Don’t know how to reconcile in QuickBooks Desktop & reconcile bank statements? In this article, we have provided the details to collect the information related to your query. Read the complete article know the steps to reconcile in QBD, and learn the points to remember before reconciling the bank account. Still, having an issue contact our QuickBooks ProAdvisor toll-free:+1-844-405-0904

Reconcile your accounts in QuickBooks Desktop is an area that is similar to balancing your checkbook. Make sure that everything is accounted for in your QB software and, consequently, and make sure that your financial records are correct, this process helps you.

Points to remember before reconciling the bank account

- Don’t forget to backup your QuickBooks Company file

- Be sure that the bank or the credit card account both have the correct beginning balance in QuickBooks.

- Insert all the uncleared transactions for the statement period.

- You must need a record of your bank or credit card statement while reconciling the bank account.

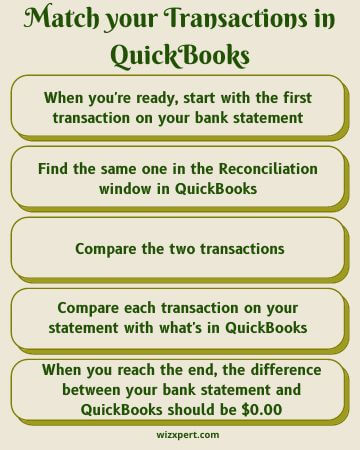

Steps to reconcile in QuickBooks Desktop

- Choose Reconcile, to the Banking menu.

- Drop-down list from the Account and choose a suitable account. Insert the ending date of the Statement that you are active with.

Note: If you use earlier reconciliation, the failure statement date is the date of the end reconciled statement added one month.

- Analyze your statement’s opening balance with the amount which sees in the Beginning Balance field. Get information to any other relevant. Tap Continue to open the Reconcile-[Account Name].

Note: When the reconcile repeatedly and the QuickBooks Beginning Balance is dissimilar from the beginning balance on your statement and the difference could be caused by expanse a transaction directly in the account register (as opposed to the Reconcile >[Account Name] window), and it’s changing or deleting by a previously reconciled transaction.

- Analysis of any items that test your bank account statement.

⇒ Contact your financial institution when your transaction does not match and the statement is incorrect.

⇒ If the QuickBooks amount is incorrect and the stated amount is correct then

- Double-tab on the transaction in QuickBooks to display it.

- Accurate the error, and then tap on Save & Close.

- Tap on the corrected transaction to reconcile it.

When your Difference is Zero, congratulations! Tap on Reconcile Now to closing your reconciliation and print your reports.

When your Difference is not zero, create a note of the difference amount.

Note 1: You can also select reconcile otherwise clicking on the Reconcile Now button and then tap on the Enter Adjustment button on the new window to record your discrepancy. Whenever this is not mentioned instead, continue to Note 2.

Note 2: When you have seen an item on the Reconcile screen, it cannot appear on your bank statement there could be many reasons like check/deposit was done near the end of the statement period and didn’t clear in the bank in time to appear on this statement and it will mostly appear on the next statement. Note: When they match, proceed to step 7.

⇨ Research your transaction to confirm that the information was correctly entered into QuickBooks.

⇨ If you check the missing item or communicate with the vendor to confirm that the check was received and deposited or not. By chance, the check was lost or needs to be reissued for another reason, tab on Reprint Checks for instructions.

⇨ Double-tap on the deposit from the reconcile screen to open it to checks the history when the missing item is a deposit. When the period of deposit checks that if there is a duplicate or another deposit may be included an item.

⇨ Right, Tap to void when you determine that the transaction was entered in error and should not have been entered into QuickBooks, right-tap to void the transaction. When there is no need to retain a record of the transaction, choose the delete option to permanently remove the transaction from your file.

Note: If voiding a transaction breaks the link to the affected account, but the record is retained if there is any future question.

By deleting a transaction if that is the course of action you want to take:

- Visit the Banking menu and tap on Use Register.

- Choose your account from the drop-down menu.

- Right-tap on the item(s) which do not match your bank account statement and tap Delete. If you will need to properly record any missing items is showing you in step 7.

⇨ Remark your bank account statement to find the missing items that you do not see on the Reconcile screen.

⇨ Go back to the Reconcile window when the missing items are properly recorded in QuickBooks.

⇨ Go back to step 4 to checkmark your new items and end your reconciliation.

If you want to cancel your latest reconciliation, you can do that using the Undo Reconciliation in QuickBooks Desktop feature. We recommend that you make a backup of your data file when you canceling the reconciliation. Follow these steps when you cancel the reconcile.

⇒ Beginning again at step 3, ensure that all amounts and transactions have been recorded correctly.

⇒ Tap on Reconcile Now, and then tap on Entering Adjustment to finish the reconciliation for the time being. (QuickBooks enters an adjustment to your account.) Sometimes, nevertheless, you should locate and correct the discrepancy.

- Select Reconcile, to the QuickBooks Banking menu.

- Choose the most suitable account from the Account drop-down list.

- Tab on Locate Discrepancies, tap on Undo Reconciliation and then follow the prompts to complete the process.

Hope, you find this article useful. If you are looking for further QuickBooks support or talk with a QuickBooks proadvisor, feel free to call our helpline number +1-844-405-0904.