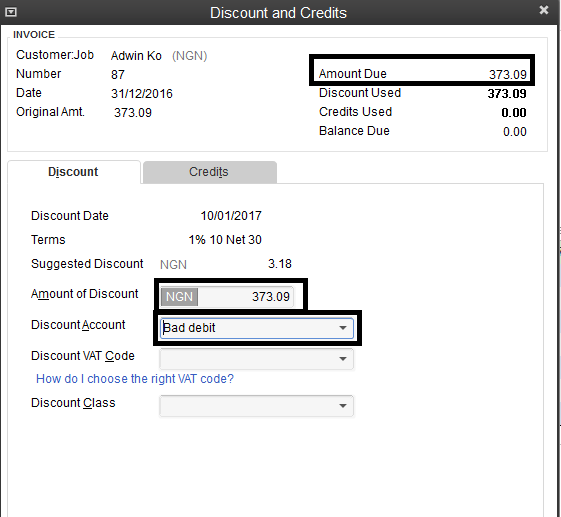

STEP 2: Record and Close the Bad Debt

- In the ‘Customer-Menu’ select the ‘Receive Payments’ option.

- Enter the Customer’s name in the ‘Receive From’ and $0.00 in the ‘Payment Amount’. (In the description you can write the Invoice number of the Bad Debt for tracking.)

- Next select ‘Discount and Credits’.

- Enter the amount of bad debt you want to write off in the ‘Amount of Discount’ field.

- In the ‘Discount Account’ select the Bad Debt account you’ve created in step 1.

- ‘Save and Close’

Frequently Asked Questions (FAQs)

Can cash basis taxpayers write off the bad debts?

No, Cash basis taxpayers cannot claim the bad debt deduction for the uncollectible amount.

How a bad debt is shown on the balance sheet?

Bad debt is charged as an expense on the balance sheet and the result of this is an asset reduction as the same amount as debt.

Even though we try to simplify the process of how to write off bad debt in QuickBooks Desktop & Online but it could be tricky for some users to perform.

Since it is related to the profit and loss of the company and you shouldn’t be taking any chances therefore for helping you we offer our service of QuickBooks ProAdvisor. They are certified as well as experienced technicians who can easily solve any issue related to QuickBooks software. Get in touch with us via our 24/7 toll-free support number +1-844-405-0904.