Want to know the details of SUI tax rates? how do changes in basic, enhanced, or standard payroll? In this article, all your questions will get their answers, Read the article to know what is SUI tax rate is, important facts about the SUI tax rate, and the steps to change SUI tax rates. Go through the article to get all your queries resolved and learn to change in basic, enhanced, or standard payroll in simple steps with ease. Still, having an issue then contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

SUI Tax rates are only paid by the employers (unless the State specifies that the workers need to contribute too) and this is not a part of your tax table, the rate needs to be updated in the QuickBooks Payroll system. This article covers how to change SUI tax rates for basic, enhanced, or standard payroll.

For a variety of reasons, the State changes these SUI rates now and then. The state has a right to change the rate, a surcharge, or any other assessment items at any time, and this requires to be updated immediately in the QuickBooks software to accommodate correct calculations. As per the SUI requirements, It’s easy to change or update the QuickBooks software.

Table of Contents

What is the SUI tax rate?

SUI stands for the State unemployment insurance rate. The SUI is an employer-funded tax that provides short-term benefits to those employees who lost or left their jobs for a variety of reasons. Read in detail about state unemployment taxes here.

Important Facts About SUI Tax Rates

- SUI tax rates are important to your business and are issued by your state.

- SUI rate is not a part of the tax table update and critical that you type your current rate in QuickBooks Desktop.

- It is paid only by the employer unless you are in a state that requires workers to contribute.

- The SUI wage base limit is updated by the tax table according to your state’s requirements and cannot be manually modified.

- Most states update their SUI rates at the beginning of the year, while others like New Jersey, Vermont, and Tennessee, update their rates in the third quarter of the year.

The majority of states attach a surcharge or assessment to state unemployment. To ensure that you type the correct percentage rate for the SUI portion:

- Compare the breakdown of the rate on your notice with a sample copy for your state.

- If your state attaches an assessment or surcharge item, update the rate for that payroll item in QuickBooks.

Know more: Some specific details about how many workers and who are eligible for benefits are determined by individual states. while the FSUI(federal-state unemployment insurance) program operates under federal guidelines. both the federal and state payroll taxes provide the funding for the program. after the Federal Unemployment Tax Act, the federal taxes are called FUTA, and state taxes mainly go by the abbreviation SUI. In most states, only employers pay SUI taxes and only employers pay FUTA tax. however, New Jersey, Alaska, and Pennsylvania require emp. to contribute to the SUI fund.

Steps to change SUI tax rates in QuickBooks Desktop

- First of all, select Lists and then click the Payroll Item List.

- After that, double-click the SUI tax item, which is typically named: [state abbreviation] – unemployment company.

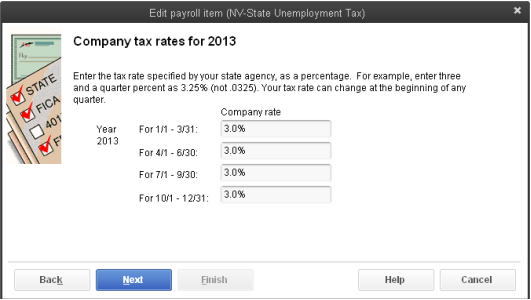

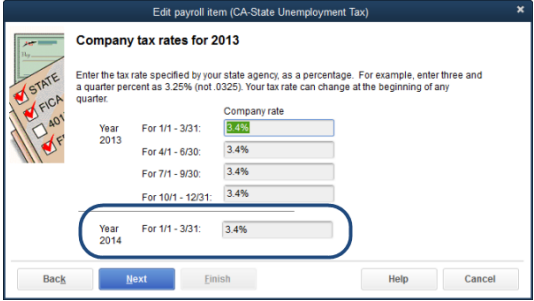

- After that, click the Next button and then click Next to Company tax rates for[year], and then type the correct rates for each quarter.

If your system date is between 7/1 and 1/1 you will also be capable of including the rate for the first quarter of the following year.

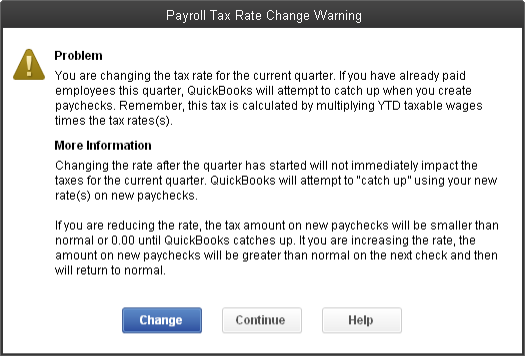

- After you enter the correct rates, you may get a message to Payroll Tax Rate Change Warning and then click Continue. Your SUI rates are updated.

- Click Next once and then click to clear any compensation items that are not subject to your SUI tax.

- At last, click Next and then click Finish.

If you want to modify SUI wage bases and sums reported for your workers, set up a Payroll report to regulate these numbers. See the steps below:

- First of all, click Reports then click Employees and Payroll, and then Payroll Item Detail.

- After that, set the date to see each specific quarter.

- Click Customize Report button and choose the following:

- Date

- Source Name

- Payroll Item

- Wage Base

- Amount

- Click the Filters, Then choose Payroll Item from the list.

- Click below to the payroll item and choose your state unemployment item.

- Look at the total wage bases column for the SUI and multiply it by your present rate.

- Match results with sums calculated.

If you have workers who are over or under-collected for SUI, then you can set up rectifying positive or negative liability adjustments for the influenced worker and influenced quarter.

How do you find out the SUI rate?

- If you don’t know your rate, we’ll set it for now to the highest, most conservative rate (6.74%).

- You can See the latest tax rate notice (Form UC-216) sent by the Department of Labor

- We will remind you later what you need to find out your rate and change it.

- If you are a new employer, they will set your state unemployment insurance (SUI) rate to the standard new employer rate (2.70%) set by the Alabama Department of Labor.

- See your Quarterly Contribution and Wage Report (Form UC-CR4

Steps to Set up an SUI Payroll Report

- Go to the REPORTS and choose Employees and Payroll to modify SUI.

- Select the payroll item detail.

- On the accounts, the detail page sets the dates to check a particular quarter.

- Choose the Customize Report tab, and click on the Date, source name, payroll item, wage base, and amount.

- Go to the Filters under the Filter option and payroll item, and click on payroll item.

- Choose the state unemployment option, review the total wage base column for SUI, and multiply it by the present SUI rate.

- Now, match the results to the sum calculated.

Steps to Update your State Unemployment Insurance Rate in QuickBooks Online Payroll

Your SUI is always decided by your state. For new employers, the state offers a new employer rate until the unemployment taxes are filed for a specific period. But if there are any changes in the SUI rate then you have to adjust the payroll. So here we’ll discuss how to adjust the payroll after getting a new SUI rate:

- The first step you need to open the QuickBooks and log in to it.

- After that go to the gear icon that is settings and then choose payroll settings.

- Now you must choose the edit option for the state you need to edit.

- Next, go to the SUI setup section where you need to select Change or Add New Rate.

- Now in the next step, you have to enter the day you begin with the new rate. In most of the state, the date is January 1st except in Tennessee and New Jersey.

- If you you created paychecks with the incorrect rate or want to change the previous quarter’s rate then contact the QuickBooks support team.

Steps for verifying the accuracy of payroll items utilized on the Employee paycheck

- For this, you have to go to the lists and then choose payroll items.

- Now you have to choose the additions, deductions, and company contribution which is shown in your paychecks.

- After that, you need to choose Next to open the tax tracking type window.

- Then Tax tracking type determines every payroll item’s taxability and your tax returns.

- Then next you have to check the description. And if you are not sure about the tax tracking type then you can contact and take advice from your accountant or the tax counselor.

- You have to edit if the wrong tax tracking type of payroll item is selected and becomes inactive.

Hope, you will understand the concept of SUI tax rates and the different steps to change SUI for a basic, enhanced, or standard payroll. But after reading the above steps if you still need further technical support for your QuickBooks or any other issue, you can directly call us at +1-844-405-0904 and directly discuss your issues with our Intuit Certified ProAdvisor and get quick solutions.