How much does it cost a company to use direct deposit? Is QuickBooks direct deposit free? What is the fee for direct deposit in QuickBooks? For such information related to this query read the complete article and get all your answers in a single place. If you need any suggestions then contact our QuickBooks ProAdvisor, and They will definitely help you to get information about your account and also check the fees to enable direct deposit in QuickBooks. +1-844-405-0904

Table of Contents

What is a Direct Deposit

Before learning about the cost of doing a direct deposit through QuickBooks, it is important to know what is a direct deposit. Let’s take a look at its definition.

It is always a reason to celebrate when payday is around, and you don’t even have to lift a finger to receive your money. No need to take your paycheck to the bank and deposit it with a teller if you’re using direct deposits.

Direct deposit provides an easy way to access your money via electronic funds transfer directly into your bank account. Direct deposit is commonly used with employee paychecks, hence it is also a convenient way to receive tax refunds, social security, unemployment pay, and stimulus checks. Direct deposit has become continuously popular in the digital age and electronic payments.

In simple words, direct deposit refers to the electronic transfer of funds directly into a bank account rather than using a physical check. It is possible by using an electronic network named “Automated Clearing House” (ACH) which provides facilities to make digital deposits between banks.

When a Direct Deposit is used

Direct deposit is used in different scenarios. It is most commonly used for employee paychecks, and also used to receive federal funds from a tax refund, unemployment benefits, or stimulus checks. Let’s understand how it is used in each of the scenarios.

Employee Pay

Most of the American employers use direct deposits to pay their employees. For employers, direct deposit is available at lower costs and higher convenience and for employees, direct deposit makes payday just like a breeze, which means the funds you earned simply appear in your account.

Tax Refunds

Due to the more secure and streamlined process of direct deposit, the U.S. government prefers to pay citizens through direct deposit rather than physical checks. If you’re owed a tax refund and setting up a direct deposit with IRS, it makes the transfer quick and simple.

Stimulus Checks

As a part of the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act, the U.S. government provides emergency assistance stimulus checks to the citizens. According to IRS.gov, citizens who opted for IRS’ direct deposit program received these checks in their bank account on their tax return.

After learning about direct deposit and its uses, let’s go to the cost of direct deposit in QuickBooks.

The QuickBooks Direct Deposit Cost varies depending on your payroll subscription. You don’t need to pull up your account to check your payroll subscription.

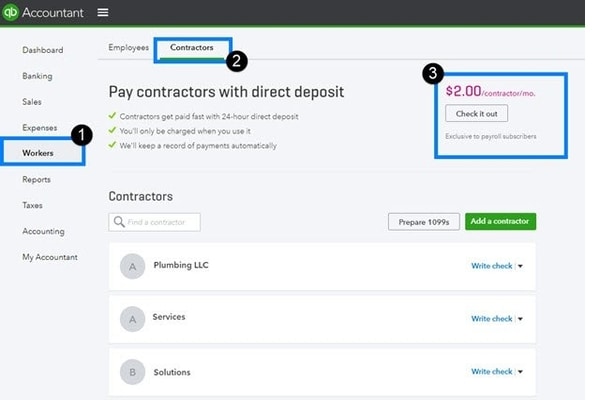

QuickBooks Direct Deposit Cost

If you are using the QuickBooks Enhanced Payroll for Unlimited Employees subscription, $1.75 QuickBooks direct deposit fees for each transaction created for W-2 employees or a 1099 contractor. The fees will not include in the base subscription charge, you only received the bill the moment you process DD checks in QuickBooks.

But with the new payroll subscription which is currently offered by Intuit, there is no limit to the number of users you can add to QuickBooks. But additional fees may apply to the number of employees you can process payroll at a given month period. Check out the given below the list:

- Basic: $2.00/Employee per month.

- Standard: No charge for adding employees.

- Enhanced: $2.00/employee per month.

- Enhanced for Accountants: No charge for adding employees

- Assisted: $2.00/ Employee per payroll.

To check your payroll service, follow the steps below:

- Select the Employees menu.

- And choose My Payroll Service.

- Choose Manage Service Key.

- Select the Service Name segment and check your current subscription.

If you want to know more about your payroll billing, it will be best for you to consult the payroll team. And they provide you with depth details about the billing.

To contact support:

- Press F1 or click on the Help menu in QuickBooks.

- Select QuickBooks Desktop Help to search for your answer.

- And click on the Contact Us option.

Some points about Quickbooks payroll direct deposit fees are mentioned in the service agreement of QB Desktop Direct Deposit Service.

What fees apply to exception processing in the Direct Deposit payroll service?

Applicable fees to exception processing

Uncollectable Funds: If any electronic payment transaction returns to Intuit because of insufficient or uncollectable funds, you will be charged an exception processing fee of $100, which is due by 2 pm PT on the day Intuit notify you. In the event of an e-payment funding shortfall, your payroll and tax liabilities may not be paid on time or at all, and Intuit will take no liability.

ACH returns for invalid account numbers: If by chance direct deposit to an employee’s account is returned due to an invalid account number, then you will be charged by Intuit to return the funds to your company account for a processing fee of $25.00 per transaction.

Corrected tax returns: If you face any error to your account setup, and you are required to file corrected tax returns, then intuit will prepare these returns for a fee of $200.00 per return. In the event of a calculation or reporting error by Intuit service, the fee will be waived.

QuickBooks Direct Deposit service agreement

When you do sign up for QuickBooks Direct Deposit cost, you must have to sign in to some service agreement that shows the terms of service. This article helps you to know all about the basic terms related to limitations and fees in the agreement without going to the legal level covered that all in the actual Service agreement about QuickBooks direct deposit fees.

This description is intended to give you easy to read an overview of what you know to agree in the Service agreement regarding QuickBooks direct deposit cost.

Transactions that take place after certain processing deadlines may be considered to occur on the next business day.

Limitations and special fees

Be aware of the following limitations and special fees with respect to your use of the Direct Deposit service:

- You are eligible to use the services only for paycheck direct deposits.

- Internet access to connect with the service isn’t included, nor is advice about deductions or direct deposit to employees

- Intuit establish certain security limits on transactions they provided and also may change these limits from time to time, and choose not to disclose them.

- Some of the services affect the capabilities of the QuickBooks Desktop.

- The service operators cooperate with the version of the QuickBooks Desktop. Sometimes you may need to purchase and install updates and upgrades( you can also allow Intuit to install them automatically) to continue taking the service. Some of the updates and upgrades require fees or a reduced cost.

- Some special processing requests may also be available with the service as an option for an additional charge.

- Some of the transactions require special processing fees.

Conditions governing ACH transactions

After signing up for Direct Deposit, you need to agree to the following conditions:

- First, your transaction will be governed by ACH (Automated Clearing House) rules

- The origination of ACH transactions to your account will comply with applicable provisions of U.S. law

- Intuit warrants as an ACH Originator you must warrant to Intuit everything.

- Intuit may acquire as a result of your transactions for the liability that you accept.

- If get any account number or other information provided through Intuit concerning your transactions has changed, so you must have to use this corrected information for Intuit’s future transactions.

Authorizations you grant

Just because Direct Deposit is an automated service, then you must have granted the following authorizations when you sign up:

- You give the authority to Intuit to initiate debit entries in your account.

- You can also give the authority to Intuit to collect any sales tax, use tax, or other taxes payable on the service in the same way you do your payment.

- You authorize Intuit to send transactions online or any other commercial accept method, to the relevant financial institution.

- You are able to give the authority to the financial institution that holds your bank account to charge each debit to your account and pay that amount to Intuit.

- You can authorize or direct the financial institution. That operates your account to respond to queries from Intuit related to your information and your account.

All these authorities and permissions will remain in full control and effect. Until Intuit doesn’t receive any termination notification from you. The time of notification must be supportable to Intuit and the financial institution a reasonable probability to act on it.

How the Direct Deposit service works

Following is the list of the Direct deposit service process:

- In QuickBooks Desktop, you can do electronic withdrawals from the account you know in order to fund the direct deposit paychecks to your employees.

- Intuit may use wire draw-down requests or other funding methods in some cases. Debits are initiated to pay fees for the service and any adjustments to those fees.

- You do the payments online over the internet called a “transaction”.

- After completing the transaction Intuit confirms that we received the payment. If you don’t receive the confirmation before the session is over, then your transactions may not be processed. On the other hand, if you receive the confirmation. It doesn’t guarantee that the transaction is error-free. It will search for an error later and if the transaction does not get completed. Still, Intuit finds the reason for the error and tells you the reason why your transactions can’t be completed.

That’s all in this article. We hope it was helpful for you.