Here in this blog, we will talk about when & what time of the day do direct deposits post in QuickBooks. Don’t worry, if you are facing the same issue; here we are with an article to resolve your issue. Go through the article and get the info to work on it, according to the time specified. For any help or support connect with us, our QuickBooks ProAdvisor consult you toll-free +1-844-405-0904

When does DD post and how can you do it? Through direct deposit, you can pay your workers/employees, as they get their wages via DD.

Direct Deposits Post Overview

You might have determined that you just pay some or all of your workers via direct deposit. You wish to try and do it once it involves paying workers. workers would possibly raise you once they should expect their wages to be deposited. Most users are confused about this. So, we will be discussing here in detail some key facts for direct deposit posts.

Your workers may surprise once they can receive their paychecks. Some employers plan to pay on a monthly, biweekly, weekly, or daily pay schedule. Your pay frequency can confirm once you submit payroll and once workers can receive their direct deposit.

The amount of your time it takes a direct deposit to travel through depends on many various factors. Take a glance at the subsequent answer: “When will payroll direct deposit post?”

QuickBooks Direct Deposit Details

| 2 banking days | Before 5:00 pm pacific time:

|

|

| 1 banking Days | Debit the employer’s bank account. |

See also Desktop payroll bank returns due to NSF |

| 0 banking Days

(Check Date) | Available to the receiving banks as of 12:00 a.m. Pacific time. | See also Direct Deposit rejected |

For payrolls transmitted a minimum of two banking days from the check date:

As long as you transmit your payroll two banking days before the payroll check date, direct deposits are created and offered to the receiving bank as of 12:00 a.m. on the payroll check date. But if the payroll check date falls on a non-banking day, direct deposit paychecks are announced on the next banking day. The funds are announced to the employee’s account at the discretion of the receiving bank. Workers ought to contact their banks to be told the precise time that direct deposits are denoted to their accounts.

For backdated payrolls:

If you transmit a backdated payroll (i.e., the paychecks are dated but two banking days in advance), then the direct deposits can post two banking days when the payroll is transmitted.

To confirm that Intuit received your payroll transmission:

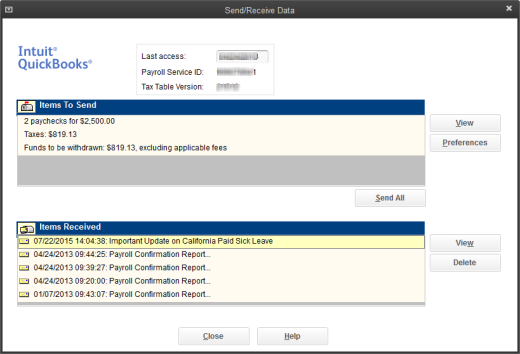

Option 1: Check the Items Received by Intuit in the Send/Receive Payroll Data window.

- From Employees on the top menu bar, choose to Send Payroll Data.

- In the Items Received area, look for payroll data confirmation of your payroll.

Option 2: Wait for the direct deposit email confirmation.

After transmitting payroll to Intuit, the QuickBooks Direct email confirmation is sent, to the listed Payroll administrator of the company.

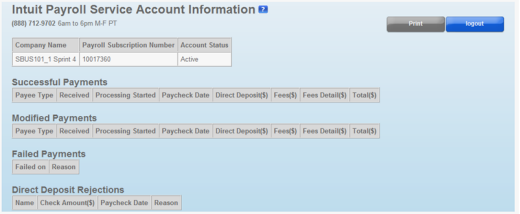

Option 3: View the current status of your payroll on the QuickBooks Desktop Payroll Service Account Maintenance page.

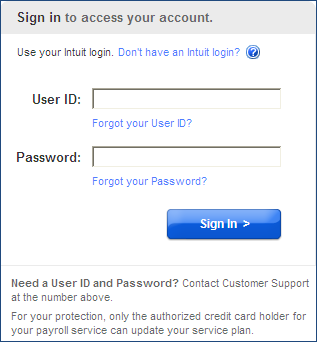

- In QuickBooks Desktop, click the Employee menu > My Payroll Service > Account Info/Preferences.

- Sign in using your Intuit Account login.

- In the Direct Deposit section, click the View link next to Payroll History.

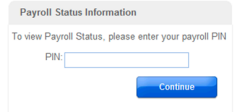

- Enter the PIN, and click Continue.

- You may click Print to print the page, or you may click logout to close the page.

What to do to Pay employees on time using QuickBooks Direct Deposit?

Here, we’re going to show you how you can pay your employees on time with the help of a Direct Deposit. First, you have to understand when you need to submit your payroll and also learn about the lead time of the QuickBooks Payroll service.

Before Proceeding further there are two terms that you need to understand

- Lead Time: Sometimes, peoples also prefer this as Funding time. It is the time between the day you submit the payroll and the day the employee received the payment through direct deposit,

- Payroll Submission Date: As the name suggests it is the day on which you submit your payroll. This date will determine the lead time of your direct deposit.

Both the lead time and payroll submission date are the terms that we are going to mention a few times while we discuss Direct Deposit Post therefore it is important to understand both.

Let’s have a look at the things that you need to do to pay employees on time with various QuickBooks Payroll versions:

QuickBooks Desktop Payroll and Intuit Online Payroll

Both of these services have a lead time of 2 days. Then according to this, the payroll submission date will be 5:00 PM Pacific Standard Time 2 business days before the payday.

Even after submitting the payroll, you can still void or add paychecks up to 04:59 PM Pacific Standaer time that day. The payroll processing begins after 5:00 PM and after that, you cannot stop it.

QuickBooks Online Payroll Enhanced and QuickBooks Online Payroll Core

In these QuickBooks Payroll services, you’ll get a lead time of 1 day and 5 days.

For 1 Day Lead Time

If you are using direct deposit with 1 Day lead time then it means that you need to submit your payroll by 5:00 PM PST 1 day before the payday.

For 5 Days Lead Time

If you are using direct deposit with 5 day lead time then it means that you need to submit your payroll by 5:00 PM Pacific Standard Time 5 days before the payday. For example, if your payday is on Tuesday then you need to submit the payroll on Tuesday before payday.

Your money will deduct from your bank account as soon as you submit the payroll in QuickBooks. But the employees will get the amount on payday.

QuickBooks Online Payroll (All other Versions)

The products that offer both same-day direct deposit as well as 5-day lead time Direct Deposit are QuickBooks Online Payroll Full Service, QuickBooks Online Payroll Premium, and QuickBooks Online Payroll Elite.

Same Day Direct Deposit

There are two different ways for same-day Direct Deposit.

The first is to submit the Payroll before 7:00 AM on the payday or you can submit the payroll before 5:00 PM a day before the payday.

In case, you submit the payroll before 7:00 AM on the payday then the money will be deducted from your account on the same day and your employees will be able to see them in their account by 5:00 PM(According to the employee’s bank timezone) on the same day.

If you had mistakenly submitted a wrong payroll then you can still void or add a new paycheck before 6:59 AM PST on that day. The processing of payroll begins after 7:00 and after you won’t be able to stop it.

If you choose to submit payroll before 5:00 PM PST a day before the payday then Intuit QuickBooks will start processing and then deduct the payroll amount on the submission date but your employees can see the money in their account on the payday.

After you submitted the payroll before 5:00 PM but later you found out that amount on the paycheck was wrong then you can void or add a new paycheck until 4:59 PM. The payroll processing starts after 5:00 PM and you won’t be able to do anything after that.

5 Days Lead Time

If you want to choose this option then you need to submit the payroll before 5:00 PM PST 5 business days before the actual payday. For example, if the payday is on Friday, then the payroll submission day will be Friday before payday.

The money will be deducted from the account on the same day as the payroll submission date. The employees will be able to see money in their bank account only on payday. So make sure, you have sufficient funds in your bank account on the day you are submitting the payroll.

NOTE: Also keep in mind that, Intuit won’t process any payroll on the weekends and on state or federal holidays, so plan the payroll submission date accordingly.

The Bottom Line

In this article, we have described everything you need to know about the Direct Deposit Post and also what things you should do to pay your employees on time using even if you are using different QuickBooks Payroll Products.

If you are still facing any kind of issues related to the Direct Deposit Post in QuickBook or if you want to learn how to use Direct Deposit in QuickBooks Payroll then we recommend you contact our customer support team. Our team consists of Intuit certified experienced QuickBooks ProAdvisors who can provide you with the best payroll support of QuickBooks Desktop. Call us at our 24/7 toll-free customer support number +1-844-405-0904 for more information.