Looking for how to download, install, & verify QB payroll tax tables? Then the article is here to cater to you with all the information related to these topics, read the whole article to understand the steps to download, to know about disk delivery service to verify the payroll tables, and many more. This article will help you how to install, download, and verify the software with easy steps. We will also provide the information about Quickbooks payroll update 2023 Canada. Go through the article and follow the details to perform all these actions. For more info contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

QuickBooks Payroll Tax Tables is a chart we will give you complete knowledge of this chart. Sometimes, downloading, installing, and verifying QB Payroll Tax Table can be a very difficult task.

Table of Contents

QuickBooks Payroll Tax Tables

First, we define what exactly QB payroll tax tables are. A payroll tax table is a chart that is characteristic of different columns, helping to figure out the suitable taxes to be withheld from the employee’s paycheck.

The withholding taxes are affected by several factors such as the income sum, whether the worker is unmarried or married, and the schedule by which the worker is paid whether bi-weekly or monthly.

Important Points to remember:

Requirements are given below for QuickBooks Payroll Tax Tables Downloads, Install and Verify:

- In order to update your tax table within QuickBooks Desktop, you must have an active payroll subscription.

- Intuit recommends that you download your tax table every time you pay employees or at least every 45 days.

- To receive payroll tax table updates automatically as soon as they get released, turn on the automatic updates feature in QuickBooks Desktop.

Steps to Download QuickBooks Payroll Tax Table

Perform these steps to complete the process. If you are willing to hire our QuickBooks support team, give us a call at +1-844-405-0904.

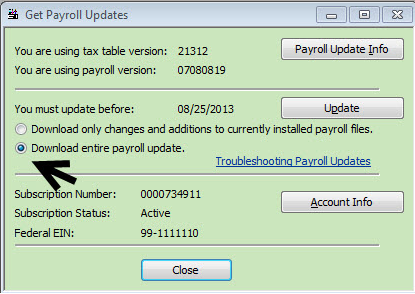

- First of all, click Employees and then get Payroll Updates.

- After that, click to choose Download the entire payroll update.

- Choose Update.

- When the download is finished, a pop-up message will appear “A New tax table and updates to your payroll tax forms have been installed on your Desktop. Click OK to read about the modification.” Click OK.

Disk Delivery Service: To Install a payroll tax update from a CD

- First of all, you have to insert the Payroll Update CD.

- After that, open the get payroll updates.

- QuickBooks Desktop Pro and Premier: Select Employees and then get payroll updates.

- In the Install Payroll Update window, if you are prompted to locate the update.dat or data file, respond to the prompts.

- Click Browse.

- In the install from the window, select the CD drive from the Look in the drop-down arrow.

- Choose the date either or update3.dat from the Payroll Update Disk and then click Open.

- Now, you need to select between update.dat or update3.dat from the payroll Update Disk.

- Tap Open.

- Then move on to the Payroll Update window, and tap on OK.

Note: If you receive the pop-up message stating “File Not Found” check your CD drive:

- First of all, close QuickBooks Desktop and then click the Windows Start button, and then choose Computer or My Computer.

- After that, right-click the CD drive and then choose, If you cannot see the files, test the CD on a second desktop. If you can see the files on the second desktop, you have a hardware problem with the CD drive on the first desktop.

If you can’t see the files on both desktops, then orders a new payroll update disk by visiting our Support site, then choose Payroll and click View Contact info.

How to verify the QuickBooks Payroll Tax Tables

- In the Install Confirmation window, verify that you are installing the correct location and that the tax table versions in the Current and New fields are correct.

- Click When the update is finished or a message appears like “ A new tax table has been installed on your desktop.

- Click OK to read about the modification.”

- If the tax table version has not been modified, a pop-up appears as “You have successfully installed payroll update.”

How to download the latest QuickBooks payroll tax tables updated

Payroll tax table update provided by QuickBooks Desktop with the most current and accurate rates and calculations for Supported provincial and federal tax tables, Payroll Tax forms, and e-file options.

- Firstly you need to go to the Employee section.

- Now select Get payroll updates.

- To check your tax table version

- You have to click on you are using tax table version and check the number which shows the version you are using.

- To identify the latest version, or identify the correct version you have to check the latest news about the QuickBooks payroll update.

- Now select the Payroll update info for getting the details of the tax table version.

- To get the tax table version

- Choose “Download entire update“.

- The information window is open after completing the download, then select Update.

- To check your tax table version

What’s new in Payroll Update 22302 (Jan 12, 2023)

Let’s discuss the new update and new functionalities in payroll update 22302

Tax Table Update: This tax table covers a new tax tracking type to track employer liabilities for paid credit leaves. The wage limit for state unemployment insurance is increased for Alaska and Hawaii and the withholding table is effective from 01/01/2023.

Forms Update: In this payroll update, there are no form updates.

e-File and Pay Update: The Iowa State W-2, Wage, Tax Statements, and State E-file, have been updated.

Note: Earlier, if you do not enable Auto-Update then close and re-open QuickBooks after downloading tax table updates to accomplish the installation process.

Find out recent payroll updates according to your version

For a full overview of the current payroll update, choose your product year from the list below:

- QuickBooks Desktop 2023

- QuickBooks Desktop 2020

- QuickBooks Desktop 2019

- QuickBooks Desktop 2018

- QuickBooks Desktop 2017

The latest version and how do I check if I have it?

To check which version you have,

- In QB, First, go to the Employees menu, then select My Payroll Services, then Tax Table Information.

- The first 3 number reflects your tax table version in “You are using Tax table version” and should read 108.

Important Note: Need to manually enter their provincial TD1 amounts in QBD, If you have employees in Nova Scotia.

Steps to get the latest payroll tax table update

You need an active payroll subscription to update your tax table, you need an active payroll subscription. We suggest you update your tax table every time when you pay your employees. Follow the below steps to stay updated with the QuickBooks payroll tax table

Download the latest tax table in QuickBooks Desktop

Tip: Turn on automatic updates in QuickBooks to update the payroll tax table automatically.

- First, go to the Employees’ menu

- Choose Get Payroll Updates.

- Choose the Download Entire Update checkbox.

- Click on Download Latest Update. A window displays automatically when the download is complete.

Install the latest tax table from a CD

If you use Disk Delivery Service, follow these steps. If you already set your service keys, go to step 2.

Step 1: Enter your service and disk delivery keys

If you do not have your service key, use the Automatic Service and Disk Delivery Key Tools. Sign in with your Intuit account login.

- First, open the Employees menu.

- Choose Payroll.

- Insert Payroll Service Key.

- Choose to Add on the QuickBooks Service Sign-Up screen.

- Insert your Service Key, and choose Next.

- Insert your Desk Delivery Key, and choose Next.

Step 2: Install the update from the CD

- Enter the Payroll Update CD into your CD drive then after go to the Employees menu

- Choose Get Payroll Updates.

- Choose Install Update from Disk.

- Click on Install.

Important: QuickBooks Disk Delivery customers receive updates on CDs via mail. We suggest that you download and install payroll updates if you have internet access.

View the Current and historical TD1, CPP & EI amounts

TD1 Amounts:

| Effective date | 7/1/2018 | 1/1/2018 | 7/1/2017 | 1/1/2017 | 7/1/2016 | 1/1/2016 | 7/01/2015 | 1/1/2015 |

| Tax table version # | 108 | 107 | 106 | 105 | 104 | 103 | 101 | 100 |

| TD1 Amounts | ||||||||

| Federal | 11,809 | 11,809 | 11,635 | 11,635 | 11,474 | 11,474 | 11,327 | 11,327 |

| AB | 18,915 | 18,915 | 18,690 | 18,690 | 18,451 | 18,451 | 18,214 | 18,214 |

| BC | 10,412 | 10,412 | 10,208 | 10,208 | 10,027 | 10,027 | 9,938 | 9,938 |

| MB | 9,382 | 9,382 | 9,271 | 9,271 | 9,134 | 9,134 | 9,134 | 9,134 |

| NB | 10,043 | 10,043 | 9,895 | 9,895 | 9,758 | 9,758 | 9,633 | 9,633 |

| NL | 9,247 | 9,247 | 8,978 | 8,978 | 8,802 | 8,802 | 8,767 | 8,767 |

| NT | 14,492 | 14,492 | 14,278 | 14,278 | 14,081 | 14,081 | 13,900 | 13,900 |

| NU | 13,325 | 13,325 | 13,128 | 13,128 | 12,947 | 12,947 | 12,781 | 12,781 |

| ON | 10,354 | 10,354 | 10,171 | 10,171 | 10,011 | 10,011 | 9,863 | 9,863 |

| PE | 9,160 | 8,160 | 8,320 | 8,000 | 8,292 | 7,708 | 7,708 | 7,708 |

| QC | 15,012 | 15,012 | 11,635 | 11,635 | 11,550 | 11,550 | 11,425 | 11,425 |

| SK | 16,065 | 16,065 | 16,065 | 16,065 | 15,843 | 15,843 | 15,639 | 15,639 |

| YT | 11,809 | 11,809 | 11,635 | 11,635 | 11,474 | 11,474 | 11,327 | 11,327 |

| ZZ (employees outside Canada) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Canada Pension Plan (CPP)

| Effective date | 7/1/2018 | 1/1/2018 | 7/1/2017 | 1/1/2017 | 7/1/2016 | 1/1/2016 | 7/01/2015 | 1/1/2015 |

| Tax table version # | 108 | 107 | 106 | 105 | 104 | 103 | 101 | 100 |

| Canada Pension Plan (CPP) – outside Québec | ||||||||

| Maximum Pensionable Earnings | 55,900 | 55,900 | 55,300 | 55,300 | 54,900 | 54,900 | 53,600 | 53,600 |

| Basic Exemption | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 |

| Contribution Rate | 4.95% | 4.95% | 4.95% | 4.95% | 4.95% | 4.95% | 4.95% | 4.95% |

| Maximum Contribution (EE) | 2,593.80 | 2,593.80 | 2,564.10 | 2,564.10 | 2,544.30 | 2,544.30 | 2,479.95 | 2,479.95 |

| Maximum Contribution (ER) | 2,593.80 | 2,593.80 | 2,564.10 | 2,564.10 | 2,544.30 | 2,544.30 | 2,479.95 | 2,479.95 |

EI amounts:

| Employment Insurance (EI) – outside Québec | ||||||||

| Maximum Insurable Earnings | 51,700 | 51,700 | 51,300 | 51,300 | 50,800 | 50,800 | 49,500 | 49,500 |

| Premium EI Rate (EE) | 1.66% | 1.66% | 1.63% | 1.63% | 1.88% | 1.88% | 1.88% | 1.88% |

| Premium EI Rate (ER) (1.4*EE) | 2.62% | 2.62% | 2.62% | 2.62% | 2.62% | 2.62% | 2.62% | 2.62% |

| Maximum Premium (EE) | 858.22 | 858.22 | 836.19 | 836.19 | 955.04 | 955.04 | 930.60 | 930.60 |

| Maximum Premium (ER) (1.4*EE) | 1,201.51 | 1,201.51 | 1,170.67 | 1,170.67 | 1,337.06 | 1,337.06 | 1,302.84 | 1,302.84 |

Québec Pension Plan (QPP)

| Effective date | 7/1/2018 | 1/1/2018 | 7/1/2017 | 1/1/2017 | 7/1/2016 | 1/1/2016 | 7/01/2015 | 1/1/2015 |

| Tax table version # | 108 | 107 | 106 | 105 | 104 | 103 | 101 | 100 |

| Québec Pension Plan (QPP) | ||||||||

| Maximum Pensionable Earnings | 55,900 | 55,900 | 55,300 | 55,300 | 54,900 | 54,900 | 53,600 | 53,600 |

| Basic Exemption | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 | 3,500 |

| Contribution Rate | 5.40% | 5.40% | 5.40% | 5.40% | 5.33% | 5.33% | 5.25% | 5.25% |

| Maximum Contribution (EE) | 2,829.60 | 2,829.60 | 2,797.20 | 2,797.20 | 2,737.05 | 2,737.05 | 2,630.25 | 2,630.25 |

| Maximum Contribution (ER) | 2,829.60 | 2,829.60 | 2,797.20 | 2,797.20 | 2,737.05 | 2,737.05 | 2,630.25 | 2,630.25 |

| Employment Insurance (EI) – Québec only | ||||||||

| Maximum Insurable Earnings | 51,700 | 51,700 | 51,300 | 51,300 | 50,800 | 50,800 | 49,500 | 49,500 |

| Premium EI Rate (EE) | 1.30% | 1.30% | 1.27% | 1.27% | 1.52% | 1.52% | 1.54% | 1.54% |

| Premium EI Rate (ER) (1.4*EE) | 1.820% | 1.820% | 1.778% | 1.778% | 2.13% | 2.13% | 2.16% | 2.16% |

| Maximum Premium (EE) | 672.10 | 672.10 | 651.51 | 651.51 | 772.16 | 772.16 | 762.30 | 762.30 |

| Maximum Premium (ER) (1.4*EE) | 940.94 | 940.94 | 912.11 | 912.11 | 1,081.02 | 1,081.02 | 1,067.22 | 1,067.22 |

| Québec Parental Insurance Plan (QPIP) | ||||||||

| Maximum Insurable Earnings | 74,000 | 74,000 | 72,500 | 72,500 | 71,500 | 71,500 | 70,000 | 70,000 |

| Contribution Rate (EE) | 0.548% | 0.548% | 0.548% | 0.548% | 0.548% | 0.548% | 0.559% | 0.559% |

| Contribution Rate (ER) (1.4*EE) | 0.767% | 0.767% | 0.767% | 0.767% | 0.770% | 0.770% | 0.782% | 0.782% |

| Maximum Contribution (EE) | 405.52 | 405.52 | 397.30 | 397.3 | 391.82 | 391.82 | 391.30 | 391.30 |

| Maximum Contribution (ER) (1.4*EE) | 567.58 | 567.58 | 556.08 | 556.08 | 548.81 | 548.81 | 547.40 | 547.40 |

| Commission des norms du travail (CNT) | ||||||||

| Maximum earnings subject to CNT | 74,000 | 74,000 | 72,500 | 72,500 | 71,500 | 71,500 | 70,000 | 70,000 |

Troubleshoot payroll Update Issues

- Is it on or after the effective date of the tax table?

- The new numbers won’t be visible if you downloaded tax table version 117 on or after December 19, 2022, until the tax table goes into force on January 1, 2023.

- Once you have obtained the software update that contains the revised tax tables, after January 1, 2023:

- Have you ever had to manually modify the TD1 amounts after adding a new employee or in the past?

- The new tax table will not replace any amounts that have ever been manually altered in the TD1 amounts for an employee. Moving forward, you will have to manually update the TD1 quantities.

- Are any of your workers set up with more money than the TD1 minimums?

- Only those employees who have the basic amounts for the prior tax tables will have their TD1 amounts updated automatically by QuickBooks Desktop.

- Have you ever had to manually modify the TD1 amounts after adding a new employee or in the past?

- Are your employees set up over the basic TD1 amounts? Yes or no

Because QuickBooks Desktop will automatically update TD1 amounts only for those employees with the basic amounts for the previous tax tables.

Common Error: The payroll tax table is now out of date.

When you open the payroll tax table on your computer, you see The payroll tax table is now out of date. Any payroll calculations generated using this tax table will be zero or your payroll calculations are showing as $0.00.

Reasons: You can face this type of error when,

- QuickBooks Desktop is not updated to the latest payroll tax table release.

- If you are using QuickBooks in a multi-user/network environment, and

- Not all of the versions of QuickBooks Desktop located within your network have been updated to the latest tax table.

Solution:

- First, check your QuickBooks Desktop is using the latest product update. Check all versions located on the network, if you have a multi-user network.

- Compare the product release number of your currently installed product by product update page when you work in QuickBooks. You can press the F2 key to see the release reference number.

- If you do not update your product with the latest release so please update because this should resolve an error.

By cleaning uninstalling and reinstalling QBD, you can resolve the error and Back up your QuickBooks company file first.

Payroll tax table update error

- PS038

- PSXXX errors

- 15XXX errors

- UEXP error

What is updated in the most recent payroll tax table?

There are several TD1 modifications from the July 2022 payroll tax table update for the January 2023 tax table update.

You may also like :

- Verify that a tax table update is downloaded and installed

- How do I do payroll taxes?

Hope, this article helps you resolve your problems and helps you to understand how to download, install & verify QuickBooks payroll tax tables. For any further assistance contact our intuit certified experts, you can dial our toll-free+1-844-405-0904. We are always ready to help you at any point in time.