In this article, we are to discuss ProAdvisor certification and Continuing Professional Education credits for attending a live seminar. Read the article to know the certification courses which QB offers, how to access the certification courses, and to print CPE. Go through the article to get all your queries resolved and understand the facts about ProAdvisor certification and CPE credits. For more info contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

ProAdvisor must click the link in the E-mail they receive during the training and the keyword that was provided by the instruction during the event. The CPE Administrator will email the CPE certificates once all the responses from the participants are received.

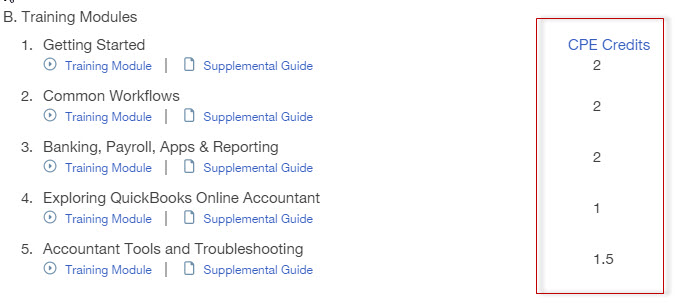

Each and every certification courses come with optional raining modules that might be worth CPE credits. CPE numbers and availability vary from course to course or year by year. To know, how many CPE credits you can receive during the certification course you need to see the most up to date information in QuickBooks Online Accountant:

Procedure to get the up to date information regarding CPE credit;

- Select ProAdvisor from the left menu.

- Choose the Training tab.

- Review the available credits listed on the module card beneath the name of the module. If no credits are listed, the module does not offer CPE credits.

- When the module is completed, then you can access the CPE Assessment that must need to complete to receive CPE Credits for a particular module. The module must need to complete to access CPE Assessment.

Note: In some of the states CPE Credits are not allowed while taking the QBProAdvisor Certification courses. State boards of accountancy have final authority to accept individual courses for CPE credit. At the time of earning CPE credits, it is your responsibility to see what your own state board of accountancy recognizes with respect to any CPE course.

This article describes the following:

- How many ProAdvisor certifications Continuing Professional Education credits you can receive by completing the optional courses for the ProAdvisor.

- How to verify whether your state will accept the Continuing Professional Education credits associated with the optional courses.

- When you entire the optional training courses in your course locker, you can qualify for CPE hours. The spare time has listed a step from each course name under the CPE column.

QuickBooks Offers Five Certification Courses

- QuickBooks Certification(Desktop Version)

- QuickBooks point of sale certification

- QuickBooks online certification

- QuickBooks desktop advance certification

- QuickBooks Enterprise solutions certification

The QuickBooks Customer services can give further details on the courses and their rates. Apart from making one a Proadvisor, these courses also give the professionals unlimited support from the QuickBooks Customers support and the technical support team, making it a worthwhile opportunity to explore.

Access your certification courses

- Go to: https://qbo.intuit.com/

- On the left side, you will see the ProAdvisor tab. Click on that.

- Choose whatever the exam you are interested in.

- Once you are ready to take the exam, click it on the right side.

To print CPE Certification:

- In QuickBooks Online Account, from the Navigation menu, select ProAdvisor.

- From the drop-down to the right of the exam, select the Download Certificate.

Note: The button may read as “Take Update Exam” or “Download Tokens” until you can drop-down.

Important:

- It is the accountability of the respective acquire and a few states do not acknowledge Counting Professional Education recognition when taking the QuickBooks ProAdvisor Certification courses state boards of accountancy have final power on the acceptance of individual courses for Counting Professional Education credit for CPAs. It is the accountability of the respective acquire the CPE credits to investigate what his/her own state board of accountancy recognizes with respect to any CPE course. Enrolled Agents would need to contact the IRS-Office of Return Prepares for final authority on CPE acceptance

- Once you have developed your CPE approved Exam please go to QAS Promotes. Because the ProAdvisor entering course is NASBA and QAS approve active to this website will help you with finding out if your state requires QAS, and how you can go about receiving your recommended CPE credits.

- Delight assign to your own State Board of Accountancy for information concerning their necessity. It is the accountability of the absolute make money the CPE credits to explore what his/her own state board of accountancy remembers with consideration to any CPE course. You will be able to find Sponsor Necessity, Application processes, Download Applications, as well as get complete QAS Sponsor agenda.

QuickBooks Technical Support: If you want to resolve any type of QuickBooks issue, related to anything. Just dial our toll-free phone number 1-+1-844-405-0904 to get the instant help when you need.