In this article, we’ll teach you how to adjust sales tax payable in QuickBooks Online and Desktop. So you can report your sales tax summary without any issues. The complete process is arranged in order with relevant images to guide you in a proper way, the article also helps to understand what the sales tax is and how efficiently it could be managed. Read the complete article for better learning, in case you have any problem related to it. Contact our QuickBooks ProAdvisor toll-free; +1-844-405-0904

Sales tax collected is the aggregate amount of tax you collect from customers during the sale on behalf of the government.

For all types of businesses, it is very important to follow the sales tax regulations of the local and out-of-state tax agencies. The owner of the business requires to track the taxable and non-taxable sales separately.

Therefore, QuickBooks offers a very useful feature to its users where they can adjust their sales tax according to the tax authorities.

Table of Contents

Sales Tax Adjustment in QuickBooks Online

If you use Automated Sales Tax in QuickBooks Online then it will be quite easy to add and delete the sales tax adjustments.

With the help of Automated Sales Tax, you can easily adjust the sales tax whenever you received a tax credit, discount, or fine.

Add Sales Tax Adjustment

STEP 1: Create an account for Sales Tax Adjustment

Set up an expense account when you need to increase the due sales tax, on the other hand, create an income account when you need to decrease the sales tax. It is very important to create an appropriate account.

- Click on the Gear icon at the top right and then select the ‘Chart of Accounts’ Option.

- After that, click on the New at the top right corner.

- Select any one of Income or Expense from the Account drop-down menu.

Income Account: Select this, if you want to decrease the sales tax.

Expense Account: Select this, if you want to increase the sales tax.

- Then, Click on the Details Type option.

If you are using the Income Account then, click on the Sales of Product Income.

If you are using the Expense Account then, click on the Taxes Paid option.

- Name your account. (For Example Sales Tax Adjustment)

- After reviewing, select Save and Close.

STEP 2: Add an Adjustment

- From the navigation bar, select Taxes and then click on the Sales Tax tab.

- Then, select the tax period you want to adjust and then click on View Return.

- Select Add an Adjustment and the Reason of the Adjustment.

- After that, select the account you want to make the adjustment. Select the Expense if you want to increase and choose Income if you want to decrease the tax due.

- After entering the adjustment, select the Add option.

Delete Sales Tax Adjustment

QuickBooks also provides you an option to delete the sales tax adjustment if the adjusted tax is incorrect or mistakenly added.

Follow the steps mentioned below carefully to complete this process.

- Go to the Gear icon at the top right and then click on the ‘Chart of Accounts’ option.

- Here, find the expense or income account in which you want to delete the sales tax adjustment.

- Next, select the Run Report and then click on the adjustment you want to delete.

- Then, click on the Delete and confirm the same.

Adjust Sales Tax in QuickBooks Desktop

In QuickBooks Desktop, when you make changes to the sales tax you transfer money from and to the Sales Tax Liability account. Therefore, it is necessary for you to know when and how to adjust sales tax payable in QuickBooks Desktop.

Here are the reasons due to which you should adjust the sales tax.

- When the Sales Tax agency has offered you any type of discount.

- When a fine is charged on you by the Tax authority due to late or non-payment of sales tax.

- If you want to make corrections in the previous tax period.

- When QuickBooks and Sales Tax forms don’t match.

Adjusting the Sales Tax in QBD

- First, select the Vendors option and then, click on Sales Tax.

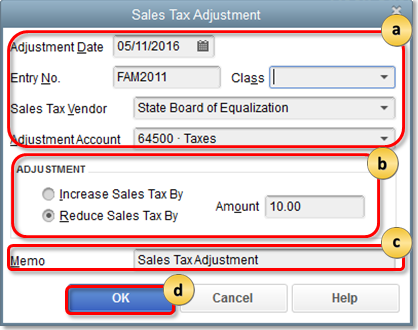

- Next, when you click on the Adjust Sales Tax Due. A new Sales Tax Adjustment window will open.

- In this window, enter the adjustment date, Class, Sales Tax Vendor, and Adjustment account. (NOTE: Select an Expense account if you are adding penalties or fines and choose an Income account if you got a discount from the Tax Agency.)

- Then, select if you want to increase or decrease the sales tax and enter the amount.

- (OPTIONAL)In Memo, you could write Sales Tax Adjustment for reference.

- Finally after reviewing the information, click OK.

Conclusion

We hope that you’ve now understood how to adjust sales tax payable in QuickBooks Online and Desktop. Recording an adjustment in the sales tax helps you in managing and reporting the sales tax to the official authority in the best way possible.

Since this is directly related to the local or state tax agencies, you may not want to do any mistakes. Therefore, for assisting you in accounting, we offer you our service of Intuit certified QuickBooks ProAdvisor. They can easily help you with bookkeeping and accounting related tasks. Contact us via our 24*7 toll-free customer support number +1-844-405-0904.