Here in this article, we will discuss why we need undeposited funds to the account and how to use the undeposited funds account in QuickBooks Online to receive payments. An undeposited fund account is a unique account that QuickBooks uses to hold invoice payments before you deposit that payment into the bank. Here in this article, we have provided all the relevant details to go through and learn them. Still, if you need QuickBooks payment support for further support then dial the toll-free number +1-855-525-4247.

An undeposited fund account is a unique account that QuickBooks uses to hold invoice payments before you deposit that payment into the bank. This workflow is particularly relevant for those QuickBooks users who are not processing transactions by QuickBooks Payments and also do not import payment data from external processing services.

Other Useful Resources:

Why should we need to use an Undeposited Funds QuickBooks Online?

The undeposited fund account is an “other current asset account” and designed by QuickBooks Desktop to hold funds until you are ready to deposit them. It is just like a short-term account or secure lock where you hold payments until you are ready to take them to the bank.

When you receive payment from an invoice, the undefined fund account acts as the default “deposit” account, uses the payment item on the invoice, or enters a sales receipt. This account is created to operate with both receive payments and bank deposit features to perform the invoicing process. This means that if your bank has entered a set of payments in the form of a single deposit, you should do the same in QuickBooks.

The workflow of Undeposited funds:

- Send Invoice

- Receive Payment in Undeposited funds

- Bank Deposit

For Single Payment:

If you have a single invoice payment, then you can miss the undeposited fund process and directly deposit your received payments into your checking accounts(savings, or credit card), as long as it is processed payments. Bank details will appear on your account. When skipping the intermediary step, you have to save a few extra clicks, knowing how and when to use each workflow can be confusing – each time it can be easier to miss a workflow and use the undeposited fund process is.

It may be a few extra clicks, but you will know that you are always “doing it right.” Taking a few moments to track payments through an undeposited fund account can prevent major difficulties during your monthly reconciliation when the details of each transaction are not fresh in your mind.

For Grouped Payments:

When you are working with grouped payments, it becomes very easy to manage transactions using the Undeposited Funds account to receive payments.

Suppose that you had three different invoices that were paid at once from a customer. And your bank manages your checking account and identifies all three payments as a deposit. When you enter these in QuickBooks, you want to copy the bank and add the deposit to your QuickBooks checking account. But how do you group them?

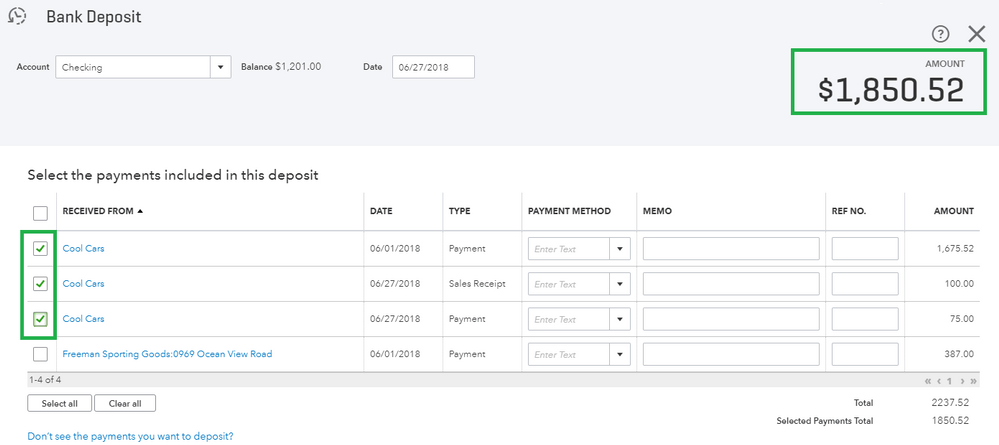

That’s the reason for “undeposited funds”. In the following example, I received multiple payments of invoices and sales receipts from the same customer that are in my undeposited fund’s account.

When the time has come to make my bank deposit, all three payments are waiting in the “Select the payments included in this deposit” section that is hard-wired to the undeposited fund’s account. Here, choose all three and group payments into a single deposit. When I consolidate my QuickBooks accounts with my bank statement. At the end of the month, the bank statement of my transaction amount will match accurately with the amount in QuickBooks.

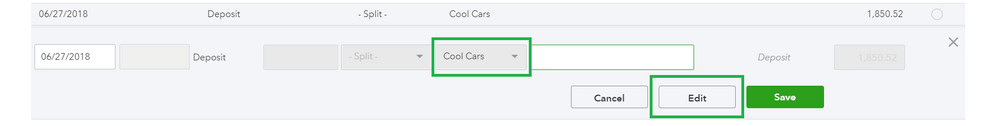

If you want to edit to make a deposit to the bank (and send the payment back to the undefined fund), then simply go to the Edit and redistribute the deposit.

This is for illustration only, but when you clicked edit on reconciliation and finished one of the three payments. Once you click on Save, you can see the new correct amount.

Steps to use the Undeposited Funds Account in QuickBooks Online

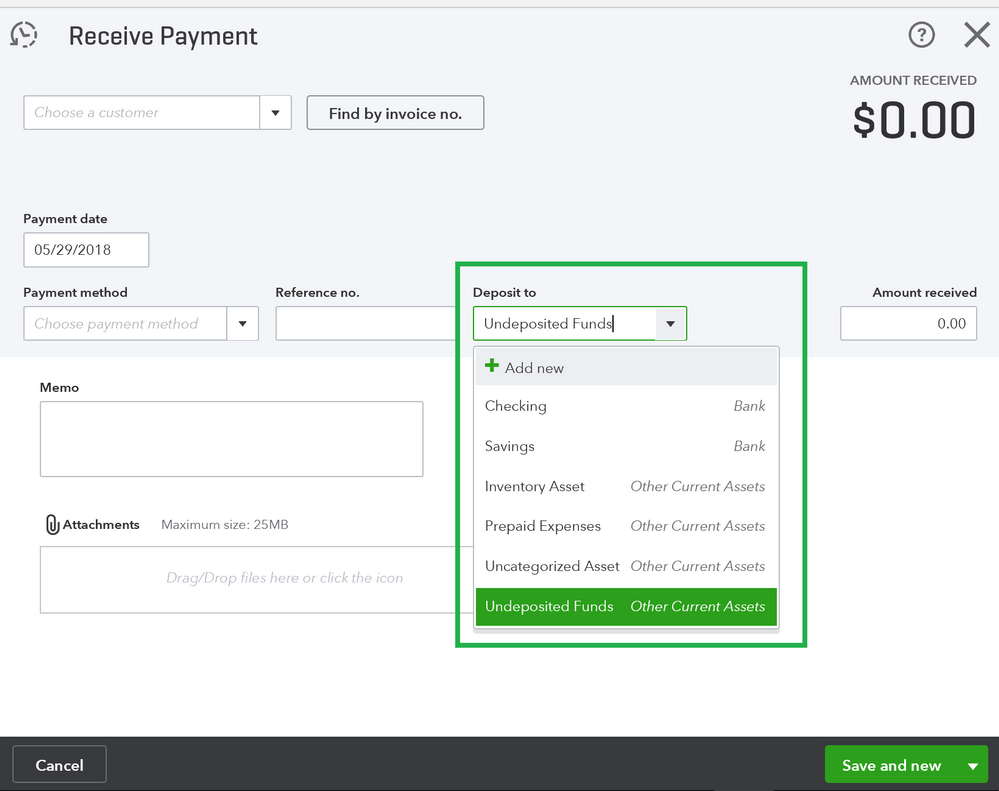

When you receive your first invoice payment or file a sales receipt, your undefined fund account is set as your default “deposit” account. Always keep in mind to cross-check the “Deposit” account before performing any transaction.

- Once you are paid for an invoice and are receiving payments, click the () icon and choose the payment received.

- From the drop-down menu choose the customer

- Later, Choose the payment method and confirm the received amount.

- You can also change this money to “deposit” before depositing it to the bank by selecting a different account from the drop-down menu, but remember this to work with the bank deposit facility

- If you only want to deposit a single payment directly to your checking account then here your work is finished and the invoice is processed.

- After getting the payment in your undeposited fund account, your need to deposit the money in the bank and close the invoice.

Hope this article will help you to understand about undeposited funds accounts and also how to use undeposited funds account in QuickBooks Online to receive payments. In case after reading these following steps if you are facing any issue then feel free to contact us on +1-855-525-4247 and have a one-to-one talk with our intuit certified ProAdvisor team and get the quick solution to your problem.