When you are running a business and there are a number of employees working for you, then you need to issue W2 tax forms for those employees to whom you pay more than $600 per year. So, here we are with an article having the steps to print W2 forms according to IRS guidelines. The article consists of the process and steps of printing the W2 forms with images attached of the real interface and other necessary guidelines. Read the complete article to learn all the details of QuickBooks W2 forms in QBO & QBD. If you encounter any trouble, then contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

These W2 forms are used for reporting the wages of the employees to the Federal Tax agencies or the IRS(Internal Revenue Service). In this post, we’ll teach you how to print W2 in QuickBooks Online and Desktop.

Table of Contents

IRS Requirements to Print QuickBooks W2 Forms

Before proceeding to the printing process, you should arrange all the requirements to print the QuickBooks W2 forms. Read the following to know the requirements;

For Intuit QuickBooks Online Payroll

- Must have an account in QuickBooks Online Payroll or Intuit Online Payroll

- Blank 3-part & 4-up Perforated/Blank printable QuickBooks W2 forms for employees

- You can only use non-reflective black ink to print QuickBooks W2 forms as per IRS guidelines.

- Purchase a W2 kit (Optional)

Note: Remember, preprinted W2 forms are not compatible with QuickBooks Online.

For Intuit QuickBooks Desktop Payroll

- An updated version of QuickBooks Desktop.

- Blank 4-part perforated paper

- The updated Payroll Tax Table.

- Purchase a W-2 kit (Optional)

Note: QuickBooks Desktop is not compatible with the W2 PDF forms that are available from the IRS website.

How to Order a Kit for QuickBooks W2 Forms

Follow the procedure to purchase a W-2 kit:

- Click on the link to visit the QuickBooks Checks & Supplies page.

- Select the ‘Tax products’ option, then the ‘Blank W2 Kits’ option.

- After that, follow the on-screen instructions for the complete order.

How to Print W2 in QuickBooks Online Payroll?

Find out the Online Payroll product, and follow the procedure to print the QuickBooks W2 forms.

QuickBooks Online Payroll

There is an automated tax option in QuickBooks Online payroll. This pay, and file your federal, state payroll taxes automatically. Before following the printing procedure of the QuickBooks W2 forms, check whether the automated tax form is turned on or not.

If the automated taxes and forms on:

QuickBooks sends the W2 to the employees during the period from January 20 to January 31. If you need to send the forms to your employees from January 13, you can reprint them on plain paper. And can also print the current and previous year QuickBooks W2 forms from the starting date of payroll in QuickBooks Online. Follow the procedures for the current and previous year’s QuickBooks W2 forms.

To Print Current Year QuickBooks W2 Forms of Employees:

QuickBooks has a preview of all W-2s, but you are not allowed to print them. You can only print them after January 13. Now, follow the steps to print the current forms.

- Login to QuickBooks Online Payroll.

- And visit the ‘Taxes’ section.

- Select the ‘Payroll Tax’ option from the ‘Taxes’ section.

- Click on the ‘Fillings’ option, and then the ‘View’ option for any one of the following;

- W-2, Copies A & D (employer)

- Transmittal of Wage and Tax Statements (W-3)

- W-2, Copies B, C & 2 (employee)

- QuickBooks will ask you a question about your employee regarding the retirement plan. Read the question properly, and select the option ‘Yes’ or ‘No’.

- Again, visit the ‘Taxes’ section, ‘Payroll Taxes’.

- Select the filling period (year) from the drop-down menu.

- Click on the ‘View’ option to open the Adobe Reader in a new window.

- On the Reader toolbar, select the ‘Print Icon’.

- And then the ‘Print’ option.

To Print Previous Year W-2 Forms for Employees:

It is easy to print the previous year’s W-2 form. Follow the procedure

- Visit the ‘Taxes’ section, and select the ‘Payroll Tax’ option.

- Select the ‘Annual Forms’ from the ‘Filings’ drop-down menu.

- Now, choose the year you need to get the printout from the ‘Select the period’ dropdown menu.

- You can select the options.

- W-2, Copies A & D (employer)

- Transmittal of Wage and Tax Statements (W-3)

- W-2, Copies B, C & 2 (employee)

- Then get a view of the printout in a new window, in the form of Adobe Reader.

- Click on the ‘Print Icon’ option from the Reader toolbar. And click on the ‘Print’ option.

If the automated taxes and forms are off:

Here, you pay for the tax and file it manually or electronically. You need to follow two steps to print W-2 when the automated tax form is off.

Step 1: Set the Print Preference

- At first, purchase the W-2 paper, then set up the print preferences.

- Go to the ‘Settings’ tab, and select the ‘Payroll Settings’ option.

- Click on the ‘Edit’ option, on the ‘W2 print preference’ option.

- Choose the paper type that you have purchased.

- Then click on the ‘Ok’ option.

Step 2: Print the W-2 form

- Visit the ‘Taxes’ section, and select the ‘Payroll Tax’ option.

- Click on the ‘Filings’ tab, and select any one of the following archives;

- W-2, Copies A & D (employer)

- Transmittal of Wage and Tax Statements (W-3)

- W-2, Copies B, C & 2 (employee)

- Click on the ‘View’ option to open Adobe Reader in a new window.

- Go to the ‘Reader Toolbar’, and click on the ‘Print Icon’ option.

- Click on the ‘Print’ option one more time.

Intuit Online Payroll Full Service

Follow the steps to print W-2 if you are an Intuit Online Payroll Full Service user.

- Log in to Intuit Online Payroll Full Service.

- Visit the ‘Tax Records’ tab.

- Select the applicable year from the ‘Forms’ tab.

- Choose any one of the following employee copies;

- Form W-2 (W-2, Copies A & D)

- Transmittal of Wage and Tax Statements (W-3)

- Employee Copies: Form W-2 (W-2, Copies B, C & 2)

- Click on the ‘View’ option, then the ‘Print’ icon to print the employee copy.

If in case, you reprint the copy for the employee, write REISSUED STATEMENT on the top, and mention a copy of the W-2 instructions.

Intuit Online Payroll Enhanced

If you are an Intuit Online Payroll Enhanced user, then follow the steps to print the W-2 form.

Step 1: Set Up the Print Preferences

- At first, purchase a W-2 form.

- Then visit the ‘Set Up’ tab.

- After that, click on the ‘Preferences’ link for the ‘W-2 Form Printing’ option.

- Choose the needed printing option, and click on the ‘Ok’ option.

Step 2: Print the Current Year W-2 Form

- Go to the ‘Taxes & Forms’ tab, and select the ‘Forms’ option.

- Select the ‘Annual Forms’ link from the ‘Forms’ section.

- You can print both employer and employee copies of the W-2 form. Select anyone from the options.

- Employer Copies: Form W-2 (W-2, Copies A & D)

- Transmittal of Wage and Tax Statements (W-3)

- Employee Copies: Form W-2 (W-2, Copies B, C & 2)

- Click on the ‘View’ option, then the ‘Print’ icon to print the W-2 form.

How to Print W2 in QuickBooks Desktop Payroll?

Here, we have mentioned all of the printing procedures of the W-2 forms for all Desktop payroll products. Choose your payroll Desktop version, and follow the procedure according to that.

Print the W-2 form in QuickBooks

- Firstly, open QuickBooks software.

- Select the QuickBooks W2 forms and choose the employees’ menu from the QuickBooks dashboard.

- After that, click on the Payroll Center option.

- Hit the File Forms tab.

- After going out of the Print or View forms option, submit the payroll PIN.

- Now, click on the OK button.

- You can choose the year and number of employees on the W-2 tab.

- Then click on the Save and Open button.

- Before printing the W-2 forms, you have to select the appropriate reason.

- Open the file in Adobe Reader and click the Print button to print the forms.

QuickBooks Desktop Payroll Basic

If you have the QuickBooks Desktop Payroll Basic, then you can’t be able to print the W-2 form. Because this product doesn’t include the W-2 and W-3 forms. You should upgrade it to the Enhanced or Standard.

QuickBooks Desktop Payroll Enhanced & Standard

If you are a Desktop Payroll Enhanced user or a Standard user,re then follow the two steps to print the W-2 form.

Step 1: Purchase W-2 Form, and Update QuickBooks

First of all, purchase a W-2 form or paper. And check the QuickBooks Desktop is in the latest version or not. If it is not updated, then update it to the latest version. Also, make sure that the payroll tax table is in the latest release.

Step 2: Create & Print W-2 & W-2 Form

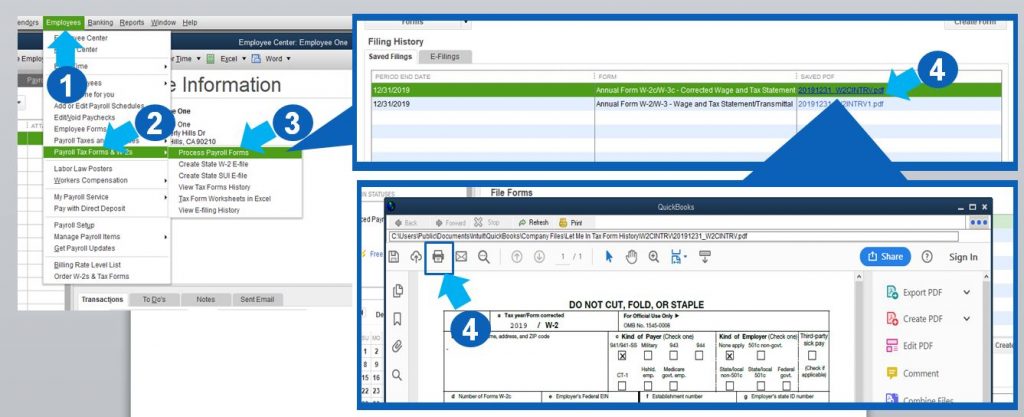

- Go to the ‘Employees’ drop-down, and select the ‘Payroll Tax Forms & W-2’ option and the ‘Process Payroll Forms’ option.

- After that, select the ‘Annual Form W-2/W-3 – Wage and Tax Statement/ Transmittal’ option from the ‘File Forms’ tab.

- Click on the ‘Create Form’ option, and select the employees you need to file.

- Put the year, and click on the ‘Ok’ option.

- Now, select the employees whom you want to print the W-2.

- Click the ‘Review/Edit’ option to review all of the W-2 forms. All of the reviewed W-2 are in the ‘Reviewed’ column.

- After that, click on the ‘Submit Form’, and follow the steps to print files and forms.

QuickBooks Desktop Payroll Assisted

Choose any one of the procedures to print W-2 forms in QuickBooks Desktop Payroll Assisted.

Intuit Print

Intuit or QuickBooks will send the forms during date of January 20 to January 31. If you want to reprint the form on plain paper, you can do it easily after January 13.

- Go to the ‘Employees’ tab, and select the ‘Payroll Center’ option.

- Choose the ‘File Forms’ tab, then the ‘View/Print Forms & W-2’ option.

- Type your payroll PIN, and click the ‘Ok’ option.

- After that, choose the ‘W-2’ tab.

- Choose the year and the employees.

- Select a reason to print W-2.

- At last, click on the ‘File’ option on Adobe Reader, and then the ‘Print’ option.

Self-Print

If you want to print the W-2 form yourself, then you can print the form and send the form by mail.

- Purchase a W-2 form or a W-2 kit.

- Then visit the ‘Employee’ tab.

- Select the ‘Payroll Center’ option from the ‘Employee’ tab.

- Click on the ‘File Forms’ tab, and then the ‘View/Print Forms & W-2’ option.

- Put the payroll PIN and click on the ‘Ok’ option.

- Choose the ‘W-2’ tab, select the year, and then the employees.

- Click on the ‘Open/Save Selected’ button.

- Select a reason for printing the W-2 form.

- Click on the ‘File’ option on Adobe Reader, and then the ‘Print’ option.

How to Reprint W-2 in QuickBooks Desktop

In QuickBooks, you can also reprint a lost W-2 form. If any employee has lost their W2 forms by mistake, then you can reprint the form within the W2 tax terms and Internal Revenue Service guidelines.

Follow the steps below to reprint a QuickBooks W2 forms.

- From the top menu bar, select the employees and then click on the ‘Payroll Centre’.

- Select the ‘Annual Form’.

- From the drop-down menu, select the employee for whom you want to reprint the W2 form and then click on the ‘W2 Copy B, C, 2’.

- Enter the desired year and select ‘View Reprint’. Internal Revenue Service requires the words ‘Reissued statement’ if the form is being reprinted.

- By clicking View Report, the W2 form will open in a new window in PDF format, and after that, click on ‘continue’.

- You can either use a Blank/Perforated paper or simple plain paper to reprint the W2 form.

- To print, go to the File menu and then click on the ‘Print’ option.

- A printing paper will appear, according to your selection, and adjust the paper in your printer.

- QuickBooks Desktop Payroll Assisted needs 4 horizontal W-2 per page, so arrange the page properly.

- Now, a file of Adobe Reader will open, including the W-2 selections.

- Select the ‘File‘ menu, and then the ‘Print‘ option to print the W-2.

Review the W2 Forms in QuickBooks

Selecting the type of paper for the item to print in the W2 forms in Windows:

- You have to select the paper option in perforated paper, blank paper, or preprinted forms.

- Now, choose for whom you are printing.

- After that, choose an item to print and then select the option mentioned below:

For an Employer

- W-2 – Copy D: For your record information, 2 per page.

- Filing instructions for W2 forms by the Employer.

For the Government

- W-2 – Copy 1: It is for the state and the local tax departments, 2 per page.

- W-2 – Copy A: For the SSA, 2 per page.

If you choose perforated paper or blank paper

- 4 Per Page: Copies B, 2, 2, C

- 3 Per Page: Copies B, 2, C

- Employee Filing Instructions: It is required if not printed on paper.

In the case of Preprinted Forms

- Copy C of W-2: It is for Employee records, 2 per page.

- Copy B of W-2: This form is for the Employee’s Federal Tax Return, 2 per page.

- Copy 2 of W-2: It is for your State or Local Tax Department, 2 per page.

- Employee Filing Instructions: Required if not already printed on paper.

Start printing your PDF reader after exporting the Form

- If you’re using preprinted forms, you must perform a print test.

- Now, click on the Print PDF option.

- After that, you have to start the printing process from the PDF reader.

Things to Know, While Printing W2 Forms in QuickBooks

- Automatically archive QuickBooks W-2 forms after e-filing or printing in QuickBooks Desktop

In the Payroll Tax Form window, make sure to check the box in front of Automatically create an archive when I e-file or print. You can find this option at the bottom left corner of the QuickBooks Payroll tax form window.

By doing this, the form will be automatically saved in the PDF form at the default location whenever you e-file or print the form.

- Save a Draft of W-2 Form

In the ‘Payroll Tax Form‘ window, click on the ‘Save as PDF’ option at the bottom left corner of the screen. Then, select a location where you want to save the form as a draft and click on the ‘Save‘ option.

Frequently Asked Questions (FAQs)

How to Print W2 in QuickBooks Without Payroll Subscription?

If you don’t have an active QuickBooks Payroll subscription plan then don’t worry you can still access your archived W-2 forms. You can browse through the folder in your system that contains the archived forms without even opening the QuickBooks Desktop.

Go to the Local Disk C\Users\Public\Documents\Intuit\QuickBooks\Sample Company File\QuickBooks 20XX\(Company Name) Tax Form History. After that, select the folder of the archived form that you need. The name of the folder will consist of 941, W-2 in its name.

What is the W-2 form used for?

This is an IRS tax form (Internal Revenue Service) to report the wages paid to employees in the United States.

Hopefully, you learned how to print W2 in QuickBooks Online & Desktop. Preparing, e-filing, or printing W2 forms or any other federal tax-related forms, like 1099 forms or W4 forms, could be a very difficult task to accomplish. In that case, you can get our QuickBooks ProAdvisor support by dialing our toll-free number +1-844-405-0904 for instant service.