In QuickBooks, creating and paying child support garnishment is an important thing. Most users get confused about this. So, our QuickBooks customer support service team has tried to discuss key facts for support garnishments. So, don’t waste the time anymore and go through the article to understand the important points and follow the steps mentioned in the article to create or pay child support garnishment. You can also get help from a certified Intuit expert toll-free: +1-844-405-0904

Two common types of garnishments are child support orders and government tax levies. Child Support is a post-tax deduction from the employee’s paycheck. In a Child Support Deduction, it is possible that you will have more than one employee. It is not important to have employee special liability accounts on your Chart of Accounts in child support. In this, It is good to have employee special deduction items in your Payroll Item list.

Points to Remember about Child Support Garnishment

- Child support garnishment is a tax amount that is deducted from the employee’s bank check.

- It is possible for one employee to have more than one support garnishment.

- The Payroll item list also includes the deduction done for the employees.

- For employer, it is not mandatory to include the liabilities of each employees in the chart of accounts.

How to Set Up Child Support in QuickBooks?

- At very first, click on the Lists menu and later go to the Payroll Item

- Later, go to New.

- Next, you need to select EZ Setup or Customer Setup according to your requirements and click on Next.

- You have to select the Deduction option and later select Next.

- later, you need to assign a name to the payroll deduction, for example, Child Support Smith for employee Bob Smith, and then select the Next.

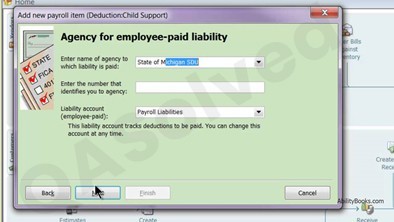

- Now, add the name of the agency for the liability that needs to be paid. If you are not sure about the agency name, you can add it later and click on Next.

- Go to the Tax Tracking Type drop-down, and click on it.

- Here, you need to select the None option and later go to Next.

- Now, you will see a Default Taxes window will appear on your screen, you have to select Next.

- Be sure that you choose ‘Net to calculate amount after taxes’ from the Gross vs Net window.

- It will calculate the deduction before taxes.

- When you click on gross, then insert the Default Rate and Limit.

- Add a percentage or decimal sign accordingly.

- Now, you need to add a percentage or decimal sign accordingly.

- At last, you need to click on Finish.

Setting Up Child Support Garnishment in the Employee Record

- Very first, go to the Employees drop-down menu and click on it.

- Later, you need to click on the Employees Center

- Next, give double-click on the Employees Name and click on the Payroll Info

- You will see a blank area below the Item Name, select it and later click on garnishment items.

- You need to click on the Additions, Deductions & Company Contributions

- You have to enter the deducted amount in the Amount Field.

Steps to Setup a Liability Payment Schedule

- At the very first, go to the Employees and click on it.

- Next, you need to click on Payroll Taxes and Liabilities and later go to Edit Payment Dues/ Methods.

- Once your payroll set-up window has appeared on your screen, you need to click on “review your scheduled tax payment lists”.

- Next, go to Continue.

- A message will have appeared: “add or edit scheduled payments for benefits and other payments”, you have to click on Continue.

- Now, you will view the Child Support or other wage garnishments on another window and next click on Edit.

- A new window will arrive on your screen, now you have to select the payment frequency.

- Last, you need to shut down the payroll setup window and go to the Finish