Eager to know the best stuff for accountants, here in this article we are to discuss Intuit Online Payroll; stay with us to know to intuit online payroll in depth. Intuit Online Payroll for Accountants is a platform for the firm or accountant, they will use it. A firm wants to provide the best payroll services for its clients and a better understanding of the software. Read the complete article to know all the facts related to Intuit Online payroll, and its usability with other platforms, software as well. If you need any suggestions or support for QuickBooks Online Payroll, contact our QuickBooks ProAdvisor toll-free:+1-844-405-0904

Intuit has designed a highly flexible and easy to help product for Accounting Professionals, which is Online Payroll. Intuit better understands the needs of small businesses and your clients.

Most trust-able companies for small business clients and users widely used Intuit products and software.

You don’t afraid with payroll because Intuit Online Payroll provides the full support and easily manage all payroll tasks or set up clients to share payroll responsibilities with you.

Intuit Online Payroll is different from other QuickBooks Software but this software is integrated with QBMac, QBD, and QVBO.

QuickBooks Online Payroll Vs Intuit Online Payroll

One main thing in this is data from Intuit Online Payroll for Accountants imports into the QuickBooks ecosystem as regular checks, so all your financial reports reflect the payroll data.

But QuickBooks Online payroll features differ, this QuickBooks online payroll clients lives inside the QuickBooks Online file because it is integrated with QB Online.

In Any Software, features play an important role in processing. Do many people think about which Online payroll is best between Intuit Online Payroll and QuickBooks Online Payroll? So we say don’t be confused with this term, we describe all points related to both features.

If you plan on providing payroll solutions to more than 1 client so it easy to choose Intuit Online Payroll because QuickBooks online file takes time to turn on. You choose the QuickBooks Online Payroll for one of your clients.

Intuit offer for pricing, particularly for those who plan on doing payroll for lots of clients. When the firm gets a free payroll subscription is called Your Payroll.

- 1 Clients- $35.00 per month + $2 monthly fee per employee

- 2-5 clients- $19.99 per month (per client) + $0.50 monthly fee per employee

- 6-20 Clients- $15.99 per month (per client)+ $0.50 monthly fee per employee

- 21-50 Clients – $11.99 per month (per client)+ $0.50 monthly fee per employee

- 51 plus Clients – $9.99per month (per client)+ $0.50 monthly fee per employee

Above shows, the pricing of the Intuit Online Payroll for Accountants depends on clients.

Really I am happy to share my experience with you when any company wants the popularity of your own product so he makes the product user-friendly and easy to understand or he knows the needs of clients.

You use the QuickBooks online in your iPhone and operate it, You will see the ere some perceived comfort in clicking Employee in the left-hand panel of QuickBooks Online and seeing payroll right here.

Intuit Online Payroll for Accountants allows the work outside of QBO and QBD to do client payroll.

Check the client’s file by log into Intuit Online Payroll for Accountants and this is related to QuickBooks Online Accountants to manage their clients Quickbooks Online Files and invite their staff, choose what clients they want them to work on, and see when they login to QuickBooks Online Accountant, right?

Select Access Level

Below give some level of access for clients

| Full

Setup and Payroll Payroll Only | When you click in full you have full access to their account, from setting up and running payroll top paying and filing taxes

In this, clients can set up their account, run payroll, and view reports but one problem in this is clients cannot process any tax-related tasks. Clients cannot process any tax-related tasks or change the setup of the account and clients can run payroll and view reports. |

Difference Between Main Features of QBOP Vs IOP

We share some main features of Intuit Online Payroll for Accountants that QuickBooks Online Payroll does not.

- Paying 1099 contractors and Household employees

- To-Do/Tasklist

- Export to other Software: This feature is inside of QuickBooks online so QBOP does not have it.

- Job Costing: A paycheck of Intuit Online Payroll is nice and it has the ability to assign a customer or a class to a paycheck.

- Paycheck records: An employee can view their paystubs and W2s

- Intuit Online Time Tracking: Intuit payroll has a time clock solution for employees, so employees can clock in and out at some workstations. And QBO provides the time QBOP from its own time-tracking.

- Convenient and Easy to Use: you have internet so you easy to use payroll anywhere and at any time.

- Guaranteed Accurate: work with intuit you feel good because he pays the state taxes by calculated using the latest tax rates.

- WA Workers’ Compensation Tax payment service.

Employees: QuickBooks Online Payroll does not support the savings for paying contractors.

Overview:

Employees Go to contractors add an Employee

| Last Name First Name Pay Rate Pay Schedule Pay Method Status

Barnes Romy $75,0000.00?/year Twice a Month Check Active Lee Tim $35.00/hr Twice a Month Check Active Add an Employee |

Bob Barnes’s Overview

| Basic Edit

Name Rony Barnes Address 1234 street Ct. Thousands of Oaks, CA 91360 Gender M Birth Date |

| Employment Edit

Employee ID Work Location 1014 E Alguien Rd Schaumburg, IL 60173 Employment Status Active Hire Date 9/14/2015 I-9 Form Filed New Hire Report Filed Workers’ Comp Class |

| Pay Edit

Salary $75000.00 Year Additional Pay Salary Bonus Commission Method Check Schedule Twice a Month |

| Taxes & Exemptions Edit

Social Security # …..4852 Federal Filing Status Single Allowances 1 Additional $0.00 Withholdings CA Filing Status Single or married (with two or more incomes) CA Allowances 1 Additional $0.00 Withholdings IL Filing status Regular IL Allowances 1 Additional $0.00 Withholdings Tax Exemptions Currently no exemptions Advance Earned No Income Credit (EIC) |

| Deductions & Contributions Edit

Deductions none Garnishments none Contributions none |

| Vacation & Sick Pay Edit

You have not told us about vacation or sick pay yet |

| Employee Site Access Edit

Paycheck Records No Access User ID |

| Notes Edit

Add a note |

Additional ways do you pay Bob?

- Overtime Pay

- Double Overtime Pay

- Holiday Pay

- Bonus

- Commissions? Add/edit types?

Compared to what it looks like for an employee in QuickBooks Online Payroll…

Add employee

| Name Pay Rate Pay Method Status

Heckman jane $17.00 / hour Check Active Fisher Duncan $20.00 / hour Check active |

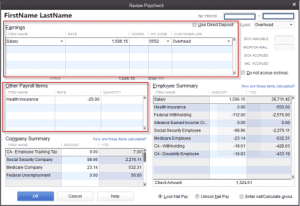

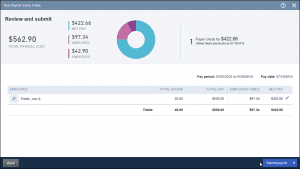

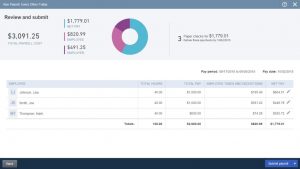

Difference Between QBOP and IOP Creating Paycheck

Intuit Online payroll

Creating single paycheck QuickBooks Online Payroll

QuickBooks Online Payroll

Conclusion

Intuit Online Payroll is a great platform for accountants and firms. Intuit Online payroll is different from QuickBooks’ Online Payroll. I hope you must have learned about intuit Online Payroll through this article. for more information and queries you can contact to wizxpert team of QuickBooks ProAdvisor.